Meeting Between Finance Minister And Deutsche Bank: Implications For The Economy

Table of Contents

Potential Topics Discussed During the Meeting

The meeting between the Finance Minister and Deutsche Bank likely covered a range of critical issues impacting the German and global financial landscape. Discussions probably centered around several key areas:

-

Financial Stability of Deutsche Bank: The bank's current financial health and its resilience to ongoing economic headwinds were undoubtedly a primary focus. This includes assessing capital adequacy, liquidity positions, and risk management strategies. The stability of Deutsche Bank is crucial for the stability of the German financial system.

-

Government Support or Intervention: The possibility of government intervention, whether direct financial assistance or regulatory support, was likely discussed. The scale and nature of any potential support would depend heavily on the assessment of Deutsche Bank's financial health and the systemic risk it poses.

-

Impact of Recent Interest Rate Hikes: The European Central Bank's recent interest rate hikes to combat inflation have significant implications for Deutsche Bank's profitability and risk exposure. Discussions likely included assessing the impact of these rate hikes on the bank's lending activities and overall financial performance.

-

Regulatory Reforms: The ongoing regulatory environment and the need for potential reforms within the German financial sector were probably addressed. Discussions may have focused on strengthening bank supervision, improving risk management practices, and enhancing financial stability.

-

Economic Outlook for Germany: The broader German economic outlook and its impact on Deutsche Bank's business prospects were likely significant discussion points. This would have encompassed evaluating economic growth forecasts, inflationary pressures, and potential recession risks.

-

International Financial Market Implications: Deutsche Bank's global reach means that its stability has international ramifications. The meeting likely included discussions on the bank’s role within global financial markets and the potential contagion effect of any instability.

Immediate Implications for the German Economy

The outcome of the "Meeting Between Finance Minister and Deutsche Bank" will have immediate and significant impacts on the German economy:

Impact on Investor Confidence

The meeting's outcome will strongly influence investor confidence in Deutsche Bank and the wider German financial market.

-

Positive Scenarios: A clear statement of support from the Finance Minister, combined with assurances of Deutsche Bank's financial stability, could boost investor confidence, leading to increased investment and potentially a rise in the bank's stock price.

-

Negative Scenarios: Conversely, a lack of clear support or hints of further difficulties could trigger a sell-off, increasing market volatility and potentially triggering a broader crisis of confidence in the German financial system. This could lead to reduced investment and slower economic growth.

Potential Effects on Lending and Credit Markets

Deutsche Bank plays a vital role in Germany's lending and credit markets. The meeting's consequences will ripple through these markets:

-

Changes in Lending Policies: Depending on the outcome, Deutsche Bank may adjust its lending policies, potentially tightening credit availability for businesses and consumers. This could lead to a credit crunch, hindering investment and economic growth.

-

Impacts on Businesses and Consumers: Reduced credit availability could significantly impact SMEs, hindering their ability to invest and grow. Consumers might also face tighter lending conditions, impacting their spending and overall economic activity.

-

Possible Government Interventions: The government might implement measures to mitigate the negative consequences of any credit crunch, potentially through government-backed lending schemes or other interventions.

Wider European and Global Implications

Given Deutsche Bank's international presence, the "Meeting Between Finance Minister and Deutsche Bank" holds broader European and global implications:

-

Potential Impact on the Euro: Any significant negative developments concerning Deutsche Bank could negatively affect the Euro's value, impacting international trade and investment.

-

Spillover Effects on Other Banks: Concerns about Deutsche Bank's stability could spill over to other European and global banks, creating systemic risk and potentially triggering a broader financial crisis.

-

International Investor Sentiment: The meeting's outcome will significantly influence international investor sentiment towards Germany and the Eurozone, impacting capital flows and investment decisions.

Long-Term Economic Outlook Following the Meeting

The long-term consequences of the meeting depend heavily on its outcome and subsequent policy responses.

-

Positive Long-Term Scenarios: Successful restructuring of Deutsche Bank, combined with effective government policies, could pave the way for a strong economic recovery and sustainable growth in Germany.

