Market Movers: Sensex And Nifty Climb; Sectoral Performance Analysis

Table of Contents

The Indian stock market experienced a significant surge this week, with both the Sensex and Nifty indices registering impressive gains. This market rally, fueled by a confluence of factors, presents a compelling opportunity to analyze the key drivers behind this positive movement and delve into the sectoral performance that contributed to this "stock market rally." This article will dissect the Sensex and Nifty performance, examining the daily/weekly movement, key drivers, and a detailed sectoral performance analysis, including top gainers and laggards. We will also explore potential future market trends, providing insights into the current investment landscape. Key sectors to be covered include IT, banking, pharmaceuticals, and others showing significant movement.

H2: Sensex and Nifty Index Performance

H3: Daily/Weekly Movement:

The Sensex witnessed a remarkable [Insert Percentage]% increase this week, closing at [Insert Closing Value] index points. Similarly, the Nifty experienced a substantial [Insert Percentage]% surge, reaching [Insert Closing Value] index points. This represents a significant increase in market capitalization for listed companies. The charts below illustrate the daily and weekly movement of both indices, highlighting the impressive upward trajectory.

[Insert Chart/Graph showing Sensex movement]

[Insert Chart/Graph showing Nifty movement]

H3: Key Drivers of the Surge:

Several factors contributed to this impressive stock market rally. Positive global economic indicators, coupled with strong corporate earnings reports, boosted investor confidence. Furthermore, supportive government policies and a generally optimistic investor sentiment played crucial roles.

- Positive Global Economic News: The recent positive economic data released from [mention specific country/region] significantly impacted investor sentiment, leading to increased foreign portfolio investment (FPI) inflows.

- Strong Corporate Earnings: Several blue-chip companies announced better-than-expected quarterly earnings, further bolstering investor confidence and driving up stock prices. Examples include [mention specific companies and their sectors].

- Government Policies: The government's recent announcement regarding [mention specific policy, e.g., infrastructure spending, tax reforms] had a positive impact on market sentiment, providing further impetus to the rally.

- Increased Investor Confidence: A combination of these positive factors resulted in significantly increased investor confidence, driving demand and pushing up index values. This is reflected in increased trading volumes.

H2: Sectoral Performance Analysis

H3: Top Performing Sectors:

The IT sector emerged as a clear winner, with many companies experiencing double-digit percentage gains. This surge is likely attributed to [mention specific reasons, e.g., increased demand for tech services, positive industry outlook]. The banking sector also performed exceptionally well, boosted by [mention specific reasons, e.g., positive interest rate outlook, strong loan growth]. Pharmaceuticals also saw substantial gains due to [mention specific reasons, e.g., strong drug pipeline, increased demand].

- IT Sector Top Gainers: [List companies with percentage gains]

- Banking Sector Top Gainers: [List companies with percentage gains]

- Pharmaceuticals Sector Top Gainers: [List companies with percentage gains]

H3: Underperforming Sectors:

While many sectors celebrated impressive gains, some lagged behind. The [mention sector] sector witnessed minimal growth, primarily due to [mention specific reasons, e.g., sector-specific challenges, global headwinds]. Similarly, the [mention sector] sector experienced slight declines, possibly attributed to [mention specific reasons, e.g., regulatory hurdles, decreased consumer demand].

- Underperforming Sectors: [List sectors with percentage changes or minimal gains]

- Reasons for Underperformance: [Detailed explanation for each underperforming sector]

H2: Future Market Outlook

While the current market trend is positive, it's crucial to remember that market predictions are inherently uncertain and involve risk. However, based on current trends and expert opinions, a continued positive outlook is anticipated in the short term, driven by [mention key factors]. However, potential global uncertainties could impact this trajectory.

Conclusion: Sensex and Nifty's Positive Trajectory and Investment Strategies

The Sensex and Nifty indices have exhibited a significant positive trajectory this week, driven by a confluence of factors including strong corporate earnings, positive global economic indicators, and supportive government policies. While the IT, banking, and pharmaceutical sectors were among the top performers, other sectors experienced slower growth or minor declines. To stay informed about these market movers and make informed investment decisions, it's crucial to regularly monitor the Sensex and Nifty performance, along with detailed sectoral analysis. Consult with financial professionals for personalized advice tailored to your risk tolerance and investment goals. Stay updated on the latest "Sensex and Nifty" news and market trends for informed decision-making.

