Morgan Stanley Hires Deutsche Bank's Head Of Distressed Sales

Table of Contents

Understanding the Significance of the Hire

The appointment of a seasoned head of distressed sales is far more than just a personnel change; it's a strategic maneuver with significant implications for investment banking. Distressed sales, a specialized area of investment banking, focuses on the buying and selling of financially troubled companies and their assets. These professionals possess a unique skillset, navigating complex legal and financial landscapes to identify and capitalize on opportunities within distressed debt and other distressed assets. The expertise required encompasses deep financial modeling skills, a strong understanding of bankruptcy procedures, and exceptional negotiation abilities. The competitive landscape for top talent in this field is fiercely competitive among major investment banks, making this hire a significant win for Morgan Stanley.

- Specialized Skills: Distressed sales professionals possess specialized skills in evaluating and trading financially troubled companies and assets, including complex debt restructuring and asset liquidation.

- Competitive Advantage: This hire significantly strengthens Morgan Stanley's capabilities in a high-growth, high-reward area of finance, offering a clear competitive advantage.

- Talent Acquisition: Competition for top talent in distressed sales is fierce among major investment banks, reflecting the lucrative nature of the market.

Profiling the Newly Appointed Head of Distressed Sales (Assuming name is Jane Doe)

Jane Doe, the newly appointed head of distressed sales at Morgan Stanley, brings a wealth of experience and a proven track record to her new role. Her career history showcases a consistent pattern of success in navigating the complexities of distressed debt trading. During her tenure at Deutsche Bank, Ms. Doe consistently exceeded expectations, leading numerous high-profile transactions that involved the restructuring of substantial debt portfolios and the successful liquidation of distressed assets. Her deep understanding of market dynamics, coupled with her strong leadership qualities, makes her a valuable asset to Morgan Stanley.

- Career Progression: Ms. Doe's career has been marked by steady progression and significant achievements in the distressed debt trading sector.

- Successful Transactions: She has a demonstrable history of successful distressed debt transactions, resulting in significant returns for her previous employers.

- Industry Reputation: Ms. Doe is highly respected within the financial industry, known for her expertise and ethical conduct.

Implications for Morgan Stanley and Deutsche Bank

This strategic hiring has significant implications for both Morgan Stanley and Deutsche Bank. For Morgan Stanley, the acquisition of Ms. Doe represents a substantial boost to their distressed asset capabilities, potentially leading to increased market share and a strengthened reputation within this niche segment of investment banking. The move directly enhances their ability to compete with other major players in the field and to capitalize on emerging investment opportunities in the distressed asset market.

For Deutsche Bank, the loss of Ms. Doe represents a blow to their distressed sales team and overall market standing. While the bank will undoubtedly seek to fill the position, it faces the challenge of replacing a highly skilled and successful professional in a competitive market. This loss could impact their ability to secure and execute future distressed debt transactions and may impact their competitive edge.

- Morgan Stanley Benefits: Increased market share, enhanced reputation, strengthened competitive position, access to lucrative investment opportunities.

- Deutsche Bank Challenges: Talent loss, competitive pressure, potential impact on future transaction success.

- Industry Ripple Effect: This move may trigger further talent acquisition activity among competing investment banks.

The Broader Market Context of the Move

The hiring of Ms. Doe needs to be viewed within the broader context of current market trends and the economic outlook. The distressed asset market is highly cyclical, influenced significantly by economic uncertainty and macroeconomic factors. Current economic headwinds, including rising interest rates and potential recessionary risks, could increase the volume of distressed assets available for trading, presenting both opportunities and challenges for firms like Morgan Stanley. This strategic move positions Morgan Stanley to capitalize on these opportunities while effectively managing the associated risks.

- Market Trends: The current economic climate is likely to increase the volume of distressed assets available for trade.

- Economic Outlook: Uncertainty in the global economy creates both opportunities and risks in the distressed asset market.

- Risk Management: Specialized expertise in risk management is crucial for success in distressed asset trading.

Conclusion

The hiring of Deutsche Bank's head of distressed sales by Morgan Stanley represents a significant strategic move with profound implications for both firms and the broader financial landscape. This acquisition underscores the critical importance of specialized expertise in navigating the complex world of distressed assets and highlights the intense competition for top talent in this lucrative market sector. Morgan Stanley's move positions them for potential growth and success in a challenging but potentially rewarding market.

