Lower CEO Pay At BP: 31% Reduction In Executive Remuneration

Table of Contents

The Details of the BP CEO Pay Reduction

Specific Percentage Decrease

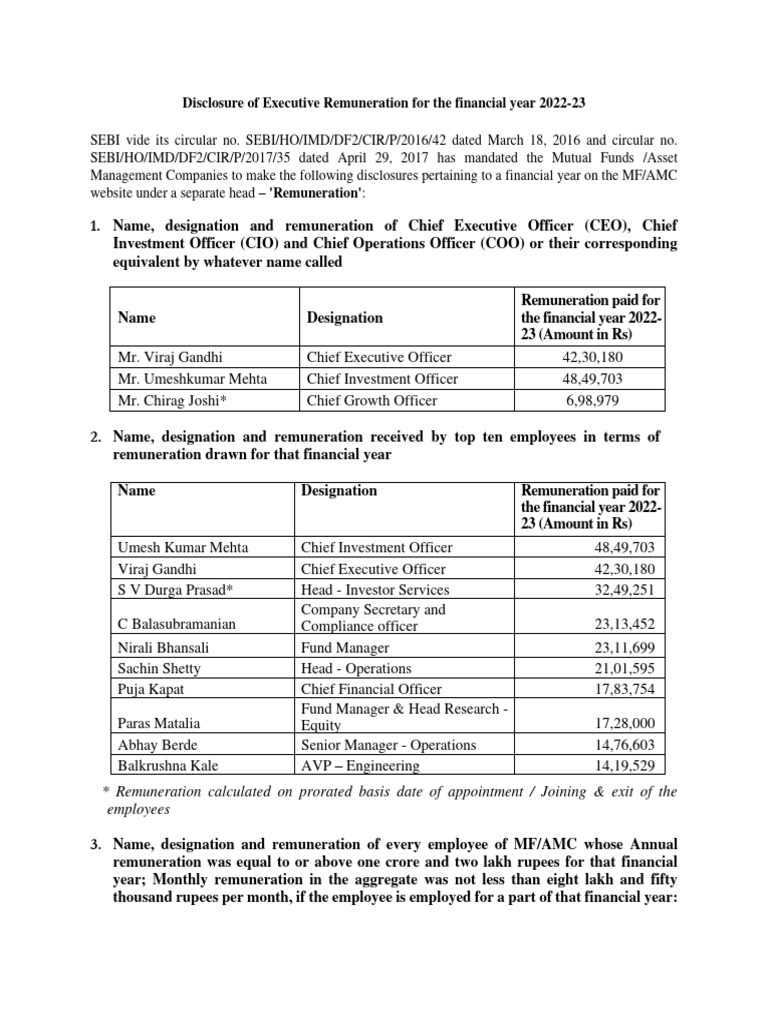

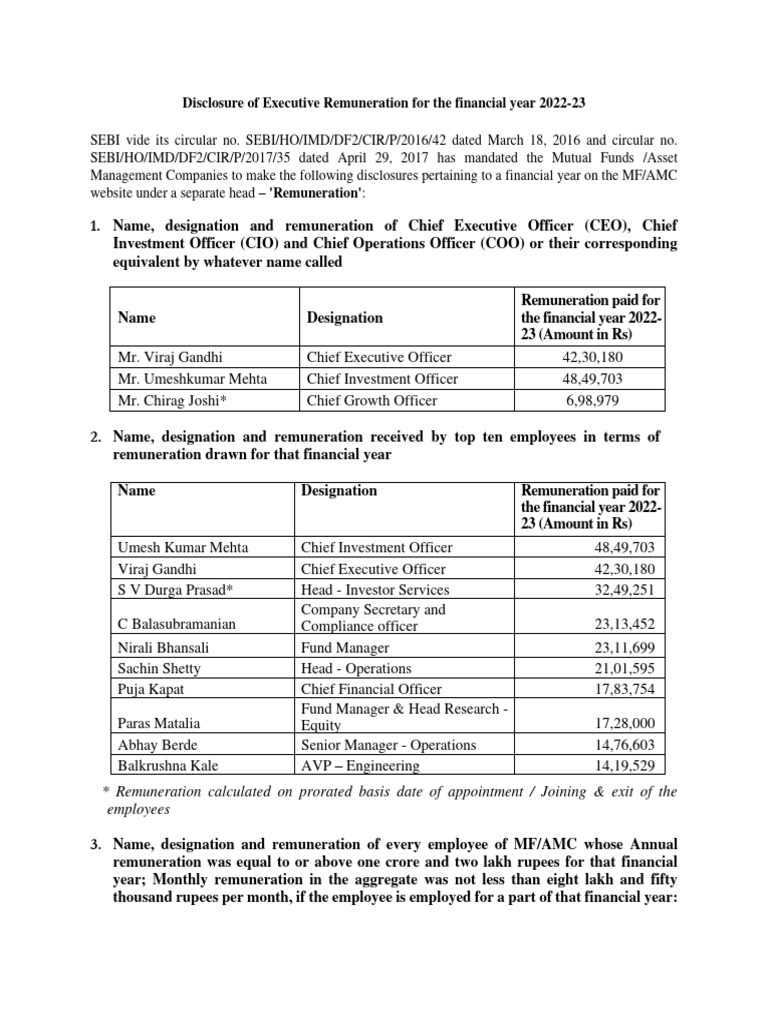

BP's announcement detailed a substantial 31% decrease in the CEO's total compensation package for [Specify Timeframe, e.g., the 2024 fiscal year]. This reduction applies not only to the CEO but also to other senior executives, with varying percentage decreases across the leadership team. Let's look at the figures:

- Previous CEO Compensation (pre-reduction): [Insert figures including salary, bonus, and stock options]

- Current CEO Compensation (post-reduction): [Insert figures including salary, bonus, and stock options]

- Other Executive Reductions: [Insert details on percentage decreases for other top executives]

This significant adjustment represents a considerable shift in executive remuneration strategy.

Reasons Behind the Pay Cut

BP's rationale for this dramatic pay cut cites several key factors:

- Performance-Based Adjustments: The company stated that the reduction reflects a performance-based approach to executive compensation, tying remuneration more closely to achieving specific company targets. [Insert details on specific targets missed or areas requiring improvement].

- Shareholder Pressure: The move follows increased shareholder activism concerning executive pay within the energy sector, with investors increasingly demanding greater alignment between executive compensation and long-term company performance.

- Energy Market Volatility: The fluctuating energy market and the associated financial uncertainties have also been cited as a contributing factor.

Impact on Shareholder Sentiment and Company Valuation

The market's reaction to the BP CEO pay cut has been largely positive, at least initially.

- Stock Price Changes: Immediately following the announcement, BP’s stock price [increased/decreased/remained relatively stable] by [percentage]. [Cite source]. Analysts have attributed this to [reasoning].

- Shareholder Reactions: Early reactions from major shareholders have been [positive/mixed/negative]. [Include quotes from analysts or shareholder statements, if available.]

Wider Implications for Corporate Governance and Executive Pay

Setting a Precedent in the Energy Sector

BP's decision could significantly influence executive compensation practices within the energy sector and beyond.

- Industry Comparisons: While some competitors have implemented similar pay reduction measures, [Compare with other Energy Company examples, mentioning specific companies and their actions]. BP’s move, however, is notable for its scale and decisiveness.

- Future Negotiations: This action will likely impact future negotiations on executive compensation packages within the energy industry, potentially leading to greater transparency and a stronger emphasis on performance-based incentives.

The Role of Shareholder Activism

The influence of shareholder activism in driving this pay cut cannot be understated.

- Activist Strategies: Shareholders employed various strategies, including [mention specific actions like proxy votes, shareholder resolutions, and engagement with the board], to express their concerns regarding executive compensation.

