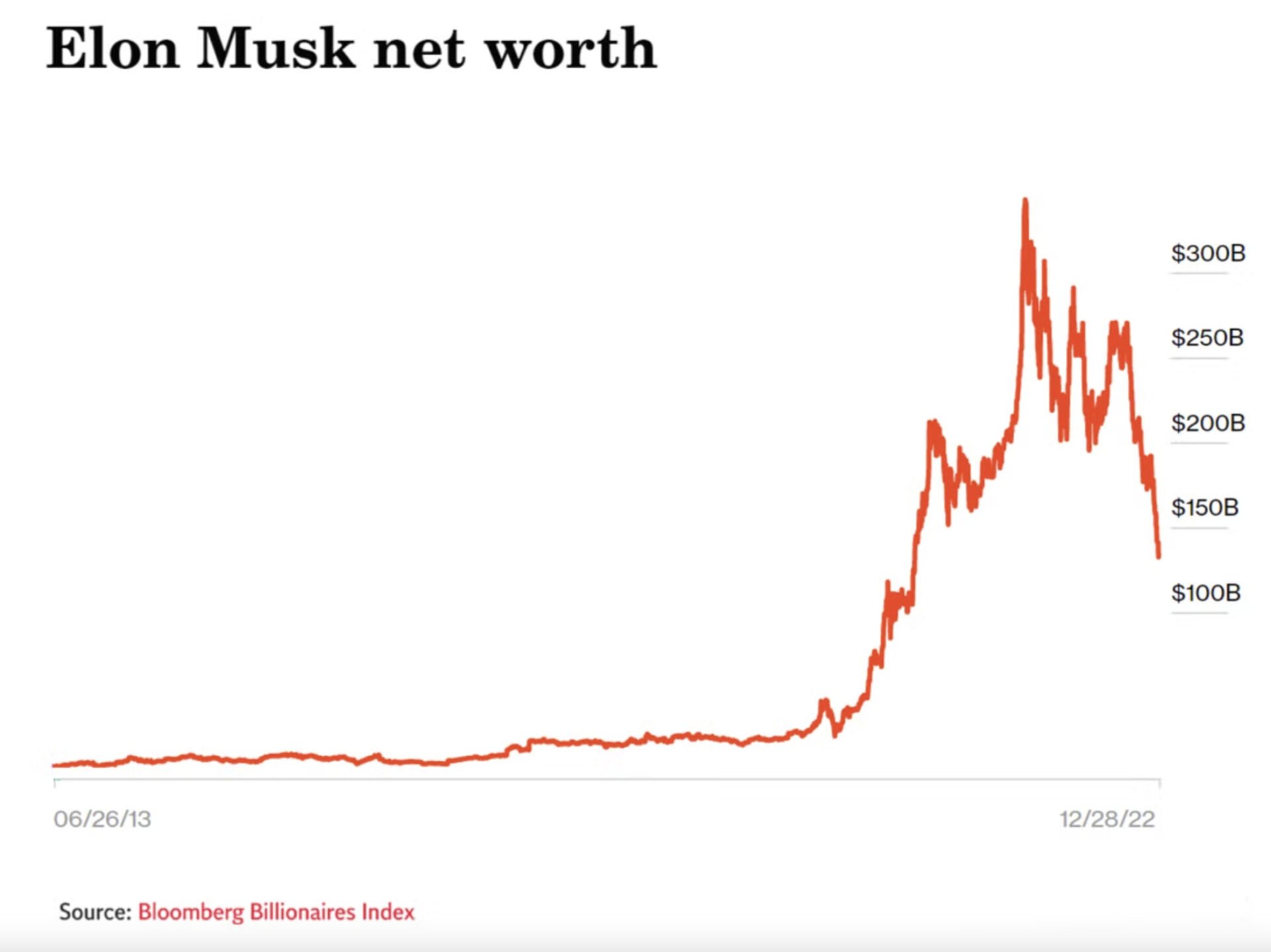

Market Downturn Impacts Elon Musk's Net Worth, Falling Below $300 Billion

Table of Contents

The Role of Tesla Stock in Elon Musk's Net Worth Decline

A substantial portion of Elon Musk's immense wealth is directly tied to his ownership stake in Tesla. Therefore, fluctuations in Tesla's stock price significantly impact his overall net worth. Recent market instability has seen Tesla's stock performance decline, mirroring the broader market downturn. This correlation underscores the vulnerability of even the most successful companies to macroeconomic trends.

- Impact of interest rate hikes on Tesla's valuation: The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but they also increase borrowing costs, making growth stocks like Tesla less attractive to investors. Higher interest rates increase the opportunity cost of holding stocks, diverting investment towards safer, higher-yield options.

