Moody's US Downgrade: White House Condemnation And Economic Fallout

Table of Contents

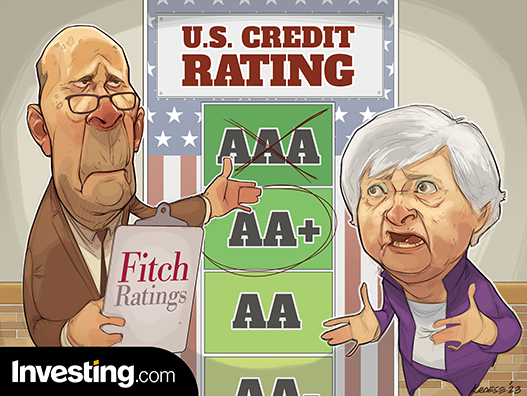

The White House Response to the Moody's Downgrade

The White House swiftly responded to Moody's downgrade with a vehement condemnation, rejecting the credit rating agency's assessment and criticizing its methodology.

Condemnation and Rebuttal

The official statement from the White House strongly criticized Moody's decision, characterizing it as flawed and based on inaccurate data. The administration argued that the downgrade failed to adequately account for the country's underlying economic strength and resilience.

- Specific Quotes: The White House press secretary stated, "[Insert direct quote from White House official criticizing Moody's methodology and conclusions]." Treasury Secretary Janet Yellen countered, "[Insert direct quote from Janet Yellen on the downgrade]." These statements emphasized the administration's belief that the downgrade doesn't reflect the reality of the US economy.

- Counter-Arguments: The administration highlighted the ongoing strength of the US job market and the resilience of the American economy in the face of global challenges. They argued that Moody's assessment neglected positive economic indicators and focused disproportionately on the political climate.

- Political Implications: The White House's strong rebuttal carries significant political implications, especially given the upcoming presidential election. The downgrade provides ammunition for the opposition, while the administration's response aims to mitigate potential damage to its economic credibility.

Economic Policies Under Scrutiny

The Moody's downgrade puts intense pressure on the Biden administration's economic policies, particularly its approach to fiscal spending and debt management.

- Policies Questioned: The downgrade casts doubt on the sustainability of current levels of government spending and the effectiveness of the administration's efforts to address the national debt. The debt ceiling debate and ongoing discussions regarding future budget allocations are now under increased scrutiny.

- Impact on Credibility: The downgrade raises questions about the administration's fiscal discipline and its ability to manage the national debt effectively. This impacts the credibility of its economic policies both domestically and internationally.

- Expert Opinions: Economists are divided on the long-term implications. Some argue the downgrade is overblown and reflects partisan political gridlock rather than fundamental economic weakness. Others suggest that the downgrade highlights the need for significant fiscal reforms to address the growing national debt.

Reasons Behind Moody's Downgrade of the US Credit Rating

Moody's cited several key factors in justifying its decision to downgrade the US credit rating. These factors underscore deep-seated fiscal challenges and governance concerns.

Fiscal Challenges

The core reason cited by Moody's is the trajectory of the US national debt and projected budget deficits. This reflects a long-term trend of increasing government spending outpacing revenue growth.

- US National Debt: The national debt continues to rise significantly, reaching record levels. This unsustainable trend places increasing pressure on future budgets and limits the government's fiscal flexibility.

- Political Gridlock: The persistent political gridlock in Congress, particularly concerning budget negotiations and fiscal reforms, contributes to the worsening fiscal situation. The inability to reach bipartisan agreements on deficit reduction hinders effective debt management strategies.

- Economic Indicators: Moody's assessment likely considered various economic indicators, including GDP growth, inflation rates, and interest rates, to arrive at their conclusion. These indicators, when analyzed collectively, may point towards a weakening fiscal outlook.

Political Polarization and Governance Concerns

Political polarization and the resulting governance challenges played a significant role in Moody's decision. The increasing difficulty in reaching bipartisan agreements on fiscal issues contributes to uncertainty about the government's ability to manage its finances effectively.

- Debt Ceiling Negotiations: The repeated contentious debt ceiling negotiations highlight the deep partisan divisions within the US government and the resulting instability in fiscal policy.

- Erosion of Institutional Trust: The highly partisan political environment has eroded public trust in government institutions and their ability to address long-term fiscal challenges. This instability creates uncertainty in the markets.

- Expert Opinions: Political scientists and economists concur that the heightened political polarization negatively impacts the government's ability to make sound long-term fiscal decisions, increasing the likelihood of financial instability.

Potential Economic Fallout from the Moody's Downgrade

The Moody's downgrade carries significant potential economic consequences, both domestically and internationally.

Impact on Interest Rates

The downgrade could lead to higher US interest rates as investors demand a higher return on US Treasury bonds to compensate for the increased perceived risk.

- Government Borrowing: Increased interest rates will make it more expensive for the US government to borrow money, potentially leading to higher budget deficits and further straining the national finances.

- Businesses and Consumers: Higher interest rates will translate into higher borrowing costs for businesses and consumers, potentially slowing down economic activity and investment.

- Global Financial Markets: The ripple effects could destabilize global financial markets as investors reassess their exposure to US assets.

Impact on the US Dollar

The downgrade could negatively impact the value of the US dollar, making it less attractive to foreign investors and potentially leading to currency depreciation.

