MicroStrategy Vs. Bitcoin: Predicting Investment Returns In 2025

Table of Contents

Bitcoin's Price Prediction for 2025

Predicting Bitcoin's price is notoriously difficult, yet crucial for evaluating potential returns. Several factors will significantly influence its value by 2025:

Factors Influencing Bitcoin's Price:

- Increased Institutional Adoption: Continued adoption by large corporations and institutional investors will likely drive up demand and price.

- Global Macroeconomic Conditions: Inflation, recessionary pressures, and geopolitical events will significantly impact Bitcoin's appeal as a hedge against inflation or a safe haven asset.

- Regulatory Landscape and Government Policies: Favorable regulations in major economies could boost adoption, while restrictive policies could dampen growth.

- Technological Advancements: Improvements like the Lightning Network and Layer-2 scaling solutions could enhance Bitcoin's usability and transaction speeds, potentially driving demand.

- Network Effects and User Growth: Wider adoption and increased user base will strengthen Bitcoin's network effect, making it more valuable and resilient.

Bullish and Bearish Price Predictions:

Predicting Bitcoin's price is highly speculative. While some analysts predict prices exceeding $100,000 per Bitcoin by 2025, others offer significantly lower figures, even suggesting a potential bear market. These predictions vary widely based on the underlying assumptions about the factors mentioned above. It's crucial to consult multiple sources and understand the caveats associated with each prediction before making investment decisions. For example, projects a price of X, while projects Y. These figures should be viewed as possibilities, not certainties.

Risk Assessment for Bitcoin Investment:

Bitcoin's price is exceptionally volatile. While potentially offering high returns, it also carries a high risk of significant losses. Investors must be prepared for substantial price swings and have a strong risk tolerance.

MicroStrategy's Investment Strategy and Performance

MicroStrategy's aggressive Bitcoin acquisition strategy has made it a prominent player in the cryptocurrency space.

MicroStrategy's Bitcoin Holdings and Acquisition Strategy:

MicroStrategy began accumulating Bitcoin in August 2020, viewing it as a long-term investment and a hedge against inflation. The company's rationale was to preserve its capital and potentially generate significant returns from Bitcoin's appreciation. Their holdings have significantly impacted their balance sheet and overall financial picture.

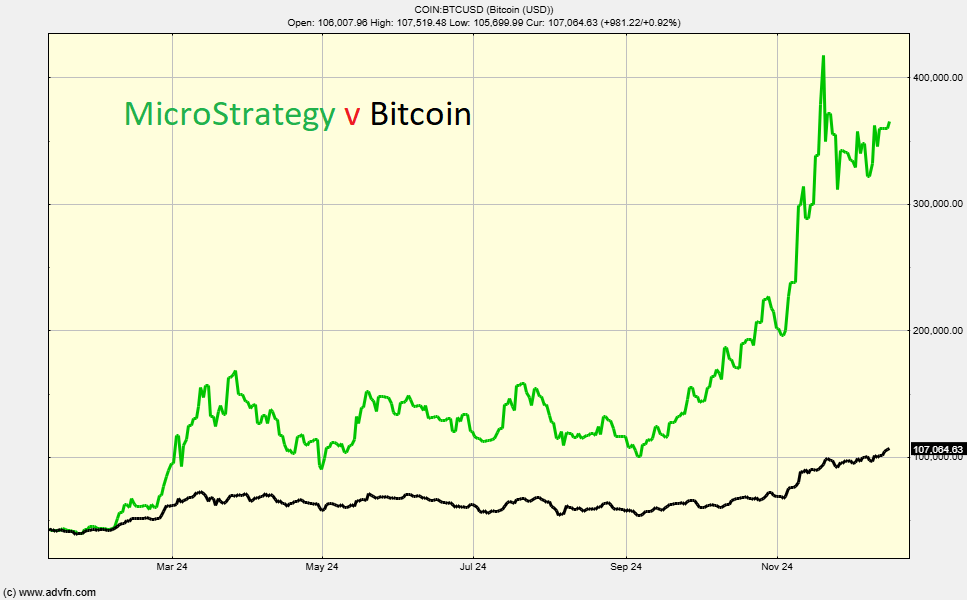

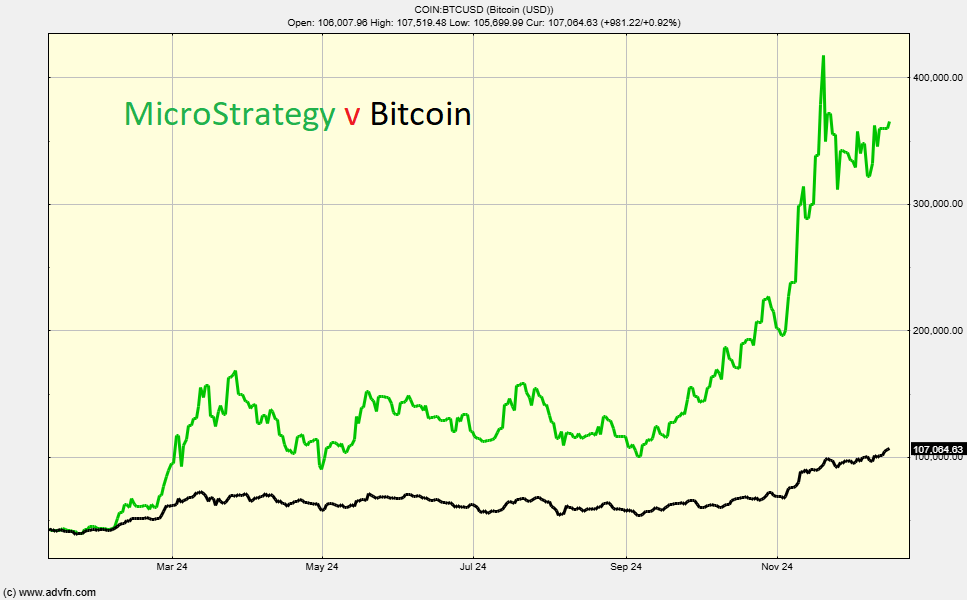

Analyzing MicroStrategy's Stock Performance in Relation to Bitcoin:

