Minority Government Could Weaken Canadian Dollar: Expert Analysis

Table of Contents

Increased Political Uncertainty and its Impact on the CAD

A minority government inherently brings increased political uncertainty and unpredictability. The need for constant negotiation and compromise to pass legislation creates instability, impacting investor confidence and ultimately, the value of the Canadian dollar. This political volatility translates directly into economic uncertainty.

- Difficulty passing key legislation impacting the economy: Budgetary measures, trade agreements, and tax reforms might face significant delays or even fail to pass, hindering economic growth and creating uncertainty.

- Increased risk of snap elections and potential policy reversals: The fragility of a minority government increases the likelihood of snap elections, leading to abrupt policy changes and further unsettling investors. Policy reversals can significantly impact business planning and investment decisions.

- Reduced investor confidence due to political gridlock: Prolonged periods of political gridlock can erode investor confidence, leading to a decrease in foreign investment and a weakening of the CAD. Uncertainty discourages both domestic and foreign investment.

- Examples of past minority governments and their effects on the Canadian dollar: Examining historical data from previous minority governments in Canada reveals a correlation between periods of political instability and fluctuations in the CAD exchange rate. A review of these periods can offer valuable insights into potential future trends.

Impact on Foreign Investment and Capital Flows

Political instability directly impacts foreign investment and capital flows. The uncertainty created by a minority government can deter multinational corporations from investing in Canada, leading to reduced demand for the CAD.

- Hesitation from multinational corporations to invest in Canada: Businesses require stability and predictability for long-term investments. The inherent instability of a minority government can make Canada seem less attractive compared to other jurisdictions.

- Reduced capital inflows leading to lower demand for the CAD: A decline in foreign investment translates directly into a lower demand for the Canadian dollar, putting downward pressure on its value.

- Potential capital flight as investors seek safer havens: Investors may move their capital to more politically stable countries, further reducing the demand for the CAD and contributing to its depreciation.

- Explain the correlation between foreign investment and currency strength: A strong correlation exists between a country's attractiveness to foreign investment and the strength of its currency. Increased investment leads to higher demand, strengthening the currency.

Government Spending and Debt Concerns

A minority government often faces challenges in controlling government spending and debt. The need for compromise to secure budgetary approval can lead to increased spending and potentially higher deficits.

- Challenges in achieving fiscal prudence and controlling deficits: Negotiations to pass budgets can result in compromises that lead to increased spending and higher deficits, negatively impacting Canada's credit rating.

- Potential for increased inflation impacting the CAD's value: Increased government spending without a corresponding increase in economic productivity can fuel inflation, eroding the purchasing power of the CAD and impacting its value.

- Credit rating agencies' potential response to increased debt: A rise in government debt can lead to downgrades from credit rating agencies, increasing borrowing costs for the government and potentially further impacting the CAD.

- Explain how government fiscal policy directly affects currency values: Government fiscal policy, including spending and taxation, has a direct impact on a country's economic health, and thus, its currency's value. Expansionary fiscal policies can potentially weaken a currency.

