Market Volatility Increases As US Fiscal Issues Intensify

Table of Contents

The Debt Ceiling Debate and its Market Impact

The US debt ceiling is a legally mandated limit on the total amount of money the federal government can borrow. Reaching this limit necessitates a vote in Congress to raise the ceiling, allowing the government to continue borrowing to meet its existing obligations. Failure to raise the debt ceiling can trigger a range of potentially disastrous consequences, directly impacting market stability and increasing market volatility.

- Potential government shutdown: A failure to raise the debt ceiling could lead to a partial or complete government shutdown, disrupting essential services and undermining investor confidence.

- Credit rating downgrade: The inability to meet debt obligations could result in a downgrade of the US credit rating, increasing borrowing costs for the government and the private sector.

- Increased interest rates: A credit downgrade and the perceived increased risk of default can lead to a surge in interest rates, impacting everything from mortgages to corporate borrowing, fueling market uncertainty and volatility.

- Negative impact on investor sentiment: The uncertainty surrounding the debt ceiling debate erodes investor confidence, leading to a sell-off in stocks and other assets, amplifying market volatility.

- Increased market uncertainty and volatility: The overall combination of these factors creates a climate of profound uncertainty, fueling significant market fluctuations.

Historically, periods nearing the debt ceiling deadline have shown a clear correlation with increased market volatility. For example, [Insert data or example of past market reaction to debt ceiling debates – ideally with a source]. This illustrates the direct and tangible impact of the debt ceiling debate on market behavior.

Inflationary Pressures and Fiscal Policy Responses

The current inflationary environment adds another layer of complexity to the US fiscal landscape. Fiscal policy plays a significant role in either exacerbating or mitigating inflation. Government spending, taxation, and the Federal Reserve's response all contribute to the overall inflationary pressure and subsequent impact on market volatility.

- Government spending and inflation: Increased government spending can fuel demand-pull inflation, pushing prices higher.

- Tax policies and their impact on inflation: Tax cuts can stimulate the economy and potentially increase inflation, while tax increases can have the opposite effect.

- Federal Reserve response to inflation: The Federal Reserve’s actions to control inflation, such as raising interest rates, directly impact market behavior and volatility.

- Impact on consumer and investor confidence: High inflation erodes purchasing power and reduces consumer and investor confidence, potentially leading to market downturns.

- Correlation between inflation and market volatility: High and unpredictable inflation levels are strongly correlated with increased market volatility as investors grapple with uncertainty about future earnings and asset values.

Different fiscal policy choices can lead to drastically different outcomes. For example, [Insert example of how contrasting fiscal policies affected inflation and market volatility – ideally with a source]. This highlights the crucial role of fiscal policy in shaping market conditions.

Geopolitical Risks and Their Interaction with US Fiscal Issues

Global events and geopolitical tensions significantly amplify the impact of US fiscal issues on market stability. These external factors interact with domestic fiscal policy to create a complex and volatile environment.

- Global economic slowdown and its impact on US markets: A global recession can exacerbate existing US fiscal problems and further increase market instability.

- International relations and their influence on investor sentiment: Geopolitical tensions and international conflicts negatively affect investor sentiment, leading to capital flight and market volatility.

- Energy prices and their connection to fiscal policy and market volatility: Fluctuations in energy prices, often influenced by geopolitical factors, can impact inflation and market stability.

- Supply chain disruptions and their role in market instability: Global supply chain disruptions, which can be caused by geopolitical events, contribute to inflationary pressures and market volatility.

The interconnectedness of global events and domestic fiscal policy cannot be overstated. [Insert an example highlighting the interaction between a geopolitical event and US fiscal policy, and its effect on market volatility – ideally with a source]. This demonstrates the complex interplay of factors shaping market behavior.

Safe Haven Assets and Investor Behavior During Periods of Increased Volatility

During periods of heightened market volatility driven by fiscal uncertainties, investors often exhibit a "flight to safety," shifting their portfolios toward assets perceived as less risky.

- Flight to safety phenomenon: Investors move away from riskier assets (stocks, bonds) and towards safer alternatives.

- Demand for safe haven assets: This increased demand drives up the prices of safe haven assets, such as gold and government bonds.

- Impact on asset prices: The shift in investor behavior significantly impacts asset prices across different markets.

- Diversification strategies for investors: Diversification becomes crucial during these periods to mitigate potential losses.

For example, [Insert example of investor behavior during a period of increased market volatility – ideally with a source]. This showcases how investors adjust their strategies in response to fiscal uncertainty.

Conclusion: Navigating Market Volatility Amidst US Fiscal Issues

The interplay of the debt ceiling debate, inflationary pressures, and geopolitical risks creates a potent cocktail of uncertainty, significantly increasing market volatility. The strong link between US fiscal issues and market instability underscores the need for informed decision-making by investors. Managing market volatility requires a multi-faceted approach.

To navigate this challenging environment, investors should focus on:

- Diversifying their portfolios to spread risk across different asset classes.

- Closely monitoring key economic indicators, including inflation rates, interest rates, and government debt levels.

- Understanding their own risk tolerance and adjusting their investment strategies accordingly.

Staying informed about US fiscal developments and their potential impact on the market is paramount. Understanding US fiscal policy, mitigating market risks, and managing market volatility are crucial skills for success in the current climate. By proactively addressing these challenges, investors can better position themselves to navigate market uncertainty and potentially capitalize on opportunities amidst the volatility.

Featured Posts

-

Cost Of Living Crisis Are Canadians Sacrificing Car Security

May 23, 2025

Cost Of Living Crisis Are Canadians Sacrificing Car Security

May 23, 2025 -

Is Erik Ten Hag Leverkusens Next Manager

May 23, 2025

Is Erik Ten Hag Leverkusens Next Manager

May 23, 2025 -

Gospodin Savrsenog Vanja I Sime Fotografije Koje Su Osvojile Publiku

May 23, 2025

Gospodin Savrsenog Vanja I Sime Fotografije Koje Su Osvojile Publiku

May 23, 2025 -

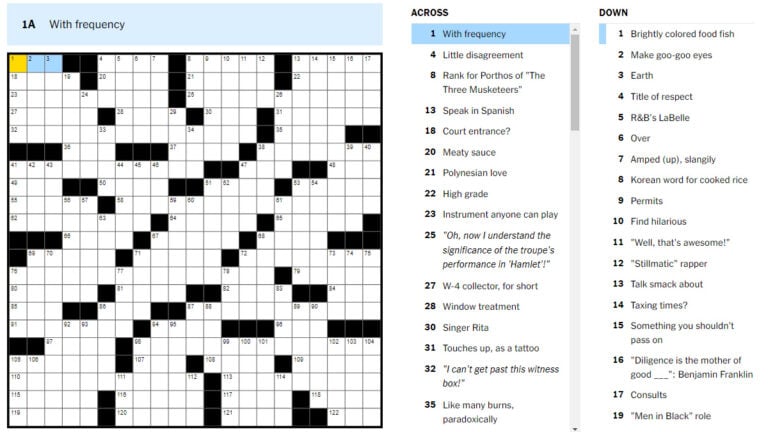

Nyt Mini Crossword Clue And Answer Help April 18 2025

May 23, 2025

Nyt Mini Crossword Clue And Answer Help April 18 2025

May 23, 2025 -

Ispovest Vanje Mijatovic Razvod I Borba Protiv Stereotipa

May 23, 2025

Ispovest Vanje Mijatovic Razvod I Borba Protiv Stereotipa

May 23, 2025