Navigating The Bond Market Crisis: Strategies For Survival

Table of Contents

Understanding the Current Bond Market Crisis

Identifying the Root Causes

Several interconnected factors have contributed to the current bond market crisis. Understanding these root causes is the first step towards effective risk management.

- Rising Interest Rates: Aggressive interest rate hikes by central banks worldwide to combat inflation have significantly impacted bond prices. Higher interest rates make existing bonds with lower yields less attractive, leading to price declines. This is especially true for longer-term bonds.

- Inflationary Pressures: Persistent inflation erodes the purchasing power of fixed-income investments. Investors demand higher yields to compensate for the loss of value due to inflation, putting downward pressure on bond prices.

- Geopolitical Risks: Geopolitical instability, such as the ongoing war in Ukraine and escalating tensions in other regions, introduces significant uncertainty into the market. This uncertainty can lead to increased volatility and reduced investor confidence.

- Credit Risk: Concerns about the creditworthiness of certain issuers, particularly in corporate bonds, have also contributed to the crisis. Rising interest rates increase the risk of defaults, particularly for companies with high debt levels.

These factors have led to increased bond yields, reflecting the higher risk premium demanded by investors. The interplay of these elements has created a perfect storm for bond market volatility.

Assessing the Severity and Potential Impacts

The severity of the bond market crisis is significant, impacting various asset classes. The potential consequences for investors are substantial, depending on their portfolio composition and risk tolerance.

- Government Bonds: While generally considered safer than corporate bonds, government bonds are not immune to interest rate risk. Their prices can still decline when interest rates rise.

- Corporate Bonds: Corporate bonds are particularly vulnerable to credit risk and interest rate sensitivity. Companies with weak balance sheets face a higher risk of default in a rising interest rate environment.

- High-Yield Bonds: High-yield bonds, also known as junk bonds, carry the highest risk of default and are likely to experience significant price declines during a bond market crisis.

The potential impacts range from temporary price fluctuations to substantial investment losses, underscoring the need for robust risk management strategies.

Risk Management Strategies for Bond Investors

Diversification

Diversification is a cornerstone of effective bond portfolio management. Spreading investments across different sectors (government, corporate, municipal), maturities (short-term, intermediate-term, long-term), and credit ratings (AAA to BB) reduces overall portfolio risk.

- Example 1: A diversified portfolio might include a mix of government bonds, investment-grade corporate bonds, and a small allocation to high-yield bonds.

- Example 2: Employing maturity laddering, where bonds with different maturities are held, minimizes interest rate risk by staggering the maturity dates.

Diversification helps mitigate losses from any single bond or sector underperforming.

Hedging Strategies

Hedging strategies can help mitigate losses from unexpected market movements. These strategies involve using financial instruments to offset potential declines in bond prices.

- Interest Rate Swaps: These contracts can help manage interest rate risk by locking in a fixed interest rate.

- Futures Contracts: Futures contracts allow investors to buy or sell bonds at a predetermined price in the future, providing protection against price declines.

- Options Trading: Options provide the right, but not the obligation, to buy or sell bonds at a specific price, offering flexibility in managing risk.

- Inflation-Protected Securities (TIPS): TIPS protect against inflation by adjusting their principal value based on the Consumer Price Index (CPI).

The choice of hedging strategy depends on the investor's risk tolerance and investment goals.

Liquidity Management

Maintaining sufficient liquidity is crucial for weathering market downturns. Having readily available cash reserves allows investors to take advantage of buying opportunities during a crisis or to meet unexpected expenses.

- Emergency Funds: Holding 3-6 months' worth of living expenses in easily accessible accounts provides a safety net.

- Short-Term Bonds: Investing a portion of the portfolio in short-term bonds provides liquidity and minimizes interest rate risk.

Proactive liquidity management reduces the need to sell assets at unfavorable prices during a crisis.

Opportunities Within the Bond Market Crisis

Identifying Undervalued Bonds

A bond market crisis can create opportunities for discerning investors to identify undervalued bonds offering attractive yields.

- Value Investing: Focus on bonds trading below their intrinsic value, considering factors such as creditworthiness, cash flows, and comparable bond yields.

- Bond Yield Spreads: Analyze the yield spreads between bonds of similar credit quality to identify potential bargains.

- Fundamental Analysis: Conduct thorough research on the issuer's financial health and prospects to determine the bond's fair value.

- Discounted Cash Flow (DCF) Analysis: Use DCF analysis to estimate the present value of future cash flows from the bond.

Careful analysis can unearth attractive investment opportunities amidst market turmoil.

Strategic Adjustments

Adapting investment strategies to changing market conditions is crucial for long-term success.

- Tactical Asset Allocation: Shifting asset allocation based on market forecasts and expectations. For example, reducing exposure to long-term bonds if interest rates are expected to rise further.

- Rebalancing Portfolio: Regularly rebalancing the portfolio to maintain the desired asset allocation. This involves selling overperforming assets and buying underperforming ones.

- Market Timing: Attempting to time the market by buying low and selling high. This requires careful analysis and a high degree of market expertise. This strategy is generally not recommended for all investors.

- Buy-and-Hold Strategy: Maintaining a long-term perspective and continuing to hold investments regardless of short-term market fluctuations. This strategy is suited to long-term investors with a high risk tolerance.

