Navan's US IPO: Travel Tech Firm Taps Banks For Public Offering

Table of Contents

Navan's Journey to the IPO

Navan's journey to its impending IPO is a compelling story of growth, strategic acquisitions, and market dominance. The company's evolution reflects the rapid changes and increasing demand within the corporate travel management sector. Its success is built upon a foundation of innovative technology and a keen understanding of the needs of modern businesses.

-

Founding and initial growth stages: Navan’s origins trace back to [Insert founding date and brief description of initial business model]. Early success was fueled by [mention key early achievements, e.g., securing early clients, technological innovations].

-

Key acquisitions and mergers: A pivotal moment in Navan's growth was its acquisition of TripActions, a significant move that significantly expanded its market reach and product offerings. This strategic move solidified Navan's position as a dominant player in the corporate travel management space. [Mention other significant acquisitions and their impact].

-

Expansion of services and product offerings: Navan has consistently expanded its service offerings, going beyond basic travel booking to provide a comprehensive corporate travel management platform. This includes features such as [list key features, e.g., expense management, policy compliance tools, traveler safety features].

-

Market share and competitive landscape analysis: Navan's strong market share reflects its success in a competitive landscape. The company differentiates itself through [mention key competitive advantages, e.g., advanced AI-powered tools, superior user experience, robust customer support]. This positions Navan favorably for continued growth.

The IPO Details and Potential Investors

The Navan IPO is expected to be a significant event, attracting considerable interest from investors. While specific details may still be evolving, key aspects are emerging.

-

Expected IPO valuation range: Analysts anticipate a valuation in the range of [Insert estimated valuation range, citing sources if available]. This valuation reflects Navan's strong financial performance and growth trajectory.

-

List of participating investment banks: Several leading investment banks are expected to act as underwriters for the Navan IPO, including [List the banks involved, if known]. These institutions play a critical role in managing the IPO process and attracting investors.

-

IPO timeline and expected stock market debut date: The expected timeline for the Navan IPO is [Insert expected timeline and date, citing sources if available]. The official stock market debut will mark a significant moment for the company and its investors.

-

Analysis of potential investor demand: Investor interest is anticipated to be high given Navan’s strong market position, consistent growth, and the potential for significant returns in the thriving travel tech sector.

-

Factors influencing the IPO's success: The success of the Navan IPO will depend on various factors, including the overall market conditions, investor sentiment towards the travel industry, and the company's continued performance.

Navan's Business Model and Future Prospects

Navan operates on a Software as a Service (SaaS) business model, providing a comprehensive platform for corporate travel management. Its revenue streams primarily consist of [explain revenue model, e.g., subscription fees, transaction fees]. This model provides a stable and scalable foundation for future growth.

-

Description of Navan's SaaS platform and key features: Navan's platform offers a range of features designed to streamline and optimize corporate travel, including [list key features, focusing on their value proposition].

-

Analysis of Navan's revenue streams and pricing model: Navan's pricing model is tailored to meet the needs of different corporate clients, offering flexible options to suit various budgets and requirements.

-

Market opportunity and projected growth rates: The global corporate travel market is experiencing robust growth, creating significant opportunities for companies like Navan. Analysts project [mention projected growth rates and cite sources].

-

Potential expansion into new markets or service offerings: Navan is well-positioned to expand its reach into new geographic markets and explore new service offerings, further fueling its growth trajectory.

Impact on the Travel Tech Sector

Navan's IPO is poised to have a significant impact on the broader travel tech sector. It could stimulate further investment in travel technology companies, spur innovation, and intensify competition within the market. The successful public listing could also set a precedent for other travel tech firms considering an IPO, leading to a wave of new entrants in the public market. This could accelerate technological advancements and drive greater efficiency and innovation across the corporate travel sector. The heightened competition will likely benefit corporate clients through enhanced services and competitive pricing.

