Managing Student Loan Debt: Expert Financial Planning Advice

Table of Contents

Understanding Your Student Loans

Before you can effectively manage your student loan debt, you need a clear understanding of what you owe. This involves identifying the types of loans you have and calculating your total debt.

Types of Student Loans

Understanding the differences between federal and private student loans is crucial for effective debt management. Federal loans often offer more flexible repayment options and potential forgiveness programs, while private loans typically have higher interest rates and fewer protections.

- Federal Subsidized vs. Unsubsidized Loans: Subsidized loans don't accrue interest while you're in school (under certain conditions), while unsubsidized loans accrue interest from day one. This impacts your total repayment amount significantly.

- Private Loan Interest Rates and Terms: Private loan interest rates vary greatly depending on your creditworthiness and the lender. Terms and conditions also differ, so carefully review all loan documents before signing.

- Consolidation Options: Consolidating multiple loans into a single loan can simplify repayment, but be aware of potential interest rate implications. It might lower your monthly payment, but could increase your overall interest paid.

Example: A $20,000 subsidized loan will accrue less interest than a $20,000 unsubsidized loan over the same period. Understanding this difference is crucial for accurate debt projections.

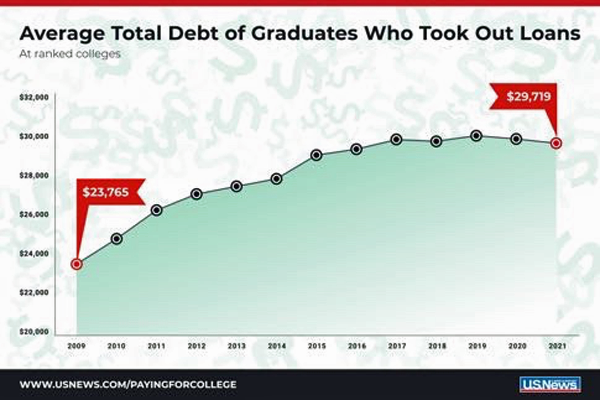

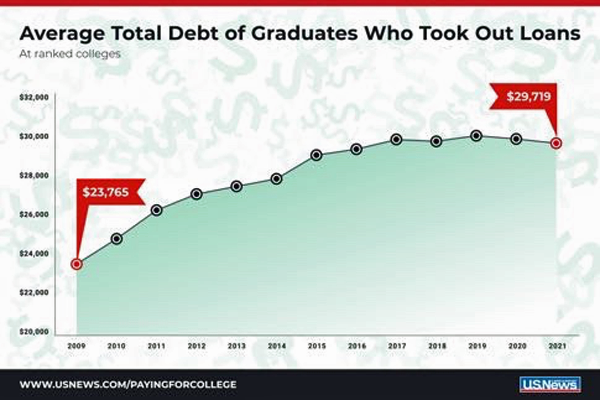

Calculating Your Total Debt

Knowing your total student loan debt—including principal, interest, and fees—is the first step to effective management. You can access this information through your loan servicers' online portals.

- Steps to Find Your Loan Information Online: Each loan servicer has a website and online account portal. Log in to access your loan details, including interest rates, payment schedules, and outstanding balances.

- Using Loan Calculators to Estimate Total Repayment Costs: Numerous online calculators can help you estimate your total repayment costs based on your loan amounts, interest rates, and chosen repayment plan. Use these tools to understand the long-term implications of your debt.

- Importance of Understanding Interest Capitalization: Interest capitalization occurs when unpaid interest is added to your principal loan balance, increasing your overall debt. Understanding this process is crucial for accurate debt projections.

Helpful Links: You can find your loan servicer information and access online loan calculators through the National Student Loan Data System (NSLDS) website: [Insert NSLDS link here].

Strategies for Managing Student Loan Debt

Once you understand your loans, you can implement effective strategies to manage your debt. This involves exploring different repayment plans and actively seeking ways to lower your monthly payments.

Repayment Plans

Several repayment plans are available, each with its own advantages and disadvantages. Choosing the right plan is crucial for managing your debt effectively.

