Major Regulatory Shift Opens Saudi Arabia's ABS Market

Table of Contents

The Regulatory Changes and Their Impact

The Saudi Central Bank (SAMA), the Kingdom's monetary authority, has spearheaded significant regulatory reforms that have fundamentally reshaped the Saudi Arabia ABS market. These changes directly address previous limitations that hindered the growth of this asset class. The impact is being felt across multiple sectors, including real estate, finance, and infrastructure, unlocking substantial investment potential. Keywords: Saudi Arabia regulatory reform, ABS regulations Saudi Arabia, SAMA regulations, Saudi Arabia financial regulations.

- Specific laws amended or introduced: New legislation has streamlined the issuance process for ABS, clarifying legal frameworks and reducing bureaucratic hurdles.

- Easing of capital requirements: Relaxed capital requirements have made it easier for issuers to bring ABS to market, increasing the supply of available securities.

- Simplification of the issuance process: The process of issuing ABS has been significantly simplified, reducing time and costs associated with bringing deals to market. This includes improvements to documentation and approval processes.

- Increased transparency and investor protection: Stronger investor protection measures and increased transparency have boosted investor confidence, encouraging greater participation.

Opportunities for Investors in the Saudi ABS Market

The opening of the Saudi Arabia ABS market presents numerous compelling investment opportunities. While all investments carry risk, the potential returns in this growing market are significant, particularly for those seeking diversification beyond traditional asset classes. Different types of ABS are available, offering investors a range of choices to match their risk tolerance and investment goals. Keywords: Saudi Arabia investment opportunities, ABS investment Saudi Arabia, high-yield investments Saudi Arabia, emerging market investments.

- Potential for high returns: Historically underserved sectors now have access to capital through the ABS market, leading to potential for strong returns for investors.

- Diversification opportunities: Investing in Saudi Arabian ABS provides international investors with diversification benefits, reducing reliance on established markets.

- Access to a growing market: The Saudi Arabian economy is expanding rapidly, providing a robust backdrop for the growth of the ABS market.

- Risks associated with emerging markets: As with any emerging market, there are inherent risks including market volatility and potential liquidity challenges. Thorough due diligence is crucial.

Challenges and Considerations for Market Development

While the regulatory changes have paved the way for significant growth, challenges remain in developing a fully mature and liquid Saudi Arabia ABS market. Addressing these challenges will be key to ensuring sustained growth and attracting further investment. Keywords: Saudi Arabia market challenges, ABS market risks, investment risks Saudi Arabia, financial market risks.

- Liquidity concerns: The market is still relatively young, and liquidity may be limited in the short term. This is a typical challenge for new markets.

- Market volatility: Global economic conditions and domestic factors can affect market volatility.

- Need for investor education: Educating investors about the benefits and risks associated with ABS is crucial for attracting wider participation.

- Regulatory uncertainty (although lessened): While significant progress has been made, some degree of regulatory uncertainty might persist, requiring ongoing monitoring.

The Role of Technology in the Saudi ABS Market

The adoption of technology is playing a vital role in accelerating the development of the Saudi ABS market. Fintech solutions are streamlining processes and improving transparency, while the potential of blockchain technology offers enhanced security and efficiency. Keywords: Fintech Saudi Arabia, blockchain Saudi Arabia, technology in finance Saudi Arabia. This technological integration is not just improving efficiency but also bolstering investor confidence.

Conclusion: Investing in Saudi Arabia's Booming ABS Market – A Call to Action

The regulatory reforms in Saudi Arabia have unlocked significant potential in the ABS market. These changes have created a compelling investment landscape, offering opportunities for high returns and diversification. While challenges remain, the long-term outlook is positive. We encourage you to explore the investment opportunities within the burgeoning Saudi Arabia ABS market. For more information on accessing these opportunities, please visit [insert relevant link here]. Keywords: Invest in Saudi Arabia ABS, Saudi Arabia ABS opportunities, Asset-Backed Securities Saudi Arabia investment.