Featured Posts

-

Implantation D Un Nouveau Vignoble De 2500 M Aux Valendons Dijon

May 09, 2025

Implantation D Un Nouveau Vignoble De 2500 M Aux Valendons Dijon

May 09, 2025 -

Find Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025

Find Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025 -

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025 -

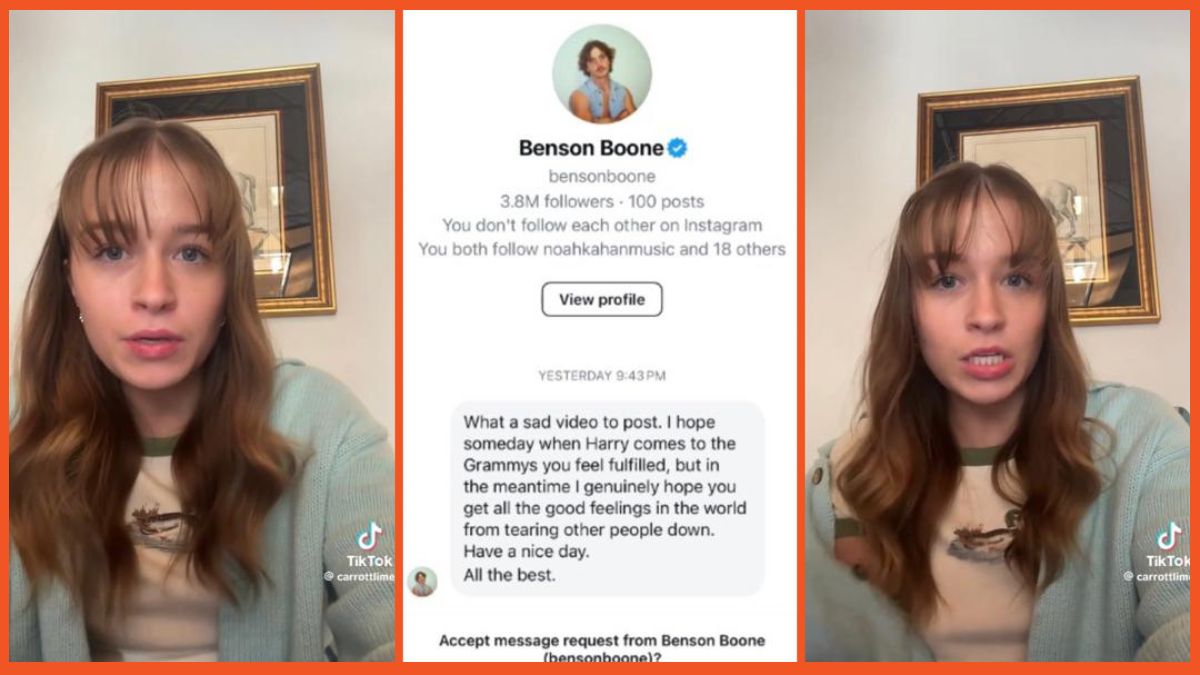

Dispelling Rumors Benson Boone And The Harry Styles Influence

May 09, 2025

Dispelling Rumors Benson Boone And The Harry Styles Influence

May 09, 2025 -

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025

Latest Posts

-

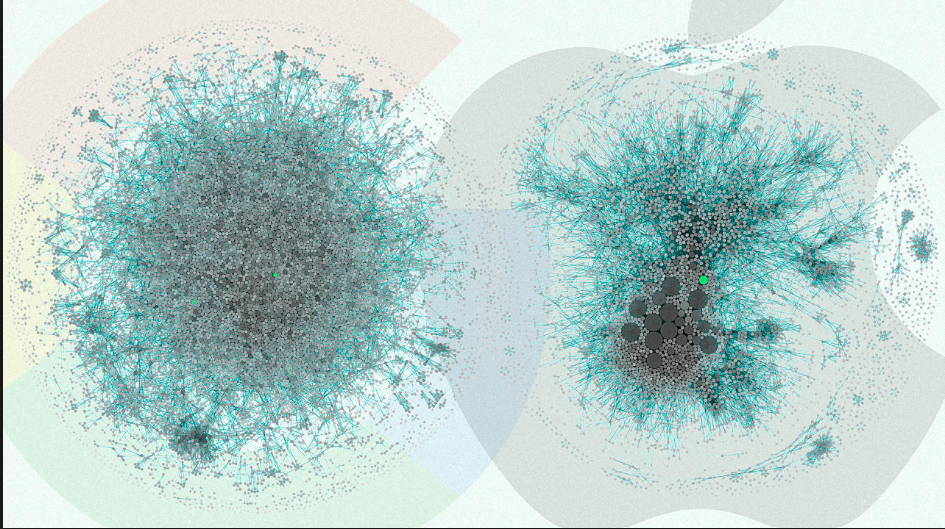

The Complex Relationship Between Apple And Google

