Major Cryptocurrency Purchase: Strategy Invests $555.8 Million In Bitcoin

Table of Contents

H2: The Significance of Strategy's $555.8 Million Bitcoin Investment

The sheer scale of Strategy's $555.8 million Bitcoin investment is unprecedented, marking a significant milestone in the cryptocurrency space. Let's break down its implications:

H3: Institutional Adoption of Bitcoin:

The influx of institutional money into Bitcoin is a pivotal development, signaling a shift away from the largely retail-driven market of the past. This isn't just about one firm; it represents a growing trend.

- Examples of other institutional investors in Bitcoin: MicroStrategy, Tesla, and numerous hedge funds have already made substantial Bitcoin investments.

- Reasons for institutional interest: Institutional investors are attracted to Bitcoin for several reasons:

- Portfolio diversification: Bitcoin offers a unique asset class, uncorrelated with traditional markets.

- Inflation hedge: Many view Bitcoin as a potential hedge against inflation, given its limited supply.

- Technological disruption: Bitcoin represents a revolutionary technology with the potential to reshape finance.

- Impact on Bitcoin's legitimacy and long-term prospects: Institutional adoption lends significant credibility to Bitcoin, bolstering its position as a legitimate asset and strengthening its long-term outlook.

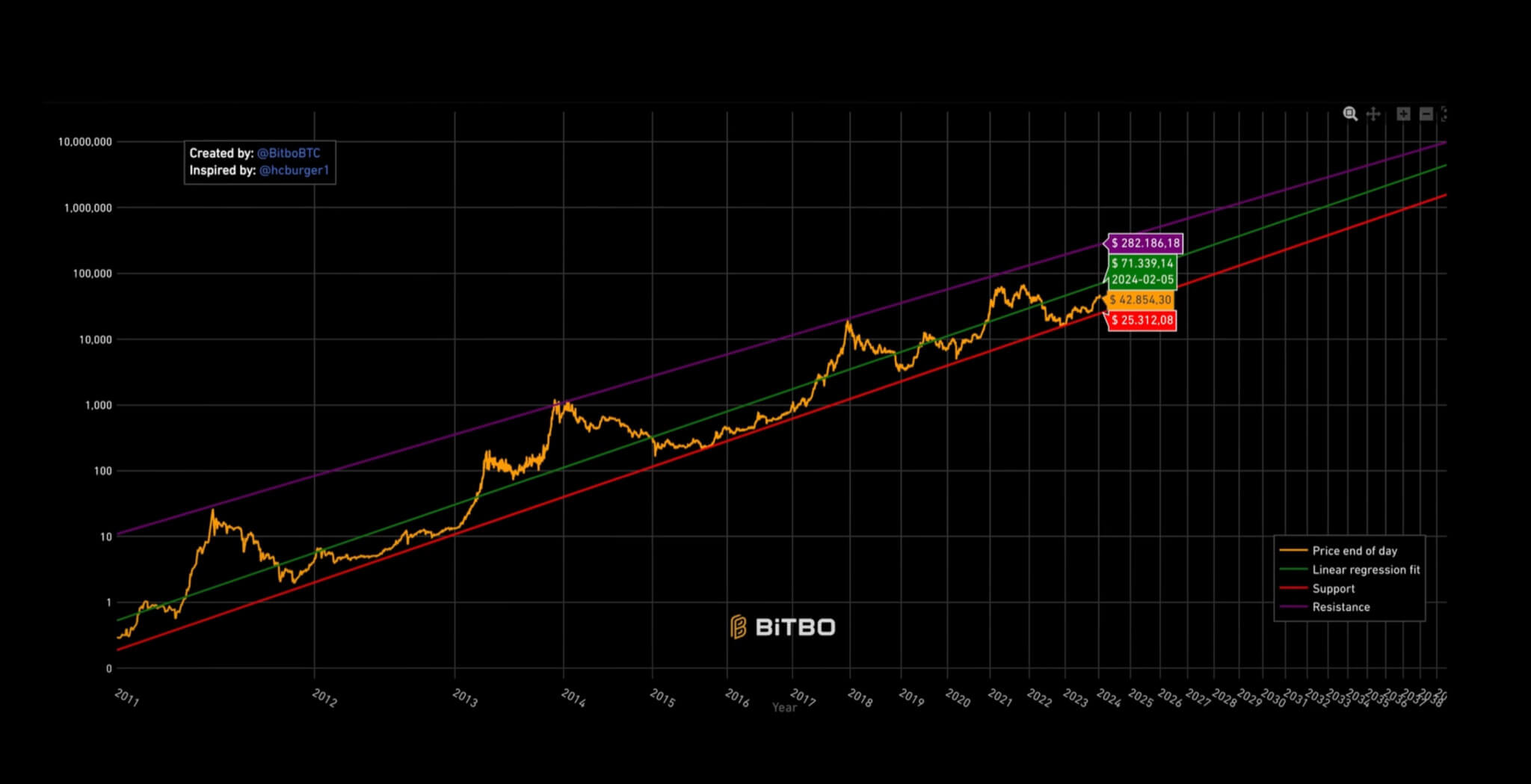

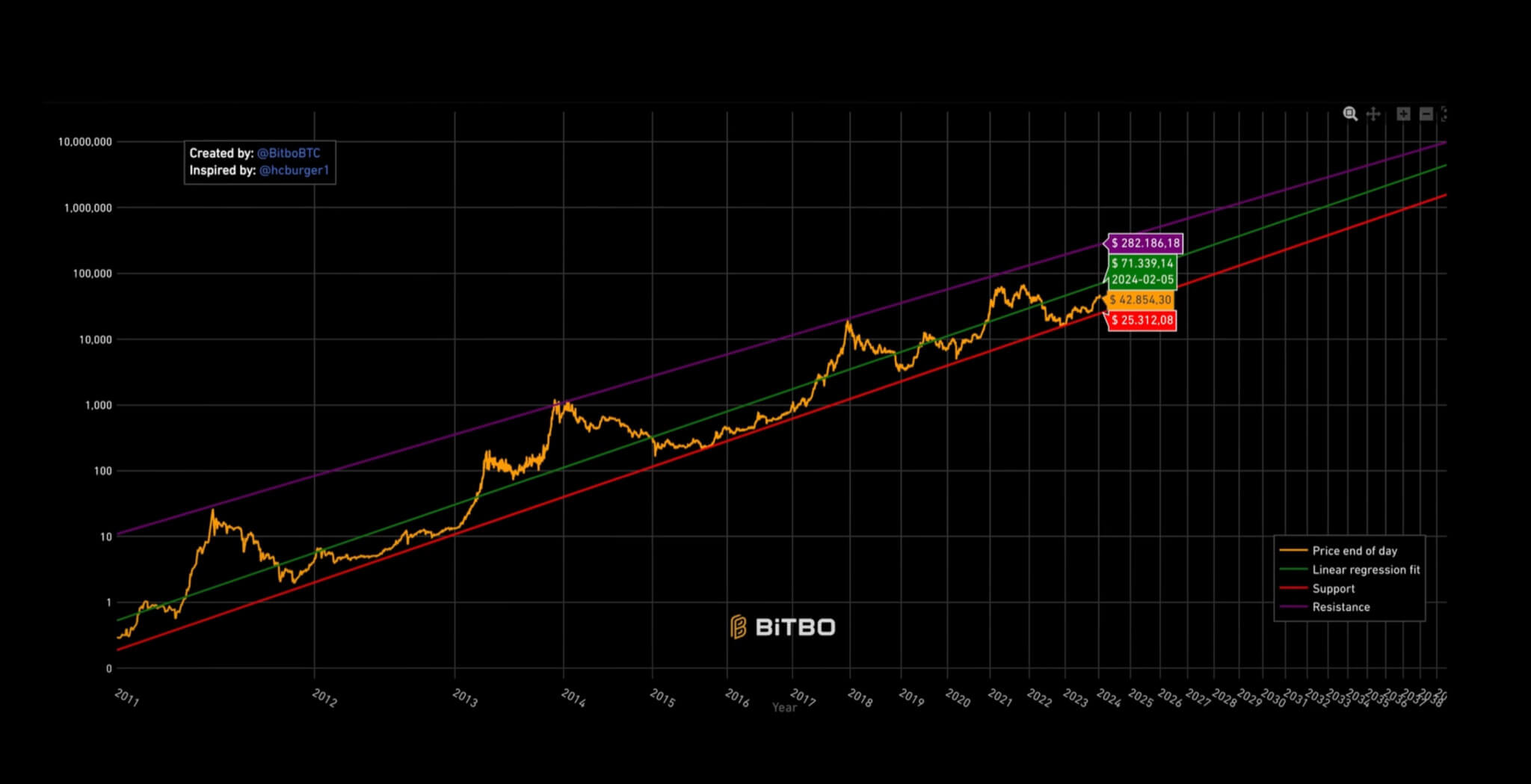

H3: Impact on Bitcoin Price and Market Volatility:

Such a large-scale Bitcoin purchase inevitably impacts its price and market volatility.

