Musk's X Debt Sale: A Deep Dive Into The New Financial Landscape

Table of Contents

The Scale and Structure of Musk's X Debt Sale

The acquisition of X by Elon Musk in 2022 resulted in a substantial debt load. The exact figures surrounding the recent debt sale are still emerging, but reports suggest a significant reduction in X's overall debt burden. This involved a complex restructuring, likely encompassing a combination of debt refinancing, sales of assets, and potentially even the issuance of new equity.

- Debt Amount: While precise figures are not publicly available, reports indicate billions of dollars were involved in this massive debt restructuring.

- Debt Instruments: The debt likely comprised a mix of high-yield bonds, bank loans, and potentially other financial instruments. The specifics of the instrument mix will significantly impact the terms of repayment and the overall financial health of X.

- Sale Terms: The terms of the sale—including interest rates, maturities, and any associated covenants—will heavily influence X's future financial flexibility. Securing favorable terms is crucial for X's long-term stability.

- Participating Institutions: The identities of the financial institutions involved in the debt sale will shed light on investor confidence in X's future prospects. The involvement of major financial players will signal a vote of confidence, while a less prominent investor base could raise concerns.

- Investor Attractiveness: The attractiveness of the terms to investors will reflect market sentiment toward X and the perceived risk involved in lending to the company. Favorable terms are critical to reduce X's future financial obligations.

Impact on X's Financial Health and Future Strategies

The successful sale of X's debt significantly impacts its financial health. By reducing its debt burden, X gains improved financial flexibility and liquidity. This strengthens its balance sheet, reduces its risk of default, and provides greater breathing room for future strategic initiatives.

- Improved Cash Flow: The reduction in interest payments frees up substantial cash flow that can be reinvested into product development, marketing, and potentially acquisitions.

- Future Acquisitions and Investments: X's improved financial health paves the way for potential acquisitions of smaller companies or strategic investments in innovative technologies, enhancing its offerings and competitive edge.

- Impact on Valuation: The debt restructuring could positively impact X's valuation, particularly if it shows signs of improved profitability and financial stability. However, the exact impact will depend on various factors, including market sentiment and X's operational performance.

Implications for the Broader Tech Industry and Financial Markets

Musk's X debt sale holds significant implications for the broader tech industry and financial markets. It serves as a case study in handling massive debt loads acquired during leveraged buyouts.

- Impact on Investor Sentiment: The success or failure of this debt restructuring could influence investor sentiment towards similar tech companies with high debt levels. A positive outcome may bolster confidence, while a negative one could raise concerns.

- Ripple Effects on LBOs: The deal could impact the appetite for future leveraged buyouts (LBOs) in the tech industry. If the X debt sale proves successful, it may encourage more LBO activity. However, if it signals significant risks, it may lead to greater caution.

- Future of Tech Debt Financing: The events surrounding Musk's X debt sale will undoubtedly shape future debt financing strategies for tech companies. It may prompt lenders to demand stricter terms or higher collateral for similar transactions.

Analysis of Musk's Financial Strategy and Long-Term Vision

Musk's decision to undertake this massive debt sale reflects a calculated strategic maneuver. The sale likely aims to improve X's financial stability and free up capital for its ambitious long-term goals.

- Motivations Behind the Sale: Reducing X's debt burden was likely a primary motivation. This move enhances financial flexibility and reduces the risk of default. This also potentially frees capital for investment in other ventures.

- Strategic Advantages and Disadvantages: While reducing debt is a significant advantage, the restructuring could have diluted ownership or imposed stricter financial constraints. This balance between risk and reward needs careful evaluation.

- Musk's Long-Term Vision: This debt sale likely aligns with Musk's broader vision for X, potentially including ambitious expansion plans requiring significant investment. Understanding this long-term vision is critical in evaluating the success of this restructuring.

Conclusion

Musk's X debt sale represents a significant event with far-reaching implications. By reducing its debt burden, X improves its financial health, enhancing its future prospects. The success of this restructuring will influence investor sentiment towards similar tech companies and may reshape future debt financing strategies in the industry. The sale’s impact on Musk's broader business empire remains to be seen, but its successful execution demonstrates a willingness to take decisive action to strengthen the financial standing of X. To stay abreast of the evolving situation, continue to monitor news related to Musk's X debt sale and X's overall financial performance. Further research into X's financial statements and related market analyses will offer deeper insights into the long-term implications of this significant debt restructuring.

