NCLH Stock Soars After Positive Earnings And Upgraded Guidance

Table of Contents

Strong Q[Quarter] Earnings Beat Expectations

Norwegian Cruise Line Holdings' Q[Quarter] earnings report significantly exceeded analyst expectations, providing a strong catalyst for the NCLH stock price increase. The key financial figures painted a picture of robust growth and operational efficiency.

- Revenue: NCLH reported a [Insert Actual Revenue Figure] in revenue, surpassing the projected [Insert Analyst Projection] by [Insert Percentage Difference]%. This substantial outperformance underscores the company's ability to capitalize on increased demand.

- EPS (Earnings Per Share): The reported EPS of [Insert Actual EPS] comfortably beat the anticipated [Insert Analyst Projection], showcasing improved profitability. This positive result reflects successful cost-cutting measures and efficient resource allocation.

- Occupancy Rates: NCLH boasted impressive occupancy rates of [Insert Occupancy Rate Percentage]%, exceeding expectations and highlighting strong consumer confidence in the cruise industry. This high occupancy directly translates to increased revenue generation.

These exceptional results were driven by a number of factors, including a rebound in travel demand post-pandemic, successful marketing campaigns targeting key demographics, and the strategic deployment of new ships enhancing capacity and appeal. The robust Q[Quarter] earnings report provided concrete evidence of NCLH's financial strength and operational excellence, thus fueling the NCLH stock price climb.

Upgraded Guidance Fuels Investor Confidence

Beyond the strong Q[Quarter] results, NCLH's upgraded guidance further solidified investor confidence and propelled the NCLH stock price higher. The company projected [Insert Projected Revenue Figure] in revenue and [Insert Projected EPS Figure] in EPS for the upcoming quarters/year. This positive outlook was based on several key assumptions:

- Sustained Demand: NCLH management expressed confidence in continued strong demand for cruises, anticipating robust booking trends throughout the remainder of the year.

- Operational Efficiency: The company highlighted its ongoing commitment to optimizing operational efficiency and cost management, ensuring healthy profit margins despite potential inflationary pressures.

- Future Investments: NCLH's plans for future investments in new ships and onboard experiences also contribute to the positive outlook, promising continued growth and innovation.

This upgraded guidance signals a positive trajectory for NCLH, projecting consistent profitability and growth, significantly boosting investor sentiment and directly contributing to the recent NCLH stock price increase. The clear and confident outlook presented by management reinforced the belief in NCLH's future potential.

