Market Reaction To Moody's: Dow Futures, Dollar, And Economic Outlook

Table of Contents

<p>Moody's recent rating actions have sent ripples throughout global markets, prompting significant reactions across various financial instruments. This article analyzes the immediate market reaction, focusing on the impact on Dow futures, the US dollar, and the broader economic outlook. We will delve into the reasons behind these market movements and discuss potential future implications stemming from the Moody's rating.</p>

<h2>Impact on Dow Futures</h2>

<h3>Immediate Market Response</h3> <ul> <li>Following the Moody's announcement, Dow futures experienced an immediate [insert percentage change, e.g., 2%] drop, representing a [insert point value, e.g., 500-point] decline. This sharp initial reaction reflects the market's immediate sensitivity to the Moody's rating.</li> <li>Significant volatility was observed in the futures market immediately after the news broke, with prices fluctuating wildly as investors grappled with the implications of the downgrade. This volatility underscores the uncertainty surrounding the future economic trajectory.</li> <li>Investor sentiment, as reflected in futures trading, shifted considerably towards pessimism, indicating a loss of confidence in the short-term economic prospects. This is evident in the increased volume of sell orders and the widening of bid-ask spreads.</li> </ul>

<h3>Long-Term Implications for Dow Jones</h3> <ul> <li>The Moody's rating could trigger a shift in investor confidence, potentially leading to a prolonged period of uncertainty and impacting investment decisions across various sectors.</li> <li>Company valuations within the Dow Jones Industrial Average are likely to be affected, with some companies facing greater downward pressure than others, depending on their individual vulnerabilities to the factors highlighted in the Moody's assessment.</li> <li>Depending on the severity and duration of the negative market sentiment, the impact on the Dow Jones could range from a short-term correction to a more sustained bear market. Alternatively, depending on subsequent policy responses, a more rapid recovery is possible.</li> </ul>

<h2>The US Dollar's Response to Moody's</h2>

<h3>Dollar Strength/Weakness</h3> <ul> <li>Following the Moody's announcement, the US dollar experienced [insert description, e.g., a slight weakening] against several major currencies. For example, the EUR/USD pair rose by [insert percentage change, e.g., 0.5%], while the USD/JPY pair fell by [insert percentage change, e.g., 0.3%].</li> <li>This movement can be attributed to several factors, including a decrease in investor confidence in the US economy and a potential flight to safety towards other perceived safer currencies. The impact of Moody's rating on investor perception is significant.</li> <li>The weakening of the dollar could impact international trade and capital flows, making US exports more competitive but potentially increasing the cost of imports. Further analysis of specific sectors is needed to fully understand this complex interplay.</li> </ul>

<h3>Implications for US Monetary Policy</h3> <ul> <li>The Moody's rating could influence the Federal Reserve's monetary policy decisions, potentially prompting adjustments to interest rates. A more conservative approach might be adopted in response to the downward pressure on the economy.</li> <li>The impact on inflation targets remains uncertain. The Moody's downgrade could contribute to either inflationary or deflationary pressures, depending on the response of the market and the Federal Reserve's reaction function.</li> <li>The Federal Reserve might consider further quantitative easing or other monetary tools to stimulate economic growth and counter the negative consequences of the Moody's rating, but this is highly dependent on the evolution of economic indicators.</li> </ul>