Featured Posts

-

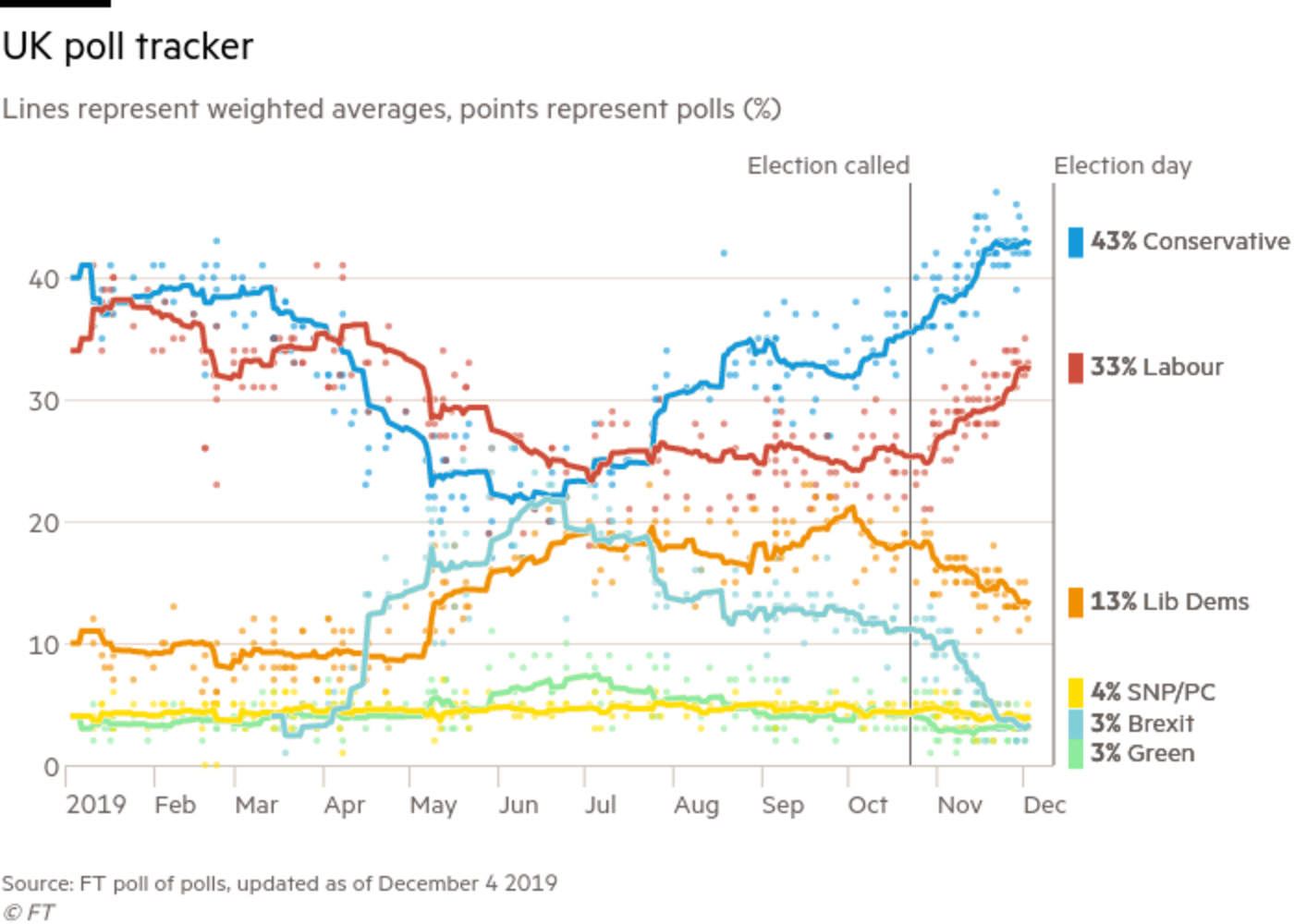

Reliable Poll Data A Key Element Of A Fair Election

May 03, 2025

Reliable Poll Data A Key Element Of A Fair Election

May 03, 2025 -

Netanyahou Accuse Macron De Grave Erreur Sur La Question Palestinienne

May 03, 2025

Netanyahou Accuse Macron De Grave Erreur Sur La Question Palestinienne

May 03, 2025 -

Daily Lotto Thursday 17th April 2025 Winning Numbers

May 03, 2025

Daily Lotto Thursday 17th April 2025 Winning Numbers

May 03, 2025 -

Nat West Nigel Farage Reach Agreement In Banking Dispute

May 03, 2025

Nat West Nigel Farage Reach Agreement In Banking Dispute

May 03, 2025 -

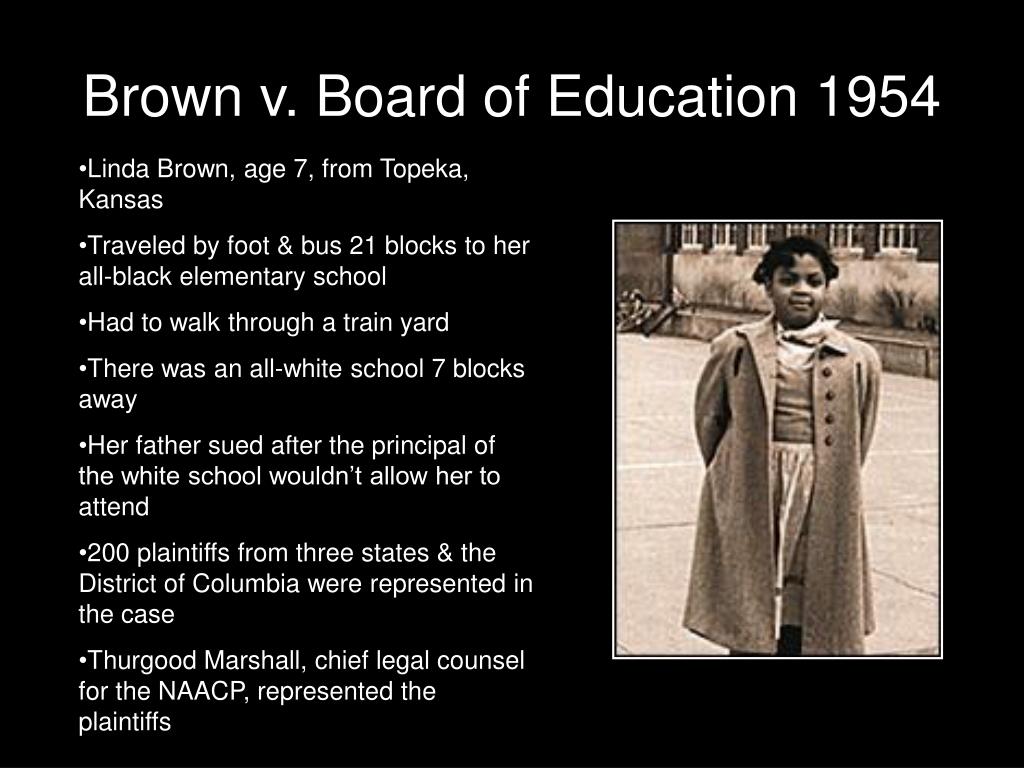

Justice Department Dismisses Longstanding School Desegregation Order Implications For Education

May 03, 2025

Justice Department Dismisses Longstanding School Desegregation Order Implications For Education

May 03, 2025