- Foreign Exchange Markets: A weaker US dollar could make imports more expensive and exports cheaper, impacting trade balances and the overall economic outlook.

- Trade Balances: Changes in the value of the dollar could have profound consequences for trade, potentially exacerbating existing trade deficits or surpluses.

- Expert Forecasts: Currency analysts predict varying degrees of impact on the US dollar’s value, with some suggesting a moderate decline while others forecast more significant fluctuations.

Broader Economic Consequences

The downgrade has far-reaching implications for the US and the global economy, impacting investor confidence, economic growth, and societal well-being.

- Investor Confidence: The downgrade could erode investor confidence in the US economy, leading to capital flight and reduced investment.

- Economic Growth: Higher interest rates, a weaker dollar, and reduced investor confidence could stifle economic growth, potentially leading to slower GDP growth and job creation.

- Social and Political Consequences: The economic fallout could exacerbate social inequalities and trigger political instability.

Conclusion: Understanding the Implications of the Moody's US Downgrade

The Moody's downgrade of the US credit rating is a significant event with far-reaching implications. The White House's condemnation, while politically motivated, does not negate the underlying fiscal challenges and governance concerns that led to the downgrade. The potential economic fallout, encompassing higher interest rates, a potentially weaker dollar, and dampened economic growth, warrants careful consideration. Understanding the long-term impact of this Moody's US credit rating downgrade requires continued vigilance. Stay informed about the ongoing implications of this Moody's US downgrade by following reputable financial news sources and engaging in further research on the topic.

Featured Posts

-

Dry Spell Threatens To Cancel Easter Bonfire Celebrations

May 18, 2025

Dry Spell Threatens To Cancel Easter Bonfire Celebrations

May 18, 2025 -

Recent Developments In Kanye Wests Custody Case Saint West Visit Confirmed

May 18, 2025

Recent Developments In Kanye Wests Custody Case Saint West Visit Confirmed

May 18, 2025 -

Kanie Goyest Epistrofi Stin Iremia Meta Tin Kontra Me Toys Jay Z Kai Beyonce

May 18, 2025

Kanie Goyest Epistrofi Stin Iremia Meta Tin Kontra Me Toys Jay Z Kai Beyonce

May 18, 2025 -

American Manhunt Osama Bin Laden Review A Critical Analysis Of The Hunt

May 18, 2025

American Manhunt Osama Bin Laden Review A Critical Analysis Of The Hunt

May 18, 2025 -

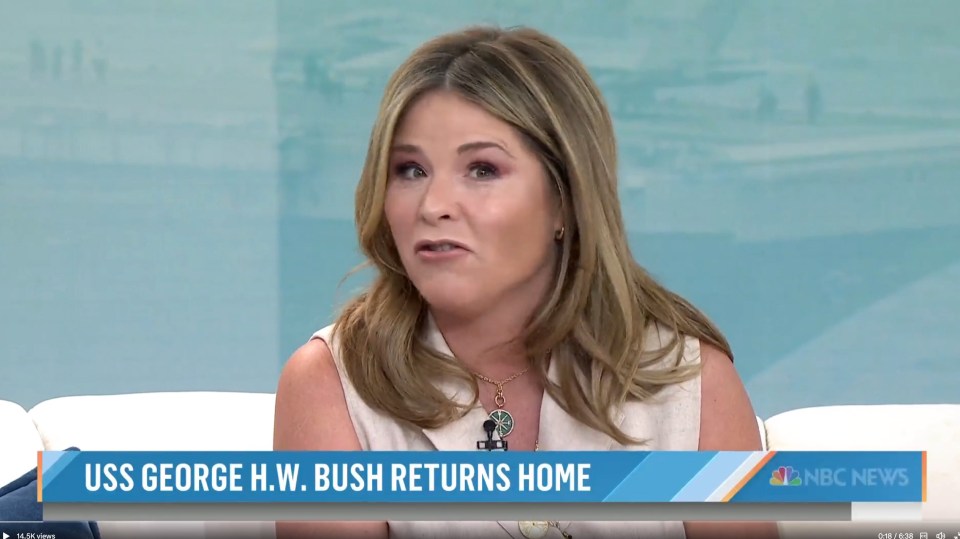

Today Show Viewers Demand Permanent Change After Jenna Bush Hager Segment

May 18, 2025

Today Show Viewers Demand Permanent Change After Jenna Bush Hager Segment

May 18, 2025

Latest Posts

-

1 0 Victory For Angels Sorianos Masterful Pitching Silences White Sox

May 18, 2025

1 0 Victory For Angels Sorianos Masterful Pitching Silences White Sox

May 18, 2025 -

Closers Name Discusses His Free Agency After Red Sox Tenure

May 18, 2025

Closers Name Discusses His Free Agency After Red Sox Tenure

May 18, 2025 -

Free Agency Former Red Sox Closer Speaks Out

May 18, 2025

Free Agency Former Red Sox Closer Speaks Out

May 18, 2025 -

Red Sox Closer On Free Agency His Next Move Revealed

May 18, 2025

Red Sox Closer On Free Agency His Next Move Revealed

May 18, 2025 -

Los Angeles Angels Defeat Chicago White Sox Thanks To Moncada And Soriano

May 18, 2025

Los Angeles Angels Defeat Chicago White Sox Thanks To Moncada And Soriano

May 18, 2025