Navigating S&P 500 Volatility: A Guide To Downside Protection

Table of Contents

Understanding S&P 500 Volatility and its Impact

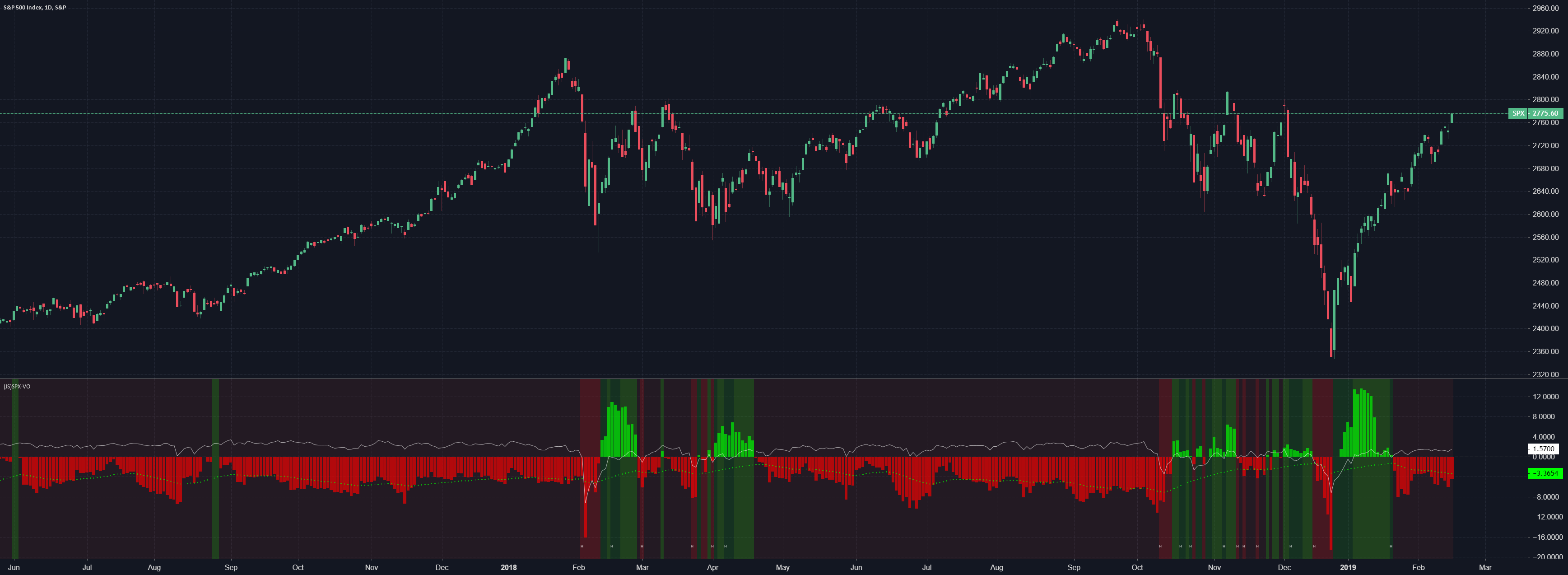

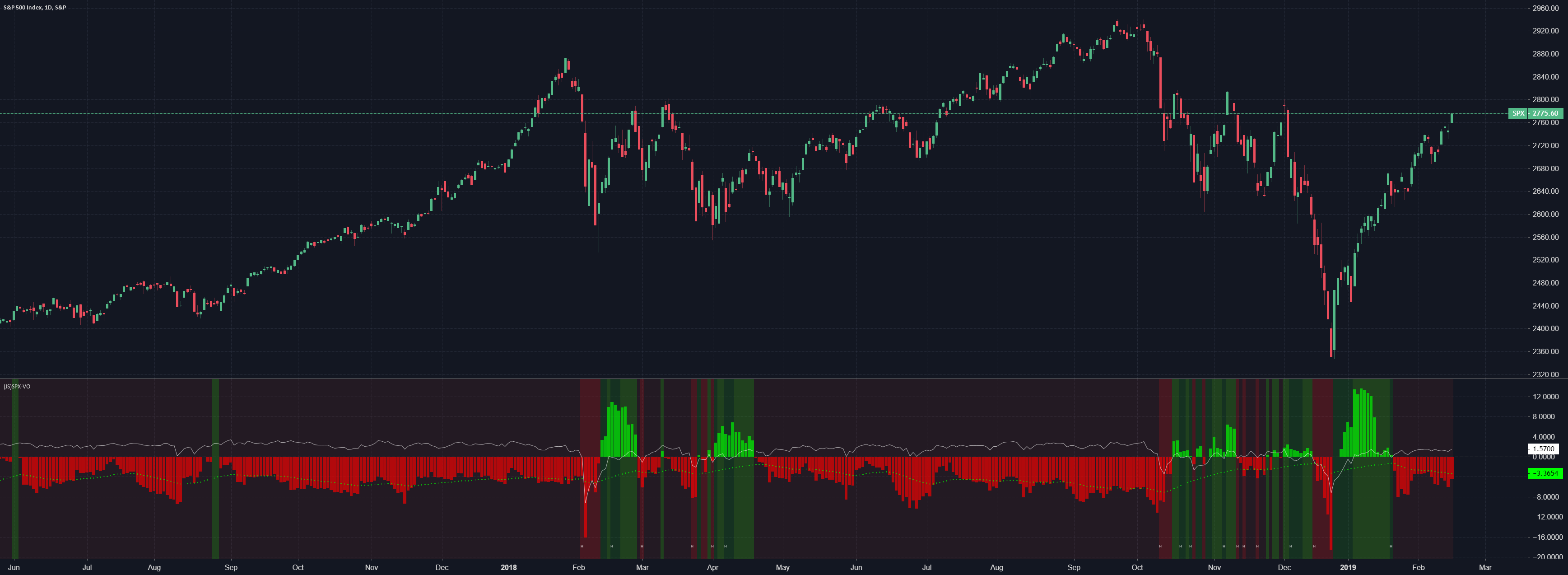

S&P 500 volatility refers to the rate at which the index's price fluctuates. These fluctuations can be dramatic, causing significant gains or losses in a short period. Several factors contribute to this volatility, including economic news (e.g., inflation reports, employment data), geopolitical events (e.g., wars, political instability), and changes in interest rates set by central banks. These events can trigger rapid market reactions, impacting investor confidence and causing price swings.

The impact of volatility on investment portfolios can be substantial, leading to potential losses, even for long-term investors. A sudden market correction can erode your investment value quickly.

- Historical examples of S&P 500 market corrections and their impact: The 2008 financial crisis and the COVID-19 market crash of 2020 serve as stark reminders of the potential for significant losses in the S&P 500. These events highlighted the importance of robust downside protection strategies.

- The importance of risk assessment before investing in the S&P 500: Before investing, understand your risk tolerance. Are you comfortable with potentially significant short-term losses in pursuit of long-term gains?

- Identifying your personal risk tolerance level: Various questionnaires and assessments can help determine your risk tolerance. Understanding your comfort level with risk is paramount in choosing the appropriate downside protection strategies.

Strategies for S&P 500 Downside Protection

Several strategies can help mitigate the risks associated with S&P 500 volatility. Let's explore some key approaches.

Hedging with Put Options

Put options grant the holder the right, but not the obligation, to sell a specific asset (like an S&P 500 index fund) at a predetermined price (the strike price) on or before a specific date (the expiration date). They act as insurance against price declines.

