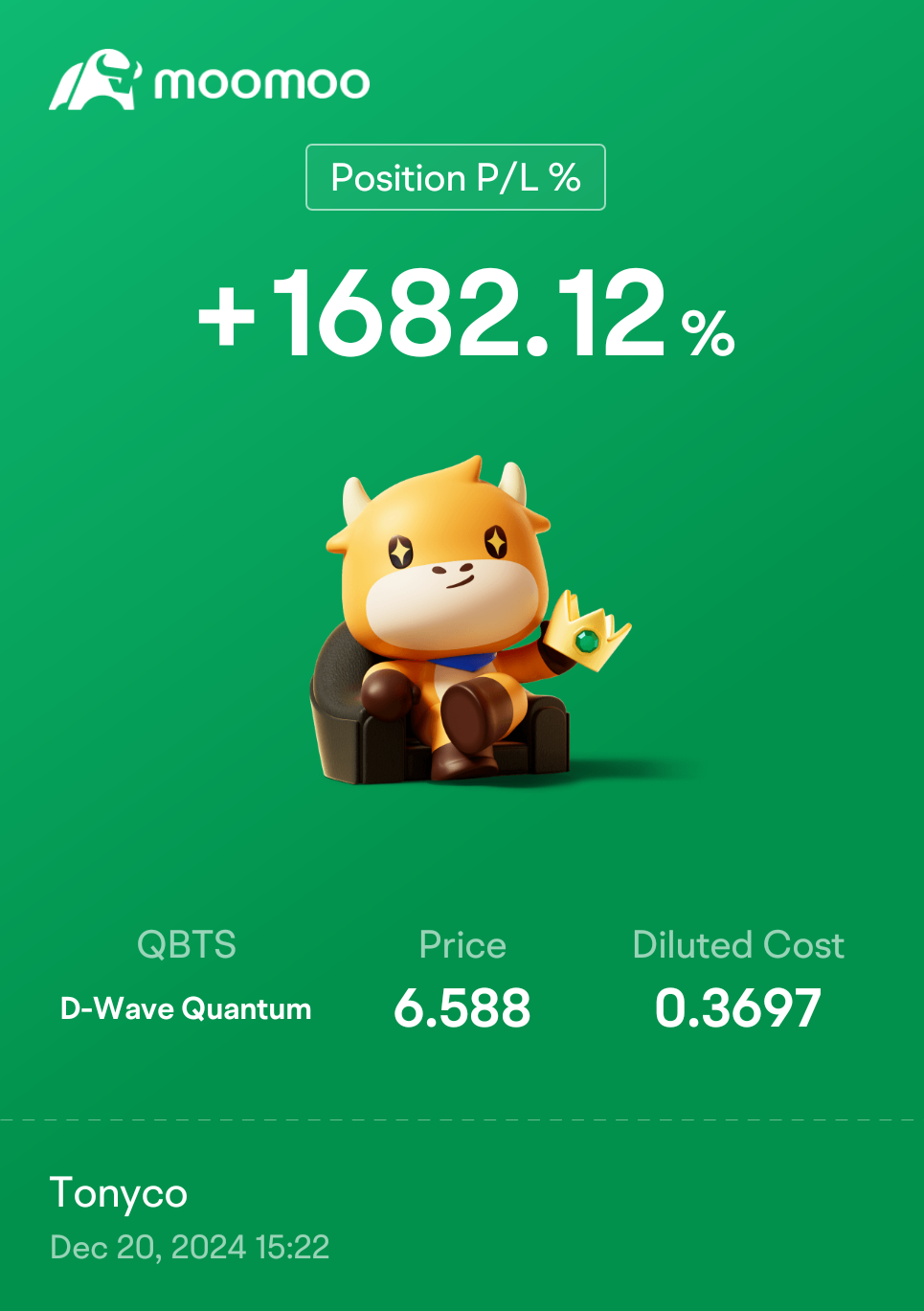

Monday's Market Drop: Analyzing The D-Wave Quantum (QBTS) Stock Crash

Table of Contents

Pre-Market Indicators and the Initial QBTS Stock Decline

Even before the market opened, signs pointed towards a potential downturn for QBTS. Analyzing pre-market activity is crucial for understanding the initial drop. Several factors contributed to this early decline:

- Specific pre-market news affecting QBTS: While no major negative news was publicly released before the market opened, a subtle shift in analyst sentiment or whisper networks could have influenced early trading. Absence of positive news, in a market expecting strong performance, can be equally impactful.

- Unusual trading volume before the market opened: A surge in pre-market trading volume, potentially driven by large institutional investors or informed traders, could signal an impending price movement. This unusual activity often foreshadows significant price changes.

