Los Angeles Wildfires And The Growing Market For Disaster Bets

Table of Contents

The Rising Risk of Los Angeles Wildfires

The threat of Los Angeles wildfires is undeniably increasing, driven by a confluence of factors.

Climate Change and its Impact

Climate change is significantly exacerbating the wildfire risk in Southern California. We're witnessing:

- Increased Temperatures: Higher average temperatures create drier conditions, turning vegetation into tinderboxes.

- Prolonged Droughts: Extended periods without significant rainfall leave landscapes parched and highly susceptible to ignition.

- Shifting Wind Patterns: Changes in wind patterns can rapidly spread wildfires, making them harder to contain.

Data reveals a disturbing trend. The acreage burned and the cost of damage from Los Angeles wildfires have skyrocketed in recent decades, highlighting the urgent need for effective mitigation strategies.

Urban Sprawl and Wildland-Urban Interface

The expansion of urban areas into historically wildland zones – the wildland-urban interface (WUI) – is a major contributing factor. This encroachment leads to:

- Increased Ignition Sources: More homes mean more potential sources of accidental or intentional ignitions.

- Difficulty in Evacuations: Densely populated areas in the WUI make rapid evacuations challenging and dangerous.

- Higher Property Values at Risk: Homes in these areas often command high prices, leading to substantial financial losses during wildfires.

Neighborhoods like Malibu, Topanga, and parts of the San Gabriel Mountains are particularly vulnerable due to their proximity to wildlands and the prevalence of flammable vegetation.

The Economic Impact of Wildfires

The economic consequences of Los Angeles wildfires are staggering. We are talking about:

- Insurance Claims: Millions, sometimes billions, of dollars in insurance claims are filed after each major wildfire.

- Rebuilding Costs: The cost of rebuilding homes and infrastructure after a wildfire is exceptionally high.

- Lost Tourism Revenue: Wildfires can severely impact tourism, a major economic driver for the Los Angeles area.

The cumulative economic impact of these events underscores the importance of proactive wildfire risk management and robust disaster preparedness planning.

The Mechanics of Disaster Bets

Individuals and businesses are exploring various avenues to manage their wildfire risk, creating a market for "disaster bets."

Types of Disaster Bets

Several ways exist to bet on or hedge against wildfire risks:

- Wildfire Insurance: Traditional homeowners' insurance policies often include wildfire coverage, albeit with varying levels of protection and often high premiums in high-risk areas.

- Catastrophe Bonds: These complex financial instruments transfer some of the risk of catastrophic events, like wildfires, from insurance companies to investors.

- Speculative Betting Markets (where legal): In some jurisdictions, specialized markets allow individuals to bet on the likelihood and severity of specific wildfire events. (Note: Legality and ethical implications should be carefully considered.)

Each option presents a unique balance of risk and reward. Understanding the intricacies of each is crucial before making any decisions.

Understanding the Odds

The odds for disaster bets are set using sophisticated predictive models that incorporate:

- Historical Data: Past wildfire occurrences, intensity, and spread patterns inform probability calculations.

- Current Weather Conditions: Real-time data on temperature, humidity, wind speed, and fuel moisture content significantly influence the odds.

- Predictive Modeling: Advanced models incorporate various factors to forecast the likelihood and potential impact of wildfires.

However, it’s crucial to understand that these models have limitations, and inherent uncertainty remains in predicting wildfire behavior.

Ethical Considerations

The ethical implications of profiting from disasters are complex and warrant careful consideration.

- Exploitation Concerns: There's a valid concern that some might exploit the suffering of others for financial gain.

- Social Impact: The overall social impact of disaster bets needs careful evaluation to ensure fair and equitable outcomes.

The Future of Disaster Bets in Los Angeles

The demand for disaster bets in Los Angeles is expected to grow significantly.

Growing Market Demand

Several factors are driving this trend:

- Increased Awareness of Wildfire Risk: As wildfires become more frequent and devastating, awareness of the risk is growing, leading to increased demand for risk management solutions.

- Higher Property Values: The high cost of homes in many Los Angeles neighborhoods increases the financial stakes involved in wildfire risk.

