Live Stock Market Updates: China Tariffs And UK Trade Deal Fallout

Table of Contents

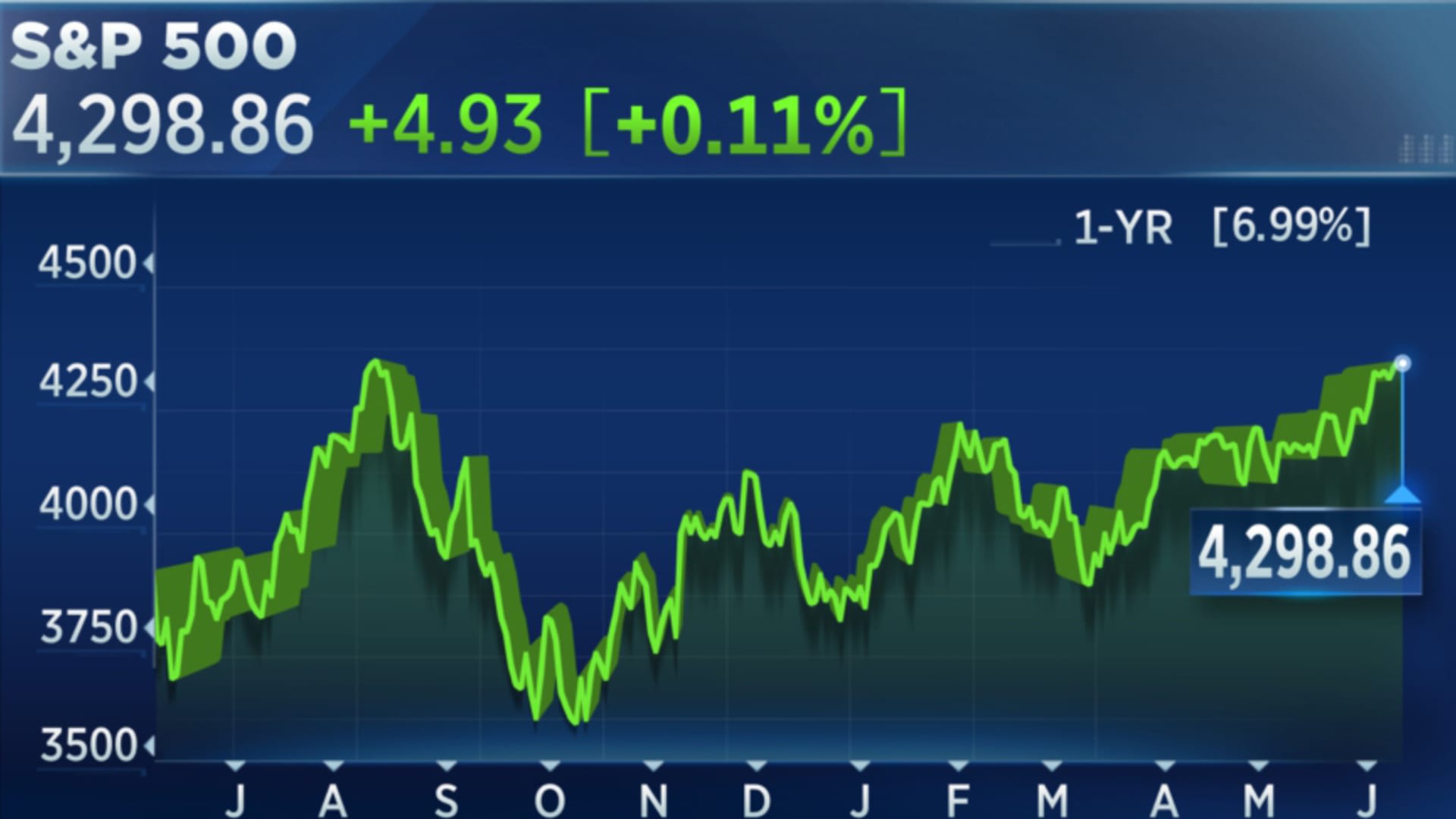

The Impact of China Tariffs on Live Stock Markets

The ongoing trade war between the US and China has significantly impacted global agricultural markets and investment strategies. China's retaliatory tariffs have created considerable uncertainty and volatility within the live stock market updates.

Agricultural Commodity Prices

Tariffs have directly affected the prices of several agricultural commodities, disrupting global supply chains. This includes:

- Soybeans: Chinese tariffs on US soybeans led to a sharp decline in exports, causing significant price fluctuations for American farmers and impacting soybean futures markets. Prices fell by approximately X% in the initial phase of the tariffs.

- Pork: Similar impacts were seen in the pork market. Increased tariffs resulted in higher prices for Chinese consumers and decreased profitability for US pork producers. Data suggests a Y% increase in pork prices in China following tariff implementation.

- Other agricultural products: The effects extend beyond soybeans and pork, impacting other agricultural exports and creating ripple effects throughout the global food supply chain.

