Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: An Investor's Guide

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. For ETFs, it's calculated daily and reflects the market value of all the securities held within the fund. Simply put, it's the value of the ETF's assets minus its liabilities.

The calculation is straightforward:

Assets - Liabilities = NAV

Let's break down the components:

- Assets: These include the market value of all the stocks, bonds, or other securities the ETF holds. It also includes any cash reserves the fund maintains. The value of these assets fluctuates constantly based on market movements.

- Liabilities: These are the fund's expenses, including management fees, administrative costs, and any outstanding payable amounts.

The daily fluctuation in NAV directly correlates with the market performance of the underlying assets. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV. Understanding this daily movement is key to effective portfolio valuation and management.

Keywords: Net Asset Value calculation, ETF valuation, asset valuation, portfolio valuation.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, providing exposure to a wide range of global equities. This broad diversification significantly impacts its NAV.

- Investment Strategy: The ETF's investment strategy aims to replicate the MSCI World Index, meaning its NAV will closely reflect the overall performance of this benchmark. Any changes in the composition of the index or the performance of its constituent companies will influence the NAV.

- Role of Currency Hedging: The "USD Hedged" aspect is critical. This means the fund employs strategies to mitigate the risk of currency fluctuations between the base currency of the underlying assets and the US dollar. This hedging can somewhat insulate the NAV from major currency swings, offering a degree of stability for US dollar-based investors.

- MSCI World Index Diversification: The MSCI World Index's broad diversification across developed markets reduces the impact of individual company or sector performance on the overall NAV. This means the NAV is less volatile than ETFs focused on specific sectors or regions.

- External Factors: Macroeconomic events like interest rate changes, geopolitical instability, and economic recessions all influence the performance of global markets and, consequently, the ETF's NAV. Market volatility, particularly, can lead to significant short-term NAV fluctuations.

Keywords: Amundi MSCI World II UCITS ETF NAV, USD Hedged NAV, MSCI World Index, ETF investment strategy, currency hedging impact.

How to access and interpret the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV

Accessing the daily NAV is straightforward. You can typically find this information on:

- The ETF provider's website: Amundi's website will provide daily updated NAV data for all its ETFs.

- Financial news sources: Reputable financial websites and data providers often display ETF NAVs.

Interpreting the NAV data requires understanding its relationship to the ETF's trading price.

- Comparing NAV to Trading Price: The ETF's trading price on the exchange might differ slightly from the NAV due to market supply and demand.

- Premium and Discount to NAV: A premium means the trading price is higher than the NAV, while a discount signifies the opposite. These discrepancies are usually minor, but understanding them is vital for maximizing returns.

Using NAV for investment decisions

NAV changes can inform investment decisions, but it's vital to take a long-term perspective.

- Buy and Sell Signals: While short-term NAV movements can be tempting to act upon, relying solely on daily NAV fluctuations for buy/sell decisions is risky.

- Long-Term Investment Strategy: A robust investment strategy focuses on the long-term growth potential of the underlying assets, rather than short-term NAV variations.

- Portfolio Performance Evaluation: Monitoring NAV changes is crucial for tracking your portfolio's overall performance. This enables adjustments to your asset allocation based on your investment goals.

Keywords: NAV data, ETF price, premium to NAV, discount to NAV, ETF trading price, investment strategy, portfolio management, buy and sell signals, long term investing.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is essential for effective investment management. Monitoring the NAV, coupled with a long-term investment strategy, allows you to track portfolio performance and make informed decisions. While short-term fluctuations are normal, the overall trend of the NAV reflects the long-term growth potential of the ETF. Remember to consider the impact of currency hedging and market conditions when interpreting NAV data. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV by visiting . Consider incorporating this ETF into a well-diversified investment portfolio to gain exposure to the global equity market. Keywords: Net Asset Value (NAV), Amundi MSCI World II UCITS ETF, USD Hedged, ETF investment, portfolio diversification.

Featured Posts

-

Darwin Shop Owner Stabbed To Death Teenager In Custody Following Nightcliff Incident

May 24, 2025

Darwin Shop Owner Stabbed To Death Teenager In Custody Following Nightcliff Incident

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025 -

Philips Shareholders 2025 Annual General Meeting Agenda Released

May 24, 2025

Philips Shareholders 2025 Annual General Meeting Agenda Released

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 24, 2025 -

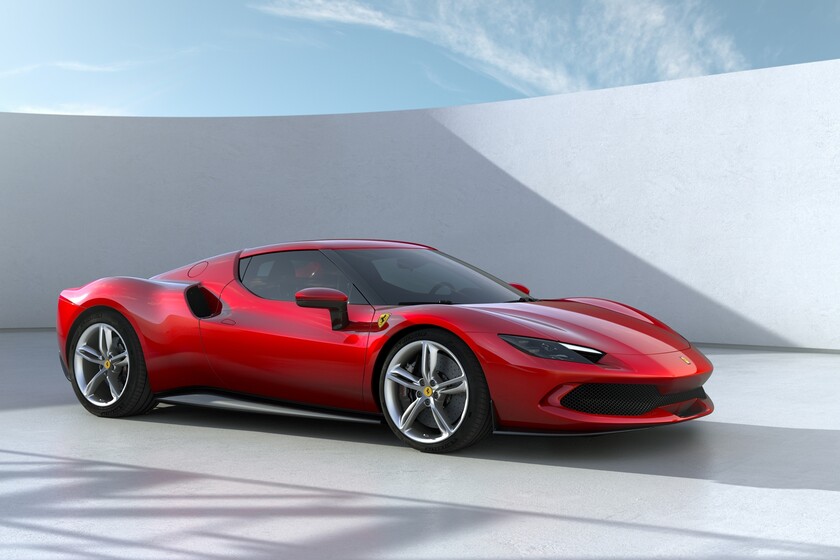

Especificacoes Do Ferrari 296 Speciale Motor Hibrido De 880 Cv

May 24, 2025

Especificacoes Do Ferrari 296 Speciale Motor Hibrido De 880 Cv

May 24, 2025