M&A Opportunities For Recordati Amidst Italian Tariff Instability

Table of Contents

Impact of Italian Tariff Instability on Recordati's Strategic Position

The unpredictable nature of Italian tariffs presents a significant challenge to Recordati's strategic position. Fluctuating import and export duties directly impact operational costs and profitability, creating a volatile business environment.

Increased Costs and Reduced Profit Margins

- Raw Material Tariffs: Changes in tariffs on imported raw materials used in Recordati's manufacturing processes directly increase production costs, squeezing profit margins. For example, a sudden increase in the tariff on a key chemical compound could significantly impact the cost of producing a flagship drug.

- Finished Product Tariffs: Tariffs on exported finished products reduce Recordati's competitiveness in international markets, potentially impacting sales volume and revenue.

- Import/Export Logistics: Tariff-related complexities add to logistical costs, impacting overall efficiency and profitability. Increased bureaucratic procedures and delays can further add to these expenses.

Data from the Italian Ministry of Economy and Finance (MEF) shows a significant increase in the average tariff rate on pharmaceutical products in the last year, impacting the entire Italian pharmaceutical sector, including major players like Recordati. This instability requires proactive strategic responses to maintain profitability and competitiveness.

Competitive Landscape Shifts

Tariff instability also reshapes the competitive landscape within the Italian pharmaceutical market. Companies with different supply chains and product portfolios may be affected differently, creating both opportunities and threats.

- Competitors reliant on imported raw materials may face proportionally higher cost increases than Recordati, creating a potential competitive advantage for Recordati if it has diversified its sourcing.

- Conversely, competitors with stronger international distribution networks might be better positioned to weather export tariffs, potentially impacting Recordati's market share.

This dynamic environment requires a flexible and adaptive approach to maintain and enhance Recordati’s competitive edge. M&A activity could be a crucial tool to capitalize on these shifts.

Identifying Potential M&A Targets for Recordati

Recordati can leverage the current instability to strengthen its position through strategic acquisitions. Opportunities exist both within Italy and internationally.

Smaller Italian Pharma Companies

Acquiring smaller Italian pharmaceutical companies presents a compelling strategy for Recordati. Ideal targets would:

- Possess complementary product portfolios, expanding Recordati's market reach and diversifying its revenue streams.

- Hold strong market share in specific niche therapeutic areas, bolstering Recordati’s market position.

- Be financially viable and well-managed, minimizing integration risks and ensuring a smooth transition.

Examples of potential targets could include smaller, family-owned pharmaceutical companies with strong regional presence but limited resources for national or international expansion.