- Lack of Affordable Insurance: The cost of wildfire insurance can be prohibitive for many homeowners, driving them to explore alternative risk management strategies.

Technological Advancements and Data Analysis

Technological advancements are improving the accuracy of wildfire risk predictions, impacting the disaster bet market:

- Improved Satellite Imagery: High-resolution satellite imagery provides more accurate data on fuel conditions and fire spread.

- Predictive Modeling Techniques: Sophisticated models are constantly being refined to better forecast wildfire behavior.

- Real-Time Weather Data: Real-time access to weather data enables more accurate and timely risk assessments.

Role of Insurance Companies

Insurance companies play a pivotal role in the disaster bet market:

- Insurance Premiums: They are adjusting premiums based on risk assessments, reflecting the rising threat of wildfires.

- Risk Assessment: Insurance companies are investing heavily in risk assessment models to better understand and manage wildfire risk.

- Preventative Measures: Many insurers are actively promoting and supporting preventative measures to reduce wildfire risk, such as defensible space creation.

Conclusion

The increasing frequency and intensity of Los Angeles wildfires are creating a significant and growing market for disaster bets. While traditional wildfire insurance remains the primary method of risk mitigation, the rise of catastrophe bonds and other innovative financial instruments highlights a complex interplay of risk, reward, and ethical considerations. The future of this market hinges on technological advancements, accurate predictive modeling, and responsible risk management practices.

To safeguard your property and financial well-being, it's crucial to research and understand your options for mitigating wildfire risk. Explore various forms of Los Angeles wildfire insurance, consider strategies for mitigating wildfire risk in your specific neighborhood, and prioritize disaster preparedness. Proactive measures and informed decision-making are essential for navigating the growing threat of wildfires in Los Angeles. Don't wait until it's too late; take control of your wildfire risk today.

Featured Posts

-

Trumps Threats Canadian Automotive Industry Calls For Increased Ambition

May 23, 2025

Trumps Threats Canadian Automotive Industry Calls For Increased Ambition

May 23, 2025 -

Vegan Food Revolution Odd Burger Launches In 7 Eleven Stores

May 23, 2025

Vegan Food Revolution Odd Burger Launches In 7 Eleven Stores

May 23, 2025 -

Baba Olmak Burclarin Etkisi Ve Erkeklerin Rolue

May 23, 2025

Baba Olmak Burclarin Etkisi Ve Erkeklerin Rolue

May 23, 2025 -

Nisanda Hangi Burclar Zengin Olacak 2024 Para Tahminleri

May 23, 2025

Nisanda Hangi Burclar Zengin Olacak 2024 Para Tahminleri

May 23, 2025 -

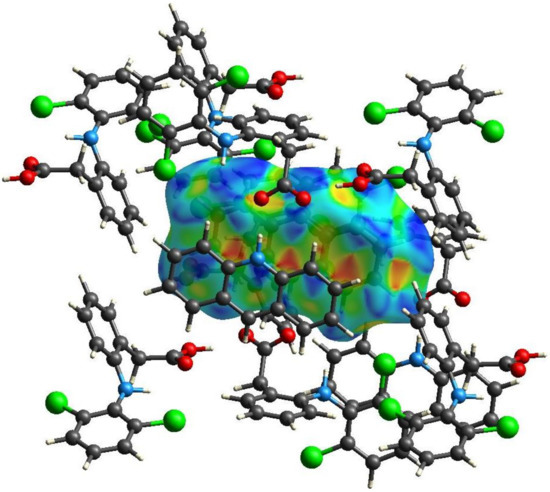

The Role Of Orbital Space Crystals In The Pharmaceutical Industrys Future

May 23, 2025

The Role Of Orbital Space Crystals In The Pharmaceutical Industrys Future

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025 -

Instinct Magazine Interview Jonathan Groff On Asexuality

May 23, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff On Bobby Darin Method Acting And Broadway Buzz

May 23, 2025

Jonathan Groff On Bobby Darin Method Acting And Broadway Buzz

May 23, 2025 -

Jonathan Groffs Just In Time A Night Of Broadway Camaraderie

May 23, 2025

Jonathan Groffs Just In Time A Night Of Broadway Camaraderie

May 23, 2025