Conclusion: Navigating the Bond Market Crisis: A Path to Resilience

Navigating the bond market crisis requires a multifaceted approach combining diversification, robust risk management strategies, and the ability to identify opportunities. Proactive risk management and informed decision-making are paramount in this volatile environment. Don't let the current bond market crisis catch you off guard. Take control of your investments by implementing the strategies outlined in this article and building a resilient portfolio. Learn more about navigating the bond market crisis and its various impacts today!

Featured Posts

-

Ekthesi Goyes Anterson Sto Londino Eikastiki Kai Kinimatografiki Eksereynisi

May 28, 2025

Ekthesi Goyes Anterson Sto Londino Eikastiki Kai Kinimatografiki Eksereynisi

May 28, 2025 -

Jacob Wilson Breakout Star Or Flash In The Pan A Poll Explores

May 28, 2025

Jacob Wilson Breakout Star Or Flash In The Pan A Poll Explores

May 28, 2025 -

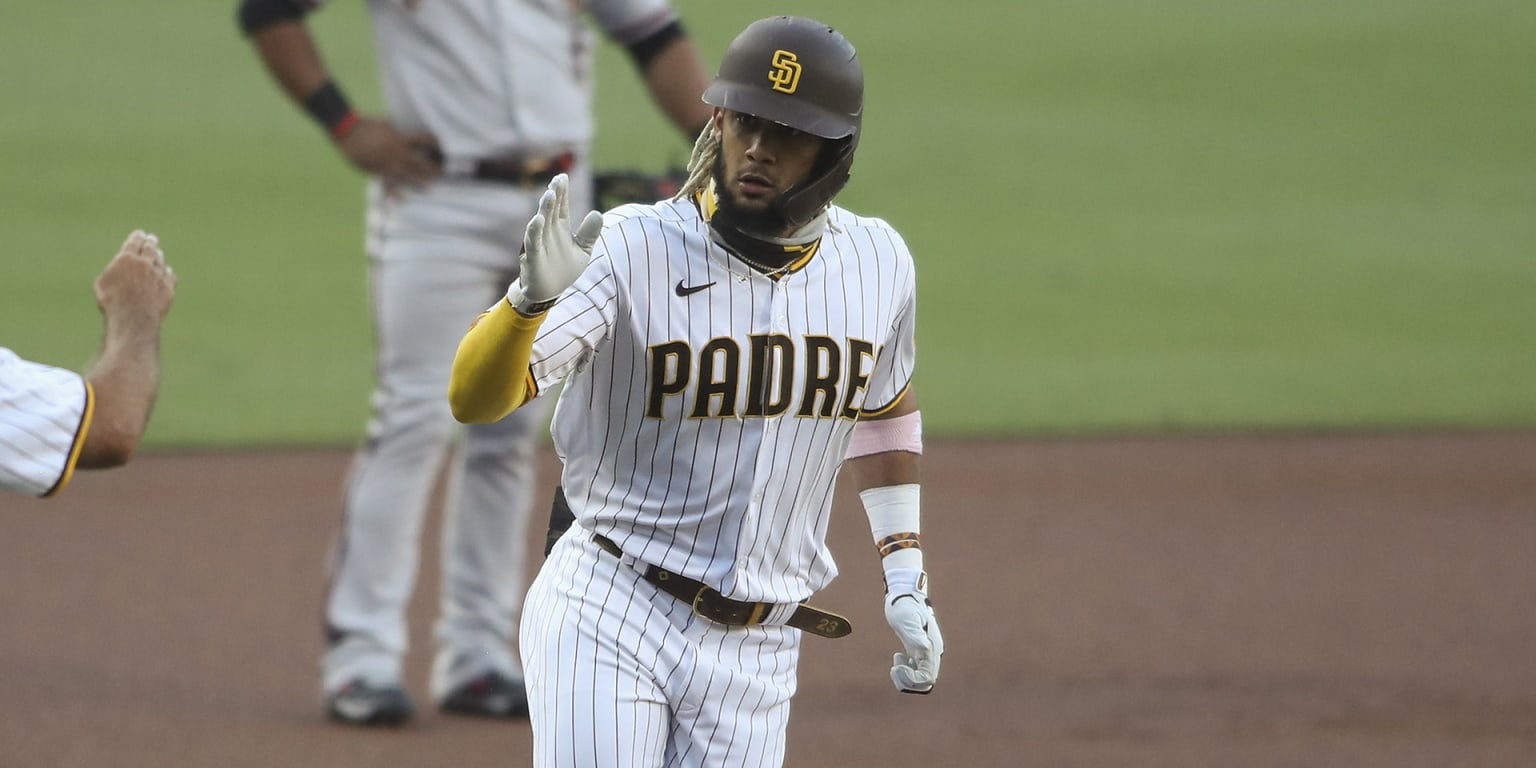

Fernando Tatis Jr Back In The Padres Leadoff Spot What To Expect

May 28, 2025

Fernando Tatis Jr Back In The Padres Leadoff Spot What To Expect

May 28, 2025 -

Real Madrid Triumphs Over Atletico In Thrilling Champions League Derby

May 28, 2025

Real Madrid Triumphs Over Atletico In Thrilling Champions League Derby

May 28, 2025 -

Prakiraan Cuaca Hari Ini Dan Besok Di Jawa Tengah 23 4

May 28, 2025

Prakiraan Cuaca Hari Ini Dan Besok Di Jawa Tengah 23 4

May 28, 2025