Navigating High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Current Market Outlook & Valuation Concerns

BofA's analysts regularly assess the overall market valuation, considering factors like price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and other key metrics. While specific reports change, BofA generally expresses caution regarding persistently high stock market valuations, often highlighting the potential for reduced future returns. Their assessments are usually based on a combination of macroeconomic indicators, corporate earnings projections, and historical market data.

-

Summary of BofA's key concerns regarding high valuations: BofA often points to the risk of a market correction or a period of slower growth when valuations are elevated. High valuations suggest investors are pricing in significant future growth, which may not always materialize.

-

Specific sectors or asset classes BofA flags as particularly vulnerable: BofA's research may highlight sectors like technology or other growth-oriented sectors as potentially more vulnerable to corrections during periods of high valuations due to their higher sensitivity to interest rate changes and growth expectations.

-

Potential risks associated with sustained high valuations: The primary risk is a market correction – a significant and sudden drop in prices. Sustained high valuations can also lead to reduced returns compared to periods of lower valuations. This means investors may see lower gains, or even losses, relative to the capital invested.

Strategies for Investing in a High-Valuation Market

Navigating high stock market valuations effectively requires a strategic approach. While BofA doesn't offer a prescriptive "one-size-fits-all" solution, their analyses indirectly suggest several prudent strategies:

-

Diversification strategies: Diversification across asset classes (stocks, bonds, real estate, etc.), sectors, and geographies is crucial to reduce the overall portfolio risk. This helps mitigate losses if one sector or region underperforms.

-

Importance of defensive investing and value stocks: In high-valuation markets, focusing on defensive sectors (like consumer staples or healthcare) and value stocks (companies trading below their intrinsic value) can be beneficial. These tend to be less volatile than growth stocks during market corrections.

-

The role of active vs. passive management: The choice between active and passive management depends on individual investor preferences and risk tolerance. Active management allows for more targeted selection of undervalued assets, while passive management offers broad market exposure at a lower cost.

-

Risk management techniques: Utilizing stop-loss orders (automatic sell orders triggered when a stock falls below a certain price) and hedging strategies (using derivatives to protect against potential losses) are crucial risk management tools in any market, but particularly valuable during periods of high valuations.

Identifying Undervalued Opportunities Amidst High Valuations

Even in a market characterized by high stock market valuations, identifying pockets of undervaluation remains possible. While BofA doesn't explicitly publish lists of "undervalued" stocks, their research implicitly suggests some avenues for investors to explore:

-

Sectors or companies BofA may see as potentially undervalued (implied): By analyzing BofA's reports on specific sectors, investors can identify areas where the bank's analysts may express relatively more positive sentiment, even within a generally cautious overall market outlook. This may indicate potential opportunities for further investigation.

-

Fundamental analysis techniques: Investors can employ fundamental analysis to identify undervalued assets by examining a company's financial statements, assessing its competitive advantages, and forecasting future earnings.

-

Importance of due diligence and thorough research: Before investing in any asset, conducting thorough due diligence is critical. This includes reviewing financial statements, understanding the business model, and assessing the management team's competence.

The Importance of Long-Term Investing in High Valuation Environments

Maintaining a long-term investment horizon is paramount when facing high stock market valuations.

-

Avoiding emotional decision-making: Market volatility is inevitable. Short-term fluctuations should not dictate long-term investment strategies.

-

Importance of a well-defined investment plan: A well-defined plan, tailored to individual risk tolerance and financial goals, serves as a roadmap, reducing the impact of emotional responses to market changes.

-

Benefits of dollar-cost averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market price. This strategy mitigates the risk of investing a large sum at a market peak.

Conclusion

Navigating high stock market valuations requires careful consideration and a strategic approach. BofA's insights provide a valuable framework for investors to understand the current market environment and make informed decisions. By diversifying portfolios, employing risk management techniques, and focusing on long-term growth, investors can effectively navigate the challenges presented by high stock market valuations. Remember to conduct your own thorough research and consider seeking professional financial advice before making any investment decisions. Don't hesitate to consult additional resources to further refine your understanding of high stock market valuations and how to best manage your investments in this climate.

Featured Posts

-

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025 -

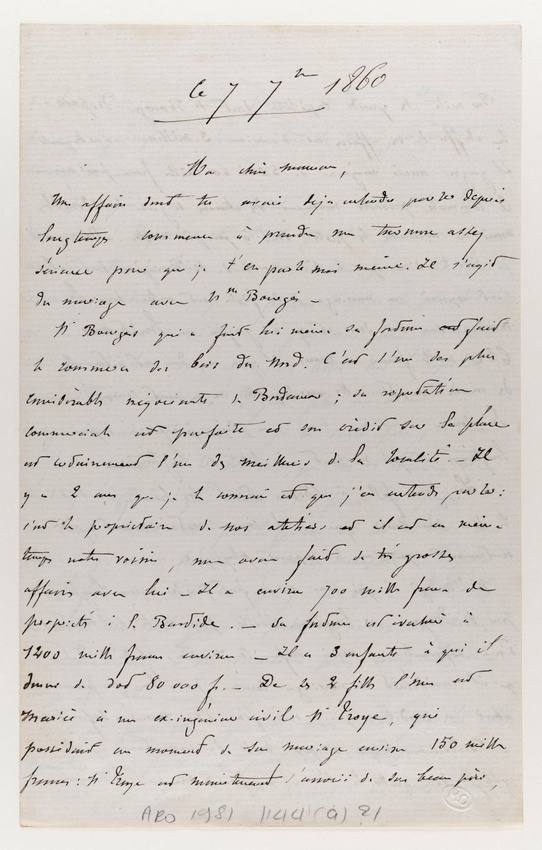

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 10, 2025

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 10, 2025 -

Living Legends Of Aviation Awards Recognizing Exceptional Service In Firefighting And Other Fields

May 10, 2025

Living Legends Of Aviation Awards Recognizing Exceptional Service In Firefighting And Other Fields

May 10, 2025 -

Is Wall Street Staging A Comeback Analyzing The Shift In Market Sentiment

May 10, 2025

Is Wall Street Staging A Comeback Analyzing The Shift In Market Sentiment

May 10, 2025 -

Bbc Show Joanna Pages Sharp Words For Wynne Evans

May 10, 2025

Bbc Show Joanna Pages Sharp Words For Wynne Evans

May 10, 2025