Navigating The DEF 14A Proxy Statement: What Investors Need To Know

Table of Contents

Understanding the Structure and Key Sections of a DEF 14A Proxy Statement

The DEF 14A proxy statement, a filing required by the Securities and Exchange Commission (SEC), provides shareholders with essential information before a company's annual meeting or other significant shareholder votes. This document serves as a roadmap for understanding the company's performance, proposed actions, and executive compensation. Let’s break down its key sections:

The Introductory Section

This initial section sets the stage, offering a company overview and outlining the meeting details. Crucially, it lays the groundwork for understanding the subsequent proposals. Key information typically included in this section includes:

- Meeting date, time, and location (if applicable): This clarifies when and where the shareholder meeting will take place.

- Shareholder voting deadlines: Knowing these deadlines is crucial to ensure your vote is counted.

- Information on proxy voting procedures: This section explains how shareholders can cast their votes, either in person or by mail.

- Contact information for inquiries: This provides resources for shareholders who need additional clarifications.

Effective keyword integration, using terms such as "DEF 14A filing," "proxy voting," and "annual meeting" throughout this section, improves search engine visibility.

Proposals and Recommendations

This is arguably the heart of the DEF 14A proxy statement. It details the proposals put forth for shareholder consideration. These proposals can originate from management or shareholders themselves, often addressing crucial matters impacting the company's future. Understanding the rationale behind each proposal is vital. Examples include:

- Director elections: This section outlines the candidates nominated for the board of directors and provides information about their backgrounds and experience.

- Executive compensation: This details the compensation packages for company executives.

- Mergers and acquisitions: Information on proposed mergers, acquisitions, or other significant corporate transactions are outlined here.

- Shareholder proposals: These are proposals submitted by shareholders and address various issues relating to corporate governance and company strategy.

By understanding the nuances of "shareholder proposals" and "management proposals," as detailed in the proxy voting materials, investors gain a clearer picture of the company's direction.

Executive Compensation

Scrutinizing executive compensation is crucial. The DEF 14A proxy statement provides a detailed breakdown of salaries, bonuses, stock options, and other benefits received by company executives. It's important to:

- Compare compensation to company performance: Examine whether executive pay aligns with the company's financial success. Significant disparities may indicate potential issues.

- Understand the methodology used to determine compensation: The rationale behind the compensation structure should be clear and transparent.

- Analyze Say-on-Pay proposals: This mechanism allows shareholders to vote on executive compensation packages, providing a voice in determining fair compensation.

Keywords like "executive compensation," "Say-on-Pay," and "director compensation" should be incorporated naturally throughout this section to improve search engine optimization.

Analyzing the Information Presented in a DEF 14A Proxy Statement

Effectively using a DEF 14A proxy statement involves a thorough analysis of the information presented. This requires a critical approach and the ability to identify key insights.

Identifying Potential Conflicts of Interest

This section requires careful attention to detail. Look for:

- Related-party transactions: These transactions between the company and its directors or executives require scrutiny to ensure fairness and transparency.

- Independent director composition: A board with a significant number of independent directors is generally considered more effective at overseeing management.

- Disclosure of any potential conflicts of interest: Transparency on potential conflicts strengthens corporate governance.

Keywords like "corporate governance," "conflict of interest," and "independent directors" are essential for optimizing this section.

Evaluating Financial Information

The DEF 14A proxy statement typically includes or references:

- Summary financial data: This provides a high-level overview of the company's financial performance.

- Audited financial statements: This section typically refers to the complete audited financial statements filed with the SEC, providing a more in-depth look into the company’s financial health.

Understanding how to use this information in conjunction with other financial statements is crucial. Terms such as "financial statements," "audit report," and "company financials" are important for search engine optimization.

Assessing the Risks and Opportunities

The proxy statement often includes a Management's Discussion and Analysis (MD&A) section. This helps assess:

- Risk factors: Identify potential challenges and threats facing the company.

- Growth opportunities: Examine the company's strategies for future growth and expansion.

Use keywords such as "risk factors," "company risks," and "investment opportunities" to improve search engine optimization.

Effectively Using the DEF 14A Proxy Statement to Make Informed Investment Decisions

Turning the information within the DEF 14A proxy statement into actionable investment decisions requires a multi-pronged approach.

Utilizing Online Resources

The SEC's EDGAR database is an invaluable resource. It provides free access to all SEC filings, including DEF 14A proxy statements. Use these steps:

- Access EDGAR: Go to the SEC website and search for the company's filings.

- Download the document: Download the DEF 14A proxy statement in PDF format.

- Utilize analysis tools: There are numerous online tools that can help in analyzing the data within the proxy statement.

Keywords such as "SEC EDGAR," "proxy statement database," and "online proxy resources" are important for online discoverability.

Seeking Professional Advice When Necessary

For complex financial issues or legal interpretations, don't hesitate to consult a professional.

- Financial advisor: A financial advisor can provide personalized guidance on investment strategies.

- Legal counsel: Legal counsel can help with interpreting complex legal aspects of the document.

Use relevant keywords such as "financial advisor," "investment advice," and "legal counsel" to enhance SEO.