- Potential price increases: Significant buy orders like this can exert upward pressure on the Bitcoin price.

- Increased market liquidity: Large institutional investments contribute to increased liquidity in the Bitcoin market.

- Influence of large buy orders: The market reacts to large buy orders, often leading to short-term price surges.

- Potential for short-term corrections: While price increases are likely, short-term corrections or periods of consolidation are also possible.

H3: Strategy's Investment Strategy and Rationale:

While Strategy's precise investment rationale remains undisclosed, several factors likely played a role:

- Potential long-term holding strategy: Many institutional investors view Bitcoin as a long-term hold, believing in its potential for appreciation.

- Hedging against inflation: Bitcoin's limited supply makes it an attractive hedge against inflationary pressures.

- Belief in Bitcoin's future value: Strategy's investment suggests a strong belief in Bitcoin's long-term value proposition.

- Diversification of investment portfolio: Adding Bitcoin to a portfolio diversifies holdings and reduces overall risk.

H2: Analyzing the Broader Cryptocurrency Market Trends

Strategy's investment is part of a larger trend reshaping the cryptocurrency landscape:

H3: The Rise of Institutional Investment in Crypto:

The cryptocurrency market is no longer solely the domain of individual investors.

- Examples of other cryptocurrencies attracting institutional investment: Ethereum, Polkadot, and other altcoins are also seeing increased institutional interest.

- The role of crypto exchanges and custodians: Secure exchanges and custodial services are essential for facilitating institutional participation.

- Regulatory developments and their impact: Clearer regulatory frameworks will further encourage institutional adoption.

H3: Bitcoin's Position in the Cryptocurrency Landscape:

Despite the emergence of numerous altcoins, Bitcoin maintains its dominant position.

- Bitcoin's market capitalization: Bitcoin continues to hold the largest market capitalization among cryptocurrencies.

- Its role as a store of value: Bitcoin's scarcity and established track record contribute to its role as a store of value.

- Network effects and security: Bitcoin benefits from strong network effects and robust security.

- Technological advancements and future potential: Ongoing development and upgrades continue to enhance Bitcoin's functionality and potential.

3. Conclusion:

Strategy's $555.8 million Bitcoin investment represents a pivotal moment in cryptocurrency history, highlighting the growing acceptance of Bitcoin as a legitimate asset class by institutional investors. This major cryptocurrency purchase underscores the increasing institutional adoption of Bitcoin and the broader cryptocurrency market, impacting price volatility and long-term market trends. The implications are far-reaching, influencing Bitcoin's price, market liquidity, and the overall perception of digital assets.

Call to Action: Learn more about major cryptocurrency purchases and explore Bitcoin investment opportunities. Understanding the implications of institutional investment in Bitcoin is crucial for navigating this evolving market. Stay updated on the latest Bitcoin news and consider diversifying your portfolio with crypto assets. [Link to relevant resource/newsletter signup]

Featured Posts

-

Ryan Coogler Et Le Reboot De X Files Rumeurs Et Analyse

Apr 30, 2025

Ryan Coogler Et Le Reboot De X Files Rumeurs Et Analyse

Apr 30, 2025 -

Channing Tatum Confirms Relationship With Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025

Channing Tatum Confirms Relationship With Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025 -

Untucked Ru Pauls Drag Race Season 16 Episode 11 Free Online Viewing

Apr 30, 2025

Untucked Ru Pauls Drag Race Season 16 Episode 11 Free Online Viewing

Apr 30, 2025 -

Il Cardinale Becciu E Le Chat Segrete Verita O Falsa Accusa

Apr 30, 2025

Il Cardinale Becciu E Le Chat Segrete Verita O Falsa Accusa

Apr 30, 2025 -

Packing Light For A Cruise What To Leave Behind

Apr 30, 2025

Packing Light For A Cruise What To Leave Behind

Apr 30, 2025