Los Angeles Wildfires: A Case Study In The Ethics Of Disaster Gambling

Table of Contents

The Nature of Disaster Gambling in the Context of LA Wildfires

Disaster gambling refers to speculation on the scale and impact of natural disasters, often involving financial instruments such as derivatives or insurance policies. In the context of the LA wildfires, this manifests in several disturbing ways. Individuals and entities might bet on the extent of property damage, the number of evacuations, the total cost of relief efforts, or even the length of time businesses remain closed. This isn't simply about assessing risk; it's about profiting from the immense suffering caused by the fires.

- Increased insurance premiums: The heightened wildfire risk in Los Angeles creates opportunities for speculative investments in insurance companies, with investors betting on increased payouts due to widespread damage.

- Trading of disaster relief bonds: Bonds issued to finance disaster relief efforts can become speculative instruments, with traders attempting to profit from the scale of the disaster and the subsequent need for funding.

- Derivatives markets: Sophisticated financial instruments like derivatives are used to predict wildfire damage and subsequent recovery costs, allowing for speculative trading based on projected losses and government responses.

- Social media speculation: Rumors and misinformation spread rapidly on social media, impacting market sentiment and creating volatility in financial markets related to disaster recovery. This can lead to further exploitation.

Ethical Concerns and Moral Implications

The ethical objections to profiting from the suffering of others in the wake of the LA wildfires are profound. Disaster gambling fundamentally exploits the inherent vulnerability of disaster victims who are already facing immense loss and trauma.

-

Vulnerability of disaster victims: Those impacted by the wildfires are often in a state of shock, grief, and displacement, lacking the capacity to understand or engage in complex financial transactions. They are easy targets for exploitation.

-

Lack of informed consent: Disaster gambling involves profiting from events where victims have no say or control, representing a gross violation of ethical principles and fundamental human rights.

-

Exploitation and manipulation: Disaster gambling creates a system ripe for manipulation, where individuals or entities can exploit information asymmetry to gain an unfair advantage and profit from others' misfortune.

-

Moral hazard: The very possibility of profiting from disaster creates a moral hazard, discouraging proactive disaster preparedness and potentially exacerbating the impact of future events.

-

Impact on community rebuilding: Financial speculation detracts from the resources available for community rebuilding and recovery, delaying crucial support for those affected.

-

Psychological effects on survivors: Witnessing such speculation can inflict further psychological trauma on survivors, adding insult to injury and undermining their sense of security and hope.

Regulatory Frameworks and Legal Challenges

Existing regulations struggle to effectively address disaster gambling. The complexity of financial markets and the difficulty in proving intent to profit from human suffering create significant challenges.

- Proving intent: Demonstrating that speculation was specifically intended to profit from human suffering is extremely difficult, making legal prosecution challenging.

- International jurisdictional issues: Many financial instruments involved in disaster gambling cross international borders, making regulation complex and requiring international cooperation.

- Lack of harmonization: Regulations across different financial sectors (insurance, derivatives, etc.) often lack harmonization, creating loopholes that can be exploited.

The Role of Media and Public Perception

The media plays a crucial role in shaping public perception of disaster gambling. Sensationalized reporting can inadvertently fuel speculation, while social media amplifies rumors and misinformation.

-

Sensationalism: Focus on the scale of devastation, without sufficient context or analysis of the ethical implications of financial speculation, can inadvertently contribute to the problem.

-

Social media's impact: The speed and reach of social media enable the rapid spread of rumors and misinformation related to disasters, potentially influencing market behavior.

-

Responsible journalism: Media outlets have a responsibility to report ethically, avoiding the exploitation of tragedy for increased viewership or engagement.

-

Social media algorithms: The algorithms that govern social media platforms can amplify disaster-related speculation, leading to misinformation cascades and increased market volatility.

-

Fact-checking and accurate reporting: The media needs to prioritize fact-checking and accurate reporting, particularly in the immediate aftermath of a disaster, to combat misinformation and prevent the exacerbation of unethical practices.