- Choosing strike prices and expiration dates: The strike price should be set at a level representing an acceptable loss threshold. The expiration date should align with your investment timeline and risk tolerance.

- Costs associated with put options: Buying put options involves a premium cost, which reduces potential profits if the market performs well.

- Examples of using put options to hedge against S&P 500 declines: If you believe the market might decline, buying put options on an S&P 500 ETF can limit potential losses.

- Advantages and disadvantages of using put options: Advantages include downside protection; disadvantages include the cost of the premium and the potential for the option to expire worthless.

- Calculating the cost of put option protection: The cost depends on several factors including the underlying asset price, volatility, time to expiration, and strike price.

Diversification Strategies

Diversification is a cornerstone of risk management. It involves spreading your investments across different asset classes to reduce your reliance on any single investment's performance.

- Importance of diversification across asset classes (bonds, real estate, commodities): Diversifying into bonds, real estate, or commodities can reduce the impact of S&P 500 volatility on your overall portfolio.

- Benefits of international diversification to reduce S&P 500-specific risk: Investing in international markets can further reduce dependence on the US market's performance.

- Role of asset allocation in managing volatility: Asset allocation involves determining the proportion of your portfolio allocated to each asset class, aligning with your risk tolerance and investment goals.

- Examples of diversified portfolios less susceptible to S&P 500 volatility: A portfolio including bonds, international stocks, and real estate will likely experience less volatility than a portfolio solely invested in the S&P 500.

