Live Stock Market Updates: Bitcoin Rally Continues Amidst Bond Sell-Off

Table of Contents

Bitcoin's Continued Price Surge: A Deep Dive

Bitcoin's price has been on an upward trajectory recently, leaving many analysts scrambling to understand the reasons behind this resurgence. Let's examine the contributing factors.

Factors Contributing to the Bitcoin Rally:

- Increased Institutional Investment: Major corporations are increasingly adopting Bitcoin as a part of their treasury reserves. This institutional interest provides a significant boost to Bitcoin's credibility and price stability. Companies like MicroStrategy and Tesla have already made headlines with their substantial Bitcoin holdings, signaling a shift in how mainstream finance views cryptocurrencies.

- Growing Adoption by Retail Investors: The accessibility of Bitcoin through user-friendly exchanges and platforms has led to a surge in retail investment. This increased adoption reflects growing confidence in Bitcoin's potential as a long-term store of value and a hedge against inflation.

- Positive Regulatory Developments (if any): While regulatory clarity remains a work in progress globally, some jurisdictions are taking more progressive stances on cryptocurrency regulation. Positive regulatory developments, even incremental ones, can foster investor confidence and drive price appreciation.

- Technical Analysis: Technical indicators, such as chart patterns and trading volume, are providing further support for the current Bitcoin rally. For example, the recent break above a key resistance level has been interpreted by many analysts as a bullish signal. Analyzing Bitcoin chart analysis, including Bitcoin price history is crucial for informed decision-making.

- Bitcoin Price Prediction: While predicting Bitcoin's price is inherently speculative, several analysts are expressing cautiously optimistic forecasts, citing the aforementioned factors and the potential for further institutional adoption. However, it's essential to remember that Bitcoin remains a volatile asset.

Analyzing Bitcoin Volatility in the Current Market:

Bitcoin's inherent volatility is a defining characteristic, and its price is susceptible to significant fluctuations. News events, whether positive or negative (regulatory changes, major company announcements, or even social media trends) can significantly impact Bitcoin's price. Analyzing historical Bitcoin price history and using tools like Bitcoin chart analysis can provide insights into its behavior but never guarantees future performance. [Insert chart/graph illustrating recent Bitcoin price fluctuations here].

The Bond Market Sell-Off: Understanding the Dynamics

The simultaneous decline in the bond market presents an intriguing counterpoint to Bitcoin's rise. Understanding the factors driving this sell-off is crucial for a comprehensive market analysis.

Reasons Behind the Bond Market Decline:

- Rising Inflation Concerns: Persistent inflation erodes the purchasing power of fixed-income assets like bonds. As inflation rises, bond yields become less attractive, leading to a sell-off.

- Increased Interest Rates: Central bank decisions to increase interest rates to combat inflation directly impact bond yields. Higher interest rates make newly issued bonds more attractive, leading investors to sell existing bonds with lower yields.

- Geopolitical Factors: Global instability and geopolitical tensions can significantly impact investor sentiment and trigger a flight to safety, away from riskier assets like bonds.

- Technical Factors: Supply and demand dynamics within the bond market itself can influence prices. For example, an increase in the supply of bonds can lead to lower prices.

Correlation (or Lack Thereof) Between Bitcoin and Bonds:

Traditionally, Bitcoin and bonds have been considered inversely correlated. However, the current market situation showcases a divergence, with Bitcoin surging while bonds decline. This unusual relationship suggests a decoupling from traditional market dynamics. Potential explanations include investors seeking alternative assets during periods of high inflation and uncertainty. Further research into "Bitcoin vs Bonds" and "Bitcoin correlation" is necessary to fully understand this evolving relationship. "Market correlation" between assets is constantly changing and requires ongoing analysis.

Implications and Future Outlook: Where Do We Go From Here?

The simultaneous rally in Bitcoin and sell-off in bonds presents both risks and opportunities for investors.

Potential Risks and Opportunities:

- Risks: The Bitcoin rally could be unsustainable, leading to a sharp correction. Over-exposure to Bitcoin, given its volatility, represents a substantial risk. The ongoing bond market sell-off also poses risks, especially for investors holding large bond portfolios.

- Opportunities: Strategic investors might see opportunities to profit from both markets. Diversification remains key, balancing exposure to Bitcoin's potential upside with the relative stability (historically) of well-diversified bond portfolios.

Strategies for Navigating the Current Market:

- Risk Management: Employing robust risk management strategies, such as diversification and position sizing, is crucial. Avoid investing more than you can afford to lose, especially in volatile assets like Bitcoin.

- Investment Strategies: Consider a diversified portfolio that includes both Bitcoin and traditional assets, allowing you to balance risk and potential returns. Adjust your asset allocation based on your risk tolerance and long-term financial goals.

- Diversification: Diversification is paramount. Don't put all your eggs in one basket; spread your investments across different asset classes to mitigate risk.

Conclusion: Live Stock Market Updates and the Road Ahead

The current market situation highlights the complex interplay of factors influencing both the cryptocurrency and traditional finance markets. The continued Bitcoin rally amidst a bond market sell-off defies conventional wisdom, emphasizing the need for careful analysis and informed decision-making. Staying informed about live stock market updates is critical for navigating this evolving landscape. The unusual market dynamics underscore the importance of diversification and robust risk management strategies. To stay ahead of the curve and make informed investment decisions, subscribe to our newsletter for regular live stock market updates and in-depth analysis. [Link to newsletter signup] Stay tuned for further insights into the continued Bitcoin rally and the evolving bond market situation.

