Market Turmoil Fuels Record ETF Growth: Understanding The Investment Surge

Table of Contents

Safety and Diversification in Uncertain Times

Market uncertainty often leads investors to seek safety and diversification. ETFs offer a powerful solution.

Reduced Risk Through Diversification

ETFs offer instant diversification across various asset classes (stocks, bonds, commodities, real estate), mitigating the risk associated with individual stock picking during market turmoil.

- Reduced exposure to single-stock volatility: Instead of relying on the performance of a single company, ETFs spread your investment across numerous holdings, reducing the impact of any one stock's poor performance.

- Access to diverse market segments with a single investment: A single ETF can provide exposure to a broad range of sectors, geographies, or asset classes, simplifying portfolio construction.

- Easier portfolio rebalancing compared to individual stock trading: Adjusting your asset allocation is much simpler with ETFs, requiring fewer trades and less time.

Hedging Against Market Downturns

Investors are increasingly turning to less volatile ETFs, such as bond ETFs or those focused on defensive sectors (consumer staples, utilities), to protect their portfolios during market corrections.

- Lower correlation with overall market fluctuations: Certain ETFs demonstrate lower correlation with the broader market, meaning they may not decline as sharply during downturns.

- Potential for capital preservation during bear markets: These ETFs aim to preserve capital while minimizing losses, offering a safer haven during periods of market stress.

- Opportunities for contrarian investing strategies: Market downturns can present opportunities to buy low and benefit from future market rebounds. ETFs provide efficient access to this strategy.

Accessibility and Affordability

Beyond safety, the accessibility and affordability of ETFs contribute significantly to their rising popularity.

Lower Transaction Costs

ETFs generally have lower expense ratios compared to actively managed mutual funds, making them a more attractive option, especially during times of economic uncertainty when preserving capital is paramount.

- Reduced brokerage commissions compared to frequent individual stock trades: Building a diversified portfolio through individual stocks can be expensive; ETFs significantly reduce these costs.

- Transparent fee structures: ETF fees are clearly stated and easily understood, providing investors with complete cost transparency.

- Cost-effective access to a diversified portfolio: Investors can gain access to a well-diversified portfolio at a fraction of the cost of buying individual stocks.

Ease of Trading

ETFs trade like stocks on major exchanges, offering investors the flexibility to buy and sell throughout the trading day, unlike mutual funds, which typically only trade at the end of the day.

- Intraday liquidity: Investors can buy or sell ETFs at any point during trading hours, providing greater control and flexibility.

- Simple and efficient trading process: The trading process is identical to buying or selling individual stocks, making it easy for investors of all experience levels.

- Access to real-time pricing information: Investors can track ETF prices throughout the day, enabling informed decision-making.

The Rise of Thematic ETFs

The current investment climate has fueled significant growth in specialized ETFs.

Targeted Investment Strategies

The current climate has increased interest in thematic ETFs focusing on specific sectors expected to perform well regardless of overall market conditions, such as technology, healthcare, or sustainable energy (ESG ETFs).

- Exposure to high-growth potential sectors: These ETFs allow investors to capitalize on the growth potential of specific sectors.

- Alignment with personal values (ESG investing): ESG ETFs allow investors to align their investments with their environmental, social, and governance values.

- Ability to capitalize on emerging trends: Thematic ETFs provide access to emerging market trends and innovations.

Increased Sophistication and Innovation

The ETF market is constantly evolving, offering investors access to niche strategies and innovative products catering to diverse risk tolerances and investment goals.

- Leveraged and inverse ETFs (for experienced investors): These sophisticated products offer amplified returns (leveraged) or inverse returns (inverse), providing advanced investment strategies for experienced investors.

- Smart beta and factor-based ETFs: These ETFs employ sophisticated strategies to potentially outperform traditional market-cap weighted indices.

- Global and international ETFs offering geographical diversification: These ETFs provide exposure to international markets, expanding investment opportunities beyond domestic borders.

Conclusion

The unprecedented growth in ETF adoption is a direct response to the market’s volatility. The combination of diversification, accessibility, affordability, and the increasing sophistication of ETF offerings makes them an attractive option for investors navigating turbulent markets. Whether you’re a seasoned investor or just starting, understanding the benefits of ETFs and exploring various options could be crucial for managing your portfolio effectively during periods of uncertainty. Don't miss out on the potential advantages of harnessing the power of ETF growth to achieve your financial goals. Start researching different ETFs today and explore how they can fit into your investment strategy. Understanding ETF growth trends will empower you to make more informed investment decisions.

Featured Posts

-

Tragedi Di Balikpapan Balita Tewas Tenggelam Di Parit Drainase

May 28, 2025

Tragedi Di Balikpapan Balita Tewas Tenggelam Di Parit Drainase

May 28, 2025 -

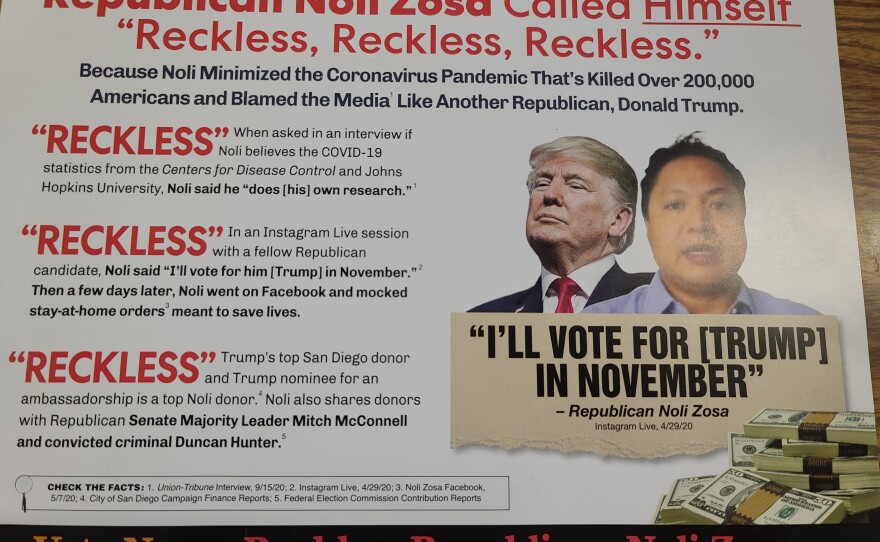

Bethlehem Local Elections Analysis Of Recent Attack Mailers

May 28, 2025

Bethlehem Local Elections Analysis Of Recent Attack Mailers

May 28, 2025 -

Tueketici Kredileri Abd De Beklentilerin Uezerinde Bueyueme

May 28, 2025

Tueketici Kredileri Abd De Beklentilerin Uezerinde Bueyueme

May 28, 2025 -

Acheter Le Samsung Galaxy S25 256 Go Notre Avis Et Le Meilleur Prix

May 28, 2025

Acheter Le Samsung Galaxy S25 256 Go Notre Avis Et Le Meilleur Prix

May 28, 2025 -

Build Voice Assistants With Ease Open Ais New Tools Unveiled

May 28, 2025

Build Voice Assistants With Ease Open Ais New Tools Unveiled

May 28, 2025