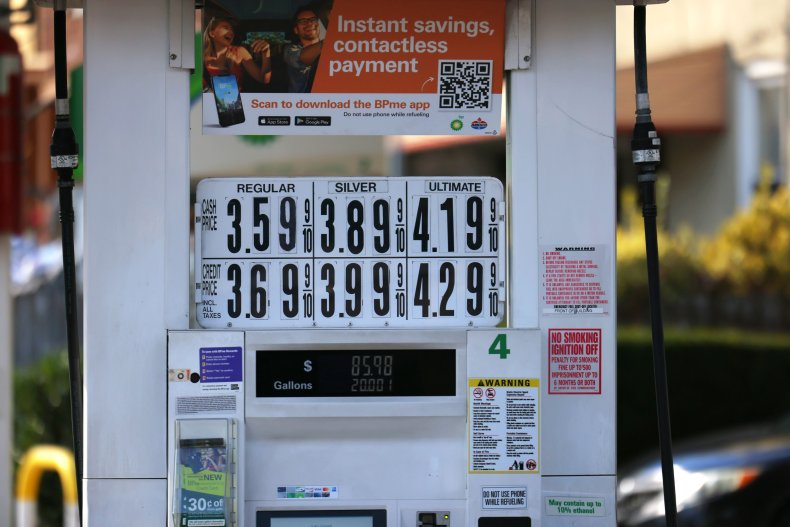

National Average Gas Price Drops Below $3 Amid Economic Uncertainty

Table of Contents

Factors Contributing to the Gas Price Drop

Several intertwined factors have contributed to this significant drop in the national average gas price. Understanding these factors provides crucial context for interpreting the current situation and anticipating future trends in fuel prices.

Decreased Global Oil Demand

A global economic slowdown is significantly impacting oil demand. Reduced energy consumption in major economies is directly affecting oil prices, a key determinant of gas prices at the pump.

- Europe's energy crisis: The ongoing energy crisis in Europe has led to reduced industrial activity and lower energy consumption, impacting global oil demand.

- Slowing growth in China: China's economic growth has slowed, resulting in lower demand for oil and contributing to the price decrease.

- Oil and gas prices are intrinsically linked: The price of crude oil is a major component of the final price of gasoline. Lower oil prices translate directly to lower gas prices.

Increased Domestic Oil Production

The United States has seen an increase in domestic oil production, contributing to a greater supply and thus, lower prices.

- Technological advancements: Improved drilling techniques and technologies have increased efficiency and output in the US oil industry.

- Policy changes: Government policies encouraging domestic energy production have also played a role.

- Increased supply lowers prices: A higher supply of oil in the market pushes prices downward due to the basic principles of supply and demand.

Strategic Petroleum Reserve Releases

The US government's release of oil from the Strategic Petroleum Reserve (SPR) has also helped to stabilize and lower prices.

- Scale of releases: The administration has authorized substantial releases of oil from the SPR to ease price pressures.

- Timing of releases: These releases have been strategically timed to coincide with periods of high demand or geopolitical instability.

- Effectiveness debated: While the SPR releases have had a noticeable impact, some experts debate their long-term effectiveness as a price-control mechanism.

Economic Implications of Lower Gas Prices

The decrease in the national average gas price has several potential economic implications, both positive and negative.

Impact on Consumer Spending

Lower gas prices directly translate to increased disposable income for consumers. This can lead to a boost in consumer spending across various sectors.

- Increased disposable income: Reduced transportation costs free up money for other purchases.

- Stimulus to other sectors: Increased consumer spending could benefit retail, tourism, and the hospitality industries.

- Positive feedback loop: Increased consumer confidence and spending could further stimulate economic growth.

Inflationary Pressures

Lower gas prices can help mitigate overall inflationary pressures. Decreased energy costs directly affect the Consumer Price Index (CPI).

- Lower CPI: The reduction in energy costs can contribute to a lower CPI, signaling a decrease in inflation.

- Counterarguments: However, other factors, such as supply chain disruptions and labor shortages, could still contribute to inflationary pressures.

- Complex relationship: The impact of lower gas prices on inflation is complex and depends on the interplay of various economic factors.

Recessionary Fears

While lower gas prices offer some relief, they don't fully address the broader economic concerns regarding a potential recession.

- Economic indicators: Other economic indicators, such as unemployment rates and business investment, are crucial in assessing recession risk.

- Temporary reprieve?: The lower gas prices might be a temporary reprieve rather than a long-term solution to economic anxieties.

- Expert opinions vary: Financial experts hold differing views on the likelihood of a recession, with some suggesting the lower gas prices might mitigate the risk while others remain cautious.

Future Outlook for Gas Prices

Predicting future gas prices is inherently challenging, given the interplay of various factors.

Geopolitical Factors

Geopolitical events significantly impact oil prices and, consequently, gas prices.

- Global tensions: Ongoing conflicts and geopolitical instability can disrupt oil supplies, leading to price volatility.

- OPEC decisions: Decisions by the Organization of the Petroleum Exporting Countries (OPEC) can significantly influence global oil production and pricing.

- Unpredictable events: Unexpected events, such as natural disasters or political upheavals, can create significant price fluctuations.

Seasonal Demand

Seasonal changes in demand play a role in gas price fluctuations.

- Summer driving season: Increased travel during the summer months typically leads to higher demand and potentially higher prices.

- Historical patterns: Analyzing historical data on seasonal price changes provides valuable insights for future predictions.

- Uncertainties: Unpredictable weather patterns or changes in travel habits could influence seasonal demand and affect gas prices.

Predicting Price Trends

Experts offer varying predictions on future gas price trends, emphasizing the inherent uncertainty of the market. Many acknowledge that several unpredictable factors could impact future prices.

Conclusion

The drop in the national average gas price below $3 is a complex issue with both positive and negative implications. While lower fuel costs provide some relief for consumers and potentially help mitigate inflationary pressures, broader economic concerns regarding a potential recession remain. Several interacting factors, including global oil demand, domestic production, government intervention, and geopolitical instability, influence the price at the pump. Staying informed about these factors is crucial for navigating the current economic landscape. Stay informed about fluctuations in the national average gas price and their effect on your wallet and the economy.

Featured Posts

-

Thong Tin Chinh Thuc Cau Ma Da Dong Nai Binh Phuoc Khoi Cong Thang 6 Nam Nay

May 22, 2025

Thong Tin Chinh Thuc Cau Ma Da Dong Nai Binh Phuoc Khoi Cong Thang 6 Nam Nay

May 22, 2025 -

Video Game Adaptation Michael Bays Outrun Movie With Sydney Sweeney

May 22, 2025

Video Game Adaptation Michael Bays Outrun Movie With Sydney Sweeney

May 22, 2025 -

Core Weaves Initial Public Offering 40 Listing Price Lower Than Projected

May 22, 2025

Core Weaves Initial Public Offering 40 Listing Price Lower Than Projected

May 22, 2025 -

Ex Councillors Wife Fights Racial Hatred Tweet Conviction

May 22, 2025

Ex Councillors Wife Fights Racial Hatred Tweet Conviction

May 22, 2025 -

Sibiga Rubio Ta Grem Rezultati Vazhlivoyi Zustrichi V S Sh A

May 22, 2025

Sibiga Rubio Ta Grem Rezultati Vazhlivoyi Zustrichi V S Sh A

May 22, 2025