Live Stock Market Updates: Dow Futures, Key Earnings, And Market Trends

Table of Contents

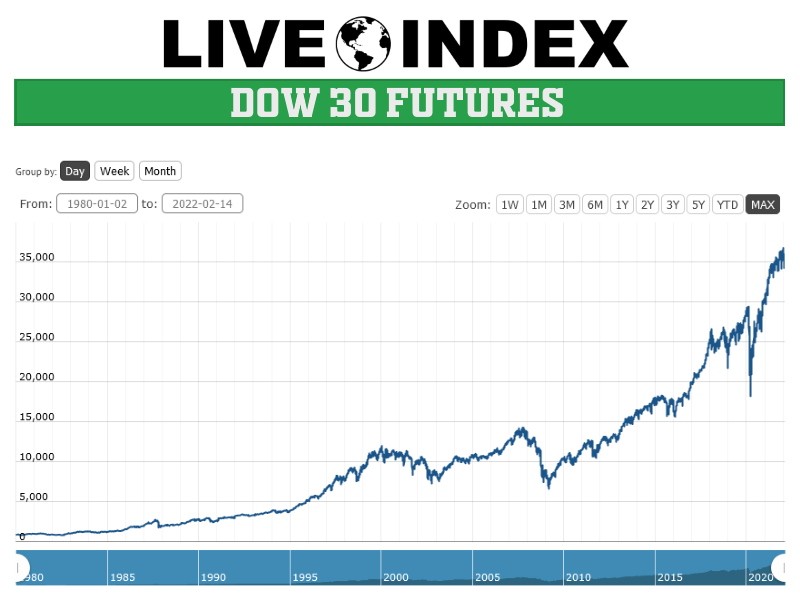

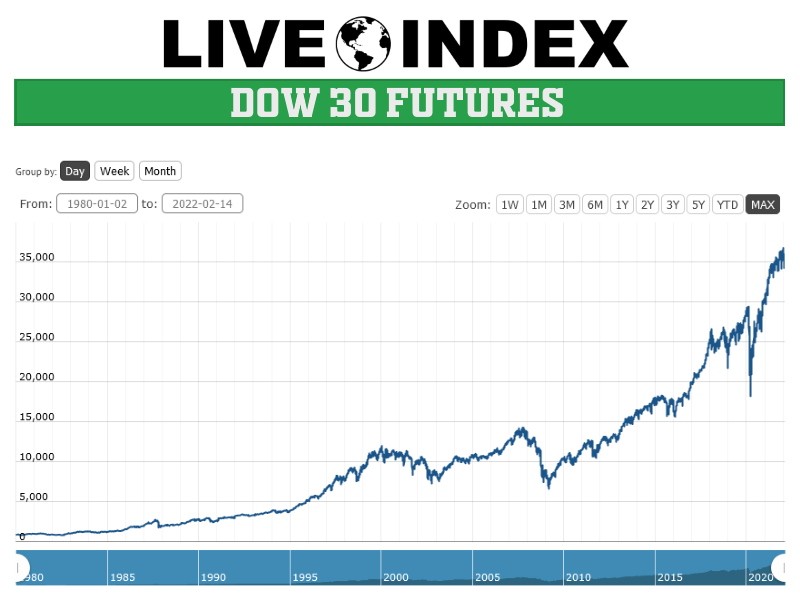

Dow Futures: A Glimpse into the Day's Trading

H3: Understanding Dow Futures Contracts:

Dow futures contracts are agreements to buy or sell the Dow Jones Industrial Average (DJIA) at a specific price on a future date. They are traded on exchanges like the CME Group and provide a valuable glimpse into the anticipated direction of the market before the actual opening bell. This pre-market trading activity offers insight into investor sentiment and potential daily movements.

- Relationship to the DJIA: Dow futures prices generally mirror the expected movement of the DJIA. A rise in Dow futures often indicates a positive opening for the index, and vice versa.

- Hedging and Speculation: Investors use Dow futures for both hedging (reducing risk) and speculation (profiting from price fluctuations). For example, a company with significant exposure to the stock market might use Dow futures to protect against potential losses. Speculators, on the other hand, attempt to profit from short-term price movements.

Relevant keywords: Dow Jones Industrial Average, Dow futures contracts, index futures, pre-market trading, CME Group

H3: Analyzing Dow Futures for Trading Signals:

Interpreting Dow futures price movements requires a combination of technical and fundamental analysis.

- Technical Analysis: Tools like moving averages, Relative Strength Index (RSI), and candlestick patterns can help identify potential trading signals. For example, a sustained upward trend in Dow futures, confirmed by multiple indicators, might suggest a bullish market outlook.

- Fundamental Analysis: Macroeconomic factors like interest rate changes, inflation data, and geopolitical events significantly influence Dow futures prices. Analyzing these factors can provide valuable insights into potential market shifts.

Relevant keywords: Technical analysis, fundamental analysis, trading signals, market prediction, moving averages, RSI, candlestick patterns, macroeconomic factors

Key Earnings Reports: Unveiling Corporate Performance

H3: Impact of Earnings on Stock Prices:

Company earnings reports are a major driver of stock price volatility. The release of quarterly earnings significantly impacts market sentiment and investor confidence.

- Beating or Missing Expectations: When a company surpasses earnings expectations (EPS – Earnings Per Share), its stock price typically rises. Conversely, missing expectations often leads to a price decline.

- Earnings Guidance: Companies often provide guidance on future performance. This outlook significantly influences investor expectations and can impact the stock price even before the next earnings report.