- Standard Repayment: Fixed monthly payments over 10 years. This results in the lowest total interest paid but may lead to higher monthly payments.

- Extended Repayment: Fixed monthly payments over up to 25 years. This lowers monthly payments but increases the total interest paid.

- Income-Driven Repayment (IBR, PAYE, REPAYE): Monthly payments are based on your income and family size. Payments are typically lower, but the loan repayment period is typically longer (20-25 years). This may lead to loan forgiveness after a certain period.

- Graduated Repayment: Payments start low and gradually increase over time. This can be beneficial in the early years, but payments can become significantly higher later.

Example: An income-driven repayment plan might significantly reduce your monthly payments, making them more manageable, even though it extends the repayment period.

Reducing Your Monthly Payments

Beyond choosing a suitable repayment plan, other strategies can help lower your monthly payments. However, always weigh the long-term consequences.

- Refinancing Student Loans: Refinancing can lower your interest rate, reducing your monthly payment. However, ensure you're eligible and compare offers carefully. This often involves private lenders and may forfeit federal loan benefits.

- Consolidating Federal Loans: Consolidating your federal loans into a single loan can simplify repayment. This doesn't lower the interest rate but can streamline the process.

- Exploring Forbearance and Deferment: Forbearance and deferment temporarily postpone your payments, but interest typically continues to accrue. These options should be used cautiously and only as a temporary solution.

Caution: Refinancing with a private lender can remove access to federal loan forgiveness programs. Thoroughly research this option before proceeding.

Budgeting and Financial Planning

Effective budgeting is paramount to successful student loan debt management. It helps you prioritize loan payments while managing your expenses.

- Creating a Monthly Budget: Track your income and expenses to identify areas for potential savings.

- Tracking Spending Habits: Utilize budgeting apps or spreadsheets to monitor where your money is going.

- Identifying Areas for Savings: Explore ways to reduce non-essential spending to free up funds for loan payments.

- Automating Loan Payments: Set up automatic payments to ensure timely payments and avoid late fees.

Tip: Many budgeting apps are available to assist with tracking your expenses and creating a realistic budget.

Seeking Professional Help

Navigating student loan debt can be challenging. Don't hesitate to seek professional help when needed.

Credit Counseling

Credit counseling agencies can provide guidance on managing debt, consolidating loans, and negotiating with creditors.

- Finding Reputable Credit Counseling Agencies: Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) or a similar reputable organization.

- Understanding the Services Offered: Reputable agencies offer debt management plans, budgeting assistance, and financial education.

- Avoiding Predatory Practices: Beware of agencies that charge excessive fees or make unrealistic promises.

Resource: Find accredited credit counseling agencies through the NFCC website: [Insert NFCC link here]

Financial Advisors

A financial advisor can help create a comprehensive financial plan tailored to your specific needs and goals, incorporating your student loan debt management strategy.

- The Benefits of Working with a Financial Advisor: A financial advisor can provide personalized advice, create a long-term financial plan, and help you navigate complex financial decisions.

- Finding a Qualified Advisor: Choose a fiduciary advisor who is legally obligated to act in your best interest.

- The Cost of Financial Advice: Fees vary depending on the advisor and services provided.

Conclusion

Managing student loan debt effectively requires a proactive and strategic approach. By understanding your loan types, exploring repayment options, and creating a sound financial plan, you can significantly reduce your burden and work towards a debt-free future. Remember to utilize available resources, such as credit counseling and financial advisors, to create a personalized strategy that best suits your individual needs. Don't let student loan debt define your financial future; take control and start planning your path to financial freedom with effective student loan debt management today!

