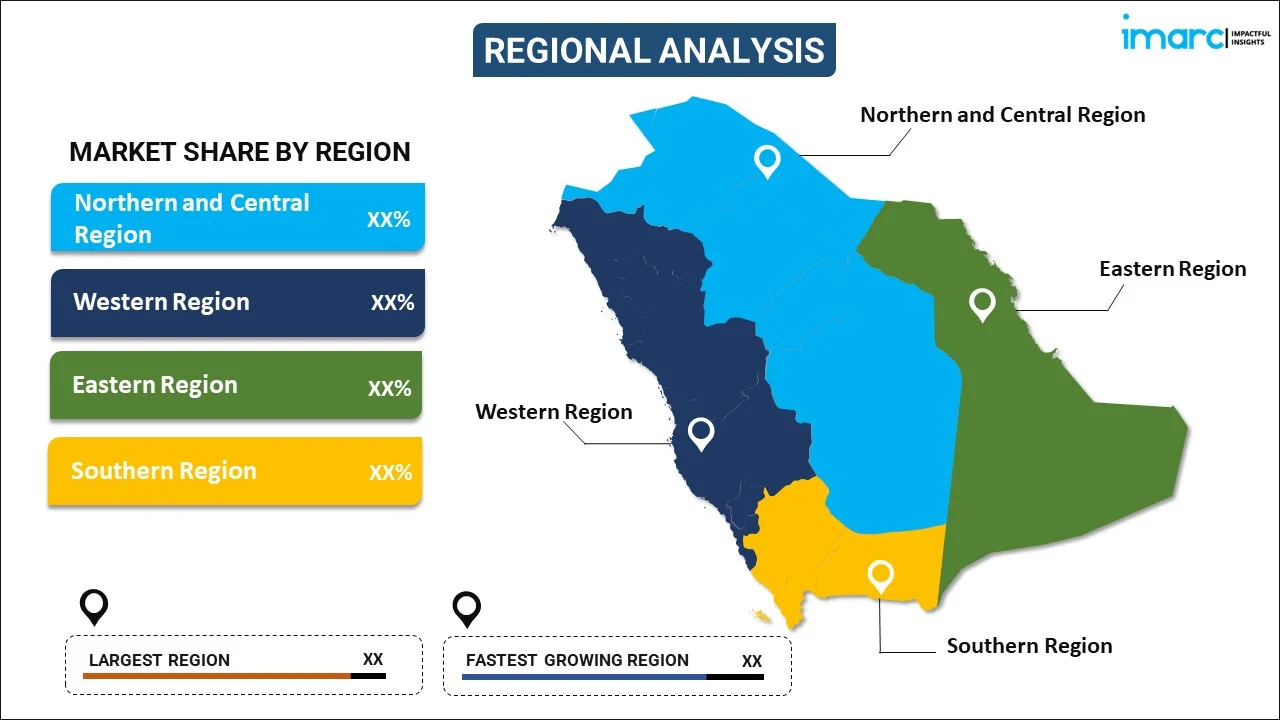

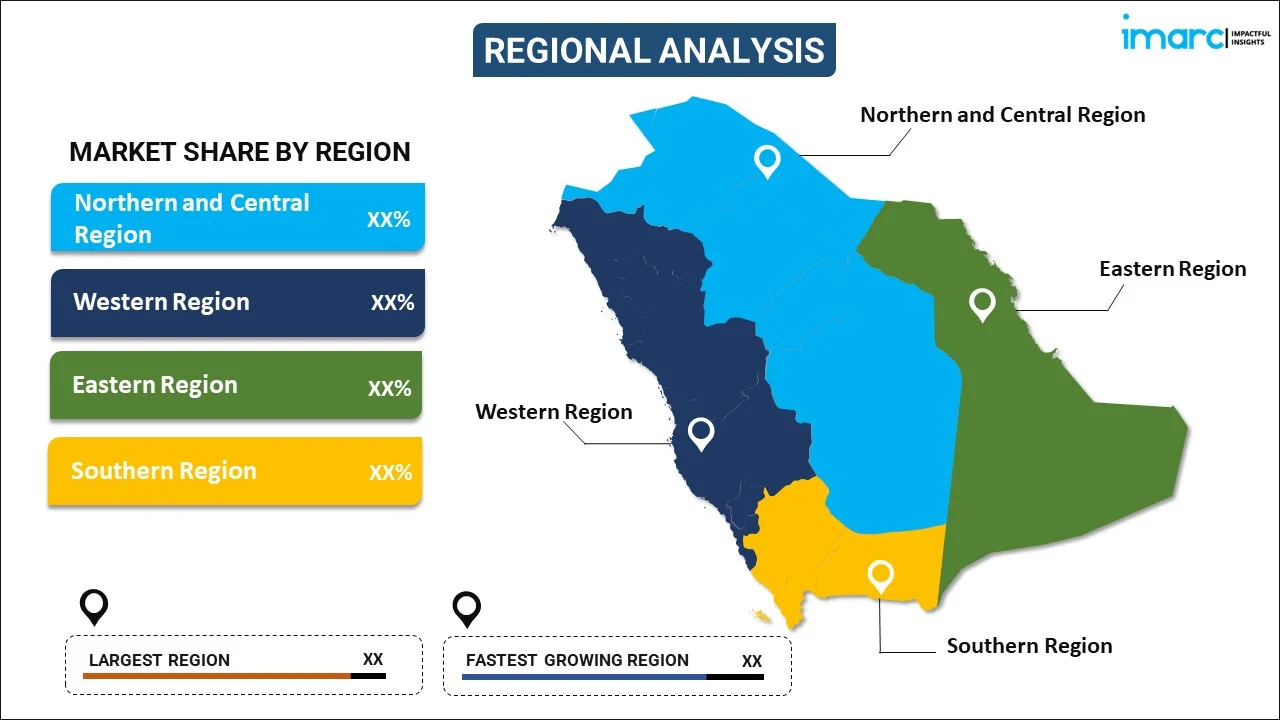

Major Regulatory Shift Unlocks Saudi Arabia's ABS Market Potential

Table of Contents

The Regulatory Overhaul: Paving the Way for ABS Growth in Saudi Arabia

The recent regulatory changes are the cornerstone of the Saudi Arabia ABS market's revitalization. These reforms aim to create a more attractive and efficient environment for issuing and trading asset-backed securities.

Key Regulatory Changes:

-

Relaxation of capital requirements for issuing ABS: Lower capital requirements significantly reduce the barrier to entry for issuers, encouraging a wider range of companies to participate in the market. This fosters competition and increases the diversity of ABS offerings.

-

Streamlined approval processes for ABS issuances: Faster and more efficient approval processes reduce the time and costs associated with bringing ABS to market, making the process more attractive to potential issuers. This directly contributes to increased market liquidity.

-

Increased transparency and standardization of ABS structures: Clearer regulations and standardized structures enhance investor confidence by reducing uncertainty and improving the overall understanding of ABS products. This transparency is crucial for attracting both domestic and international investment.

-

Enhanced investor protection measures: Stronger investor protection mechanisms build trust and confidence in the market, attracting a wider range of investors. These measures are vital for the long-term sustainability and growth of the ABS market.

-

Specific provisions addressing Islamic finance principles within the ABS framework (Sukuk): The inclusion of Sharia-compliant structures explicitly caters to the significant Islamic finance sector within Saudi Arabia, furthering market diversification and growth. This opens up a vast potential for Sukuk issuance.

-