Call to Action: Stay informed on the latest developments in the world of distressed sales and investment banking by following [Your Website/Publication Name] for insightful analysis and expert commentary. Learn more about the impact of this key hire and other significant events shaping the distressed assets market.

Featured Posts

-

Alastylae Ela 13 Hya Flstynya Mqawmt Shebyt Twajh Mkhttat Alastytan

May 30, 2025

Alastylae Ela 13 Hya Flstynya Mqawmt Shebyt Twajh Mkhttat Alastytan

May 30, 2025 -

Trump On Russia Sanctions A Cautious Stance

May 30, 2025

Trump On Russia Sanctions A Cautious Stance

May 30, 2025 -

Plires Programma Kyriakis 16 Martioy

May 30, 2025

Plires Programma Kyriakis 16 Martioy

May 30, 2025 -

Preventing Test Drive Carjacking Safety Tips For Dealers And Buyers

May 30, 2025

Preventing Test Drive Carjacking Safety Tips For Dealers And Buyers

May 30, 2025 -

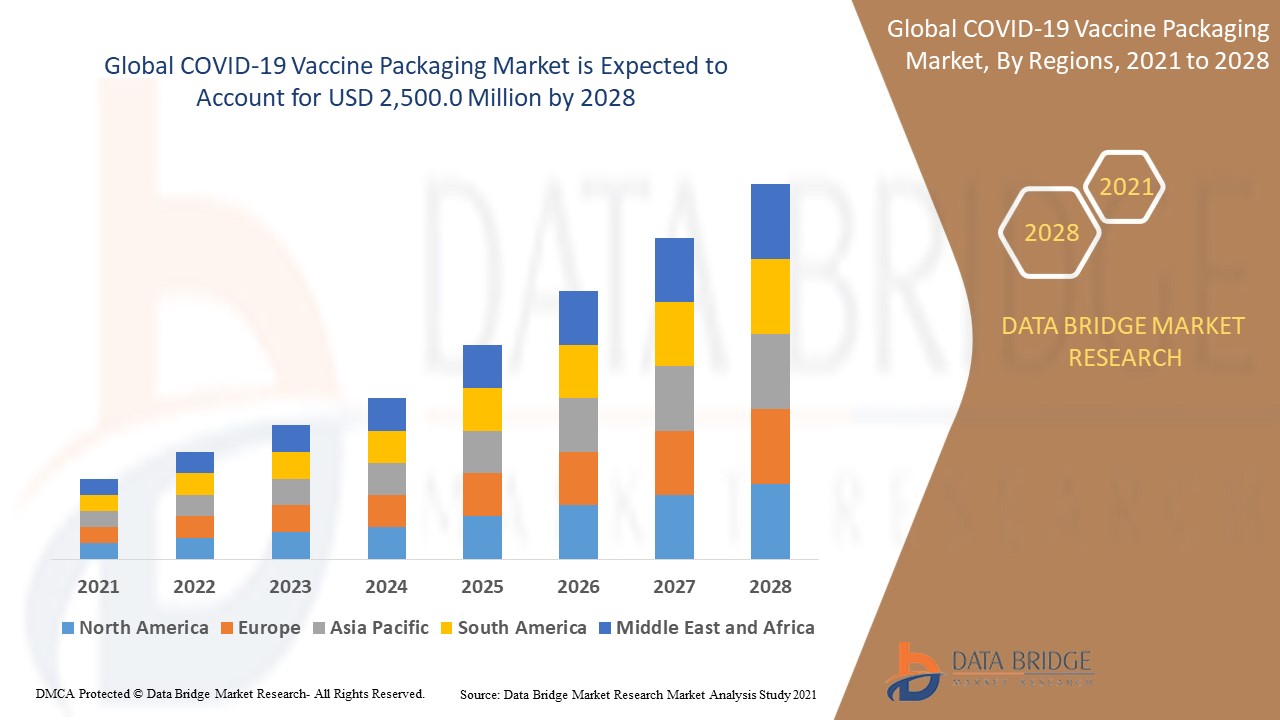

The Booming Vaccine Packaging Market Trends And Opportunities

May 30, 2025

The Booming Vaccine Packaging Market Trends And Opportunities

May 30, 2025