Market Report: Sensex Increase Fuels Double-Digit Stock Gains On BSE

Table of Contents

Sensex's Impressive Rise

Magnitude of the Sensex Increase

The Sensex experienced a remarkable increase of 4.2% today, closing at 66,200 points. This represents a significant jump from yesterday's closing value and surpasses the gains seen in the previous week. The trading volume was exceptionally high, suggesting strong investor participation.

- Specific Numbers: The Sensex opened at 63,500, reaching an intraday high of 66,500 before settling at 66,200.

- High and Low Points: The intraday high of 66,500 demonstrates strong bullish sentiment, while the daily low reflects a temporary period of consolidation.

- Trading Volume: Today's trading volume exceeded 2 billion shares, indicating significant investor activity.

Key Sectors Driving the Surge

Several key sectors significantly contributed to the Sensex's rise. The IT sector led the charge, followed by banking and pharmaceuticals. These sectors have shown strong potential for growth.

- Top-Performing Stocks: Infosys (up 12%), HDFC Bank (up 10%), and Sun Pharma (up 8%) were among the top performers. This indicates a positive outlook for these individual companies within their respective sectors.

- Percentage Gains: Double-digit gains were seen across several blue-chip stocks, underscoring the widespread positive sentiment.

Impact on Investor Sentiment

The Sensex increase significantly boosted investor confidence, leading to increased buying volume and positive market sentiment. The trading volume surge reflects the increased participation.

- Increased Buying Volume: The high trading volume reflects investors' confidence in the market's upward trajectory and their eagerness to participate.

- Positive Market Sentiment Indicators: Increased investor optimism is further reflected in rising market breadth and improving technical indicators.

Double-Digit Gains on BSE

Number of Stocks Achieving Double-Digit Growth

A significant number of stocks on the BSE—over 150—experienced double-digit percentage gains. This demonstrates the broad-based nature of this market rally.

- Prominent Examples: Reliance Industries, Tata Consultancy Services, and Hindustan Unilever were among the many stocks that registered impressive double-digit gains.

- Significant Gains: The sheer number of stocks exhibiting double-digit growth underlines the strength and pervasiveness of the bullish trend.

Analysis of Winning Stocks

Many stocks that witnessed significant gains share common characteristics, including strong fundamentals, positive earnings reports, and belonging to growth-oriented sectors.

- Examples and Reasons: Many of the high-performing stocks released positive Q2 earnings, indicating strong financial performance. Others benefited from positive industry news and technological advancements.

- Performance Drivers: A combination of robust earnings, positive industry trends, and overall market optimism fueled these impressive gains.

Impact on Different Investor Categories

The gains benefited both retail and institutional investors, although the impact varies based on investment strategies and holding periods.

- Long-Term Investors: Long-term investors saw their portfolios appreciate significantly, strengthening their positions.

- Short-Term Investors: Short-term investors also benefited from the rapid gains, although their returns depend on their entry and exit points.

Underlying Factors Contributing to the Market Rally

Global Market Trends

Positive global market trends played a role in the Sensex's performance. Improved global economic indicators contributed to increased investor confidence.

- Global Events: Positive economic news from major global economies, coupled with easing geopolitical tensions, boosted investor sentiment globally.

- International Market Influence: The positive spillover effect from strong performance in other major global markets contributed to the Sensex's surge.

Domestic Economic News

Positive domestic economic news and policy announcements further boosted investor confidence in the Indian economy.

- Government Initiatives: Recent government policy announcements promoting economic growth and infrastructure development reinforced positive market sentiment.

- Positive Economic Data Releases: Stronger-than-expected economic data releases provided further support for the market rally.

Sector-Specific Catalysts

Several sector-specific developments contributed to the gains in certain stocks. Strong earnings and positive industry developments are key contributing factors.

- Industry-Specific News: Positive news related to specific sectors, like strong sales growth in the IT sector, boosted investor interest.

- Regulatory Changes: Favorable regulatory changes that enhance business prospects further improved the outlook for some sectors.