Relevant keywords: Earnings season, earnings per share (EPS), revenue growth, stock price volatility, market sentiment, earnings guidance

H3: Analyzing Key Earnings Releases:

Analyzing earnings reports requires a thorough understanding of financial statements (income statement, balance sheet, cash flow statement). Key metrics like revenue growth, profit margins, and debt levels provide valuable insights into a company's financial health.

- Recent Examples: For instance, analyzing the recent earnings release of a major tech company reveals whether its revenue growth met expectations and how its profit margins are trending. This information could help investors assess if the stock is undervalued or overvalued.

- Evaluating Performance: Comparing key metrics against previous quarters and industry averages provides a broader perspective on a company's performance and potential for future growth.

Relevant keywords: Financial statements, income statement, balance sheet, cash flow statement, revenue, profit margins, debt levels

Market Trends: Identifying Major Shifts and Patterns

H3: Identifying Emerging Market Trends:

Identifying market trends involves analyzing various data points, from sector-specific performances to macroeconomic indicators and global events.

- Chart Analysis and Indicators: Technical indicators such as moving averages and trendlines can help identify prevailing trends in the market. For example, a consistently upward-sloping moving average suggests a bullish trend.

- Economic News and Global Events: Monitoring economic news releases (inflation reports, unemployment data, etc.) and significant global events (political instability, trade wars) is critical for anticipating market shifts.

Relevant keywords: Market trends, sector rotation, economic indicators, geopolitical risks, moving averages, trendlines

H3: Responding to Market Volatility:

Market volatility presents both risks and opportunities. Effective strategies are essential for managing risk and capitalizing on fluctuations.

- Diversification and Risk Management: Diversifying investments across different asset classes and sectors helps mitigate risk. Employing strategies like stop-loss orders can protect against significant losses during market downturns.

- Investment Strategies: Different investment strategies suit various market conditions. Value investing might be suitable during a bear market, while growth investing could be more attractive during a bull market.

Relevant keywords: Risk management, diversification, portfolio management, investment strategies, stop-loss orders, value investing, growth investing

Conclusion: Stay Updated with Live Stock Market Updates

Regularly monitoring live stock market updates, including Dow futures, key earnings announcements, and prevailing market trends, is crucial for informed investment decision-making. Understanding these factors empowers you to assess risk, identify opportunities, and develop a robust investment strategy. Stay ahead of the curve by regularly checking back for live stock market updates and develop a sound investment strategy based on the insights shared. Don't miss out on crucial market movements; follow us for daily updates!

Featured Posts

-

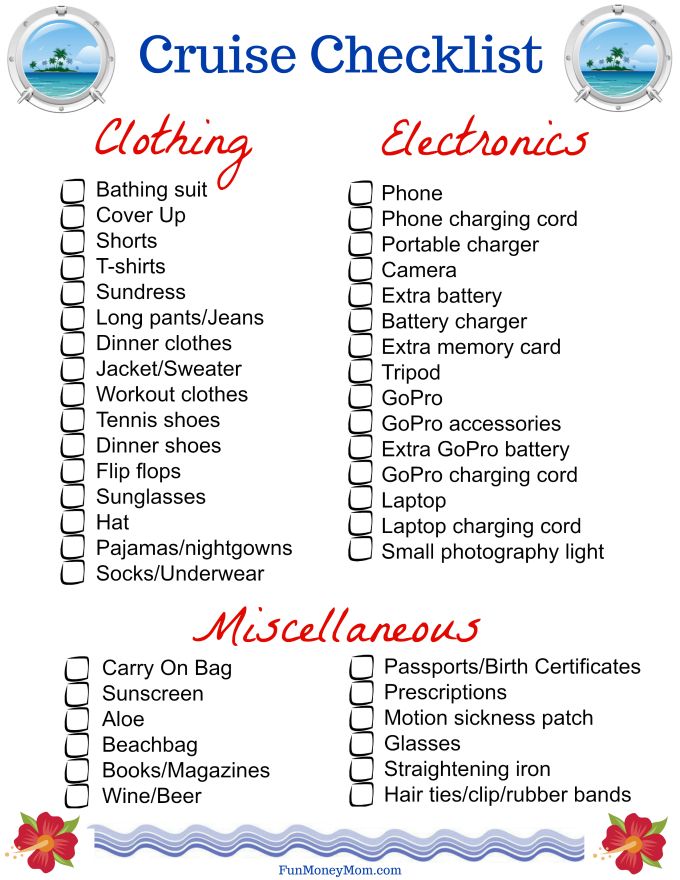

Smart Cruise Packing Items To Avoid

Apr 30, 2025

Smart Cruise Packing Items To Avoid

Apr 30, 2025 -

Coronation Street Popular Characters Departure To Bring Unexpected Twists

Apr 30, 2025

Coronation Street Popular Characters Departure To Bring Unexpected Twists

Apr 30, 2025 -

Cardinale Becciu Condannato Al Risarcimento 40 000 Euro Agli Accusatori

Apr 30, 2025

Cardinale Becciu Condannato Al Risarcimento 40 000 Euro Agli Accusatori

Apr 30, 2025 -

Unlock 150 With Bet Mgm Bonus Code Rotobg 150 Nba Playoffs Betting

Apr 30, 2025

Unlock 150 With Bet Mgm Bonus Code Rotobg 150 Nba Playoffs Betting

Apr 30, 2025 -

Seating Plan For A Papal Funeral A Complex Undertaking

Apr 30, 2025

Seating Plan For A Papal Funeral A Complex Undertaking

Apr 30, 2025