Featured Posts

-

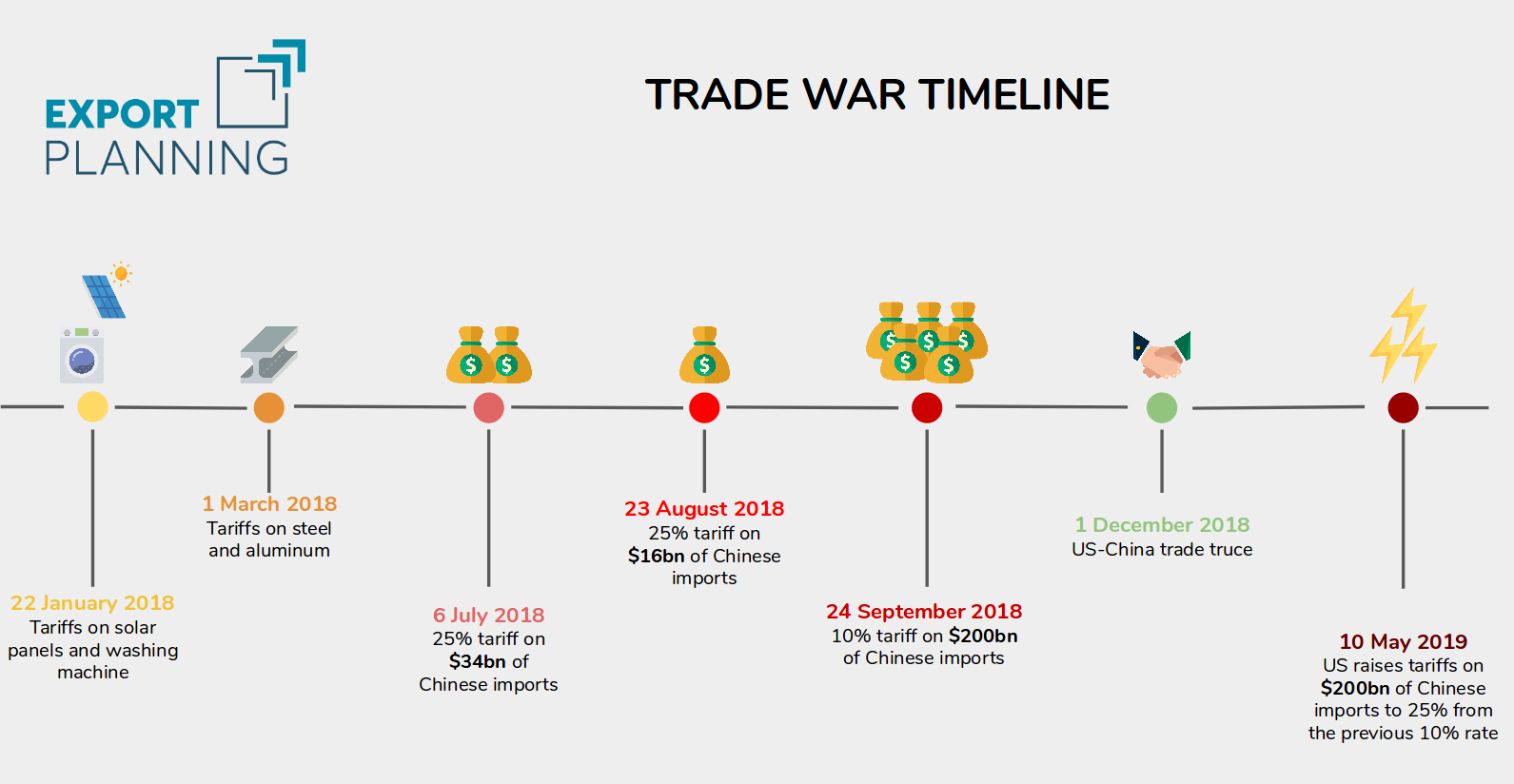

Us China Trade Selected Tariff Relief Announced By China

Apr 28, 2025

Us China Trade Selected Tariff Relief Announced By China

Apr 28, 2025 -

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

Assessing The Economic Fallout A Fed Snapshot Of The Canadian Travel Boycott

Apr 28, 2025

Assessing The Economic Fallout A Fed Snapshot Of The Canadian Travel Boycott

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

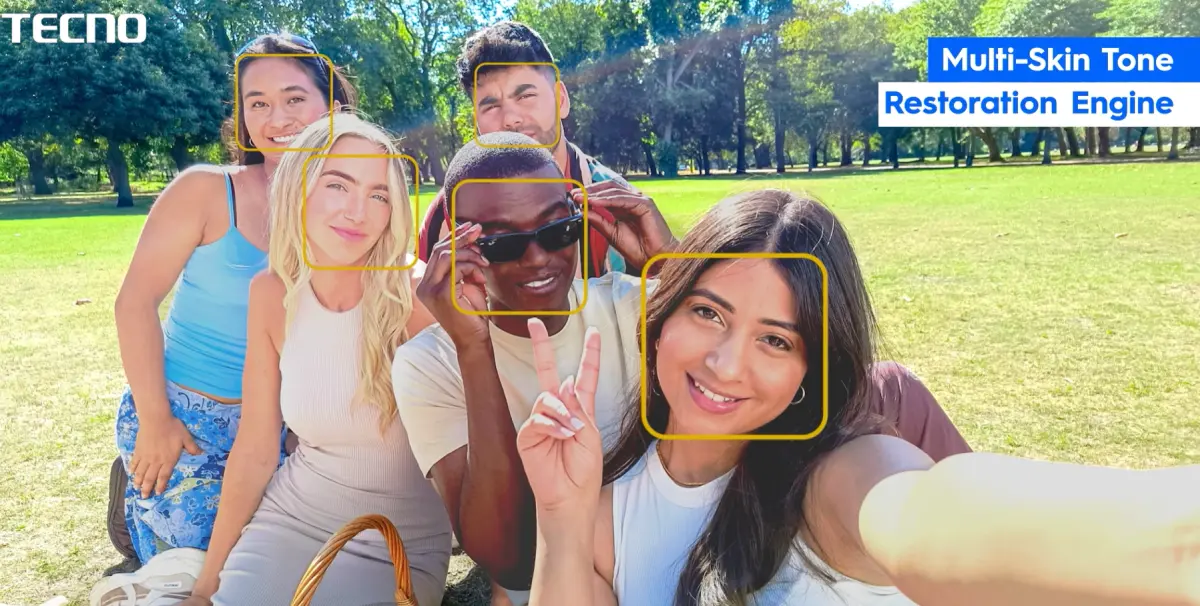

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025