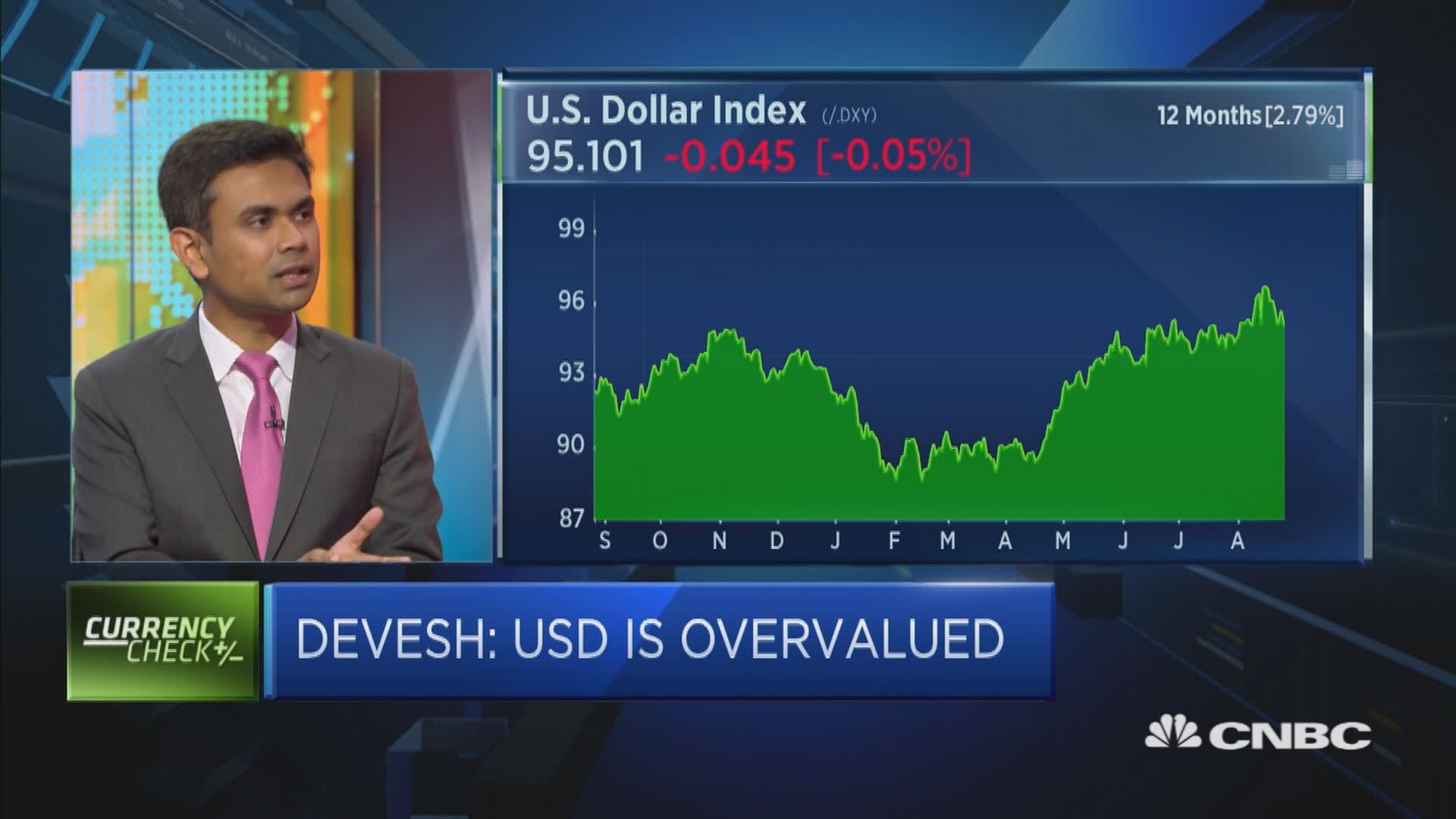

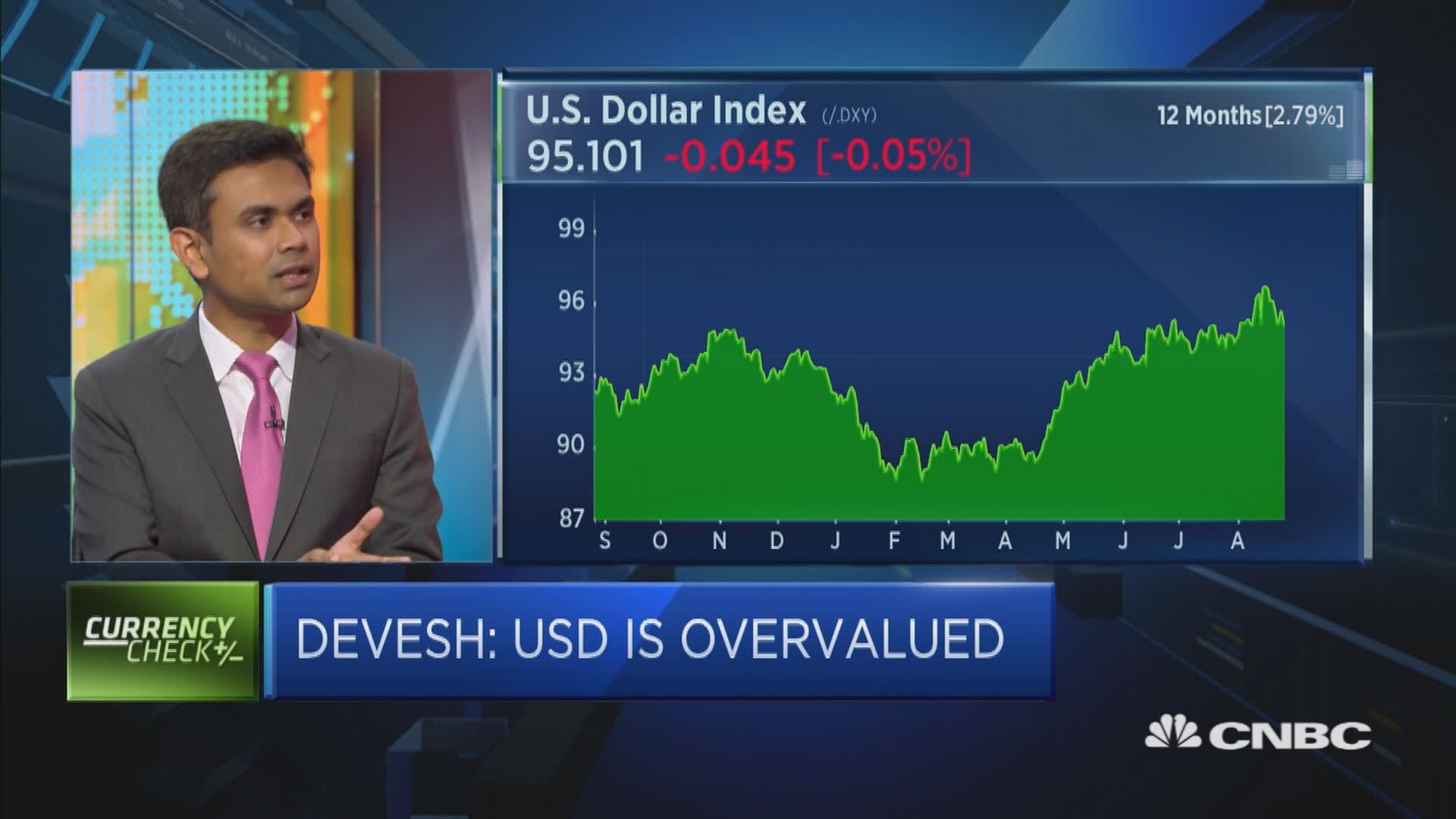

Expert Opinions and Predictions

Leading economists and financial analysts express varying degrees of concern about the potential impact of a minority government on the Canadian dollar. Their predictions offer valuable insight into possible scenarios.

- Quotes from experts highlighting their concerns or predictions: Including quotes from respected sources adds credibility and authority to the analysis.

- Summarize various expert perspectives on the potential scenarios: Presenting a range of expert opinions provides a comprehensive understanding of the potential risks and outcomes.

- Reference reputable sources to support the analysis: Citing reputable financial news sources, economic journals, and analyst reports strengthens the credibility of the analysis.

Conclusion

In summary, the political instability inherent in a minority government can significantly impact the Canadian economy and the value of the CAD. Reduced investor confidence, decreased foreign investment, potential increases in government debt and inflation all contribute to a weakening of the Canadian dollar. Understanding these potential consequences is crucial for making informed financial decisions. To mitigate risk