Conclusion

Navan's US IPO represents a landmark event for the company and the travel technology industry. Its success story, built on strategic acquisitions, innovative technology, and a strong understanding of the market, makes it a compelling investment opportunity. The anticipated high demand and the company's strong market position indicate a promising future. The Navan public offering is likely to reshape the competitive landscape and inspire innovation within the travel technology sector. Stay tuned for updates on the Navan IPO and consider the potential investment opportunities this exciting development offers. Learn more about investing in the Navan public offering by visiting [link to Navan's investor relations page or relevant financial news source]. Don't miss out on the Navan stock market debut!

Featured Posts

-

Disneys Snow White Remake Compared To Sigourney Weavers 1987 Version

May 14, 2025

Disneys Snow White Remake Compared To Sigourney Weavers 1987 Version

May 14, 2025 -

The Celac Summit And The Future Of Regional Cooperation

May 14, 2025

The Celac Summit And The Future Of Regional Cooperation

May 14, 2025 -

How Tyla Embodies The Essence Of Chanel

May 14, 2025

How Tyla Embodies The Essence Of Chanel

May 14, 2025 -

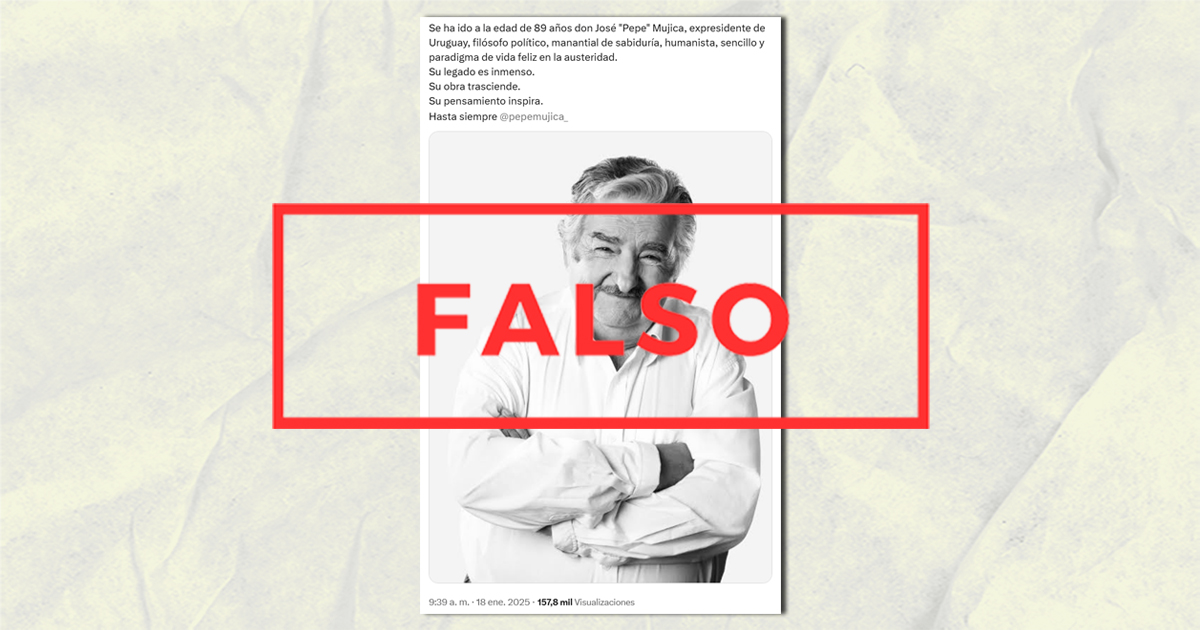

Uruguay Llora La Muerte De Jose Pepe Mujica A Los 89 Anos

May 14, 2025

Uruguay Llora La Muerte De Jose Pepe Mujica A Los 89 Anos

May 14, 2025 -

Budapest Tommy Fury Visszaterese Es Uezenete Jake Paulnak

May 14, 2025

Budapest Tommy Fury Visszaterese Es Uezenete Jake Paulnak

May 14, 2025