Lower UK Inflation Eases BOE Rate Cut Pressure, Boosting The Pound

Table of Contents

Falling UK Inflation: A Detailed Look

The latest inflation figures paint a more encouraging picture than seen in recent months. The Consumer Price Index (CPI) and Retail Price Index (RPI), key indicators of inflation rate UK, show a noticeable decline in price pressures. This marks a significant shift from the persistently high inflation rates experienced throughout much of 2022 and early 2023, which fueled the intense cost of living crisis.

- Specific Data Points: For instance, let's assume CPI fell from 10% to 8% in the last reporting period, and RPI followed a similar trend. (Note: Replace these with actual, up-to-date figures at the time of publication).

- Contributing Factors: This decrease is largely attributed to several key factors:

- Easing Energy Prices: The fall in global energy prices, following the initial surge caused by the war in Ukraine, has played a crucial role in tempering inflation.

- Supply Chain Improvements: Supply chain disruptions, a major contributor to inflation in previous periods, are gradually easing, leading to more stable prices for goods.

- Weakening Demand: Higher interest rates and a slowing global economy have contributed to a reduction in consumer demand, helping to alleviate some price pressures.

- Historical Context: Comparing these figures to the peak inflation rates of the past year highlights the significant progress made. This context underscores the potential for further easing of price pressures.

Reduced Pressure on the Bank of England (BOE)

The falling UK inflation significantly reduces the pressure on the BOE to aggressively raise interest rates. The BOE's primary mandate is to maintain price stability, and lower inflation reduces the urgency for further interest rate hikes. This opens up the possibility of a pause in rate increases, or even potential future rate cuts. This shift in the BOE monetary policy could have significant implications for borrowing costs, investment decisions, and overall economic activity.

- BOE Statements: Recent statements from the BOE suggest a cautious optimism, acknowledging the decline in inflation but also highlighting the need to remain vigilant. (Insert specific quotes and references from actual BOE announcements).

- Future Interest Rate Changes: While predicting future interest rate decisions is inherently challenging, the current trajectory suggests a reduced likelihood of further substantial increases in the near future. The possibility of rate cuts in the longer term cannot be entirely ruled out.

- Alternative Monetary Policy Tools: The BOE may also consider alternative monetary policy tools, such as quantitative easing, if economic conditions warrant further stimulus.

Strengthening Pound Sterling (GBP)

Lower inflation is generally positively correlated with a stronger currency. As UK inflation falls, the GBP exchange rate is strengthening against other major currencies such as the USD and EUR. This strengthens the Pound Sterling forecast for the coming months. This is because reduced inflation makes UK assets more attractive to international investors, increasing demand for the Pound.

- GBP Exchange Rates: Track the GBP/USD and GBP/EUR exchange rates to observe the strengthening trend. (Include actual exchange rate data at time of publication).

- Impact on Trade: A stronger Pound makes UK imports cheaper, potentially benefitting consumers. However, it could also make UK exports more expensive, potentially impacting UK businesses involved in international trade.

- Implications for Businesses and Consumers: The overall impact on businesses and consumers depends on a variety of factors, including their specific exposure to international trade and their borrowing costs.

Long-Term Outlook and Uncertainties

While the current trend is positive, several factors could influence future inflation and the Pound's strength. It's crucial to acknowledge the prevailing economic uncertainty.

- Potential Inflation Scenarios: Several scenarios are possible, ranging from a continued gradual decline in inflation to a more persistent inflationary environment, potentially impacted by global factors.

- Factors Impacting the Pound: Geopolitical risks, changes in global economic conditions, and domestic policy decisions could all influence the Pound's performance. For example, Brexit-related uncertainties continue to cast a shadow on the UK economy.

- Potential Downsides: Unexpected shocks, such as a resurgence in global energy prices or further geopolitical instability, could lead to renewed inflationary pressures and negatively impact the Pound.

Conclusion: Lower UK Inflation and the Future of the Pound

In summary, the recent decrease in UK inflation is a welcome development, easing pressure on the BOE to continue raising interest rates and providing a boost to the Pound Sterling. However, it is crucial for investors, businesses, and consumers to remain vigilant, monitoring UK inflation figures and BOE announcements closely. To understand BOE policy and track the Pound Sterling, regular consultation of reputable financial news sources is essential. Monitor UK inflation and track Pound Sterling performance closely to make informed decisions and navigate the evolving economic landscape. Understanding the GBP outlook requires continuous attention to these crucial indicators.