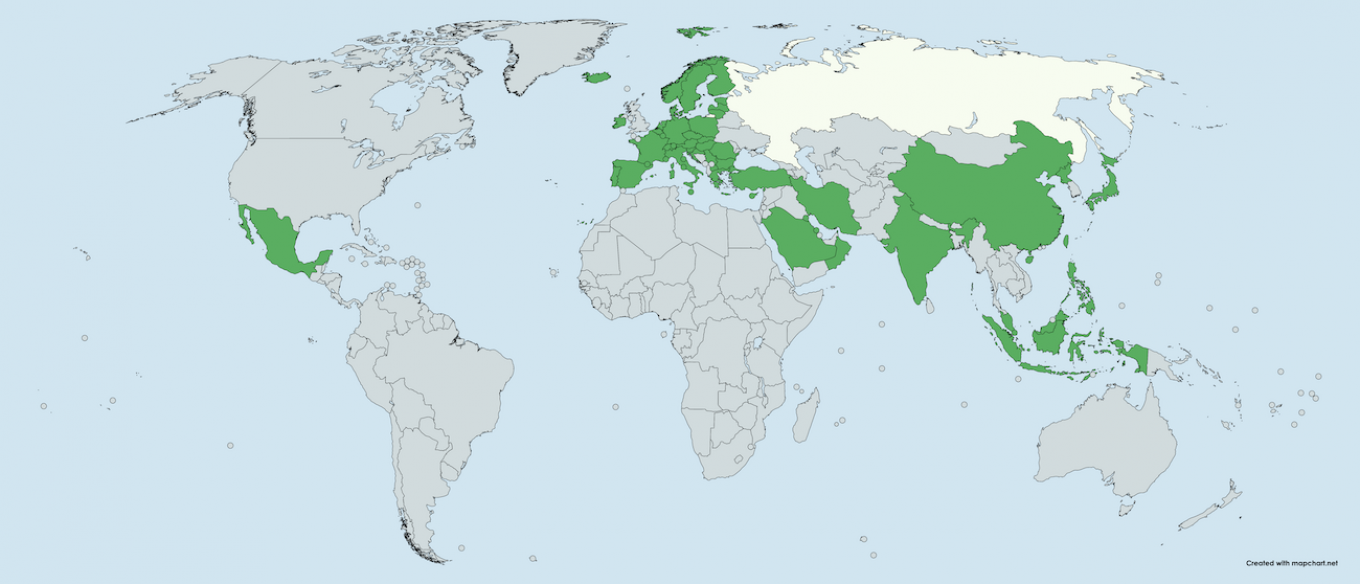

International Expansion via M&A

Expanding internationally through acquisitions offers significant growth potential. Focus should be on:

- European Union (EU) Countries: Countries within the EU offer streamlined regulatory pathways and access to larger markets. Countries with similar regulatory frameworks to Italy would minimize integration complexities.

- Emerging Markets: While potentially riskier, emerging markets could offer high-growth opportunities if due diligence mitigates political and economic uncertainties.

However, navigating international regulations and cultural differences requires careful planning and execution. The current economic climate necessitates a thorough assessment of risks and opportunities before pursuing international M&A.

Strategic Considerations for Successful M&A

Successful M&A requires meticulous planning and execution, especially in a volatile environment.

Due Diligence and Risk Assessment

Thorough due diligence is paramount, paying particular attention to:

- Regulatory Compliance: Ensuring the target company’s full compliance with all relevant Italian and international regulations, particularly concerning tariffs and import/export procedures.

- Financial Stability: Rigorous assessment of the target’s financial health, including its ability to withstand tariff fluctuations.

- Integration Challenges: Anticipating and mitigating potential challenges related to integrating the target company’s operations, culture, and systems into Recordati's existing infrastructure.

Financing and Regulatory Approvals

Securing appropriate financing is crucial, and the process may be influenced by the current economic climate. Navigating the regulatory approval process in Italy and any other relevant countries requires expertise and proactive planning.

- Securing Financing: Explore various funding options, including bank loans, private equity, and strategic partnerships.

- Regulatory Approvals: Engage with regulatory bodies early in the process to expedite approvals.

Failure to address these aspects can significantly impact the success of the acquisition.

Integration and Synergies

A smooth integration process is key to maximizing the value of any acquisition. Strategies must focus on:

- Cultural Alignment: Creating a cohesive organizational culture that integrates employees from both companies.

- Operational Efficiency Improvements: Identifying and implementing synergies that leverage the combined resources and expertise of the two entities to achieve cost savings and improve efficiency.

By carefully planning for and managing these aspects, Recordati can successfully integrate acquired companies and reap the benefits of increased market share and enhanced profitability.

Capitalizing on M&A Opportunities for Recordati's Future Growth

Recordati faces challenges presented by Italian tariff instability, but strategic M&A activity offers a pathway for future growth. This requires a focus on identifying suitable acquisition targets, both within Italy and internationally, and meticulously managing the acquisition process from due diligence to successful integration. Recordati’s M&A strategy must prioritize thorough due diligence, secure financing, and implement effective integration strategies to maximize synergies and minimize risks. Further research and discussion on M&A opportunities for Recordati and the potential to leverage these challenges for future growth within the Italian and international pharmaceutical markets is essential to capitalizing on this potential. The successful execution of a well-defined M&A strategy will be critical for Recordati’s continued success in the dynamic Italian pharmaceutical sector and its expansion into new international markets.

