Lutnick-Built FMX To Challenge CME: Treasury Futures Trading Begins

Table of Contents

FMX's Competitive Advantages in Treasury Futures Trading

FMX is entering the Treasury futures trading arena with a clear strategy focused on leveraging technological superiority, competitive pricing, and robust regulatory compliance to attract traders away from the established CME platform.

Technology and Infrastructure

FMX boasts cutting-edge technology designed for speed, efficiency, and seamless execution in high-frequency trading environments. This technological advantage is a key differentiator in the fiercely competitive world of algorithmic trading.

- Low-latency trading: FMX's infrastructure minimizes delays, ensuring rapid order execution crucial for high-frequency traders.

- Advanced order routing: Sophisticated algorithms optimize order routing for best price execution, maximizing profitability for traders.

- Superior risk management tools: FMX provides comprehensive risk management tools to help traders mitigate potential losses and control their exposure.

- Enhanced Data Analytics: FMX offers advanced data analytics tools providing traders with real-time insights and market intelligence, exceeding the current offerings at CME.

In contrast to CME's established, albeit aging, infrastructure, FMX's modern technology offers a significant advantage in the fast-paced world of high-frequency trading. This allows for faster order execution and more efficient algorithmic trading strategies.

Pricing and Fees

FMX's competitive pricing strategy is another significant draw for traders. By offering lower transaction fees and more favorable pricing structures compared to CME, FMX aims to attract volume and market share.

- Reduced transaction fees: FMX's fee structure promises significant cost savings for traders, particularly those executing a large volume of trades.

- Transparent pricing model: FMX employs a transparent pricing model, eliminating hidden fees and providing traders with clarity and control over their trading costs.

- Volume-based discounts: FMX offers volume-based discounts, rewarding high-volume traders with even lower transaction fees.

This competitive pricing, coupled with advanced trading technology, positions FMX as a compelling alternative for cost-conscious traders and institutions.

Regulatory Compliance and Security

FMX operates within a rigorous regulatory framework, ensuring transparency, security, and market integrity. The exchange prioritizes compliance and security to build trust and confidence among its users.

- Regulatory approvals: FMX has secured all necessary regulatory approvals to operate as a fully regulated exchange for Treasury futures trading.

- Robust security measures: FMX employs advanced security protocols to protect trader data and prevent unauthorized access.

- Stringent risk management protocols: FMX's risk management protocols are designed to safeguard the integrity of the market and protect traders from systemic risk.

This commitment to regulatory compliance and financial security fosters a reliable and trustworthy trading environment, a key factor for traders concerned about market integrity.

Impact on CME and the Broader Treasury Futures Market

The emergence of FMX is expected to have a profound impact on the CME Group and the broader Treasury futures market, stimulating increased competition and innovation.

Increased Competition and Innovation

The entry of FMX into the market fosters healthy competition, driving innovation and efficiency within the Treasury futures trading ecosystem.

- Technological advancements: The pressure to compete will accelerate technological innovation in areas like high-frequency trading infrastructure and advanced order management systems.

- Enhanced trading tools: Competition leads to the development of more sophisticated trading tools, analytics, and risk management capabilities.

- Improved market transparency: Increased competition can lead to greater market transparency and more efficient price discovery.

This intensified competition benefits all market participants by spurring advancements in technology and service offerings.

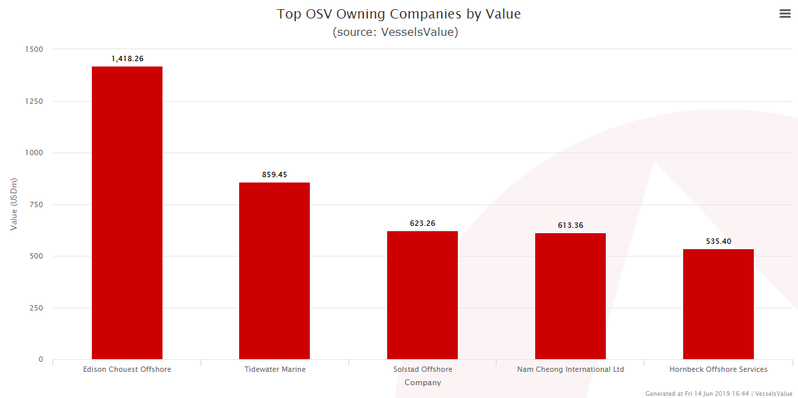

Potential Market Share Shifts

FMX's entry poses a direct challenge to CME's long-held market dominance. The potential for market share shifts depends on several factors.