Featured Posts

-

Injury Concerns For Giants And Mariners April 4 6 Matchup

May 17, 2025

Injury Concerns For Giants And Mariners April 4 6 Matchup

May 17, 2025 -

Barcelona Match Car Crash 13 Injured Police Call It Accidental

May 17, 2025

Barcelona Match Car Crash 13 Injured Police Call It Accidental

May 17, 2025 -

The Pope Thibodeau And The Knicks Connecting The Dots

May 17, 2025

The Pope Thibodeau And The Knicks Connecting The Dots

May 17, 2025 -

Thibodeaus Humorous Pope Remark A Deeper Look At The Knicks

May 17, 2025

Thibodeaus Humorous Pope Remark A Deeper Look At The Knicks

May 17, 2025 -

Uspekh V Industrialnykh Parkakh Faktory Konkurentosposobnosti

May 17, 2025

Uspekh V Industrialnykh Parkakh Faktory Konkurentosposobnosti

May 17, 2025

Latest Posts

-

Fortnites Latest Shop Update What Went Wrong

May 17, 2025

Fortnites Latest Shop Update What Went Wrong

May 17, 2025 -

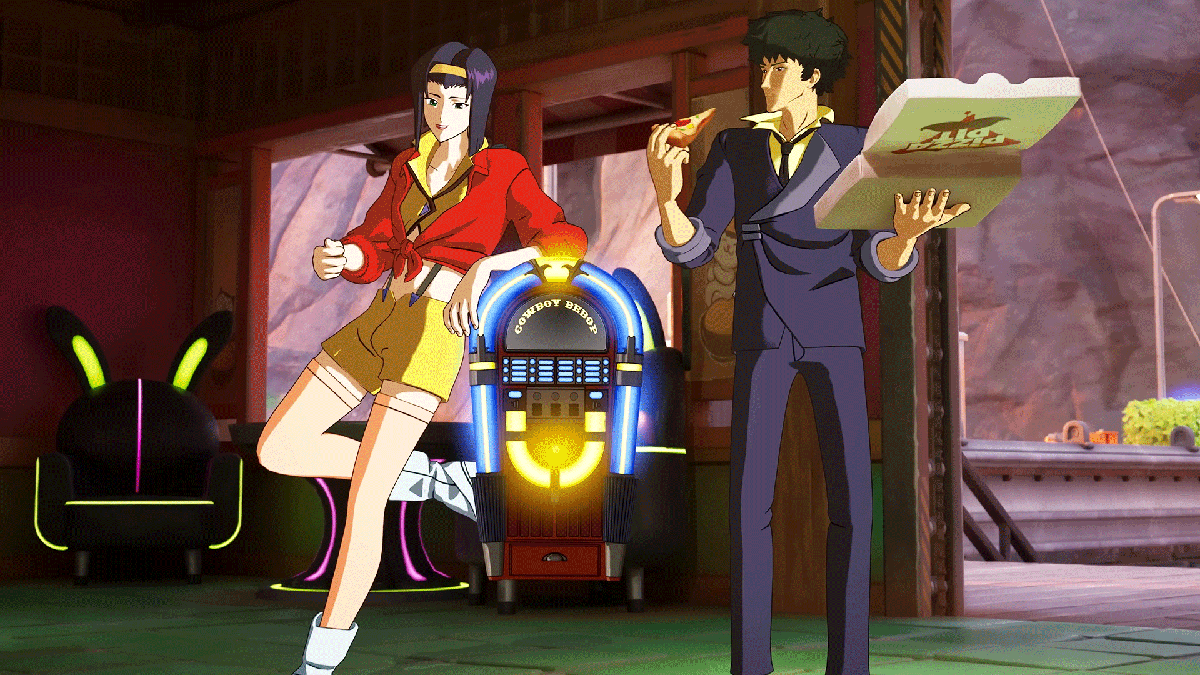

Fortnite Cowboy Bebop Skins Complete Price Guide For Faye Valentine And Spike Spiegel Bundle

May 17, 2025

Fortnite Cowboy Bebop Skins Complete Price Guide For Faye Valentine And Spike Spiegel Bundle

May 17, 2025 -

Fortnite Item Shop Update A Wave Of Player Discontent

May 17, 2025

Fortnite Item Shop Update A Wave Of Player Discontent

May 17, 2025 -

Fortnite Cowboy Bebop Bundle Price Check For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnite Cowboy Bebop Bundle Price Check For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skins Price And Release Date

May 17, 2025

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skins Price And Release Date

May 17, 2025