- Competition from other electric vehicle manufacturers: Tesla faces increasing competition from established automakers and new entrants in the electric vehicle (EV) market. This intensifying competition puts pressure on Tesla's market share and profitability, affecting investor confidence and stock price.

- Concerns about Tesla's production and delivery numbers: Any slowdown in Tesla's production or delivery targets can negatively impact investor sentiment. Concerns regarding supply chain disruptions, production bottlenecks, or lower-than-expected demand can trigger stock price drops.

- Musk's controversial Twitter/X activities and its influence on Tesla's image: Musk's highly publicized and often controversial actions surrounding Twitter/X have raised concerns among some investors about his focus and the potential impact on Tesla's brand image and long-term strategy. This distraction has led to some negative sentiment toward Tesla.

Broader Economic Factors Contributing to the Wealth Decrease

The recent market downturn isn't solely impacting Tesla; broader economic factors play a significant role in the decline of Elon Musk's net worth. Inflation and recessionary fears are impacting the overall market, leading to a decrease in valuations across various sectors, including technology.

- Rising interest rates and their effect on investor sentiment: Higher interest rates increase borrowing costs for companies, making expansion and investment more challenging. This dampens investor enthusiasm and contributes to lower stock valuations.

- Global economic uncertainty and its impact on stock markets: Geopolitical instability, supply chain disruptions, and energy price volatility contribute to global economic uncertainty. This uncertainty fuels market volatility and negatively impacts stock prices.

- The influence of geopolitical events on market volatility: Major global events, such as the war in Ukraine, significantly influence investor sentiment and market stability. Uncertainty related to these events can trigger market downturns and affect stock valuations.

The Impact of Musk's Twitter/X Acquisition

The acquisition of Twitter/X has placed a significant financial burden on Elon Musk. The substantial debt financing used for the acquisition, coupled with the platform's ongoing financial challenges, has undoubtedly contributed to the decrease in his net worth. Furthermore, the controversies surrounding the acquisition and Musk's management style have negatively impacted investor confidence in his other ventures.

- Debt financing used for the acquisition and its repayment implications: The significant debt Musk took on to finance the Twitter/X acquisition represents a considerable financial liability, impacting his overall financial position and potentially limiting his ability to invest in other ventures.

- The impact of Musk's management style on Twitter/X's financial performance: Musk's leadership style and controversial decisions at Twitter/X have raised concerns among advertisers and users, affecting the platform's revenue streams and financial performance.

- The effect of the platform's controversies on Musk's overall brand image: The controversies surrounding Twitter/X have impacted Musk's reputation and overall brand image, which could negatively affect investor confidence in his other companies and ventures.

Potential Future Scenarios for Elon Musk's Net Worth

Predicting the future of Elon Musk's net worth is challenging, but various scenarios can be considered based on market forecasts and Tesla's future performance. Technological advancements and innovations within Tesla and SpaceX could significantly impact his wealth.

- Optimistic scenarios: Continued growth and market leadership for Tesla, successful launches and contracts for SpaceX, and innovative ventures could lead to a significant rebound in Musk's net worth.

- Pessimistic scenarios: A prolonged market downturn, challenges for Tesla in the face of increased competition, or setbacks for SpaceX could further reduce Musk's net worth.

- Neutral scenarios: A gradual recovery of the market and stabilization of Tesla's stock price could lead to a gradual recovery of Musk's net worth, maintaining it within a specific range.

Conclusion: Analyzing the Impact of the Market Downturn on Elon Musk's Billions

The decline in Elon Musk's net worth below $300 billion is a result of interconnected factors. The market downturn, the performance of Tesla stock, and the financial implications of the Twitter/X acquisition all played a significant role. Understanding market volatility and its impact on high-net-worth individuals is crucial. To stay informed about these dynamics and their impact on major companies and influential figures, follow Elon Musk's net worth, understand market downturns, and track the impact of economic factors on billionaire net worth. Staying informed is key to navigating these complex economic shifts.