- Trader preferences: Trader preferences will play a significant role, with some traders likely to migrate to FMX based on price, technology, or other factors.

- Pricing strategies: The ongoing pricing strategies of both exchanges will heavily influence trading volume distribution.

- Technological superiority: FMX’s technological advantages could sway a significant portion of high-frequency traders.

The resulting redistribution of trading volume could lead to a more balanced and competitive market.

Implications for Traders and Investors

The introduction of FMX presents both opportunities and challenges for traders and investors involved in Treasury futures trading.

- Lower trading costs: Traders can potentially benefit from lower trading costs due to FMX's competitive pricing.

- Access to new technology: Traders gain access to cutting-edge trading technology offered by FMX's innovative platform.

- Increased market volatility: Increased competition could lead to greater market volatility in the short term as the market adjusts to the new competitive landscape.

Traders and investors must carefully consider the implications of this new competitive landscape and adapt their strategies accordingly.

Conclusion: The Future of Treasury Futures Trading with Lutnick-Built FMX

The arrival of Lutnick-built FMX marks a significant shift in the Treasury futures trading landscape. FMX's competitive advantages in technology, pricing, and regulatory compliance present a compelling alternative to the established CME Group. This increased competition is likely to foster innovation, enhance market efficiency, and ultimately benefit traders and investors. The potential for market share shifts and the evolving dynamics of the market make it a pivotal moment for all participants. Learn more about how Lutnick-Built FMX is revolutionizing Treasury futures trading. Visit [link to FMX website] today! Explore the implications of this competition for your trading strategies and capitalize on the opportunities this new era presents.

Featured Posts

-

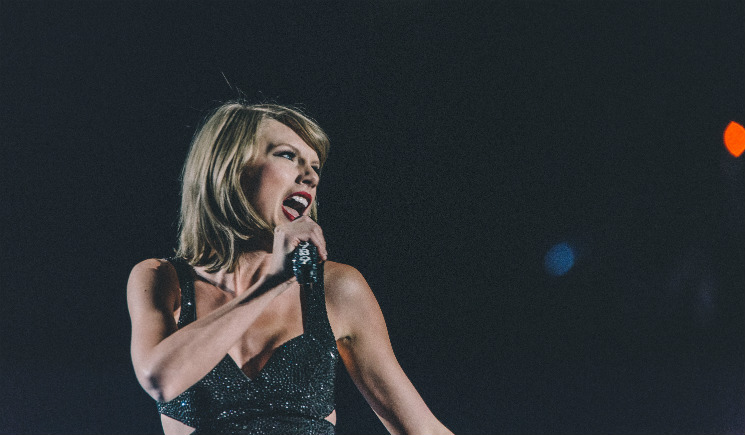

Rekord Teylor Svift Samye Prodavaemye Vinilovye Plastinki Za Desyatiletie

May 18, 2025

Rekord Teylor Svift Samye Prodavaemye Vinilovye Plastinki Za Desyatiletie

May 18, 2025 -

Omakase In Hong Kong A Review Of Roucous Cheese Centric Menu

May 18, 2025

Omakase In Hong Kong A Review Of Roucous Cheese Centric Menu

May 18, 2025 -

Voyager Technologies Files For Public Offering A New Era In Space Defense

May 18, 2025

Voyager Technologies Files For Public Offering A New Era In Space Defense

May 18, 2025 -

Eurovision 2025 Damiano David Rumoured As Guest Performer

May 18, 2025

Eurovision 2025 Damiano David Rumoured As Guest Performer

May 18, 2025 -

Transparency Concerns State Officials Rome Trip And Corporate Funding

May 18, 2025

Transparency Concerns State Officials Rome Trip And Corporate Funding

May 18, 2025

Latest Posts

-

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Comprehensive Analysis

May 18, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Comprehensive Analysis

May 18, 2025 -

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 18, 2025

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 18, 2025 -

Amazon Faces Quebec Labour Tribunal Over Warehouse Closings And Union Disputes

May 18, 2025

Amazon Faces Quebec Labour Tribunal Over Warehouse Closings And Union Disputes

May 18, 2025 -

Kahnawake Casino Dispute 220 Million Lawsuit Shakes Mohawk Council

May 18, 2025

Kahnawake Casino Dispute 220 Million Lawsuit Shakes Mohawk Council

May 18, 2025