Market Reaction: Dow Futures And Dollar Slip Following Moody's Downgrade

Table of Contents

Moody's Downgrade: The Catalyst for Market Volatility

Moody's downgrade, from Aaa to Aa1, marked a significant blow to the US's AAA credit rating, a status it had held for decades. The agency cited concerns about the US government's fiscal strength, highlighting the increasing debt burden and persistent political gridlock hindering effective fiscal policy. This downgrade signifies a diminished perception of the US government's ability to manage its debt and meet its financial obligations.

The implications are far-reaching:

- Fiscal Challenges: The US faces substantial fiscal challenges, including a ballooning national debt and projected budget deficits.

- Rising Debt Levels: The continued rise in national debt poses a considerable risk to long-term economic stability. Higher debt servicing costs could crowd out other government spending and potentially lead to increased inflation.

- Political Gridlock: Persistent political polarization and legislative gridlock hinder the implementation of necessary fiscal reforms, exacerbating the underlying problems.

Historically, credit rating downgrades have often preceded periods of market volatility. While the impact varies depending on the circumstances, previous downgrades have generally led to increased risk aversion among investors and a reassessment of investment strategies.

Dow Futures React to Negative Sentiment

The immediate reaction in the Dow Futures market was a significant drop, reflecting a widespread negative sentiment among investors. Trading volume spiked as investors reacted to the news, indicating heightened uncertainty and a rush to adjust portfolios. This negative reaction stems from several key factors:

- Investor Uncertainty: The downgrade injected significant uncertainty into the market, causing investors to reassess their risk exposures.

- Risk Aversion: A risk-off sentiment prevailed as investors sought safety in less volatile assets.

- Potential Capital Flight: The downgrade could potentially trigger capital flight from US assets, putting further downward pressure on markets.

Further contributing to the Dow Futures decline were:

- Concerns about Future Interest Rate Hikes: The downgrade could lead the Federal Reserve to consider more aggressive interest rate hikes to combat inflation, further impacting market sentiment.

- Reduced Investor Confidence: The downgrade eroded investor confidence in the US economy's long-term prospects.

- Potential Spillover Effects: The negative sentiment in US markets could spill over into other global markets, creating a ripple effect.

Dollar's Weakness Amidst Downgrade Concerns

The Moody's downgrade also contributed to a weakening of the US dollar. Credit ratings play a crucial role in determining currency valuations; a downgrade signals increased risk, reducing demand for US assets, including US Treasury bonds. This reduced demand translates into a weaker dollar.

The reasons for the dollar's decline include:

- Safe-Haven Asset Shift: Investors shifted away from the dollar, traditionally viewed as a safe-haven asset, towards other perceived safer currencies.

- Reduced Demand for US Treasuries: The downgrade reduced the attractiveness of US Treasuries, impacting their price and consequently the dollar's value.

The weakening dollar has several implications:

- Increased Uncertainty for Multinational Corporations: Currency fluctuations create uncertainty for businesses engaged in international trade.

- Potential for Higher Import Costs in the US: A weaker dollar increases the cost of imports, potentially fueling inflation.

- Impact on US Foreign Policy and International Relations: A weaker dollar can affect the US's global standing and its ability to influence international events.

Potential Long-Term Implications and Market Outlook

The long-term implications of the Moody's downgrade and the subsequent market reaction remain uncertain. Several scenarios are possible:

- Scenario 1: Government Implements Fiscal Reforms, Market Stabilizes: If the US government implements meaningful fiscal reforms to address the concerns raised by Moody's, investor confidence could rebound, and markets could stabilize.

- Scenario 2: Continued Political Gridlock, Further Market Decline: Continued political gridlock and failure to address fiscal challenges could lead to further market declines and heightened economic uncertainty.

- Scenario 3: Global Markets React Negatively, Triggering a Wider Downturn: A more severe negative reaction from global markets could trigger a wider economic downturn, impacting various sectors and economies worldwide.

The Federal Reserve's response will be crucial. Further interest rate hikes could help control inflation but might also dampen economic growth. The US government's fiscal policy decisions will also play a vital role in shaping the future economic landscape.

Conclusion: Understanding the Market Reaction to Moody's Downgrade

Moody's downgrade triggered significant market volatility, leading to a decline in Dow Futures and a weakening of the US dollar. The downgrade highlights serious concerns about the US government's fiscal health and the potential for long-term economic consequences. The market's reaction underscores the significant impact of credit ratings on investor confidence and global market dynamics. Understanding this complex situation requires consistent monitoring of the Dow Futures market and associated global events. Stay informed about the ongoing market reaction to the Moody’s downgrade and its impact on Dow Futures and the dollar by following our regular updates on economic news and analysis.

Featured Posts

-

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites Kai Aksiotheata

May 20, 2025

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites Kai Aksiotheata

May 20, 2025 -

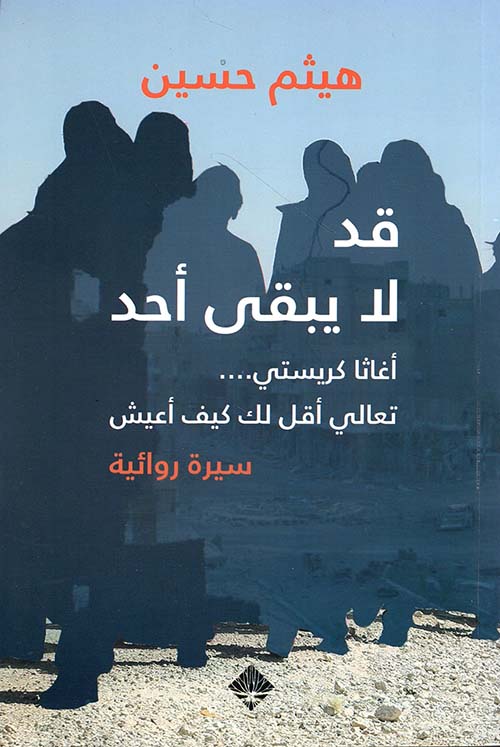

Aghatha Krysty Aldhkae Alastnaey Yudye Ela Asrar Ktabatha

May 20, 2025

Aghatha Krysty Aldhkae Alastnaey Yudye Ela Asrar Ktabatha

May 20, 2025 -

Jasmine Paolinis Breakthrough Winning In Rome

May 20, 2025

Jasmine Paolinis Breakthrough Winning In Rome

May 20, 2025 -

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025 -

Reps Vow To Recover 1 231 Billion From Oil Firms Details Inside

May 20, 2025

Reps Vow To Recover 1 231 Billion From Oil Firms Details Inside

May 20, 2025