Featured Posts

-

3 000 Babysitting To 3 600 Daycare One Dads Expensive Childcare Struggle

May 09, 2025

3 000 Babysitting To 3 600 Daycare One Dads Expensive Childcare Struggle

May 09, 2025 -

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025 -

Elizabeth Hurley Rocks Bikinis On Luxurious Maldives Holiday

May 09, 2025

Elizabeth Hurley Rocks Bikinis On Luxurious Maldives Holiday

May 09, 2025 -

Leon Draisaitl Injury Update Oilers Star Expected For Playoffs

May 09, 2025

Leon Draisaitl Injury Update Oilers Star Expected For Playoffs

May 09, 2025 -

Prognozirovanie Snegopadov V Mae Zadachi I Ogranicheniya Sinoptikov

May 09, 2025

Prognozirovanie Snegopadov V Mae Zadachi I Ogranicheniya Sinoptikov

May 09, 2025

Latest Posts

-

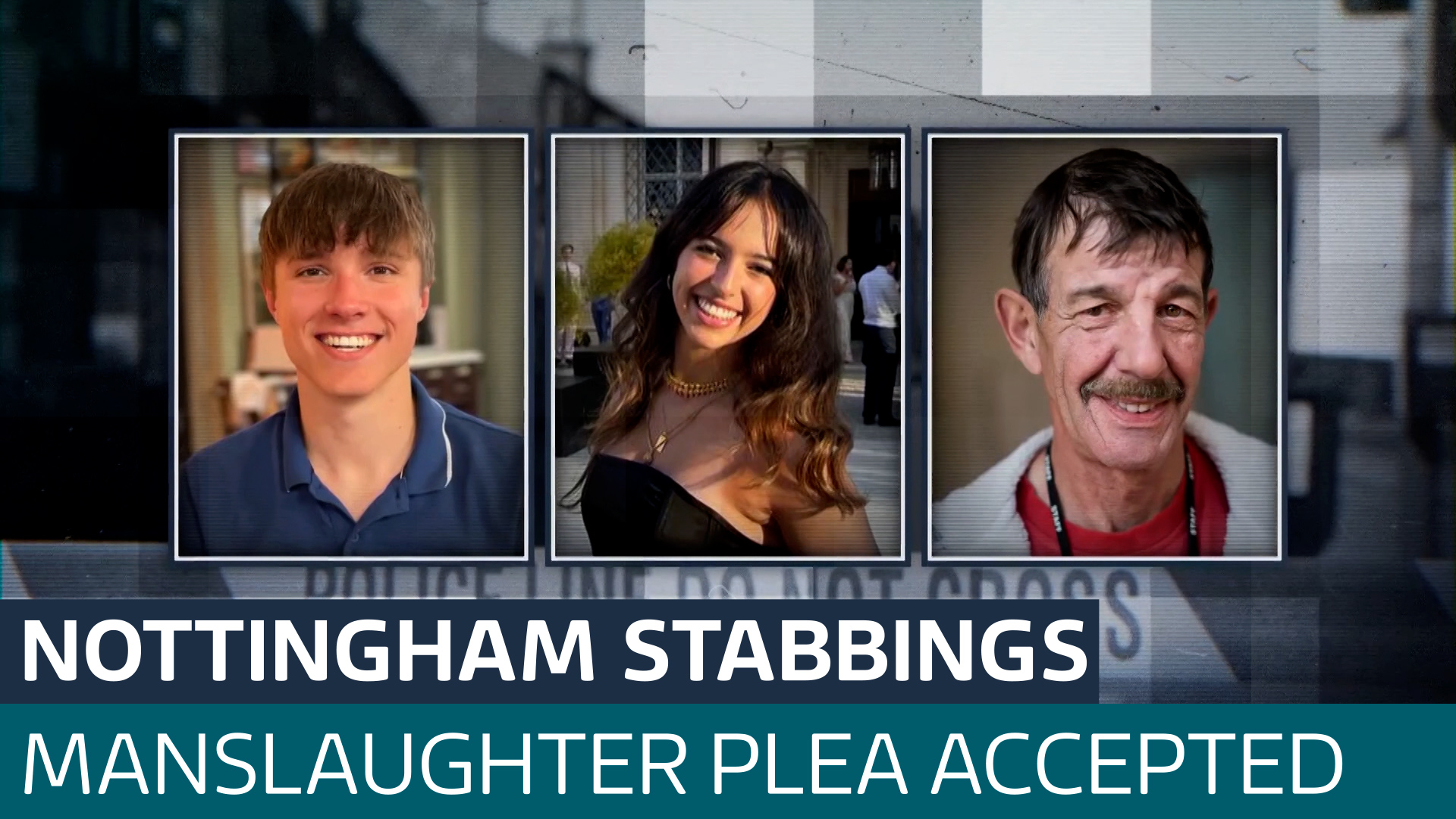

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed

May 09, 2025

Nottingham Attacks Inquiry Retired Judge Appointed

May 09, 2025 -

Nottingham A And E Records Accessed Illegally Families Of Stabbing Victims Demand Justice

May 09, 2025

Nottingham A And E Records Accessed Illegally Families Of Stabbing Victims Demand Justice

May 09, 2025 -

Nhs Data Breach In Nottingham Stabbing Victims Families Demand Answers

May 09, 2025

Nhs Data Breach In Nottingham Stabbing Victims Families Demand Answers

May 09, 2025 -

Families Furious After Nhs Staff Accessed A And E Records Of Nottingham Stabbing Victims

May 09, 2025

Families Furious After Nhs Staff Accessed A And E Records Of Nottingham Stabbing Victims

May 09, 2025