-

Negative Long-Term Scenarios: Failure to address the underlying challenges at Deutsche Bank could lead to prolonged economic uncertainty, impacting investment, employment, and overall economic growth.

-

Required Policy Adjustments: The German government may need to implement further policy adjustments, including fiscal policies or structural reforms, to stabilize the economy and promote sustainable growth.

-

Potential for Future Collaborations: The meeting could pave the way for future collaborations between the German government and Deutsche Bank, focusing on building a more resilient and stable financial system.

Conclusion

The "Meeting Between Finance Minister and Deutsche Bank" represents a pivotal moment for the German and potentially the global economy. The immediate and long-term consequences will depend critically on the discussions' outcome and subsequent actions. The potential impact on investor confidence, lending markets, and wider international financial stability is significant. Staying informed about further developments regarding this meeting and its implications is crucial. Continue following reputable financial news sources and economic analyses for updates on the "Meeting Between Finance Minister and Deutsche Bank" and its ongoing impact on the economy.

Featured Posts

-

Exploring Baths Architectural Splendor A Somerset Photo Essay

May 30, 2025

Exploring Baths Architectural Splendor A Somerset Photo Essay

May 30, 2025 -

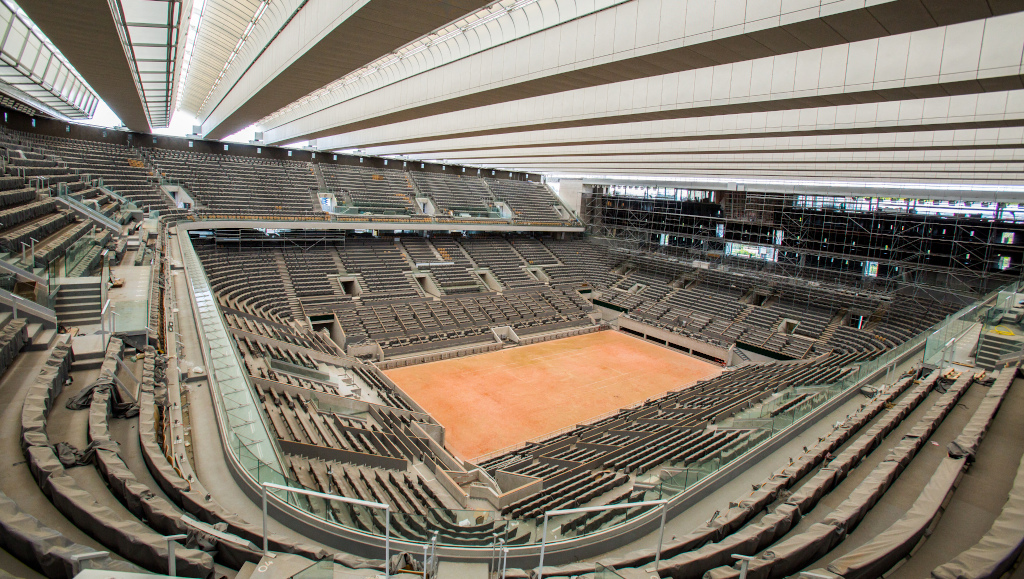

Roland Garros Knee Pain Forces Ruud To Withdraw Against Borges

May 30, 2025

Roland Garros Knee Pain Forces Ruud To Withdraw Against Borges

May 30, 2025 -

Setlist Fm Y Ticketmaster Se Unen Mejor Experiencia Para Usuarios

May 30, 2025

Setlist Fm Y Ticketmaster Se Unen Mejor Experiencia Para Usuarios

May 30, 2025 -

Manila Bay Assessing The Longevity Of Its Recent Transformation

May 30, 2025

Manila Bay Assessing The Longevity Of Its Recent Transformation

May 30, 2025 -

Current Status Of The Measles Outbreak Across The United States

May 30, 2025

Current Status Of The Measles Outbreak Across The United States

May 30, 2025