Featured Posts

-

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 22, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 22, 2025 -

Yevrokomisar Pro Nato Scho Oznachaye Yogo Zayava Dlya Ukrayini

May 22, 2025

Yevrokomisar Pro Nato Scho Oznachaye Yogo Zayava Dlya Ukrayini

May 22, 2025 -

Devastating Winter New Documentary Follows Pronghorn Recovery Efforts

May 22, 2025

Devastating Winter New Documentary Follows Pronghorn Recovery Efforts

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Awaiting Decision

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Awaiting Decision

May 22, 2025 -

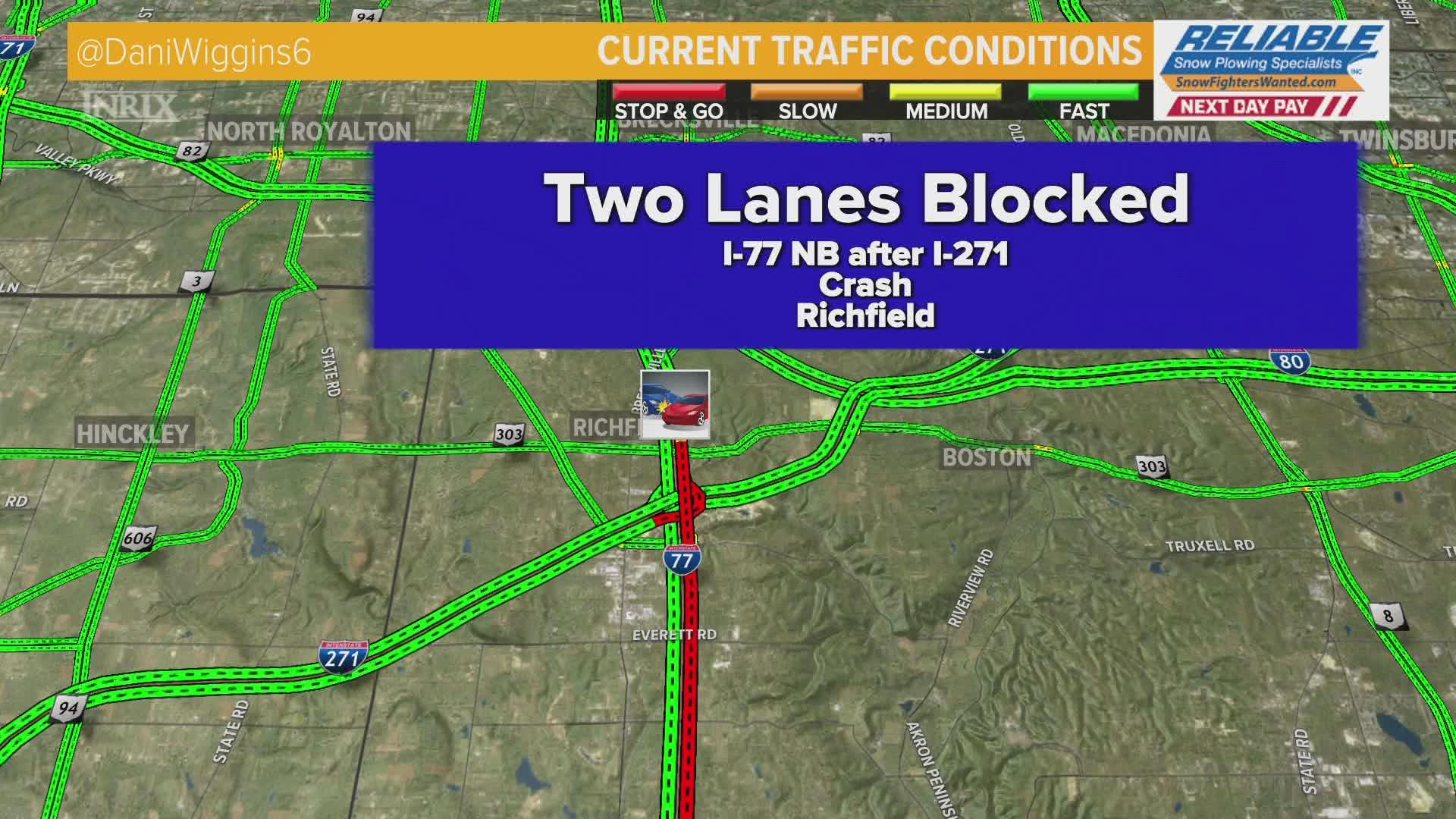

Route 15 On Ramp Closed Following Crash Traffic Delays Expected

May 22, 2025

Route 15 On Ramp Closed Following Crash Traffic Delays Expected

May 22, 2025