Featured Posts

-

Married Couples Public Dispute Over Joe Jonas His Reaction

May 23, 2025

Married Couples Public Dispute Over Joe Jonas His Reaction

May 23, 2025 -

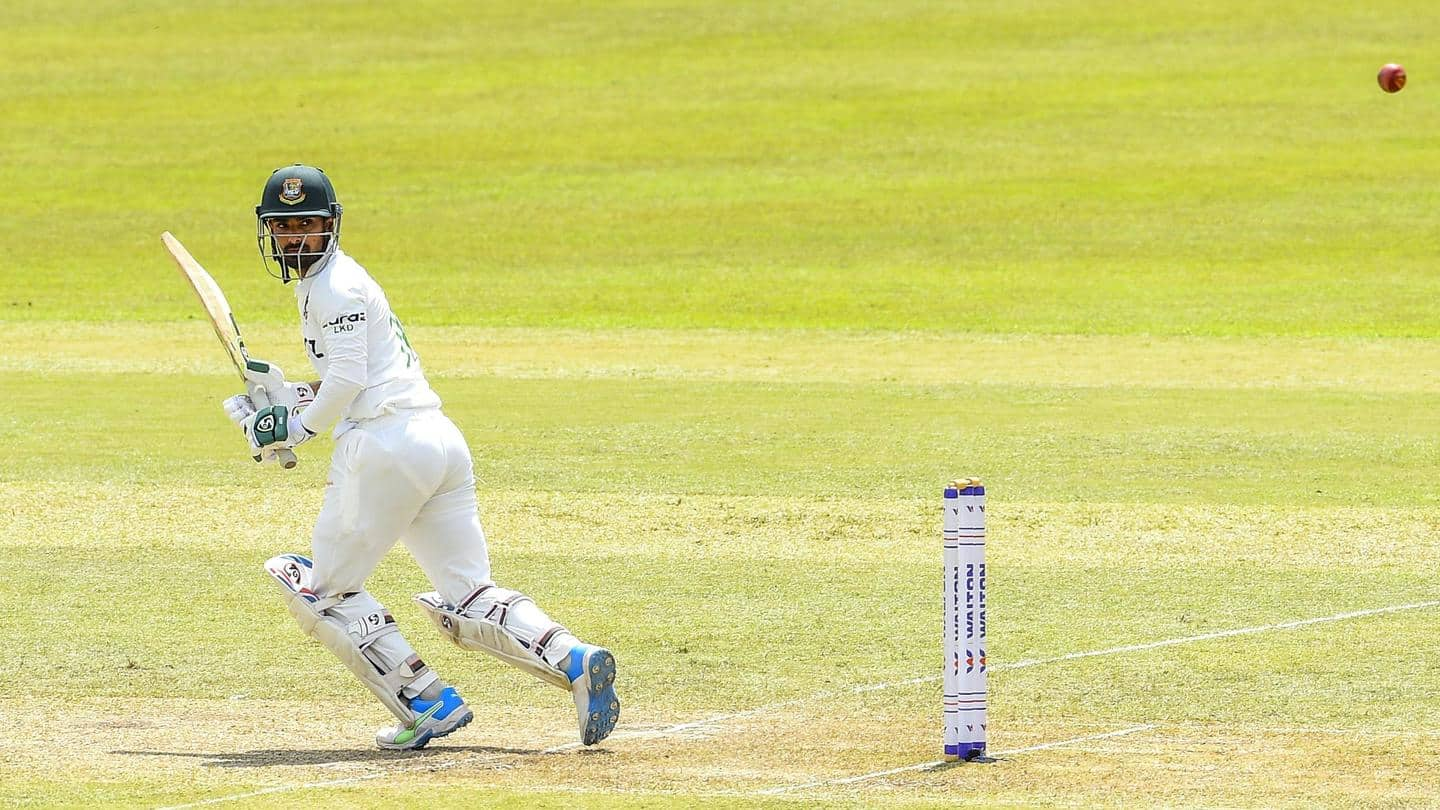

Bangladeshs Fightback Key Moments From The First Test Against Zimbabwe

May 23, 2025

Bangladeshs Fightback Key Moments From The First Test Against Zimbabwe

May 23, 2025 -

Kermit The Frogs Commencement Speech University Of Maryland 2025

May 23, 2025

Kermit The Frogs Commencement Speech University Of Maryland 2025

May 23, 2025 -

A Photographers Retrospective James Wiltshire And The Border Mail

May 23, 2025

A Photographers Retrospective James Wiltshire And The Border Mail

May 23, 2025 -

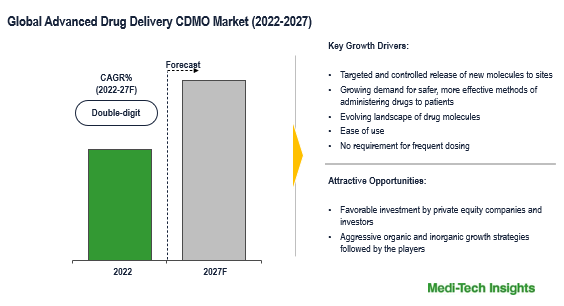

Advanced Drug Development Utilizing The Unique Properties Of Orbital Space Crystals

May 23, 2025

Advanced Drug Development Utilizing The Unique Properties Of Orbital Space Crystals

May 23, 2025