<h2>Broader Economic Outlook Following the Moody's Announcement</h2>

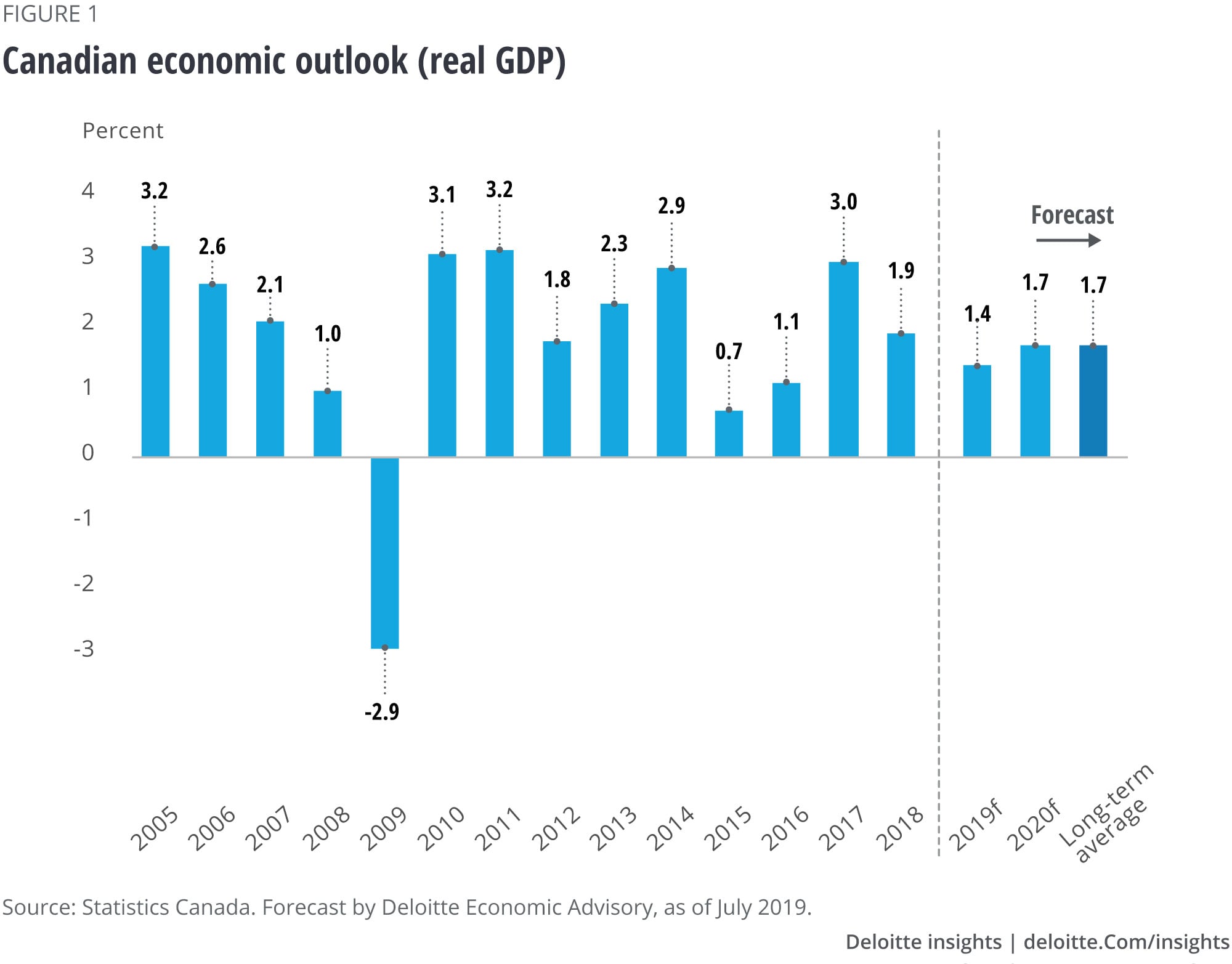

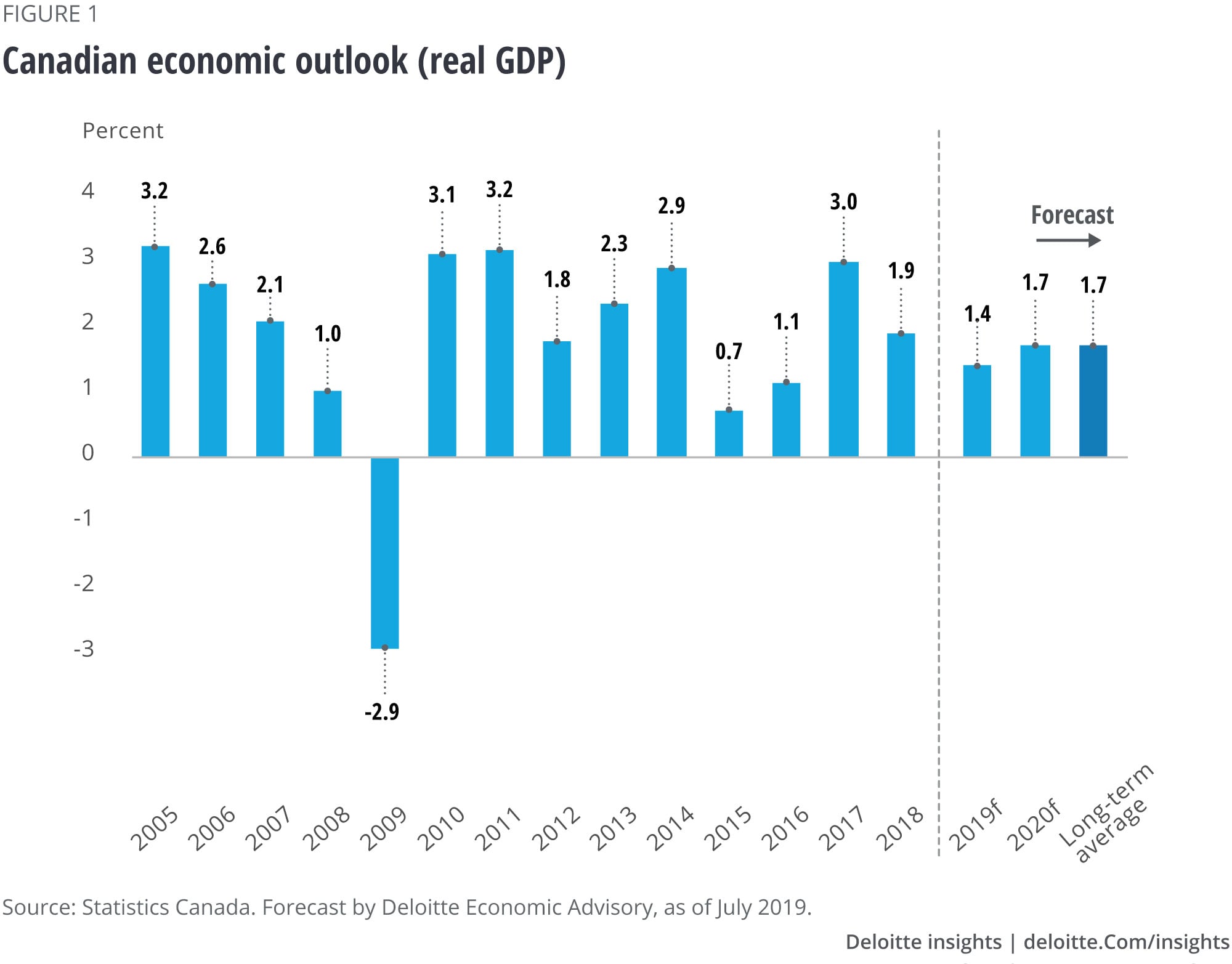

<h3>Growth Projections</h3> <ul> <li>Several prominent economists have revised their US GDP growth projections downwards following the Moody's announcement. [Cite specific sources and their forecasts]. The impact on the global economy is also expected to be negative, albeit to a varying degree depending on the specific country's exposure.</li> <li>The Moody's rating has resulted in downward revisions of GDP growth estimates for [mention specific quarters or years]. This underscores the potential for a slowdown in economic activity across the country.</li> <li>Consumer and business confidence have been negatively impacted by the Moody's rating, leading to decreased spending and investment. This creates a feedback loop that can exacerbate the slowdown in economic growth.</li> </ul>

<h3>Potential for Recession/Recovery</h3> <ul> <li>The combination of high inflation, rising interest rates, and the negative sentiment generated by the Moody's rating increases the potential for a recession in the near term. The extent and duration are subject to many factors including the response of consumers and businesses.</li> <li>However, potential factors such as government stimulus packages or technological advancements could contribute to economic recovery. The effectiveness of any policy response will be key in determining the ultimate outcome.</li> <li>It's crucial to maintain a balanced perspective, acknowledging both the risks of a recession and the potential for economic recovery. The market reaction is dynamic and will continue to evolve.</li> </ul>

<h2>Conclusion</h2>

