MicroStrategy Or Bitcoin: Smart Investment Choices For 2025

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's bold embrace of Bitcoin has made it a fascinating case study in corporate investment strategies. Understanding their approach is crucial for assessing the potential of MicroStrategy as an investment vehicle.

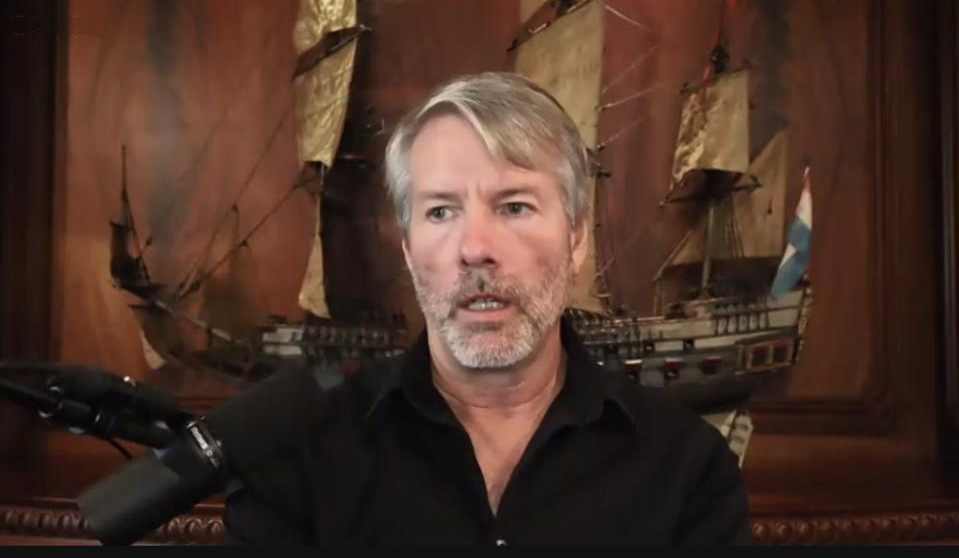

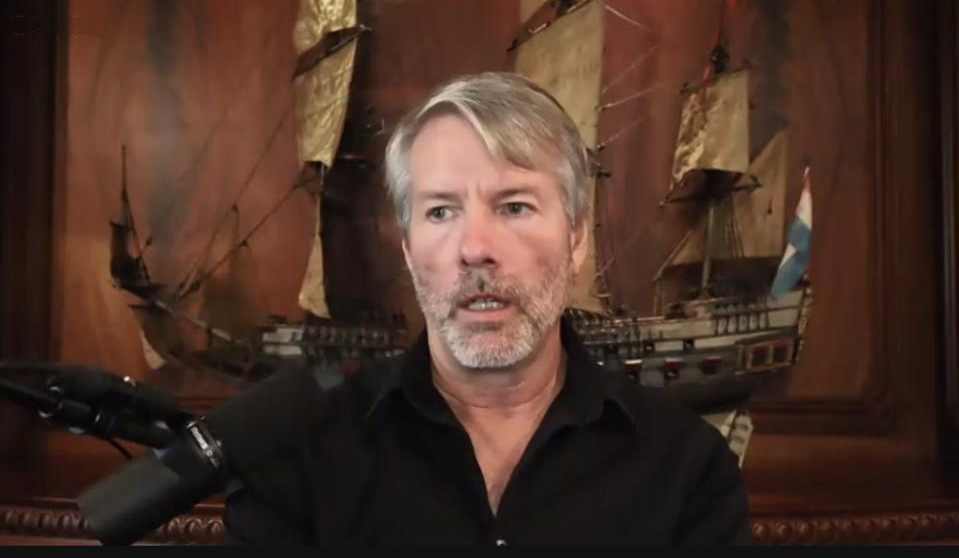

MicroStrategy's Bitcoin Holdings and Corporate Strategy

MicroStrategy's substantial Bitcoin accumulation has become a defining characteristic of the company. Their rationale stems from a belief in Bitcoin's long-term growth potential and its role as an inflation hedge. CEO Michael Saylor has been a vocal proponent of Bitcoin, significantly influencing the company's strategy and attracting attention from both investors and critics.

- High concentration of assets in Bitcoin: A large portion of MicroStrategy's treasury reserves are held in Bitcoin, creating significant exposure to its price fluctuations.

- Potential for significant gains if Bitcoin price appreciates: If the price of Bitcoin rises, MicroStrategy's holdings will appreciate proportionally, potentially leading to substantial gains for shareholders.