- Mention of any relevant analyst ratings or reports: Any downgrades or negative comments from influential analysts, even if not widely publicized, could have contributed to the pre-market sell-off. The absence of positive ratings can also be a contributing factor.

This combination of factors created a negative pre-market sentiment, setting the stage for the subsequent QBTS stock crash during regular trading hours.

Impact of Broader Market Conditions on QBTS Performance

Monday's QBTS performance wasn't isolated; broader market conditions played a significant role. The overall market sentiment was crucial in amplifying the negative impact on QBTS stock:

- Overall market indices (Dow, S&P 500, Nasdaq) performance on Monday: A general downturn in the broader market, particularly in the tech sector (where QBTS is classified), would exacerbate the negative pressure on QBTS shares. A negative correlation between QBTS and major indices needs to be explored.

- Mention of any other major news affecting the tech sector or broader market: Negative news affecting the technology sector or the overall economy can cause a ripple effect, impacting even seemingly unrelated stocks like QBTS. For example, a sudden interest rate hike or geopolitical instability would create a climate of uncertainty.

- Correlation data comparing QBTS performance to market benchmarks: Analyzing the correlation between QBTS's movement and major market indices like the Nasdaq Composite can reveal whether the drop was primarily due to company-specific issues or a general market correction.

The confluence of these macroeconomic factors amplified the impact of any company-specific issues on QBTS's stock price.

Analyzing Specific News or Events Affecting D-Wave Quantum (QBTS)

Company-specific news or events are often the primary drivers of significant stock price swings. Investigating potential triggers for the QBTS crash is crucial:

- Specific news released by D-Wave Quantum (if any): Any negative news releases, such as disappointing earnings reports, missed revenue projections, or unforeseen technical challenges, would directly impact investor confidence.

- Analysis of the impact of competitor actions or announcements: Announcements from competing companies in the quantum computing sector, revealing technological breakthroughs or successful funding rounds, could indirectly affect QBTS's market valuation.

- Discussion of any potential regulatory hurdles: New regulations or potential regulatory scrutiny in the quantum computing industry could also negatively impact investor confidence and lead to a sell-off.

Understanding the company's internal situation and external pressures is critical for interpreting the stock's behavior.

Investor Sentiment and Trading Volume in QBTS

Analyzing investor sentiment and trading volume provides additional insights into the QBTS stock crash. High trading volume often signifies significant shifts in investor behavior:

- Comparison of trading volume to average daily volume: A significantly higher-than-average trading volume on Monday suggests a substantial number of investors were actively buying or selling QBTS shares. This heightened activity indicates a strong reaction to some catalyst.

- Analysis of investor sentiment based on social media and news coverage: Social media trends and news coverage surrounding QBTS on Monday can offer valuable insights into prevailing investor sentiment. Negative sentiment often leads to increased selling pressure.

- Mention of significant short-selling activity: A surge in short-selling, indicating bets against the stock's future performance, could amplify downward pressure and contribute to a rapid decline.

The combination of high volume and potentially negative investor sentiment suggests a strong market reaction to the events discussed above.

Conclusion: Understanding the QBTS Stock Crash and Future Outlook

The QBTS stock crash on Monday resulted from a complex interplay of factors. Pre-market indicators hinted at potential trouble, broader market conditions amplified the negative pressure, and potential company-specific news likely acted as a catalyst. High trading volume and negative investor sentiment further contributed to the sharp decline. The future outlook for QBTS remains uncertain. While the quantum computing sector holds immense long-term potential, investors should proceed with caution, acknowledging the inherent volatility of this emerging technology. Further research and a careful assessment of risk are crucial for informed investment decisions. Stay informed on D-Wave Quantum (QBTS) stock and the quantum computing market by following [link to relevant resource or your website]. Continue analyzing the QBTS stock to make informed investment choices. Understand the volatility of QBTS and other quantum computing stocks.

Featured Posts

-

Nyt Mini Crossword Today Hints And Answers For March 5 2025

May 20, 2025

Nyt Mini Crossword Today Hints And Answers For March 5 2025

May 20, 2025 -

Matheus Cunha The Latest On His Potential Move To Man United Or Arsenal

May 20, 2025

Matheus Cunha The Latest On His Potential Move To Man United Or Arsenal

May 20, 2025 -

Chinas Plans For A Space Based Supercomputer Challenges And Opportunities

May 20, 2025

Chinas Plans For A Space Based Supercomputer Challenges And Opportunities

May 20, 2025 -

Reps Vow To Recover 1 231 Billion From Oil Firms Details Inside

May 20, 2025

Reps Vow To Recover 1 231 Billion From Oil Firms Details Inside

May 20, 2025 -

Us Armys Pacific Deployment A Second Typhon Battery Arrives

May 20, 2025

Us Armys Pacific Deployment A Second Typhon Battery Arrives

May 20, 2025