Los Angeles Wildfires: Where Disaster Meets The Betting Market

Table of Contents

The Impact of Wildfires on Insurance and Financial Markets

Wildfires in Los Angeles and other fire-prone regions create significant ripples throughout the insurance and financial sectors, directly impacting investment opportunities and creating unique betting scenarios.

Insurance Claims and Stock Prices

Wildfires lead to massive insurance payouts for property damage, business interruption, and liability claims. This influx of claims can strain the financial stability of insurance companies, causing increased volatility in their stock prices.

- Increased volatility in insurance stocks: After major wildfire events like those seen in Los Angeles, the stock prices of insurance companies often experience significant swings, presenting both opportunities and risks for investors and those betting on their performance.

- Potential for betting on stock performance: Some individuals may attempt to predict the stock performance of insurance companies based on forecasts of wildfire severity and frequency. This speculative activity highlights the complex relationship between disaster and the financial markets.

- The role of reinsurance markets: Reinsurance markets play a crucial role in mitigating risk for primary insurers. The dynamics of these markets also influence the opportunities and risks associated with betting on the insurance sector's response to wildfires.

Real Estate Market Fluctuations

The real estate market in areas affected by Los Angeles wildfires experiences significant volatility. Property values plummet due to damage, increased risk perception, and decreased demand.

- Decreased property values: Properties in burned areas often suffer significant devaluation, resulting in investment losses for homeowners and investors.

- Opportunities for speculative betting: Some may attempt to bet on the long-term recovery of property values in affected areas, speculating on the speed and extent of rebuilding efforts. This is inherently risky due to the unpredictable nature of these processes.

- Influence of government aid and rebuilding: Government aid programs and the pace of rebuilding significantly influence the recovery of property values, affecting the potential outcomes of such speculative bets.

Predictive Modeling and Wildfire Betting

The increasing sophistication of data analysis and predictive modeling creates new avenues for assessing wildfire risks, though these tools come with inherent limitations and ethical concerns.

The Role of Data and Algorithms

Sophisticated algorithms analyze historical wildfire data, weather patterns, fuel conditions, and other factors to predict the likelihood and severity of future fires. This data, while valuable for risk management, can also be (mis)used for speculative betting.

- Using historical wildfire data: Statistical models based on historical data attempt to forecast future wildfire occurrences, providing a basis (however imperfect) for informed speculation.

- Limitations and uncertainties: Wildfire prediction is inherently complex and uncertain; even the most sophisticated models have limitations, making accurate predictions extremely challenging.

- Ethical concerns: Using predictive modeling for gambling purposes raises ethical concerns about profiting from potential disasters and the inherent unpredictability of natural events.

The Rise of "Catastrophe Bonds"

Catastrophe bonds are financial instruments designed to transfer wildfire risk from insurance companies to investors. They offer high returns but only pay out if a predefined catastrophic event (like a significant wildfire) occurs.

- Understanding catastrophe bonds: These bonds represent a direct link between disaster risk and the investment market; investors essentially bet on the occurrence (or non-occurrence) of a major wildfire event.

- Betting on catastrophe bond payouts: While not directly gambling on the disaster itself, investors are betting on the probability of a payout, which is directly linked to the severity of the wildfire season.

- Regulatory framework: The regulatory framework governing catastrophe bonds influences their attractiveness to investors and the overall dynamics of this specific niche within the betting market.

The Ethical Implications of Wildfire Betting

Betting on wildfires raises significant ethical questions about profiting from human suffering and the potential for irresponsible behavior.

Exploitation of Disaster

The act of betting on wildfires raises serious concerns about the exploitation of human tragedy for personal gain.

- Irresponsible betting practices: The potential exists for insensitive and exploitative betting practices, fueled by the desire for profit regardless of the human cost.

- Responsible gambling initiatives: The need for responsible gambling initiatives and public awareness campaigns is paramount to mitigating the ethical concerns associated with this type of betting.

- Social and psychological impact: The social and psychological impact of gambling on events such as wildfires needs careful consideration, especially for those directly affected by the disasters.

The Influence of Media Coverage

Media coverage of wildfires can significantly influence public perception and, consequently, betting patterns.

- Impact of media sensationalism: Sensationalized media reporting can amplify public anxiety and potentially encourage irresponsible betting behavior.

- Responsible journalism: Responsible journalism plays a crucial role in preventing the exploitation of disasters for profit, focusing on accurate reporting and avoiding sensationalism.

- Potential for misinformation: The spread of misinformation through various media channels can directly influence betting decisions, potentially exacerbating ethical concerns.

Conclusion

Los Angeles wildfires, while devastating, unexpectedly intersect with the betting market. From insurance stock fluctuations to catastrophe bonds and ethical dilemmas surrounding predictive modeling, the relationship is complex. While financial opportunities exist, responsible consideration of the ethical implications and potential for exploitation is crucial. Before engaging in any betting related to Los Angeles wildfires or similar disasters, understand the risks and prioritize ethical considerations. Responsible engagement with the Los Angeles wildfire betting market is paramount.