- Exposure to Bitcoin's volatility: The inherent volatility of Bitcoin directly impacts MicroStrategy's stock price, creating significant risk for investors.

- Dependence on Bitcoin's performance for company valuation: A significant portion of MicroStrategy's market capitalization is directly tied to the performance of Bitcoin.

Assessing the Risks and Rewards of Investing in MicroStrategy

The correlation between MicroStrategy's stock price and Bitcoin's price is undeniable. This strong correlation presents both significant opportunities and considerable risks. While the potential for substantial returns exists, investors must acknowledge the possibility of substantial losses if the price of Bitcoin declines. It's essential to evaluate MicroStrategy's financial health and overall business performance independent of its Bitcoin holdings to get a complete picture.

- Higher risk, higher potential reward: Investing in MicroStrategy carries a higher risk profile due to its Bitcoin exposure, but the potential for significant returns is also higher.

- Diversification within your portfolio is crucial: Investing in MicroStrategy should be part of a diversified investment strategy to mitigate the risk associated with Bitcoin's volatility.

- Consider your risk tolerance before investing: Only invest in MicroStrategy if you have a high risk tolerance and understand the potential for significant losses.

- Analyze financial reports and company performance beyond Bitcoin: Don't solely focus on Bitcoin's performance; examine MicroStrategy's core business and its financial health.

Bitcoin as a Standalone Investment

Bitcoin, the original and still dominant cryptocurrency, presents a distinct investment opportunity. Understanding its position in the market and its inherent characteristics is vital for making an informed decision.

Bitcoin's Position in the Cryptocurrency Market

Bitcoin's dominance in the cryptocurrency market is undeniable. Its decentralization—meaning it's not controlled by any single entity—is a key feature that appeals to many investors. The growing adoption of Bitcoin by institutional investors further solidifies its position as a significant asset class.

- First and most established cryptocurrency: Bitcoin's first-mover advantage and extensive track record give it a degree of stability compared to newer cryptocurrencies.

- Limited supply (21 million coins): Bitcoin's limited supply is a key driver of its potential for long-term appreciation.

- Potential for long-term price appreciation: Many believe Bitcoin's value will continue to grow over the long term, driven by increasing adoption and scarcity.

- Exposure to regulatory uncertainty and market volatility: The cryptocurrency market is subject to regulatory changes and extreme price volatility, presenting significant risks.

Risks and Opportunities of Direct Bitcoin Investment

The volatility of Bitcoin is well-documented. Investors need to be prepared for significant price swings. Secure storage of Bitcoin is paramount, requiring careful consideration of hardware wallets and reputable exchanges. Furthermore, understanding the tax implications of Bitcoin investments is essential.

- High volatility requires careful risk assessment: Only invest in Bitcoin if you're comfortable with its high volatility and understand the potential for significant losses.

- Understanding of blockchain technology is beneficial: While not essential, a basic understanding of blockchain technology can improve your investment decision-making.

- Secure storage practices are paramount: Protecting your Bitcoin from theft or loss through secure storage methods is crucial.

- Consult with a tax professional regarding tax liabilities: The tax implications of Bitcoin investments can be complex, so professional advice is recommended.

MicroStrategy vs. Bitcoin: A Comparative Analysis

| Feature | MicroStrategy | Bitcoin |

|---|---|---|

| Risk | High (correlated with Bitcoin price) | Very High (inherently volatile) |

| Potential Return | High (correlated with Bitcoin price) | Very High (but highly volatile) |

| Liquidity | Relatively High (publicly traded stock) | High (depending on the exchange) |

| Investment Type | Stock in a company holding Bitcoin | Direct ownership of cryptocurrency |

| Management | Managed by MicroStrategy's management team | Self-managed (requires secure storage) |

Investing in MicroStrategy offers exposure to Bitcoin through a publicly traded company, mitigating some of the complexities of direct crypto ownership. However, it also introduces the risks associated with MicroStrategy's overall business performance. Direct Bitcoin investment offers potentially higher returns but with dramatically increased volatility and the responsibility of securing your assets. Your individual risk tolerance and financial goals should be the deciding factors.

Conclusion

The choice between MicroStrategy and Bitcoin for your 2025 investment strategy hinges on your risk tolerance, financial goals, and investment expertise. MicroStrategy provides indirect Bitcoin exposure within a more established corporate structure, but carries inherent risk tied to its Bitcoin holdings. Direct Bitcoin investment presents higher potential rewards but necessitates a deep understanding of cryptocurrency markets and risk management. Thorough research, diversification, and potentially professional financial advice are crucial before investing in either MicroStrategy or Bitcoin. Make informed and responsible investment choices for 2025.

