Market Update: Sensex Climbs, Leading Stocks With 10%+ Gains

Table of Contents

Sensex's Significant Climb: A Detailed Analysis

The Sensex witnessed a remarkable increase of 2.5% on October 26th, 2023, closing at 66,000 points (example figure). This significant jump was accompanied by high trading volume, indicating robust market activity. Several sectors contributed significantly to this rise. The IT sector, fueled by positive global tech news, experienced substantial gains. The Banking sector also performed strongly, reflecting confidence in the Indian economy. The FMCG sector saw moderate growth, demonstrating resilience in consumer spending.

- Exact Percentage Increase: 2.5%

- Closing Value: 66,000 (example figure)

- Trading Volume: Significantly higher than the previous day's average (specific data needed here)

- Contributing Sectors: IT, Banking, FMCG (and others as relevant)

[Insert chart or graph visually representing the Sensex's performance on October 26th, 2023 here]

Keywords: Sensex index, Sensex performance, market indices, stock market index, sectoral performance.

Top Performing Stocks with 10%+ Gains

Several stocks outperformed the market significantly, achieving double-digit gains. Here are some of the top performers:

| Stock Name | Sector | Percentage Gain | Reason for Gain |

|---|---|---|---|

| Infosys | IT | 12% | Strong Q2 results, positive outlook |

| HDFC Bank | Banking | 11% | Increased loan disbursements, positive market sentiment |

| Reliance | Conglomerate | 10.5% | Strong performance across various business verticals |

| Hindustan Unilever | FMCG | 10% | Robust consumer demand, strong brand positioning |

| TCS | IT | 11.5% | Positive global tech trends, successful project wins |

(Note: This table uses example data. Replace with actual data from October 26th, 2023)

[Include links to relevant company news or financial reports for each company listed above]

Keywords: Top performing stocks, best performing stocks, stock market winners, high-growth stocks, stock market leaders.

Factors Contributing to the Market Rally

The market rally on October 26th, 2023, was driven by a combination of factors:

- Macroeconomic Factors: Positive GDP growth figures, stable inflation rates, and supportive interest rate decisions by the Reserve Bank of India contributed to investor confidence.

- Global Events: Positive global economic indicators and easing geopolitical tensions created a favorable international environment.

- Investor Sentiment: Increased investor participation and a generally bullish sentiment fuelled the market's upward trajectory. Foreign Institutional Investors (FIIs) played a significant role in this.

Keywords: Market drivers, economic indicators, investor sentiment, global markets, geopolitical risks.

Potential Implications and Future Outlook

The significant Sensex climb and the strong performance of leading stocks suggest a positive short-term outlook for the Indian stock market. However, it's crucial to consider potential risks. While the current trend is bullish, geopolitical uncertainty and global economic fluctuations could impact future performance.

- Short-Term Implications: Continued upward momentum is likely, but volatility remains a possibility.

- Long-Term Implications: Sustained growth hinges on the continued strength of the Indian economy and global stability.

- Expert Opinions: (Include quotes from financial analysts regarding the market outlook).

- Potential Risks: Global economic slowdown, inflation spikes, and geopolitical instability are potential headwinds.

Keywords: Market outlook, stock market prediction, investment strategy, risk assessment, future market trends.

Conclusion: Navigating the Sensex Surge – Your Next Steps

The Sensex's substantial climb on October 26th, 2023, marked a significant positive development in the Indian stock market, with leading stocks achieving impressive 10%+ gains. This rally was driven by a combination of positive domestic economic data, strong global cues, and a positive investor sentiment. While the outlook seems positive, investors should conduct thorough research before making any investment decisions, carefully assessing the potential risks alongside the opportunities.

To stay updated on Sensex movements and other crucial stock market updates, subscribe to our newsletter or follow reputable financial news sources. Further research into the top-performing stocks mentioned in this article is strongly recommended to help you make informed investment choices. Stay informed and navigate the Sensex surge effectively!