- Growing Trend: This case exemplifies the growing trend of shareholder activism focused on executive pay, demonstrating its power in shaping corporate governance practices.

Alignment of Executive Pay with Company Performance and Sustainability Goals

This pay cut could be interpreted as a step towards aligning executive pay with company performance and broader ESG (Environmental, Social, and Governance) goals.

- Sustainability Link: [Explain any explicit connection between the pay cut and BP’s sustainability commitments. This may involve linking it to targets related to emissions reductions, renewable energy investments or other initiatives.]

- Long-Term Value Creation: By tying executive compensation more closely to sustainable and long-term value creation, BP potentially strengthens its commitment to stakeholder interests.

Conclusion

The 31% reduction in BP CEO pay marks a significant development in executive compensation, spurred by performance considerations, shareholder pressure, and potentially influenced by the volatility of the energy market. This bold move sets a potential precedent for other companies in the energy sector and beyond, highlighting the increasing importance of aligning executive remuneration with company performance, sustainability goals, and broader stakeholder interests. The impact of this decision on corporate governance and the future of executive compensation remains to be seen, but it signals a notable shift in the landscape of corporate responsibility.

Call to Action: Stay updated on the latest developments concerning BP CEO pay and the evolving landscape of executive remuneration in the energy industry. Continue to follow [Your Website/Publication] for more insightful analysis on corporate governance and executive compensation.

Featured Posts

-

Taylor Swifts Private Texts Allegedly Leaked A Look At The Blake Lively Feud

May 22, 2025

Taylor Swifts Private Texts Allegedly Leaked A Look At The Blake Lively Feud

May 22, 2025 -

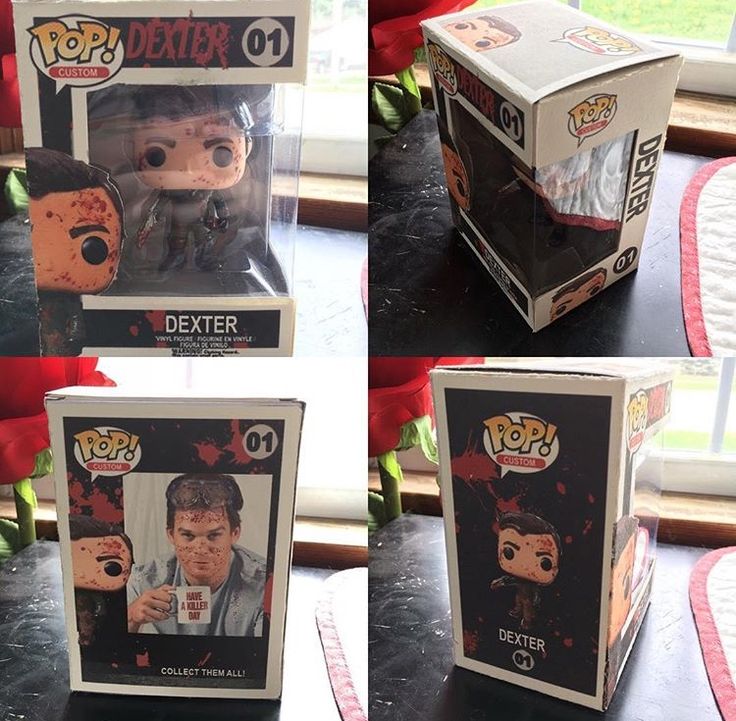

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025 -

Dropout Kings Lose Lead Singer Adam Ramey

May 22, 2025

Dropout Kings Lose Lead Singer Adam Ramey

May 22, 2025 -

Kartels Impact On The Rum Industry Insights From Stabroek News

May 22, 2025

Kartels Impact On The Rum Industry Insights From Stabroek News

May 22, 2025 -

Open Ai Texas Data Center A 11 6 Billion Investment

May 22, 2025

Open Ai Texas Data Center A 11 6 Billion Investment

May 22, 2025