Examples: Specific details about the regulatory changes (e.g., decrees, circulars from the Saudi Central Bank - SAMA) should be cited here. For example, a specific circular number and date related to capital requirement relaxations could be mentioned. News articles detailing the streamlining of approval processes should also be referenced.

-

Impact: The positive effect on investor confidence can be highlighted by referencing increased trading volumes or a rise in the number of ABS issuances post-regulatory changes.

-

Challenges: Any remaining challenges, such as potential bureaucratic hurdles or the need for further clarification on specific regulations, should be acknowledged for a balanced perspective.

Unlocking Investment Opportunities: Attracting Domestic and International Capital

The regulatory changes have unlocked significant investment opportunities, attracting both domestic and international capital to the Saudi Arabian ABS market.

Attractiveness for Domestic Investors:

- Increased diversification opportunities: ABS offer Saudi investors a new asset class to diversify their portfolios, reducing overall risk. This is particularly attractive given the ongoing economic diversification efforts within the Kingdom.

- Higher potential returns: Compared to traditional investment avenues, ABS can potentially offer higher returns, making them an attractive option for investors seeking greater yield.

- Support for Vision 2030: Investing in ABS aligns with Saudi Arabia's Vision 2030 goals for economic diversification and growth, creating a strong incentive for domestic participation.

Attractiveness for International Investors:

-

Access to a rapidly growing market: International investors gain access to a previously untapped market with significant growth potential in a strategically important region.

-

Potential for high returns: The high potential returns offered by the Saudi ABS market represent a compelling investment proposition for international investors.

-

Collaboration opportunities: International investors can collaborate with established Saudi financial institutions, leveraging local expertise and networks to capitalize on market opportunities.

