Market Reaction To D-Wave Quantum (QBTS): Deciphering Thursday's Drop

Table of Contents

Analyzing the Immediate Factors Behind the QBTS Stock Decline

Several factors likely contributed to the immediate QBTS stock price decline on Thursday. Pinpointing the exact cause requires a careful examination of the day's events. Market volatility in the tech sector is always a concern, and understanding the interplay of various influences is key to interpreting price fluctuations.

-

Specific News Releases: Did D-Wave Quantum release any news on Thursday that might have spooked investors? This could include disappointing earnings reports, the announcement of a stalled partnership, or perhaps unexpected delays in product development. Any negative press coverage concerning the company's technology or business strategy would also contribute to a negative market sentiment and QBTS stock price decline.

-

Broader Market Trends: The tech sector is notoriously sensitive to overall market trends. A general downturn in the tech market, perhaps driven by interest rate hikes or concerns about inflation, could have impacted QBTS, regardless of any company-specific news. The ripple effect of broader market forces can significantly affect even companies performing well, causing stock price drops that aren't directly reflective of company performance.

-

Analyst Downgrades and Market Sentiment Shifts: Negative commentary from financial analysts can significantly influence investor sentiment. If analysts downgraded their outlook for D-Wave Quantum, it would almost certainly contribute to a fall in the QBTS stock price. Sudden shifts in investor confidence, possibly spurred by speculation or rumors, can also trigger substantial price fluctuations. Keywords: QBTS stock price, market volatility, investor sentiment, negative news, price fluctuation, quantum computing stock.

The Role of General Market Conditions on QBTS Performance

It's crucial to consider the broader macroeconomic climate when analyzing Thursday's QBTS drop. Were there larger economic forces at play that impacted not just D-Wave Quantum but the entire market?

-

Interest Rate Hikes and Economic News: Decisions by central banks regarding interest rates can have a significant impact on stock prices. An unexpected interest rate hike, for example, often leads to increased investor risk aversion, potentially causing sell-offs across various sectors, including technology.

-

Geopolitical Events: Geopolitical instability can introduce uncertainty into the market, causing investors to seek safer investments. Major international events, even those seemingly unrelated to the technology sector, could trigger a general market downturn, dragging down even well-performing stocks like QBTS.

-

Overall Investor Risk Aversion: A general increase in investor risk aversion, regardless of specific news, can lead to a market-wide sell-off. This is often seen during times of economic uncertainty or when investors anticipate negative economic news. Keywords: macroeconomic factors, market downturn, risk aversion, tech sector performance, broader market trends.

Long-Term Implications for D-Wave Quantum (QBTS) and the Quantum Computing Industry

Thursday's drop raises important questions about the long-term outlook for D-Wave Quantum and the quantum computing industry as a whole. While a single day's stock performance doesn't necessarily define a company's future, it does impact investor confidence and future investment decisions.

-

Impact on Investor Confidence: A sharp stock drop can erode investor confidence. This might make it harder for D-Wave Quantum to secure future funding rounds or attract new investors. Rebuilding trust and demonstrating consistent progress will be crucial for the company's long-term viability.

-

Potential Effects on Future Funding Rounds: Securing funding is vital for any technology company, particularly in a capital-intensive field like quantum computing. The QBTS stock drop could make future fundraising rounds more challenging, forcing D-Wave Quantum to adjust its strategy or potentially seek alternative funding sources.

-

Wider Implications for the Adoption of Quantum Computing Technologies: While D-Wave Quantum’s performance doesn't reflect the entire quantum computing landscape, investor sentiment towards the sector might be negatively affected. This could potentially slow the adoption of quantum computing technologies across different industries. Keywords: long-term outlook, investment strategy, quantum computing future, industry impact, QBTS future, technological adoption.

Comparing QBTS to Competitor Performance

To understand if Thursday's drop was unique to D-Wave Quantum or part of a broader trend in the quantum computing sector, it's important to analyze how other key players performed on the same day.

-

Competitor Stock Performance: A comparison with competitors like IBM, IonQ, or Rigetti reveals whether the negative market sentiment was specifically directed at D-Wave or was a broader issue affecting the entire quantum computing field.

-

Similarities or Differences in Market Reaction: Analyzing the market reaction to these competitors' performance helps determine whether similar macroeconomic factors or specific news impacted the entire industry or if the QBTS stock drop was a more isolated event. Keywords: quantum computing competitors, market comparison, competitive analysis, stock performance comparison.

Conclusion: Interpreting the QBTS Market Reaction and Looking Ahead

Thursday's drop in D-Wave Quantum (QBTS) stock resulted from a combination of factors, including company-specific news, broader market trends, and general investor sentiment. While a single day's performance doesn't dictate long-term success, it highlights the importance of monitoring market reactions and understanding their implications for both D-Wave Quantum and the wider quantum computing industry. The long-term effects will depend on D-Wave's ability to navigate these challenges and demonstrate continued progress in its technology and business strategy. Stay updated on QBTS stock and monitor the quantum computing market with us for further analysis of D-Wave Quantum and its impact on the future of this exciting field. Follow our analysis of D-Wave Quantum and understand the future of QBTS and its impact.

Featured Posts

-

Is A World Class Striker Headed To Man Utd Agents Visit Sparks Transfer Rumors

May 20, 2025

Is A World Class Striker Headed To Man Utd Agents Visit Sparks Transfer Rumors

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025 -

Wintry Mix Of Rain And Snow What To Expect

May 20, 2025

Wintry Mix Of Rain And Snow What To Expect

May 20, 2025 -

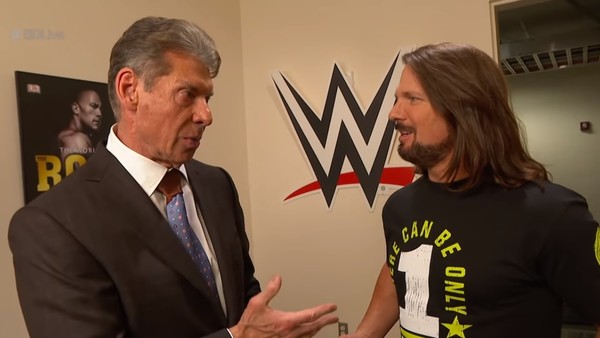

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025 -

Smack Down Next Week Rey Fenixs Wwe Arrival And Ring Name Unveiling

May 20, 2025

Smack Down Next Week Rey Fenixs Wwe Arrival And Ring Name Unveiling

May 20, 2025