- How diversification reduces overall portfolio risk: When one asset class underperforms, others may offset those losses, leading to a smoother portfolio performance.

- Tools and resources for diversifying your portfolio: Consider exchange-traded funds (ETFs) that offer diversified exposure to multiple asset classes.

Stop-Loss Orders

Stop-loss orders automatically sell your holdings when the price drops to a predetermined level. They aim to limit potential losses.

- Explanation of stop-loss orders and how they limit potential losses: They automatically trigger a sell order once a specified price is reached, preventing further losses.

- Different types of stop-loss orders (e.g., stop-limit, trailing stop): Stop-limit orders guarantee a minimum sale price, while trailing stops adjust the stop price as the asset price rises.

- Potential limitations of stop-loss orders (e.g., "gap risk"): Gap risk refers to the possibility of the price dropping significantly before your stop-loss order is executed.

- How to set appropriate stop-loss levels for your S&P 500 investments: Consider factors like your risk tolerance, recent price movements, and market volatility.

- Advantages and disadvantages of using stop-loss orders: Advantages include automatic loss limitation; disadvantages include potential for premature selling and gap risk.

- Risks associated with stop-loss orders, especially during periods of high volatility: High volatility increases the likelihood of gap risk and premature selling.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price.

- Dollar-cost averaging as a risk mitigation strategy: DCA reduces the impact of market timing, as you buy more shares when prices are low and fewer when prices are high.

- How DCA reduces the impact of market timing: It eliminates the need to predict market tops and bottoms.

- How DCA helps smooth out volatility over the long term: It averages out the purchase price over time, potentially reducing the impact of price fluctuations.

- Examples of how dollar-cost averaging can reduce risk during market downturns: During market declines, your fixed investment buys more shares at lower prices, benefiting from the subsequent recovery.

- The long-term benefits of using DCA in the S&P 500: DCA offers a disciplined approach to investing in the S&P 500, smoothing out volatility and potentially maximizing long-term returns.

- Calculating your DCA investment schedule: Determine your investment amount and frequency based on your budget and goals.

Monitoring and Adjusting Your S&P 500 Downside Protection Strategy

Effective S&P 500 downside protection is not a set-it-and-forget-it strategy. Regular review and adjustments are crucial.

- Importance of regularly reviewing and adjusting your strategy based on market conditions and your personal risk tolerance: Market conditions change constantly, requiring adaptable strategies. Your risk tolerance may also evolve over time.

- Need for ongoing monitoring of your portfolio and its performance: Track your portfolio's performance, paying attention to both gains and losses.

- Adapting your strategy to changing market environments: Be prepared to modify your approach based on economic indicators, geopolitical events, and market sentiment.

- Key indicators to monitor (e.g., VIX, economic data): The VIX (volatility index) provides insights into market volatility. Economic data can inform investment decisions.

- When to adjust your hedging strategy or stop-loss orders: Re-evaluate your stop-loss levels and hedging strategies periodically, particularly during times of increased volatility.

- Importance of seeking professional financial advice: A financial advisor can help you tailor a strategy suited to your specific needs and risk tolerance.

Conclusion

Effectively navigating S&P 500 volatility requires a proactive approach to downside protection. By understanding the risks involved and implementing strategies like put options, diversification, stop-loss orders, and dollar-cost averaging, you can significantly reduce your exposure to market downturns. Remember that S&P 500 downside protection is an ongoing process requiring consistent monitoring and adjustments. Don't hesitate to consult a financial advisor to create a personalized strategy tailored to your specific investment goals and risk tolerance. Start protecting your portfolio against S&P 500 volatility today!

Featured Posts

-

Jogador Do Palmeiras Estevao Vomita E Sai De Campo Em Partida De Altitude

May 01, 2025

Jogador Do Palmeiras Estevao Vomita E Sai De Campo Em Partida De Altitude

May 01, 2025 -

Unlocking Shared Understanding Project Muse And Collaborative Research

May 01, 2025

Unlocking Shared Understanding Project Muse And Collaborative Research

May 01, 2025 -

Canada Election Pierre Poilievre Fails To Secure His Seat

May 01, 2025

Canada Election Pierre Poilievre Fails To Secure His Seat

May 01, 2025 -

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Ghry Nzr

May 01, 2025

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Ghry Nzr

May 01, 2025 -

Michael Sheen Clears 1 Million In Debt For 900 People

May 01, 2025

Michael Sheen Clears 1 Million In Debt For 900 People

May 01, 2025