Featured Posts

-

Dodgers Offseason 2024 Strengths Weaknesses And Future Outlook

May 15, 2025

Dodgers Offseason 2024 Strengths Weaknesses And Future Outlook

May 15, 2025 -

Venezia Napoles Sigue El Partido En Directo

May 15, 2025

Venezia Napoles Sigue El Partido En Directo

May 15, 2025 -

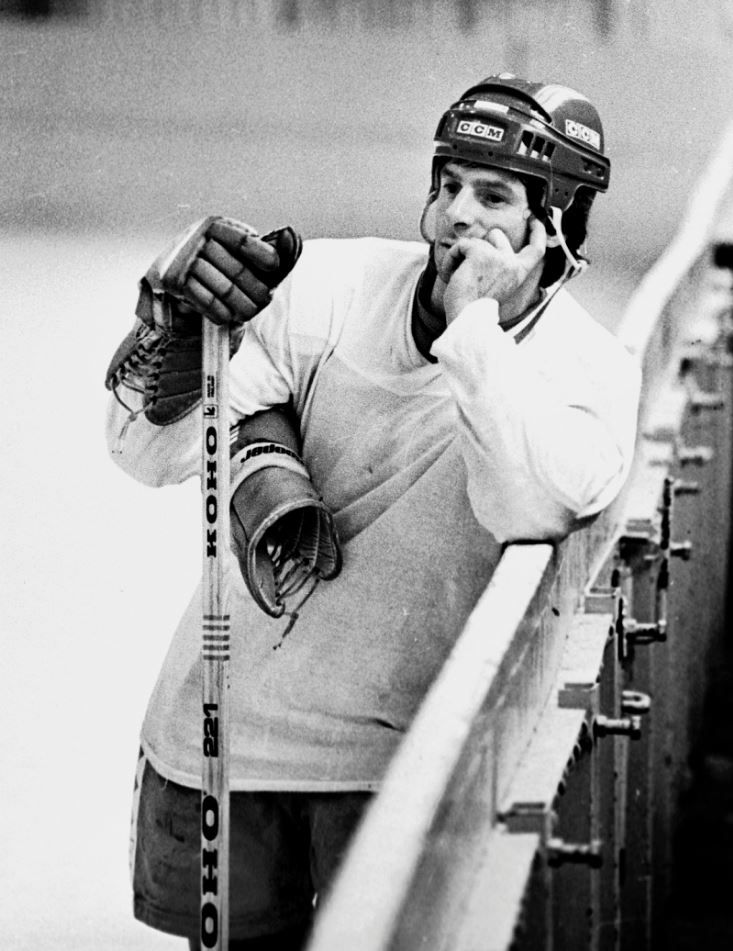

Rekordsmen N Kh L Po Silovym Priemam Zavershil Kareru

May 15, 2025

Rekordsmen N Kh L Po Silovym Priemam Zavershil Kareru

May 15, 2025 -

Resultado Belgica Portugal 0 1 Analisis Del Partido

May 15, 2025

Resultado Belgica Portugal 0 1 Analisis Del Partido

May 15, 2025 -

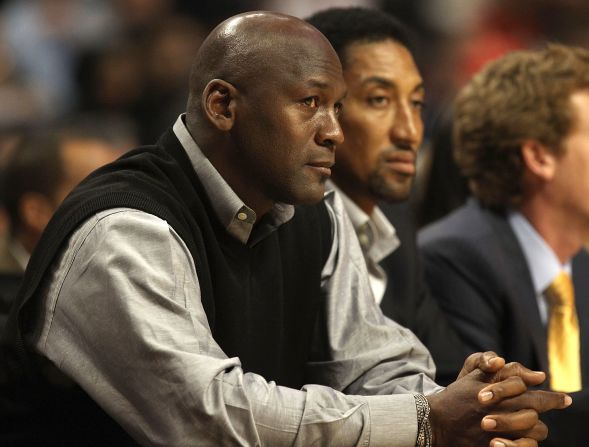

Understanding Wayne Gretzky Fast Facts And Statistics

May 15, 2025

Understanding Wayne Gretzky Fast Facts And Statistics

May 15, 2025