Conclusion

Mastering the DEF 14A proxy statement is crucial for successful investing. By understanding its structure, critically analyzing its information, and utilizing available resources, you can make informed decisions about your investments and actively participate in corporate governance. Don't let the complexity of the DEF 14A proxy statement intimidate you; actively engage with its contents to become a more informed investor and make sound voting decisions as a shareholder. Start using the information within the DEF 14A proxy statement to improve your investment strategies today!

Featured Posts

-

How Late Student Loan Payments Impact Your Credit

May 17, 2025

How Late Student Loan Payments Impact Your Credit

May 17, 2025 -

Generalna Proba Pred Evrobasket Izvestaji Iz Bajernove Dvorane

May 17, 2025

Generalna Proba Pred Evrobasket Izvestaji Iz Bajernove Dvorane

May 17, 2025 -

Leaked The Next Fortnite Icon Skin

May 17, 2025

Leaked The Next Fortnite Icon Skin

May 17, 2025 -

Is Josh Hart The Knicks Draymond Green Analyzing His Impact

May 17, 2025

Is Josh Hart The Knicks Draymond Green Analyzing His Impact

May 17, 2025 -

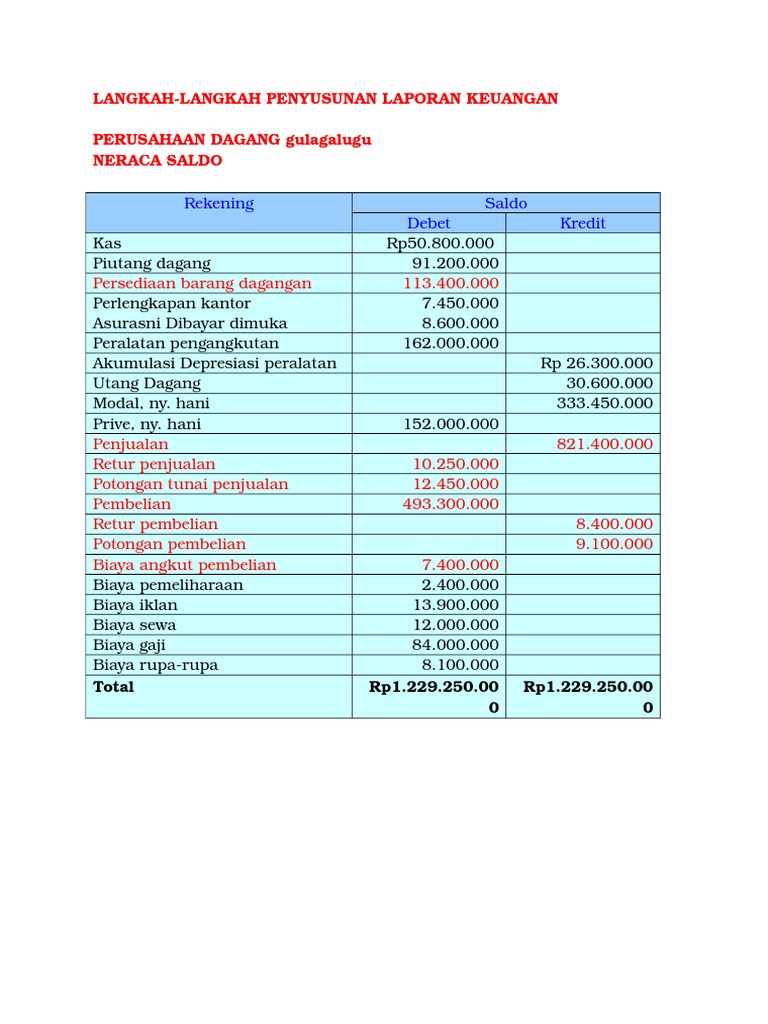

Panduan Lengkap Laporan Keuangan Untuk Pengusaha Pemula

May 17, 2025

Panduan Lengkap Laporan Keuangan Untuk Pengusaha Pemula

May 17, 2025

Latest Posts

-

Donald Trumps Scandals How Multiple Affairs And Sexual Misconduct Accusations Failed To Derail His Presidency

May 17, 2025

Donald Trumps Scandals How Multiple Affairs And Sexual Misconduct Accusations Failed To Derail His Presidency

May 17, 2025 -

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Tis Protognoris Ypodoxis

May 17, 2025

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Tis Protognoris Ypodoxis

May 17, 2025 -

Donald Trumps Family Tree A New Generation With Tiffany And Michaels Baby

May 17, 2025

Donald Trumps Family Tree A New Generation With Tiffany And Michaels Baby

May 17, 2025 -

I Megaloprepis Ypodoxi Toy Tramp Stin Saoydiki Aravia Xrysa Spathia Kai F 15

May 17, 2025

I Megaloprepis Ypodoxi Toy Tramp Stin Saoydiki Aravia Xrysa Spathia Kai F 15

May 17, 2025 -

Berlin Prosvjed Protiv Tesle Razlozi I Posljedice Upada U Izlozbeni Prostor

May 17, 2025

Berlin Prosvjed Protiv Tesle Razlozi I Posljedice Upada U Izlozbeni Prostor

May 17, 2025