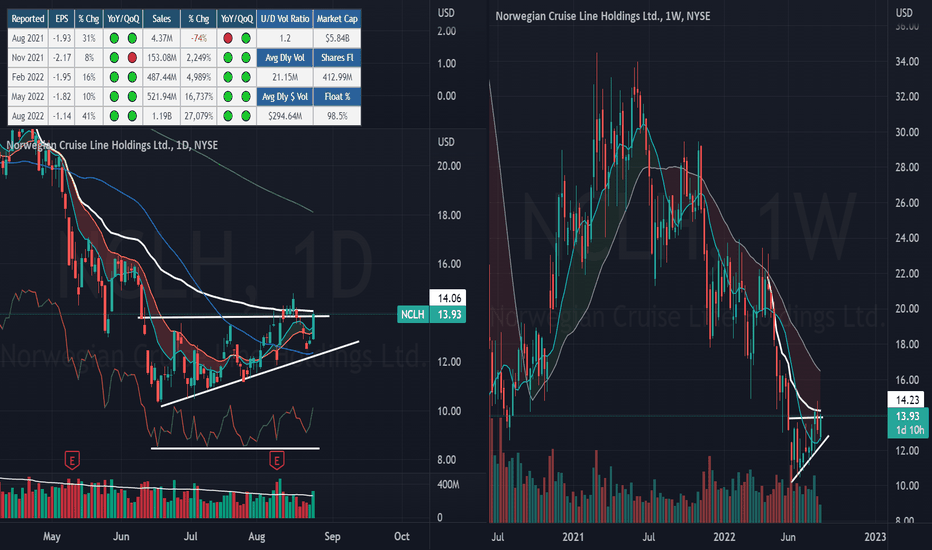

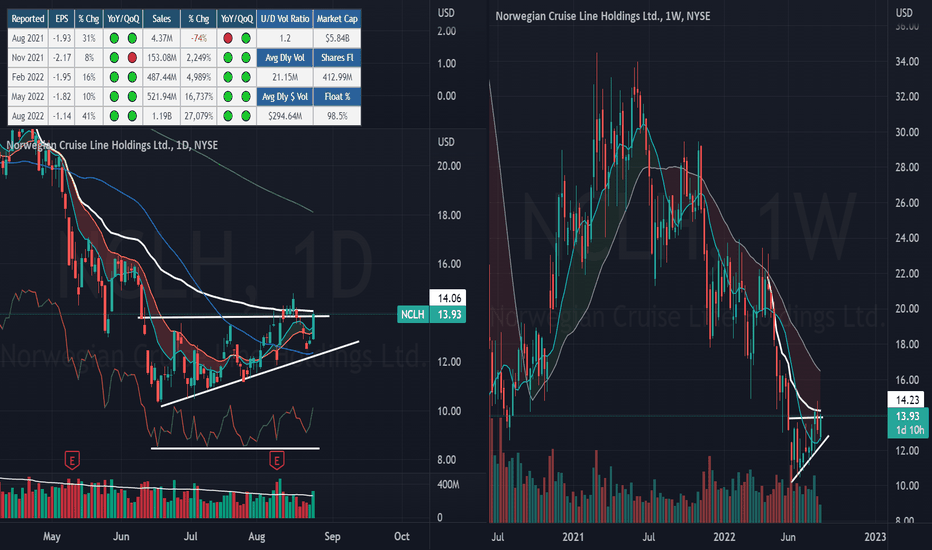

Market Reaction and Analyst Commentary

The market reacted swiftly and positively to the release of the NCLH earnings report and upgraded guidance. The NCLH stock price experienced a substantial increase, accompanied by a surge in trading volume. This demonstrated strong investor enthusiasm and a clear vote of confidence in the company's future prospects.

- Stock Price Increase: The NCLH stock price increased by [Insert Percentage] following the announcement.

- Trading Volume: Trading volume also saw a significant increase, suggesting heightened investor interest and activity.

Numerous analysts have weighed in, offering their perspectives on the NCLH stock’s performance. [Insert Analyst Quotes and Ratings]. The overall sentiment among financial experts is largely positive, with several rating upgrades reflecting the increased confidence in NCLH's future performance.

Potential Risks and Challenges

While the outlook for NCLH is undeniably positive, it's crucial to acknowledge potential risks and challenges that could impact the company's future performance and the NCLH stock price. These include:

- Economic Downturn: A global economic slowdown could negatively impact consumer spending, potentially reducing demand for luxury travel, including cruises.

- Fuel Prices: Fluctuations in fuel prices can significantly impact operational costs for cruise lines, potentially squeezing profit margins.

- Geopolitical Events: Unforeseen geopolitical events could disrupt travel plans and negatively impact demand.

- Industry Competition: Competition within the cruise industry remains fierce, requiring NCLH to constantly innovate and adapt to maintain its competitive edge.

Investors should carefully consider these potential risks when evaluating the NCLH stock. A balanced assessment of both opportunities and challenges is essential for making informed investment decisions.

Conclusion: Investing in the NCLH Stock Upswing – A Call to Action

In summary, the NCLH stock surge is primarily attributable to the company's strong Q[Quarter] earnings, which significantly exceeded expectations, and the subsequent upgraded guidance reflecting a positive outlook for future growth. While potential risks exist, the positive market reaction and analyst commentary underscore the considerable confidence in NCLH's trajectory. The robust financial performance and the promising future outlook presented by NCLH make it a compelling investment opportunity. However, it is crucial to conduct thorough due diligence and consider your personal risk tolerance before making any investment decisions regarding NCLH stock or any other cruise stock. Understanding the potential upsides and downsides of investing in Norwegian Cruise Line Holdings is key to making informed decisions.

Featured Posts

-

Oskorbitelnye Zayavleniya Trampa Kanada Otreagirovala Rezko

Apr 30, 2025

Oskorbitelnye Zayavleniya Trampa Kanada Otreagirovala Rezko

Apr 30, 2025 -

Hudsons Bay Artifacts Find A Home In Manitobas Collections

Apr 30, 2025

Hudsons Bay Artifacts Find A Home In Manitobas Collections

Apr 30, 2025 -

Kareena Kapoor And Gillian Anderson Discuss Aging Gracefully A Candid Conversation

Apr 30, 2025

Kareena Kapoor And Gillian Anderson Discuss Aging Gracefully A Candid Conversation

Apr 30, 2025 -

Remember Monday Turning Online Hate Into A Powerful Eurovision Performance

Apr 30, 2025

Remember Monday Turning Online Hate Into A Powerful Eurovision Performance

Apr 30, 2025 -

Pacers Vs Cavs Comprehensive Guide To Game Schedule Viewing Options And Match Predictions

Apr 30, 2025

Pacers Vs Cavs Comprehensive Guide To Game Schedule Viewing Options And Match Predictions

Apr 30, 2025