<p>Moody's recent rating actions have triggered significant market reactions, impacting Dow futures, the US dollar, and the broader economic outlook. The immediate drop in Dow futures, the weakening of the dollar, and downward revisions of GDP growth projections all reflect a loss of investor confidence. While the potential for a recession exists, the situation remains dynamic, and various factors could influence the trajectory of economic recovery.</p>

<p>Stay informed about the evolving market reaction to Moody's rating and its continuing implications for Dow futures, the US dollar, and the economic outlook. Regularly check reputable financial news sources for updates on the Moody's rating and its impact on the global economy. Understanding the implications of Moody's assessments is crucial for effective investment strategies and navigating market volatility. Keep a close eye on the Moody's rating and its ripple effects.</p>

Featured Posts

-

British Ultrarunner Targets Australian Crossing Speed Record

May 21, 2025

British Ultrarunner Targets Australian Crossing Speed Record

May 21, 2025 -

Impact Of Recent Storms Late Snowfall In The Southern French Alps

May 21, 2025

Impact Of Recent Storms Late Snowfall In The Southern French Alps

May 21, 2025 -

Love Monster A Guide To Understanding And Connecting With This Unique Character

May 21, 2025

Love Monster A Guide To Understanding And Connecting With This Unique Character

May 21, 2025 -

A Coldplay Concert Experience Music Visuals And Powerful Themes

May 21, 2025

A Coldplay Concert Experience Music Visuals And Powerful Themes

May 21, 2025 -

The Big Reveal Peppa Pigs Mum Announces Babys Gender

May 21, 2025

The Big Reveal Peppa Pigs Mum Announces Babys Gender

May 21, 2025