These price fluctuations create considerable risk and opportunity for investors in agricultural commodities and related futures contracts. Careful monitoring of live stock market updates is crucial for navigating this volatile landscape.

Investment in Chinese Companies

The impact of tariffs extends beyond agricultural commodities, influencing the stock prices of Chinese companies involved in affected sectors.

- Reduced profitability: Companies reliant on imported raw materials or exporting to the US have experienced reduced profitability due to increased costs and decreased demand.

- Stock price volatility: This has led to increased volatility in the stock prices of these companies, creating both risks and opportunities for investors. For example, Company X, a major soybean processor in China, saw its stock price decline by Z% following the imposition of tariffs.

- Sector-specific impacts: The impact varies across sectors, with companies in agriculture, manufacturing, and technology being differentially affected.

Investors need to carefully assess the financial health and future prospects of Chinese companies within these affected sectors to make informed investment decisions based on current live stock market updates.

Geopolitical Risk and Market Sentiment

Escalating trade tensions between the US and China have significantly impacted overall market sentiment, leading to increased uncertainty and risk aversion.

- Investor behavior: Investors are becoming more cautious, leading to decreased investment in riskier assets.

- Flight to safety: Many investors are shifting their investments towards safer assets like government bonds.

- Alternative strategies: Diversification, hedging strategies, and careful risk management are crucial to mitigate the impact of geopolitical risks.

Staying informed about evolving geopolitical events and their impact on the live stock market is essential for effective investment management.

Analyzing the Fallout from the UK Trade Deal on Live Stock Markets

The UK's departure from the European Union and subsequent trade deal have introduced significant changes to the landscape of livestock and agricultural markets. Understanding these shifts is crucial for navigating the evolving live stock market updates.

Impact on UK Agricultural Exports

The new trade deal has altered export regulations for UK agricultural products, impacting UK agricultural businesses.

- New tariffs and regulations: The introduction of new tariffs and regulations on exports to the EU has increased costs and created complexities for UK farmers and exporters.

- Reduced access to EU markets: This has potentially decreased access to the EU market, a traditionally important trading partner for UK livestock and agricultural products.

- Search for new markets: UK agricultural businesses are now actively seeking new trading partners outside the EU to mitigate the effects of reduced access to the EU market.

European Market Reactions

The UK's departure has also caused disruptions in European livestock and agricultural markets.

- Increased competition: EU producers now face increased competition from non-EU producers, potentially affecting prices and market share.

- Supply chain adjustments: The EU's livestock and agricultural supply chains have had to adapt to the absence of the UK market.

- Price fluctuations: The changes have contributed to price fluctuations in various agricultural products within the EU.

Global Supply Chain Adjustments

The UK trade deal has had wider global implications, leading to adjustments in international supply chains.

- Realignment of trade routes: The deal has prompted a realignment of trade routes for livestock and agricultural products, creating opportunities and challenges for various countries.

- New trading partnerships: Countries outside the EU and UK may find new opportunities to supply goods previously traded within the EU-UK market.

- Increased global competition: The changes are expected to increase global competition within the livestock and agricultural sectors.

Conclusion: Staying Informed on Live Stock Market Updates

The impact of China tariffs and the UK trade deal on live stock markets presents both challenges and opportunities. China tariffs have caused significant price volatility in agricultural commodities and impacted the stock prices of Chinese companies. Meanwhile, the UK trade deal has reshaped the European and global livestock markets, leading to supply chain adjustments and increased competition.

Key Takeaways:

- Global trade dynamics significantly influence live stock market prices and investor sentiment.

- Careful monitoring of geopolitical events is crucial for making informed investment decisions.

- Diversification and risk management strategies are essential to navigate market volatility.

Stay ahead of the curve with regular live stock market updates. Subscribe to our newsletter for insightful analyses and expert commentary. Understanding the intricacies of live stock market updates, especially in light of global trade dynamics, is crucial for navigating the complexities of modern investment.

Featured Posts

-

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

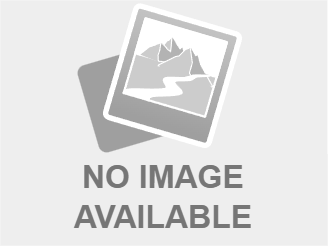

Impact Of Uk Student Visa Policy Changes On Asylum Applications

May 10, 2025

Impact Of Uk Student Visa Policy Changes On Asylum Applications

May 10, 2025 -

White House Cocaine Incident Secret Service Announces End Of Investigation

May 10, 2025

White House Cocaine Incident Secret Service Announces End Of Investigation

May 10, 2025 -

Game 4 Barbashev Scores In Ot Golden Knights Tie Series Against Wild

May 10, 2025

Game 4 Barbashev Scores In Ot Golden Knights Tie Series Against Wild

May 10, 2025 -

Nyt Spelling Bee April 4 2025 Unlock The Daily Challenge

May 10, 2025

Nyt Spelling Bee April 4 2025 Unlock The Daily Challenge

May 10, 2025