Market Volatility: Deciphering The D-Wave Quantum (QBTS) Stock Crash

Table of Contents

Understanding Market Volatility and its Impact on Tech Stocks

Defining Market Volatility

Market volatility refers to the rate and extent of changes in market prices. It's characterized by unpredictable price swings, making it difficult to forecast future returns. This inherent uncertainty is amplified in the volatile world of stock markets.

- Economic indicators: Changes in inflation, interest rates, GDP growth, and unemployment rates significantly influence investor sentiment and market behavior.

- Geopolitical events: Global conflicts, political instability, and international trade disputes can create uncertainty and trigger market fluctuations.

- Investor sentiment: Market psychology plays a crucial role. Fear, greed, and herd behavior can drive dramatic price movements, irrespective of underlying fundamentals.

These factors disproportionately affect high-growth tech stocks like QBTS. Tech companies, often valued on future potential rather than current profits, are particularly sensitive to shifts in investor confidence. A sudden downturn in investor sentiment can lead to sharp declines in their stock prices.

The Tech Sector's Vulnerability

The tech sector is inherently susceptible to market volatility. Its growth-oriented nature means valuations are often based on projected future earnings, making them highly sensitive to changes in investor expectations. Investor confidence is paramount, and any negative news can trigger a sell-off.

- Dot-com bubble (2000): A classic example of a tech stock crash driven by overvaluation and unsustainable growth.

- 2008 financial crisis: The broader economic downturn significantly impacted the tech sector, causing widespread stock price declines.

There's a strong correlation between investor sentiment and the valuation of tech companies. Positive news and strong earnings reports generally lead to price increases, while negative news or disappointing results can trigger significant drops.

Analyzing the Specific Factors Contributing to the QBTS Stock Crash

Company-Specific Factors

While market volatility played a role, the QBTS stock crash wasn't solely driven by external forces. Several company-specific issues likely contributed to the price decline. Analyzing D-Wave Quantum's recent financial performance is crucial.

- Missed earnings expectations: Did D-Wave Quantum fall short of projected revenue or profit targets? This could have triggered a sell-off by investors who anticipated stronger financial results.

- Delays in product development: Any delays in bringing new quantum computing technologies to market could have dampened investor confidence. The quantum computing sector is highly competitive.

- Increased competition: The emergence of new players or advancements by competitors could negatively impact D-Wave's market share and perceived potential.

A thorough examination of D-Wave's financial reports and public statements is necessary to pinpoint the specific company-related triggers for the QBTS stock decline.

Macroeconomic Factors

Broader macroeconomic conditions also impacted the QBTS stock price. The current economic climate plays a significant role in influencing investor risk appetite.

- Inflation and interest rate hikes: Rising inflation and subsequent interest rate increases by central banks typically reduce investor appetite for riskier assets, including growth stocks like QBTS.

- Recessionary fears: Concerns about a potential economic recession can further exacerbate the sell-off, as investors move towards safer investments.

These macroeconomic factors contributed to a broader risk-off market sentiment, impacting the valuation of growth stocks across various sectors.

Investor Sentiment and Market Speculation

Investor psychology and market speculation played a critical role in exacerbating the QBTS stock crash. Negative news, regardless of its accuracy, can trigger panic selling.

- Social media sentiment: Negative comments or news circulating on social media platforms could fuel the sell-off, especially among retail investors.

