Net Asset Value (NAV) Of Amundi MSCI World Catholic Principles UCITS ETF Acc: Key Considerations

Table of Contents

Daily NAV Fluctuations and Market Influences

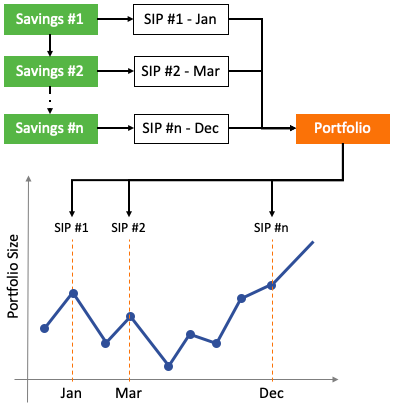

The daily Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc is directly impacted by the performance of the underlying assets it holds. These assets, mirroring the MSCI World Catholic Principles Index, fluctuate based on global market movements. Stock prices rise and fall, currency exchange rates shift, and these changes directly translate into fluctuations in the ETF's NAV.

Several events can trigger significant NAV changes:

- Economic News: Positive economic data (e.g., strong GDP growth) often leads to increased NAV, while negative news (e.g., rising inflation) may cause a decrease.

- Geopolitical Events: International conflicts or political instability can drastically impact market sentiment and, consequently, the ETF's NAV.

- Company-Specific News: Positive or negative news about individual companies within the index can affect the overall NAV.

Another important concept is tracking error. This measures how closely the ETF's performance tracks its benchmark index (MSCI World Catholic Principles Index). A high tracking error indicates that the ETF's NAV may deviate significantly from the index's performance.

- Check the ETF's fact sheet or the fund provider's website for details on tracking error.

Understanding the Components of NAV Calculation

The NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is calculated daily, typically at the close of the market. The calculation involves several key components:

- Asset Values: The total market value of all the securities held by the ETF.

- Liabilities: Any outstanding obligations or expenses owed by the fund.

- Expenses: Management fees, administrative costs, and other operating expenses.

Management fees and other expenses directly impact the NAV, reducing the overall value available to investors. Dividend distributions from the underlying holdings also influence the NAV, typically causing a slight decrease immediately after the distribution, as the fund's assets are reduced.

- NAV is calculated daily, typically at the close of the market.

- The calculation methodology should be publicly available in the ETF's documentation.

Using NAV for Investment Decisions

Investors can utilize the NAV to compare the Amundi MSCI World Catholic Principles UCITS ETF Acc's performance against its benchmark index and other similar ETFs. However, it's crucial to consider the NAV alongside other performance metrics like total return and yield for a comprehensive picture.

While a consistently rising NAV suggests strong performance, it's essential to consider the investment strategy. The "Catholic Principles" focus may lead to different performance characteristics compared to broader market indices. This strategy might result in slightly lower returns in some market cycles but could also provide more stability in the long term.

Significant changes in the NAV can signal potential buying or selling opportunities for long-term investors. However, such decisions should be carefully weighed against overall market trends and the investor's risk tolerance.

- Regularly monitor the NAV to track investment performance.

- Use reliable sources like the fund provider's website for accurate NAV data.

Factors Specific to the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Amundi MSCI World Catholic Principles UCITS ETF Acc's investment strategy, aligned with Catholic ethical principles, influences its NAV in several ways. This approach might exclude certain sectors (e.g., those involved in controversial weapons) which could lead to a different asset allocation compared to a standard world market index.

Comparing its NAV performance to similar ETFs that don't adhere to such principles is valuable. This comparison reveals the potential trade-off between ethical investment and potential returns. Analyzing sector weightings and comparing the expense ratio relative to NAV performance offers additional insights.

- Consider the ETF's expense ratio in relation to its NAV performance.

- Compare the fund's performance to its benchmark index.

Conclusion: Making Informed Decisions with Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Understanding the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is paramount for informed investment decisions. Factors such as daily market fluctuations, the underlying index's performance, management fees, and the unique ethical considerations all affect its NAV. While a rising NAV is generally positive, it's crucial to analyze it in conjunction with other performance indicators and consider the long-term implications of the ETF's Catholic Principles investment strategy. Before investing, thoroughly research the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV and other relevant data. Consider consulting a financial advisor for personalized guidance and further reading on understanding ETF NAVs to make informed decisions about your investment portfolio.

Featured Posts

-

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025 -

A Practical Guide To Obtaining Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

A Practical Guide To Obtaining Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

4 Milliarda Na Konu Pryamaya Translyatsiya Matcha Rybakinoy

May 24, 2025

4 Milliarda Na Konu Pryamaya Translyatsiya Matcha Rybakinoy

May 24, 2025 -

Interpreting The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Interpreting The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Apple Stock Q2 Earnings Preview Key Technical Levels To Watch

May 24, 2025

Apple Stock Q2 Earnings Preview Key Technical Levels To Watch

May 24, 2025