A strong correlation exists between MicroStrategy's stock price and Bitcoin's price. When Bitcoin's price rises, MicroStrategy's stock often follows suit, and vice versa. [Insert chart or graph here visually illustrating this correlation]. However, it's important to note that other factors also influence MicroStrategy's stock performance, including its core business operations and overall market sentiment.

MicroStrategy's Financial Health and Diversification:

MicroStrategy's significant Bitcoin holdings represent a considerable portion of its assets. This concentration presents both opportunities and risks. While potentially lucrative, it also increases the company's vulnerability to Bitcoin price fluctuations. An analysis of their financial statements is crucial to assess their overall health and debt levels, taking into account the volatility of their primary asset.

Risk Assessment for MicroStrategy Investment:

Investing in MicroStrategy carries similar risks to investing directly in Bitcoin, albeit potentially with a slightly lower volatility due to MicroStrategy's diverse, albeit Bitcoin-heavy, revenue streams. However, a downturn in Bitcoin could severely impact MicroStrategy's financial standing.

Comparing Investment Returns: MicroStrategy vs. Bitcoin in 2025

This section compares the potential returns of both investments under various scenarios.

Scenario Analysis:

- Bullish Scenario: Bitcoin reaches $100,000 or more by 2025. Both MicroStrategy stock and direct Bitcoin investments would likely yield substantial returns.

- Neutral Scenario: Bitcoin's price remains relatively stable, hovering around current levels. Returns would be moderate or potentially negative for both, depending on overall market conditions.

- Bearish Scenario: Bitcoin's price declines significantly. Both investments would likely experience substantial losses.

Return on Investment (ROI) Projections:

Estimating ROI requires making assumptions about Bitcoin's future price, MicroStrategy's business performance, and general market conditions. These projections should be viewed with extreme caution, as the crypto market is inherently volatile and unpredictable. [Insert table or chart with ROI projections for each scenario].

Risk-Reward Profile Comparison:

Investing directly in Bitcoin offers a higher potential reward but also significantly higher risk compared to investing in MicroStrategy. MicroStrategy's diversified business model (though heavily reliant on Bitcoin) offers some level of risk mitigation, but its success remains heavily tied to Bitcoin's price trajectory.

Alternative Investment Opportunities in the Crypto Market

Diversification is key in the crypto market. Consider exploring other avenues, such as:

- Ethereum (ETH): The second-largest cryptocurrency, with a strong ecosystem of decentralized applications (dApps).

- DeFi (Decentralized Finance): Explore lending, borrowing, and yield farming platforms. (Note: High risk associated with DeFi.)

- NFTs (Non-Fungible Tokens): Digital assets representing ownership of unique items, with potential for high returns, but also considerable risk.

Conclusion: MicroStrategy vs. Bitcoin: Making Informed Investment Decisions in 2025

Predicting the future of Bitcoin and MicroStrategy's performance in 2025 involves considerable uncertainty. Both options present significant opportunities for high returns but also carry substantial risks. The analysis highlights the strong correlation between Bitcoin's price and MicroStrategy's stock performance. Thorough research, understanding personal risk tolerance, and diversification are crucial before investing in either Bitcoin or MicroStrategy. Continue your research on "MicroStrategy vs. Bitcoin," exploring various resources and predictions to develop a well-informed investment strategy that aligns with your risk profile and financial goals for 2025. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Oscars Biggest Snubs Films And Performances That Deserved Better

May 08, 2025

Oscars Biggest Snubs Films And Performances That Deserved Better

May 08, 2025 -

Dojs Google Antitrust Action Impact On User Trust And Search Results

May 08, 2025

Dojs Google Antitrust Action Impact On User Trust And Search Results

May 08, 2025 -

Cantina Canalla Malaga Menu Reservas Y Opiniones

May 08, 2025

Cantina Canalla Malaga Menu Reservas Y Opiniones

May 08, 2025 -

Inter Milans Victory Sends Feyenoord Packing In Europa League

May 08, 2025

Inter Milans Victory Sends Feyenoord Packing In Europa League

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Latest Posts

-

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Streaming Options

May 08, 2025 -

Andor First Look Delivers On Decades Of Star Wars Teases

May 08, 2025

Andor First Look Delivers On Decades Of Star Wars Teases

May 08, 2025 -

Andor First Look A 31 Year Old Star Wars Mystery Solved

May 08, 2025

Andor First Look A 31 Year Old Star Wars Mystery Solved

May 08, 2025 -

Star Wars Andor A Look At Tony Gilroys Creative Vision

May 08, 2025

Star Wars Andor A Look At Tony Gilroys Creative Vision

May 08, 2025 -

Tony Gilroys Positive Andor Experience A Star Wars Success Story

May 08, 2025

Tony Gilroys Positive Andor Experience A Star Wars Success Story

May 08, 2025