New Rules Sought: Indian Insurers Target Bond Forward Market

Table of Contents

The Allure of the Bond Forward Market for Indian Insurers

The bond forward market presents a compelling proposition for Indian insurers, driven by its potential for enhanced returns and sophisticated risk management capabilities.

Higher Returns and Risk Management

Bond forward contracts offer Indian insurers the potential for significantly higher returns compared to traditional fixed-income investments. This is achieved through strategic leveraging and exposure to anticipated interest rate movements. Furthermore, these contracts provide effective risk mitigation tools:

- Diversification Benefits: Forward contracts allow insurers to diversify their investment portfolios beyond traditional bond holdings, reducing overall portfolio risk.

- Hedging Against Interest Rate Fluctuations: Insurers can use bond forwards to hedge against potential losses from adverse interest rate movements, protecting their investment portfolios from unexpected downturns.

- Enhanced Portfolio Management: The flexibility of forward contracts enables more dynamic portfolio management, allowing insurers to adjust their exposure based on market conditions and risk appetite.

Forward contracts offer a distinct advantage over direct bond investments in managing interest rate risk. By locking in future interest rates, insurers can mitigate the impact of unexpected interest rate hikes on their existing bond holdings, ensuring more predictable investment returns.

Growing Market Size and Liquidity

India's bond market is experiencing substantial growth, exhibiting increased liquidity and becoming increasingly attractive to large institutional investors like insurers.

- Market Growth Statistics: [Insert relevant statistics on the growth of the Indian bond market – e.g., year-on-year growth rates, market capitalization figures].

- Increasing Trading Volumes: The rising volume of transactions in the bond market indicates growing investor participation and improved market efficiency.

- Improved Market Infrastructure: Developments in trading platforms and clearing mechanisms have facilitated easier access and smoother execution of transactions in the bond forward market.

The increased liquidity and accessibility make the bond forward market particularly suitable for large institutional players like Indian insurers, who can effectively utilize the market's depth and efficiency to execute their investment strategies.

Current Regulatory Landscape and Its Shortcomings

While the Indian regulatory framework for insurance investments has evolved, it currently lacks specific provisions for managing insurers’ participation in the bond forward market.

Existing Regulations and Their Limitations

Current regulations, primarily governed by the IRDAI (Insurance Regulatory and Development Authority of India), focus largely on investment limits across different asset classes and emphasize capital adequacy. However:

- Specific Regulations Relevant to Insurance Investment: Existing regulations are primarily focused on the overall investment portfolio of insurers and may not adequately address the unique risk profile of forward contracts.

- Gaps in Existing Rules Concerning Forward Contracts: There is a lack of specific guidelines on the permissible level of exposure to bond forward contracts for insurers.

- Limitations on Exposure to Specific Asset Classes: Existing regulations may impose limitations on exposure to certain asset classes which inadvertently restricts insurers’ potential gains from strategic use of the bond forward market.

This lack of specific guidance creates uncertainty and limits the potential benefits that insurers could derive from this increasingly important market segment. More granular rules are needed to define acceptable risk levels and investment strategies within the bond forward market context.

Concerns Regarding Risk and Solvency

The bond forward market, while offering high returns, presents several potential risks that need to be carefully managed:

- Credit Risk: The risk of default by the counterparty in a forward contract.

- Counterparty Risk: The risk that the other party in the transaction will not fulfill their obligations.

- Market Risk: The risk of losses due to adverse movements in interest rates or bond prices.

- Liquidity Risk: The risk of not being able to easily exit a forward contract position due to lack of liquidity.

These risks, if not properly managed, can significantly impact an insurer's solvency and potentially threaten policyholder payouts. Robust regulatory oversight is crucial to ensure the financial stability of the insurance sector.

Proposed New Rules and Their Impact

To address the identified concerns, several regulatory changes are being proposed to govern insurers' participation in the bond forward market.

Key Proposals for Regulatory Changes

Proposed regulatory changes aim to bring clarity and structure to insurers' dealings in the bond forward market:

- Specific Limits on Exposure: Setting clear limits on the proportion of an insurer's portfolio that can be allocated to bond forward contracts.

- Mandatory Risk Assessment Frameworks: Requiring insurers to develop and implement comprehensive risk assessment frameworks specifically for their forward contract positions.

- Reporting Requirements: Implementing stricter reporting requirements to enhance transparency and regulatory oversight.

- Stress Testing Guidelines: Introducing stress testing guidelines to assess the resilience of insurers' portfolios under various market scenarios.

These proposals aim to strike a balance between enabling insurers to access the potential benefits of the bond forward market while mitigating potential risks to their financial stability.

Potential Benefits of Increased Regulation

The implementation of these new rules will bring several positive outcomes:

- Improved Risk Management: The proposed regulations will foster more robust risk management practices within the Indian insurance sector.

- Increased Transparency: Enhanced reporting requirements will improve transparency and allow for better monitoring of insurers' activities.

- Enhanced Investor Confidence: Clear regulations will boost investor confidence in the stability and soundness of the Indian insurance sector.

- Better Market Oversight: Strengthened regulatory oversight will ensure the orderly functioning of the bond forward market.

These improvements will contribute to the sustainable growth of the Indian insurance sector by promoting responsible investment practices and safeguarding policyholder interests.

Conclusion

The attractiveness of the bond forward market for Indian insurers is undeniable, offering opportunities for higher returns and sophisticated risk management. However, the current regulatory landscape presents significant shortcomings, necessitating urgent action. The proposed new rules, with their focus on exposure limits, risk assessment frameworks, and enhanced reporting, are crucial steps towards ensuring a safe and stable environment for insurers' participation in this market. The future of Indian insurance investment hinges on the timely and effective implementation of these regulations. Stay informed on the latest developments concerning Indian Insurers and the Bond Forward Market to understand the evolving regulatory landscape and its impact on the sector.

Featured Posts

-

Analyzing West Hams Potential 25m Financial Deficit

May 10, 2025

Analyzing West Hams Potential 25m Financial Deficit

May 10, 2025 -

De Facto Atheism Pope Leos Concerns In First Papal Mass

May 10, 2025

De Facto Atheism Pope Leos Concerns In First Papal Mass

May 10, 2025 -

International Transgender Day Of Visibility Three Steps Towards Inclusive Action

May 10, 2025

International Transgender Day Of Visibility Three Steps Towards Inclusive Action

May 10, 2025 -

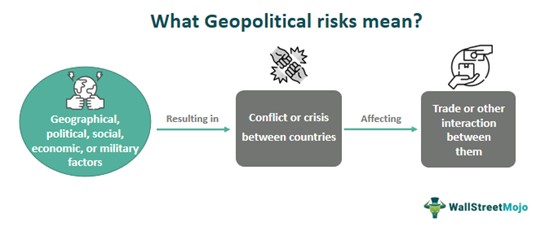

Flat Finish For Indian Stock Market Geopolitical Risks And Bajaj Losses Impact Trade

May 10, 2025

Flat Finish For Indian Stock Market Geopolitical Risks And Bajaj Losses Impact Trade

May 10, 2025 -

Thailands Transgender Community A Call For Equality In The Bangkok Post

May 10, 2025

Thailands Transgender Community A Call For Equality In The Bangkok Post

May 10, 2025