and stay ahead of potential currency fluctuations, stay informed about economic and political developments in Canada. Conduct further research on the topic using keywords like "Minority Government and CAD," "Canadian Dollar Forecast," or "Impact of Politics on Canadian Economy" to develop a more comprehensive understanding of how a minority government could weaken the Canadian dollar.

Featured Posts

-

Claudia Sheinbaum Y Julio Cesar Encabezan La Clase Nacional De Boxeo 2025 Un Evento Historico

Apr 30, 2025

Claudia Sheinbaum Y Julio Cesar Encabezan La Clase Nacional De Boxeo 2025 Un Evento Historico

Apr 30, 2025 -

000 Pontoi I Istoriki Epidosi Toy Lempron Tzeims

Apr 30, 2025

000 Pontoi I Istoriki Epidosi Toy Lempron Tzeims

Apr 30, 2025 -

Schneider Electrics 2024 Sustainability Program Early Success And Future Plans

Apr 30, 2025

Schneider Electrics 2024 Sustainability Program Early Success And Future Plans

Apr 30, 2025 -

Protecting User Privacy In Mobile Apps Adhering To Cnil Standards

Apr 30, 2025

Protecting User Privacy In Mobile Apps Adhering To Cnil Standards

Apr 30, 2025 -

Cleveland Cavaliers Clinch 10th Consecutive Win Hunter Leads With 32 Points

Apr 30, 2025

Cleveland Cavaliers Clinch 10th Consecutive Win Hunter Leads With 32 Points

Apr 30, 2025