May 11, 2025

The Complex Relationship Between Apple And Google

May 11, 2025 -

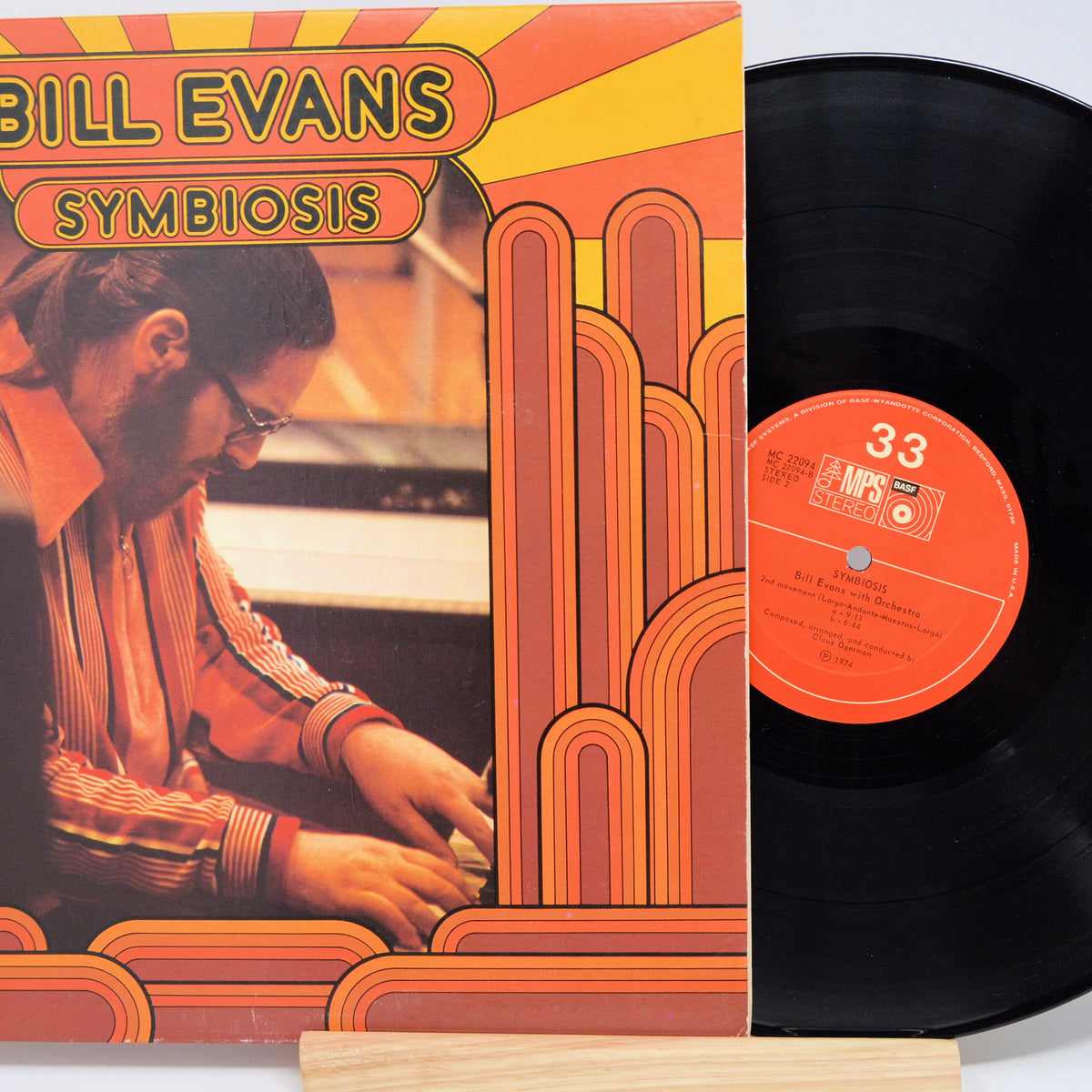

Apple And Google An Unexpected Symbiosis

May 11, 2025

Apple And Google An Unexpected Symbiosis

May 11, 2025 -

Is Apple Secretly Supporting Google A Deep Dive

May 11, 2025

Is Apple Secretly Supporting Google A Deep Dive

May 11, 2025 -

Why Apple Might Be Saving Google And Why It Matters

May 11, 2025

Why Apple Might Be Saving Google And Why It Matters

May 11, 2025 -

2024 Open Ai Developer Event Highlights Streamlined Voice Assistant Development

May 11, 2025

2024 Open Ai Developer Event Highlights Streamlined Voice Assistant Development

May 11, 2025