-

Sector Growth: Specific sectors driving ABS issuance, such as real estate, infrastructure development, and consumer finance, should be detailed here along with projections for growth.

-

Return Projections: While avoiding definitive predictions, providing a range of potential return on investment based on market analysis would further enhance the article's credibility.

-

Government Incentives: Mention any government incentives or initiatives designed to attract foreign direct investment (FDI) in the financial sector.

The Role of Islamic Finance in Saudi Arabia's ABS Market

Islamic finance plays a crucial role in Saudi Arabia’s ABS market, with Sukuk (Sharia-compliant bonds) forming a significant part of the growth story.

Growth of Sukuk:

-

Importance of Sharia-compliant ABS: The inclusion of Sharia-compliant ABS, or Sukuk, is vital for attracting investors adhering to Islamic principles, a substantial segment of the Saudi Arabian and global investment landscape.

-

Sukuk market growth potential: The regulatory changes are expected to significantly boost the Sukuk market by streamlining the issuance process and enhancing transparency.

-

Global significance: The growth of the Saudi Arabian Sukuk market contributes to the global development of Islamic finance, solidifying the Kingdom’s position as a leader in this sector.

-

Successful Sukuk Issuances: Examples of successful Sukuk issuances in Saudi Arabia, including details on the size of the issuance, the issuer, and the purpose of the funds raised, can strengthen this section.

-

Innovation in Sharia-compliant structures: Discussions on innovative Sukuk structures and their potential impact on market growth could add value here.

-

Role of Islamic Financial Institutions: Highlight the role of Islamic banks and financial institutions in promoting and facilitating Sukuk issuance.

Challenges and Future Outlook for the Saudi Arabia ABS Market

Despite the significant potential, challenges and risks remain for the Saudi ABS market. A balanced assessment is crucial for realistic expectations.

Potential Challenges:

- Regulatory Stability: Maintaining regulatory stability and consistency is crucial to foster long-term investor confidence. Any sudden changes can create uncertainty.

- Market Volatility: Addressing potential market volatility through risk management strategies is essential to ensure the sustainable growth of the market.

- Transparency and Investor Protection: Continued emphasis on transparency and robust investor protection mechanisms will be vital to building and maintaining trust in the market.

Future Outlook:

-

Market Growth Projections: Provide a reasonable forecast for the growth of the Saudi ABS market in the coming years, considering various factors.

-

Further Regulatory Enhancements: Discuss the potential for further regulatory improvements that can support market expansion.

-

Technological Advancements: Analyze how technological advancements, such as blockchain technology, can further enhance market efficiency and transparency.

-

Investment Risks: Discuss potential risks associated with investing in the Saudi ABS market, such as geopolitical risks, economic downturns, and liquidity issues.

-

Growth Forecast: A realistic forecast for market growth, supported by data and analysis, adds credibility.

-

Global Economic Factors: Analyze the potential impact of global economic factors on the Saudi ABS market.

Conclusion:

The regulatory shift in Saudi Arabia has unlocked significant potential within the Kingdom's ABS market, creating compelling investment opportunities for both domestic and international players. The streamlined regulations, combined with the burgeoning Islamic finance sector and the growth of Sukuk, are positioning Saudi Arabia as a key player in the global ABS landscape. The market offers exciting prospects for diversification and potentially high returns, making it an attractive proposition for investors seeking exposure to a dynamic and growing economy.

Call to Action: Explore the exciting opportunities presented by Saudi Arabia's rapidly expanding ABS market. Don't miss out on this significant investment opportunity – learn more about the potential of Saudi Arabia's asset-backed securities market today!

Featured Posts

-

Check The Lotto Results Wednesday April 9th Draw

May 02, 2025

Check The Lotto Results Wednesday April 9th Draw

May 02, 2025 -

Tuesdays Snowstorm Four Inches Or More Predicted Dangerous Cold To Follow

May 02, 2025

Tuesdays Snowstorm Four Inches Or More Predicted Dangerous Cold To Follow

May 02, 2025 -

Is This Christina Aguilera Fans React To Heavily Edited Photos

May 02, 2025

Is This Christina Aguilera Fans React To Heavily Edited Photos

May 02, 2025 -

Private Credit Hiring Trends 5 Dos And Don Ts To Know

May 02, 2025

Private Credit Hiring Trends 5 Dos And Don Ts To Know

May 02, 2025 -

A Dallas Legend Passes Reflecting On The Shows Iconic Stars

May 02, 2025

A Dallas Legend Passes Reflecting On The Shows Iconic Stars

May 02, 2025