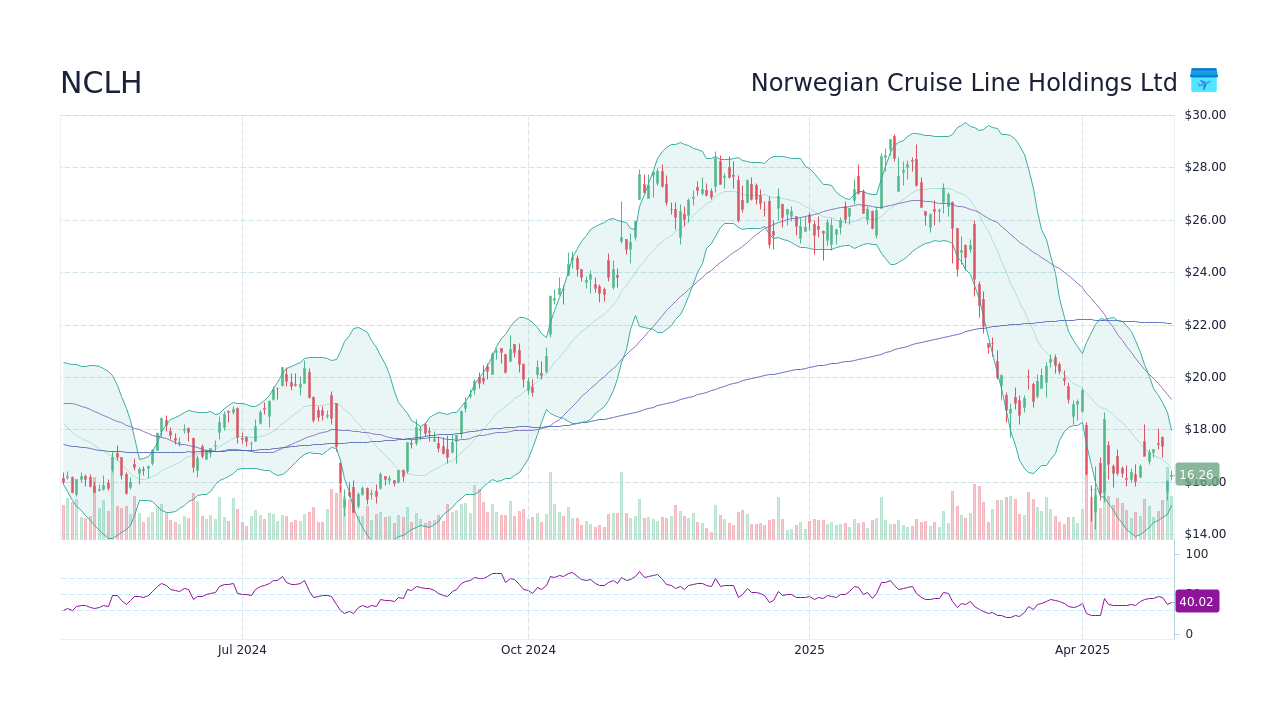

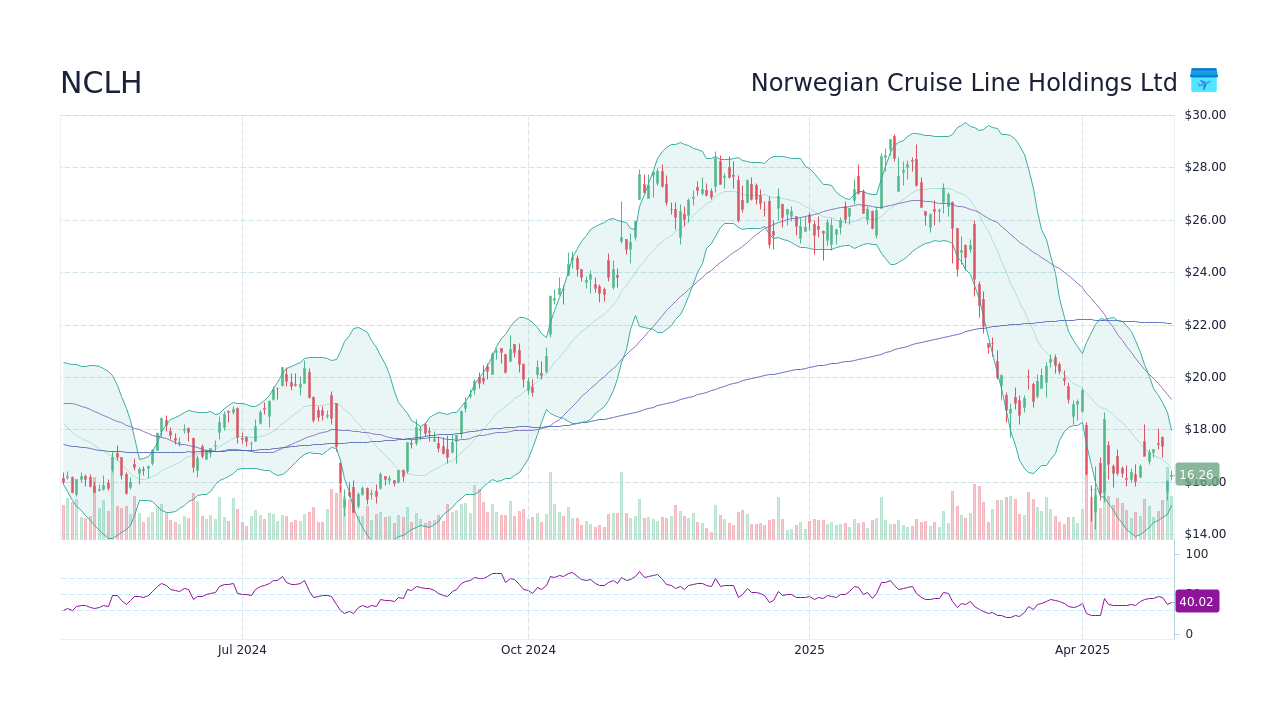

NCLH Stock: Is It A Top Pick For Hedge Fund Investors?

Table of Contents

NCLH's Recent Financial Performance and Outlook

NCLH's financial health is a critical factor in assessing its attractiveness to hedge fund investors. Analyzing recent quarterly and annual reports reveals a complex picture. While the company has shown signs of recovery post-pandemic, significant challenges remain.

-

Revenue and Profitability: Post-pandemic, NCLH has witnessed a gradual increase in revenue, driven by a surge in bookings. However, profit margins remain under pressure due to increased operating costs, including fuel prices and crew salaries. Analyzing NCLH earnings reports reveals a fluctuating trajectory, with profitability still below pre-pandemic levels. Detailed analysis of NCLH revenue growth is crucial for understanding the company's long-term prospects.

-

Debt Levels: The pandemic significantly impacted NCLH's debt levels. While the company has undertaken measures to reduce its debt burden, a high debt-to-equity ratio remains a concern for potential investors. Understanding NCLH's debt-to-equity ratio is crucial for evaluating the financial risk involved.

-

Bookings and Occupancy Rates: NCLH’s booking trends are closely monitored. Strong forward bookings indicate positive future revenue prospects. However, fluctuations in occupancy rates due to various factors like seasonality and global events need careful consideration.

-

Key Financial Indicators (Summary):

- Fluctuating Revenue Growth

- Improving but still volatile Profit Margins

- High Debt-to-Equity Ratio (compared to pre-pandemic levels)

- Increasing Occupancy Rates, but subject to external factors.

Industry Trends and Competitive Landscape

The cruise industry is highly competitive, with major players like Carnival and Royal Caribbean vying for market share. Several factors impact the overall health of this sector:

-

Fuel Prices: Fluctuations in fuel prices significantly impact operating costs for cruise lines, directly affecting profitability.

-

Tourism Trends: Global tourism trends, including consumer preferences and travel patterns, play a pivotal role in the success of the cruise industry. Emerging travel trends like sustainable tourism are also influencing industry practices.

-

Geopolitical Events and Regulations: Global events and evolving regulations (environmental concerns, safety protocols) can significantly disrupt operations and affect investor confidence.

-

Competition: Intense competition amongst established players requires NCLH to continuously innovate and offer competitive pricing and unique experiences.