Featured Posts

-

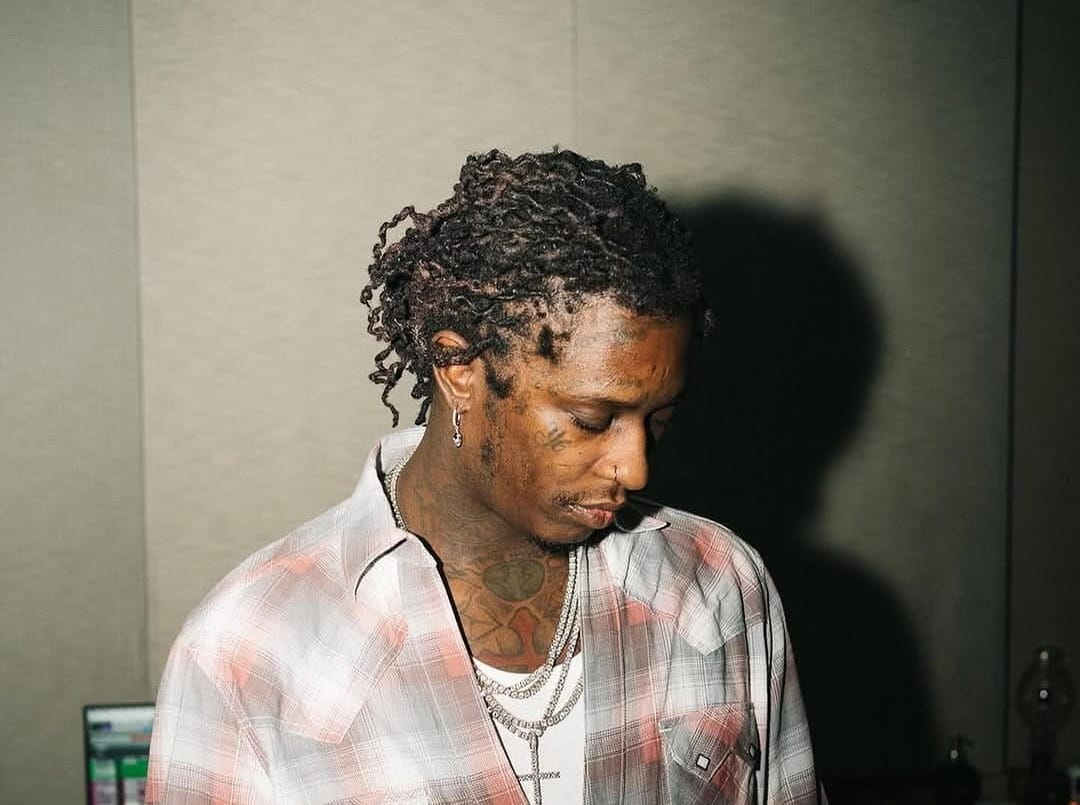

Uy Scuti Release Date Young Thug Offers A Glimpse

May 09, 2025

Uy Scuti Release Date Young Thug Offers A Glimpse

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025 -

Massive Fentanyl Bust In Us Bondi Details Record Seizure

May 09, 2025

Massive Fentanyl Bust In Us Bondi Details Record Seizure

May 09, 2025 -

Planlegg Vinterferien Trygt Veiforhold I Sor Norge

May 09, 2025

Planlegg Vinterferien Trygt Veiforhold I Sor Norge

May 09, 2025 -

Vozdushnaya Gavan Permi Zakryta Prichiny I Posledstviya Snegopada

May 09, 2025

Vozdushnaya Gavan Permi Zakryta Prichiny I Posledstviya Snegopada

May 09, 2025

Latest Posts

-

6

May 09, 2025

6

May 09, 2025 -

Edmonton Nordic Spa Development Council Approves Key Rezoning

May 09, 2025

Edmonton Nordic Spa Development Council Approves Key Rezoning

May 09, 2025 -

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 09, 2025

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 09, 2025 -

Uy Scuti Release Date Young Thug Offers A Glimpse

May 09, 2025

Uy Scuti Release Date Young Thug Offers A Glimpse

May 09, 2025 -

Young Thugs Uy Scuti Album When Is It Dropping

May 09, 2025

Young Thugs Uy Scuti Album When Is It Dropping

May 09, 2025