Featured Posts

-

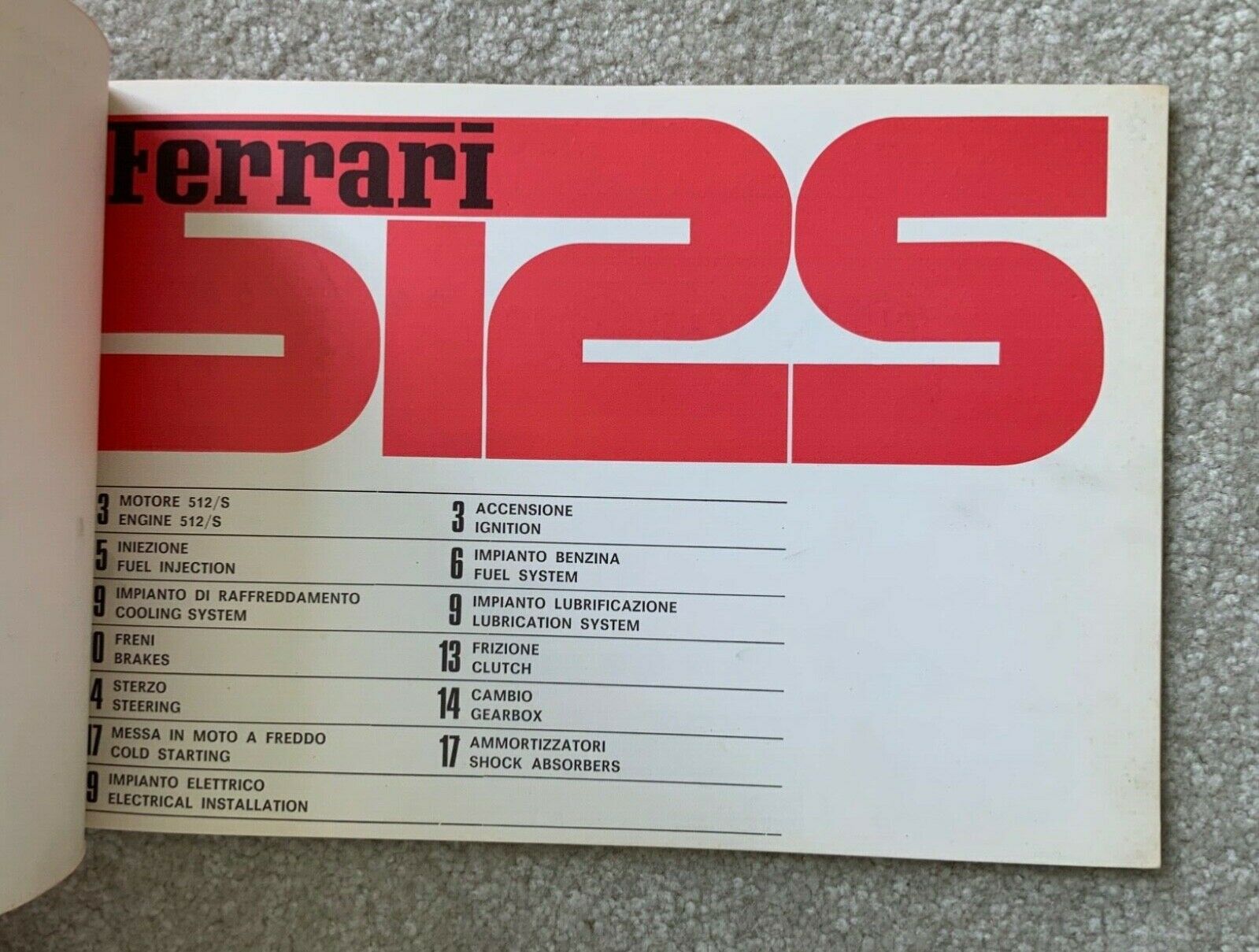

Ferrari Owners Kit Top Gear Recommendations

May 24, 2025

Ferrari Owners Kit Top Gear Recommendations

May 24, 2025 -

Significant Delays On M6 Southbound Following Accident

May 24, 2025

Significant Delays On M6 Southbound Following Accident

May 24, 2025 -

Inside Dylan Dreyer And Brian Ficheras Relationship

May 24, 2025

Inside Dylan Dreyer And Brian Ficheras Relationship

May 24, 2025 -

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 24, 2025

New Ferrari Hot Wheels Sets A Mamma Mia Moment For Collectors

May 24, 2025 -

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Tu Guia Astrologica

May 24, 2025

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Tu Guia Astrologica

May 24, 2025