Mitigation Strategies and Future Prevention

Mitigating the risks of disaster gambling requires a multi-faceted approach. Improvements to regulatory frameworks, combined with public awareness campaigns, are crucial.

- Strengthening financial regulations: More robust regulations are needed to prevent speculative trading during and immediately following natural disasters. This might include temporary trading restrictions on certain financial instruments.

- Promoting ethical investing: Encouraging responsible financial practices and ethical investing can shift the focus away from profit-seeking during times of crisis.

- Public awareness campaigns: Educational initiatives can raise public awareness about the ethical dimensions of disaster gambling and its impact on communities.

Conclusion:

Disaster gambling in the wake of the Los Angeles wildfires exposes a deeply troubling ethical dilemma. Profiteering from the suffering of others undermines fundamental principles of compassion and solidarity. Addressing this requires a multi-pronged approach, including strengthening regulatory oversight, raising public awareness, and promoting responsible financial behavior. We must work to prevent future disasters from being exploited for personal financial gain. Let's work together to prevent the normalization of disaster gambling and ensure ethical treatment for all victims of natural disasters like the devastating Los Angeles wildfires. We need to ensure that the focus shifts from profit to genuine support for those in need. Let's strive for a future where the aftermath of disaster is not further complicated by the unethical practice of disaster gambling.

Featured Posts

-

San Franciscos Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025

San Franciscos Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025 -

Lietuvos Automobiliu Rinka 2024 Porsche Dominuoja

Apr 29, 2025

Lietuvos Automobiliu Rinka 2024 Porsche Dominuoja

Apr 29, 2025 -

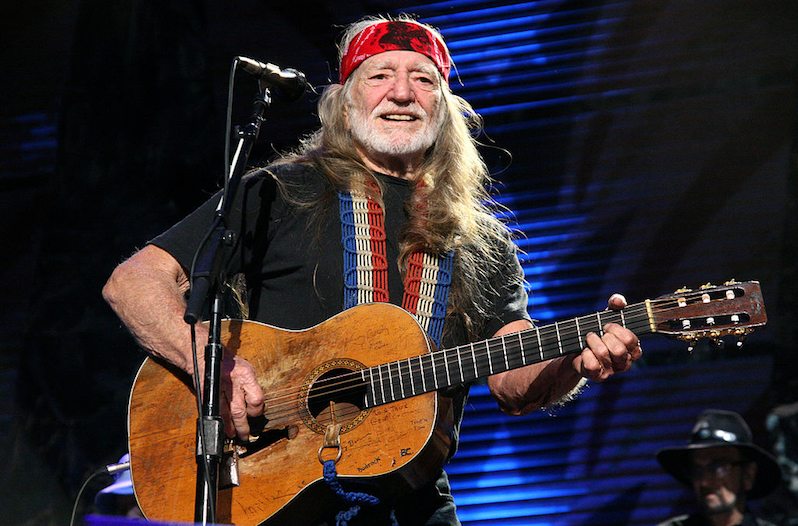

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025

Willie Nelson Documentary Tops Austins Weekly News

Apr 29, 2025 -

You Tube A New Home For Nostalgia And Classic Tv Shows For Mature Audiences

Apr 29, 2025

You Tube A New Home For Nostalgia And Classic Tv Shows For Mature Audiences

Apr 29, 2025 -

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Jazdach Testowych

Apr 29, 2025

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Jazdach Testowych

Apr 29, 2025

Latest Posts

-

Porsche

Apr 29, 2025

Porsche

Apr 29, 2025 -

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025 -

Understanding Porsches New Macan Electric Drive Technology

Apr 29, 2025

Understanding Porsches New Macan Electric Drive Technology

Apr 29, 2025 -

Porsche Ag

Apr 29, 2025

Porsche Ag

Apr 29, 2025 -

First Look Porsches Revolutionary Macan Electric Drive

Apr 29, 2025

First Look Porsches Revolutionary Macan Electric Drive

Apr 29, 2025