Featured Posts

-

Warmer Temperatures A Potential Boost For Russias Spring Offensive

May 01, 2025

Warmer Temperatures A Potential Boost For Russias Spring Offensive

May 01, 2025 -

Hanh Trinh Xay Dung Mach 3 Du An 500k V Cong Nhan Dien Luc Mien Nam

May 01, 2025

Hanh Trinh Xay Dung Mach 3 Du An 500k V Cong Nhan Dien Luc Mien Nam

May 01, 2025 -

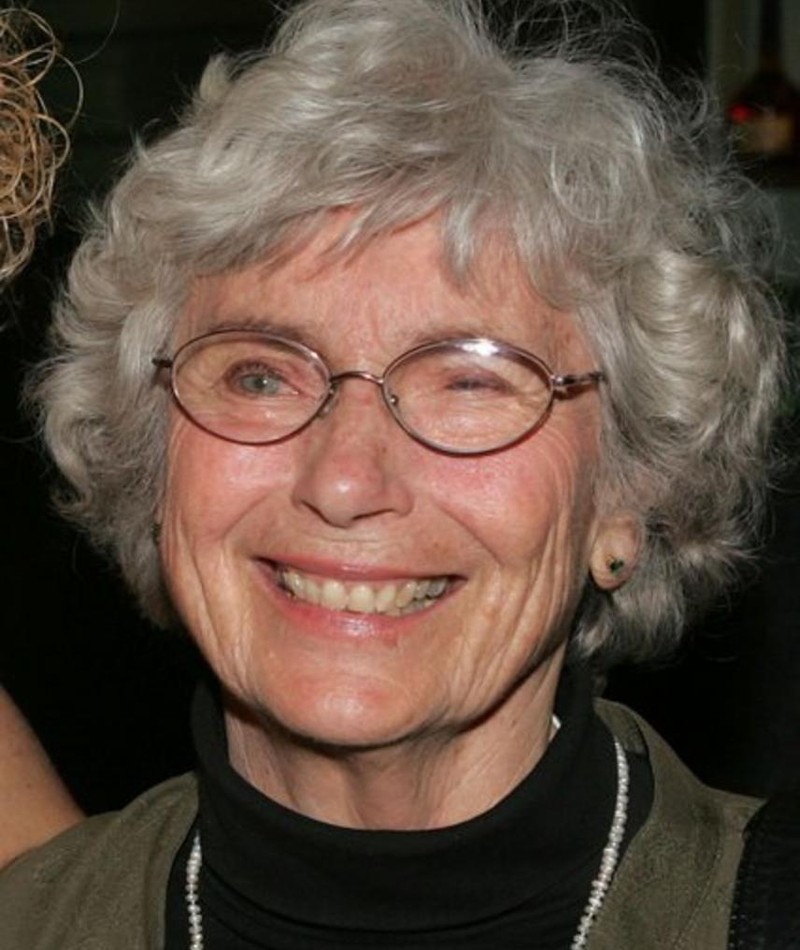

Priscilla Pointer Actress Dies At 100

May 01, 2025

Priscilla Pointer Actress Dies At 100

May 01, 2025 -

Gelecegin Doktorlari Eskisehir De Stresle Nasil Bas Ediyor Boksun Etkisi

May 01, 2025

Gelecegin Doktorlari Eskisehir De Stresle Nasil Bas Ediyor Boksun Etkisi

May 01, 2025 -

Davina Mc Calls Brain Tumour Amanda Holden Shares Reaction

May 01, 2025

Davina Mc Calls Brain Tumour Amanda Holden Shares Reaction

May 01, 2025