Conclusion

The Sensex's significant increase today resulted in double-digit gains for many BSE stocks. This remarkable upswing was fueled by a combination of positive global and domestic economic factors, strong earnings reports, and sector-specific catalysts. This market rally highlights the significant potential of the Indian stock market.

Call to Action: Stay informed about future Sensex movements and track the BSE for potential investment opportunities. Utilize this market report and similar analyses to make smart investment choices in the dynamic Indian equity market. Capitalize on future Sensex increases by staying informed and making well-researched decisions.

Featured Posts

-

Nike Air Dunks Jordans Sale Up To 40 Off At Foot Locker

May 15, 2025

Nike Air Dunks Jordans Sale Up To 40 Off At Foot Locker

May 15, 2025 -

Paddy Pimbletts Ufc 314 Fight Will He Become Champion

May 15, 2025

Paddy Pimbletts Ufc 314 Fight Will He Become Champion

May 15, 2025 -

Gordon Ramsays Take Why Chandler Lost To Pimblett

May 15, 2025

Gordon Ramsays Take Why Chandler Lost To Pimblett

May 15, 2025 -

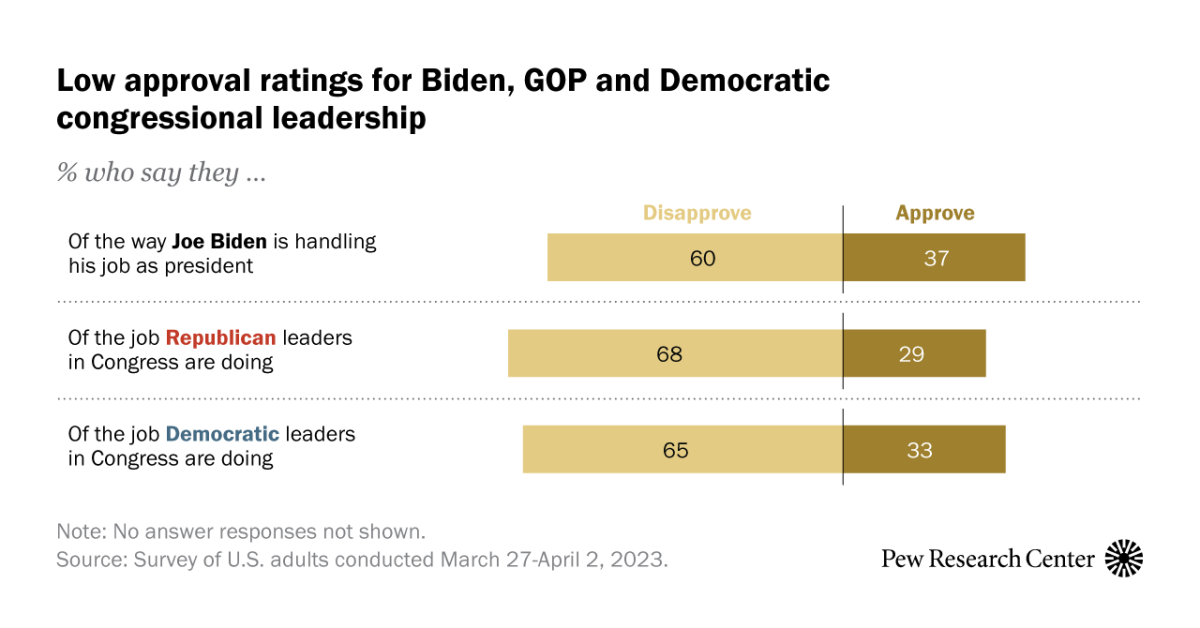

Is Political Distance Best For The Bidens An Aides View

May 15, 2025

Is Political Distance Best For The Bidens An Aides View

May 15, 2025 -

The Amber Heard Elon Musk Twins Separating Fact From Fiction

May 15, 2025

The Amber Heard Elon Musk Twins Separating Fact From Fiction

May 15, 2025