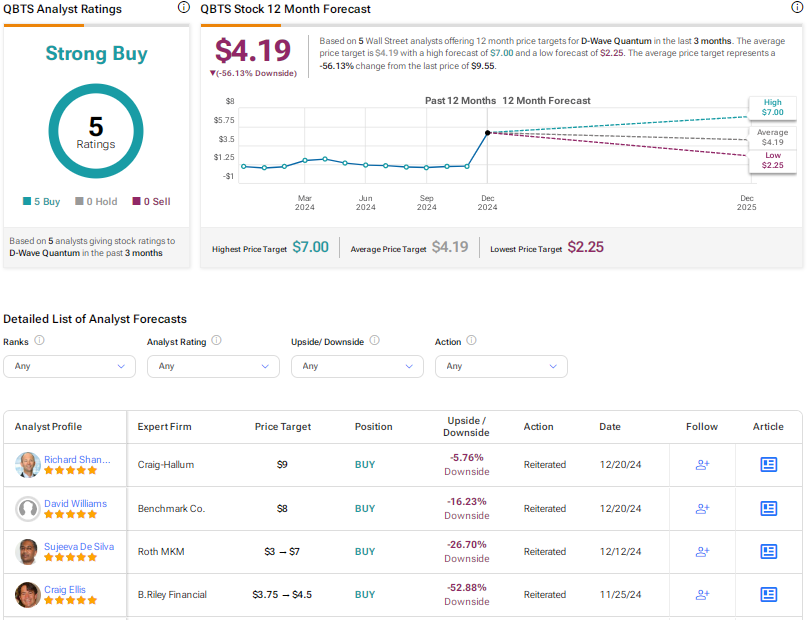

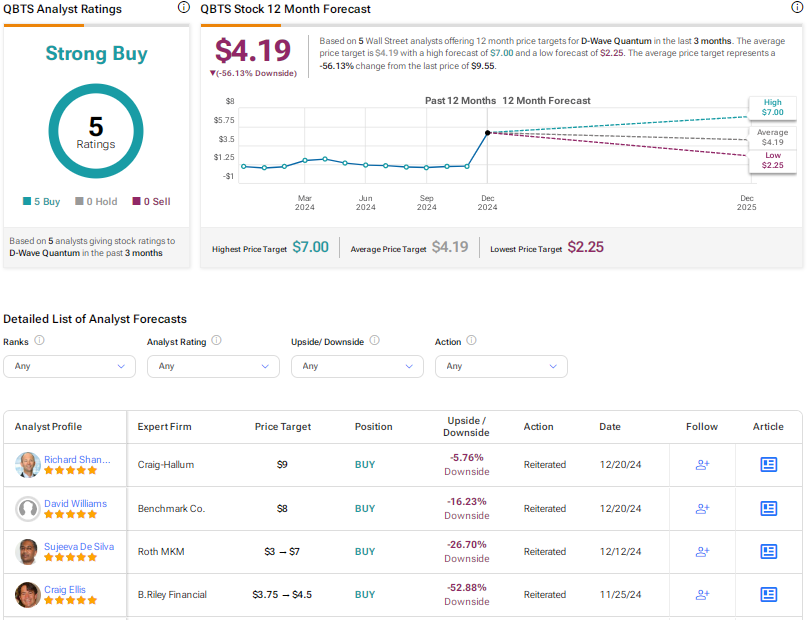

- News headlines and analyst reports: Negative media coverage or downgrades by financial analysts can contribute to a negative perception of QBTS and trigger further price declines.

- Short-selling: Short-selling activities by investors betting against QBTS could amplify the downward pressure on the stock price.

Comparing the QBTS Crash to Other Quantum Computing Stock Performances

Benchmarking Against Competitors

To understand the QBTS stock crash, it's important to compare its performance to other publicly traded quantum computing companies. This allows us to isolate factors specific to D-Wave Quantum.

- Identifying common trends: Did other quantum computing stocks experience similar price declines during the same period? This suggests broader market forces at play.

- Highlighting unique factors: Are there company-specific issues unique to D-Wave Quantum that explain the more significant drop compared to competitors?

By comparing QBTS to its peers, we can discern the interplay of industry-wide trends and company-specific factors.

Industry-Wide Trends

The broader quantum computing industry also plays a role. Investment trends and technological breakthroughs influence investor sentiment.

- Funding rounds: New funding rounds for competitors or a slowdown in investments for the quantum computing industry as a whole could impact investor confidence in QBTS.

- Technological breakthroughs: Significant technological advancements by competitors could negatively affect D-Wave's competitive position.

- Regulatory developments: Changes in government regulations or policies related to quantum computing could also influence investor sentiment.

Conclusion: Navigating Market Volatility in the Quantum Computing Sector

The QBTS stock crash illustrates the significant impact of market volatility on even promising technology stocks. The decline was a result of an interplay between broader macroeconomic factors, overall investor sentiment toward the tech sector, and company-specific issues related to D-Wave Quantum's performance. Understanding market volatility is crucial for navigating the QBTS stock.

Key Takeaways: Investing in high-growth tech stocks carries inherent risk. Thorough due diligence, including understanding both macroeconomic trends and company-specific news, is crucial before investing. Ignoring market volatility can lead to significant losses.

Call to Action: Before investing in quantum computing stocks like QBTS, learn more about market volatility and its impact. Mitigate risks associated with QBTS stock and similar investments by staying informed about market trends and company-specific news. Understanding market volatility is paramount to making informed investment decisions in the dynamic world of quantum computing.

Featured Posts

-

Michael Schumacher Gina Maria Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025

Michael Schumacher Gina Maria Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025 -

All The Answers Nyt Mini Crossword May 9

May 20, 2025

All The Answers Nyt Mini Crossword May 9

May 20, 2025 -

Fin De L Affaire Jaminet Remboursement Integral Au Stade Toulousain

May 20, 2025

Fin De L Affaire Jaminet Remboursement Integral Au Stade Toulousain

May 20, 2025 -

New Mexico Gop Arson Attack Allegations Of Censorship By Abc Cbs And Nbc

May 20, 2025

New Mexico Gop Arson Attack Allegations Of Censorship By Abc Cbs And Nbc

May 20, 2025 -

Restrictions Des 2 Et 3 Roues Sur Le Boulevard Fhb Debut Le 15 Avril

May 20, 2025

Restrictions Des 2 Et 3 Roues Sur Le Boulevard Fhb Debut Le 15 Avril

May 20, 2025