Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

Common Reasons for Unclaimed HMRC Refunds

Many factors can lead to unclaimed HMRC refunds. Understanding these common scenarios can help you identify if you're eligible for a repayment.

Tax Credit Overpayments

Tax credit overpayments can occur due to several reasons. The government might have overestimated your entitlement based on the information provided.

- Incorrect income declaration: Failing to accurately report your income can result in receiving more tax credits than you're entitled to, leading to an overpayment that needs to be repaid.

- Changes in circumstances not reported: Life changes such as marriage, birth of a child, or a change in employment status can affect your eligibility for tax credits. Failing to notify HMRC about these changes can lead to an overpayment.

- Administrative errors: While rare, administrative errors on HMRC's part can sometimes lead to overpayments.

For more information on tax credits, visit the official government website: [Insert relevant government link here]

Income Tax Overpayments

Overpaying income tax is another common reason for unclaimed HMRC refunds. This often happens due to:

- Changes in employment: A change in job, salary, or employment status can impact your tax code, potentially leading to overpayment if not adjusted correctly.

- Self-assessment inaccuracies: Errors in your self-assessment tax return, such as incorrect deductions or miscalculations, can result in overpaying your tax liability.

- Pension contributions: If you've made pension contributions that weren't correctly accounted for, you might be entitled to a tax refund.

Visit the HMRC website's self-assessment section for further details: [Insert HMRC self-assessment link here]

National Insurance Contributions (NICs) Overpayments

Overpayments on National Insurance Contributions are less common but still possible. This usually arises from:

- Errors in employer calculations: Your employer is responsible for deducting NICs from your salary. Errors in their calculations can lead to overpayments.

- Changes in employment status: A change in your employment status, such as becoming self-employed, might require adjustments to your NIC payments, potentially resulting in an overpayment if not handled correctly.

For further guidance on NICs, please refer to the official HMRC resource: [Insert relevant HMRC NICs link here]

How to Check Your Payslips for Potential HMRC Refunds

Regularly reviewing your payslips is crucial for identifying potential HMRC refunds. Here’s how to do it effectively:

Key Things to Look For

When checking your payslips, pay close attention to the following:

- Tax code discrepancies: A wrong tax code can significantly affect your tax liability. Check if your tax code matches what you expect based on your circumstances.

- Unusual tax deductions: Any unusual or unexpectedly high tax deductions should be investigated.

- Discrepancies between PAYE and actual tax liability: Compare your total tax deductions throughout the year with your expected tax liability based on your income and allowances.

Keeping Accurate Records

Maintaining organized records is essential for successful HMRC refund claims.

- Organize records digitally or physically: Keep all your payslips, P60s, P45s, and other relevant tax documents in a safe and accessible place.

- Retain documents for at least six years: HMRC generally allows claims within six years, so keep your records for this duration.

Using Online HMRC Tools

Utilize HMRC's online services for easy access to your tax information:

- Accessing your personal tax account: Log into your online account to view your tax summaries and statements.

- Downloading tax summaries: Download and review your annual tax summaries to check for any discrepancies.

- Checking tax credit statements: If you receive tax credits, regularly review your statements for any overpayments. [Insert link to HMRC online portal]

What to Do If You Believe You Are Owed an HMRC Refund

If you believe you're owed a refund, follow these steps:

Gathering Necessary Documentation

Before contacting HMRC, gather the following documents:

- Payslips

- P60s

- P45s

- Bank statements (if needed to support your claim)

Contacting HMRC

Contact HMRC through their official channels to initiate your refund claim:

- Phone: [Insert HMRC phone number here]

- Online portal: [Insert link to HMRC online claim portal here]

Understanding the Timeline

Processing times for HMRC refund claims can vary. Be prepared for a wait of several weeks, or even months, depending on the complexity of your claim.

Conclusion

Many individuals are unknowingly owed HMRC refunds due to overpayments on tax credits, income tax, or National Insurance Contributions. Checking your payslips regularly for discrepancies and maintaining accurate records is crucial. Don't miss out on potentially thousands of pounds! Check your payslips for HMRC refunds, tax refunds, and unclaimed HMRC refund today! Utilize the resources provided to access your tax information and claim what you're rightfully owed. Remember to act swiftly, as claims can only be made within a specific timeframe. Start reviewing your payslips and tax documents now to see if you're eligible for an HMRC tax refund.

Featured Posts

-

The Zuckerberg Trump Era Challenges And Opportunities For Tech

May 20, 2025

The Zuckerberg Trump Era Challenges And Opportunities For Tech

May 20, 2025 -

Hmrcs Voice Recognition System Faster Call Handling For Taxpayers

May 20, 2025

Hmrcs Voice Recognition System Faster Call Handling For Taxpayers

May 20, 2025 -

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025 -

Dusan Tadic Sueper Lig De 100 Macina Cikti

May 20, 2025

Dusan Tadic Sueper Lig De 100 Macina Cikti

May 20, 2025 -

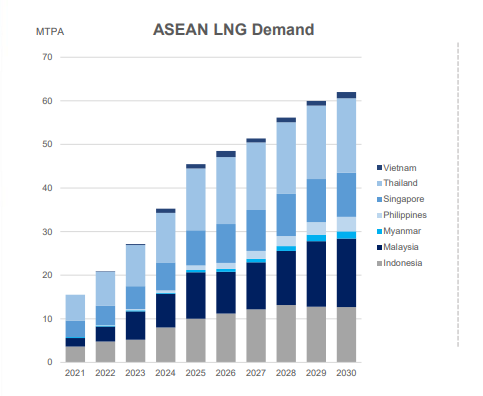

Post Nuclear Taiwan The Growing Demand For Lng Cargoes

May 20, 2025

Post Nuclear Taiwan The Growing Demand For Lng Cargoes

May 20, 2025