-

Key Competitive Advantages and Disadvantages for NCLH:

- Advantage: Strong brand recognition and a unique fleet offering.

- Disadvantage: High debt levels compared to competitors; susceptible to external factors influencing the tourism sector.

Hedge Fund Activity and Sentiment towards NCLH Stock

Examining SEC filings reveals insights into hedge fund holdings of NCLH stock. While some hedge funds have shown interest in NCLH, the extent of their investment and the rationale behind their decisions vary. Analyzing NCLH stock ownership by institutional investors provides a broader perspective on market sentiment.

-

Recent SEC Filings: Analyzing recent SEC filings reveals shifts in hedge fund ownership of NCLH stock, signaling either increased confidence or a cautious approach. This data, combined with NCLH analyst ratings, paints a comprehensive picture of market sentiment.

-

Hedge Fund Rationale: Publicly available information, including analyst reports and news articles, sheds some light on the factors driving hedge fund decisions regarding NCLH. However, the full picture often remains obscured due to the confidential nature of investment strategies.

-

Increased or Decreased Positions: Tracking whether hedge funds are increasing or decreasing their positions in NCLH stock provides valuable information regarding their current outlook on the company's performance and future prospects.

-

Key Findings on Hedge Fund Involvement (Summary):

- Mixed Signals from SEC Filings regarding Hedge Fund Interest

- Limited Public Information on the Rationale behind Investment Decisions

- Further research into analyst reports and news articles is necessary for a complete understanding.

Risk Assessment for NCLH Stock

Investing in NCLH stock involves significant risks:

-

Market Volatility: The stock market's inherent volatility directly impacts NCLH's stock price. Geopolitical events and economic downturns can trigger sharp price swings.

-

Economic Downturns: Economic recessions or significant slowdowns can drastically reduce consumer spending on discretionary items like cruises, leading to decreased revenue for NCLH.

-

Industry-Specific Risks: The cruise industry faces unique risks, including pandemics, fuel price shocks, and evolving environmental regulations. Assessing NCLH stock risk also requires evaluating these industry-specific factors.

-

High Debt Levels: NCLH's relatively high debt levels pose a significant financial risk, particularly during periods of economic uncertainty.

-

Key Risk Factors for Potential Investors (Summary):

- High Market Volatility

- Vulnerability to Economic Downturns

- Industry-Specific Risks (Pandemics, Fuel Prices, Regulations)

- High Debt Levels

Conclusion: Is NCLH Stock Right for Your Portfolio?

NCLH stock presents a complex investment proposition. While the company has shown signs of recovery, high debt levels and the inherent volatility of the cruise industry pose significant risks. Hedge fund activity surrounding NCLH stock is mixed, with some showing interest but the overall sentiment remaining unclear.

Before making any investment decisions regarding NCLH stock, it's crucial to conduct thorough due diligence, considering the factors discussed above. This includes analyzing financial reports, understanding industry trends, and assessing the overall risk tolerance of your investment strategy. Remember, this analysis is for informational purposes only and does not constitute financial advice. We recommend consulting with a qualified financial advisor before making any investment decisions. For further research, explore NCLH's investor relations website and reputable financial news sources to gain a complete understanding of NCLH's investment landscape and the current cruise industry outlook. Ultimately, the decision of whether or not to invest in NCLH stock rests solely with you.

Featured Posts

-

Dragon Den Unexpected Twist As Entrepreneur Snubs Investors For Lower Offer

May 01, 2025

Dragon Den Unexpected Twist As Entrepreneur Snubs Investors For Lower Offer

May 01, 2025 -

Buy Xrp Ripple Now A Deep Dive Into Current Market Conditions Under 3

May 01, 2025

Buy Xrp Ripple Now A Deep Dive Into Current Market Conditions Under 3

May 01, 2025 -

The Ultimate Guide To Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025

The Ultimate Guide To Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025 -

Plummeting Travel Leads To Receivership For Peace Bridge Duty Free

May 01, 2025

Plummeting Travel Leads To Receivership For Peace Bridge Duty Free

May 01, 2025 -

Canadian Dollar Risks Decline Under Minority Government Strategist

May 01, 2025

Canadian Dollar Risks Decline Under Minority Government Strategist

May 01, 2025