New Wave Of HMRC Nudge Letters: What UK Households Need To Know

Table of Contents

Understanding HMRC Nudge Letters

HMRC nudge letters are proactive communications designed to remind taxpayers of their tax obligations or to prompt action on outstanding issues. They are part of HMRC's strategy to improve tax compliance and reduce the number of late submissions or unpaid taxes. These letters aren't threats; they are gentle reminders intended to help you stay on top of your tax affairs. However, ignoring them could lead to more serious consequences down the line.

Different types of nudge letters exist, including:

- Tax Return Reminders: These letters remind you to file your self-assessment tax return by the deadline.

- Payment Reminders: These alert you to outstanding tax payments that are overdue.

- Self-Assessment Prompts: These encourage you to register for self-assessment if you haven't already.

The purpose of HMRC's nudge letter strategy is to:

- Improve tax compliance.

- Reduce the administrative burden on HMRC.

- Provide taxpayers with timely reminders to avoid penalties.

Here's what you can typically expect to find in an HMRC nudge letter:

- Examples of common reasons: Overdue tax payments, missing self-assessment returns, incorrect information provided.

- Typical wording: Formal but generally clear and concise, explaining the outstanding issue and the required action.

- Information included: Unique reference numbers, deadlines, contact details for HMRC, and details of the outstanding tax.

Identifying Legitimate HMRC Nudge Letters

It's essential to be aware of phishing scams, where fraudulent individuals attempt to mimic HMRC communications to obtain personal information. Always verify the authenticity of any HMRC letter you receive.

A genuine HMRC nudge letter will generally include:

- Official HMRC letterhead: Featuring the HMRC logo and contact details.

- Clear and professional language: Free from grammatical errors and using official HMRC terminology.

- Unique reference numbers: These numbers link the letter to your specific tax account.

- Correct address: The letter will be addressed to you at your registered address with HMRC.

To verify a letter's authenticity:

- Check the HMRC website: Look for information about the specific communication you received.

- Contact HMRC directly: Use the official HMRC contact details found on their website, not the number provided on a potentially fraudulent letter.

If you suspect a letter is fraudulent:

- Do not respond to it.

- Report it to HMRC: Use their official channels to report the suspicious communication.

- Do not click on any links or open any attachments.

Responding to HMRC Nudge Letters

Promptly responding to HMRC communications is crucial to avoid penalties and maintain a good standing with the tax authority. There are several ways to respond:

- Online Portal: The quickest and easiest method, allowing you to view your tax account, submit returns, and make payments.

- Phone: Contact HMRC directly through their helpline.

- Post: Send your response by mail, but this method is generally slower.

Ignoring or delaying your response can lead to:

- Increased penalties: Late payment penalties and late filing penalties can be substantial.

- Further demands: HMRC may send further reminders or even initiate legal action.

- Damage to credit rating: Persistent non-compliance could negatively impact your credit score.

Here’s a step-by-step guide to responding online:

- Go to the HMRC website.

- Log in to your online account using your Government Gateway user ID and password.

- Locate the relevant communication and follow the instructions provided.

- Submit your return or make your payment.

Contact details for HMRC: You can find the most up-to-date contact information on the official HMRC website.

What to do if you can't afford to pay

If you’re experiencing financial difficulties and can't afford to pay your tax bill, don't ignore the HMRC nudge letter. Contact HMRC immediately to discuss your options. They offer various support schemes, including:

- Payment plans: These allow you to spread your payments over an agreed period.

- Time-to-pay arrangements: More flexible payment plans for those facing significant financial hardship.

To apply for a payment plan:

- Contact HMRC's debt management team using the contact information on their website.

- Provide details of your financial circumstances.

- Work with HMRC to agree on a manageable payment plan.

Relevant government support websites can provide additional assistance and resources.

Conclusion

Understanding HMRC nudge letters is vital for all UK taxpayers. By knowing how to identify legitimate communications, respond appropriately, and address any financial difficulties proactively, you can avoid penalties and maintain a positive relationship with HMRC. Don't ignore those HMRC nudge letters! Understanding HMRC communications is key to avoiding tax penalties. Learn more about managing your HMRC correspondence and tax reminder letters today. Act promptly to ensure compliance and avoid unnecessary stress.

Featured Posts

-

Philippines Ups The Ante Expanded Military Exercises With The Us In Balikatan

May 20, 2025

Philippines Ups The Ante Expanded Military Exercises With The Us In Balikatan

May 20, 2025 -

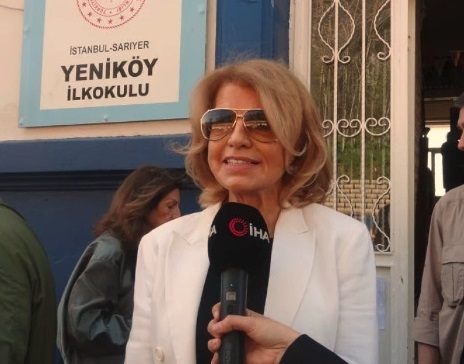

Fenerbahce De Yeni Bir Doenemin Baslangici Dusan Tadic In Tarihi Transferi

May 20, 2025

Fenerbahce De Yeni Bir Doenemin Baslangici Dusan Tadic In Tarihi Transferi

May 20, 2025 -

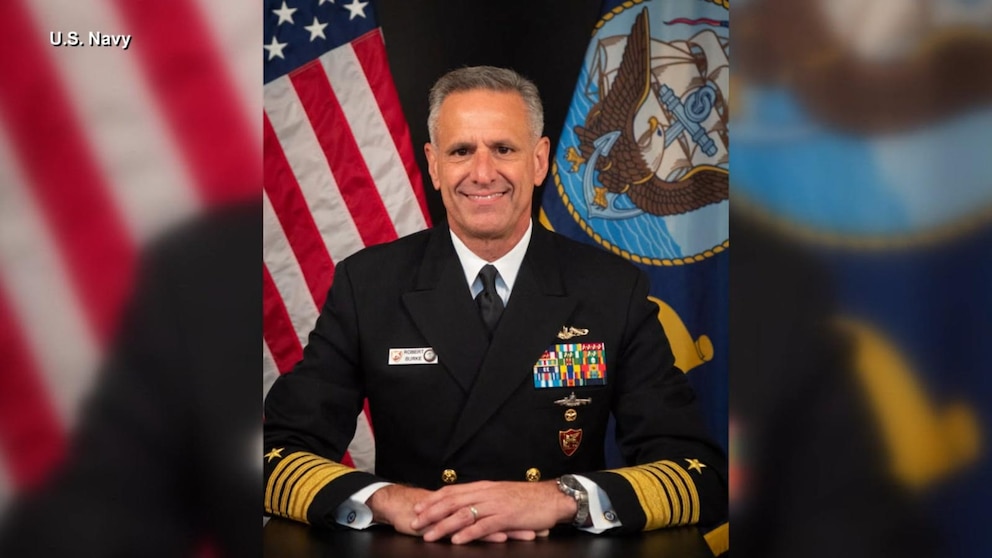

Navy Admiral Faces 30 Years For 500 000 Bribery Scheme

May 20, 2025

Navy Admiral Faces 30 Years For 500 000 Bribery Scheme

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025 -

Paulina Gretzky Channels The Soprano In Stunning Leopard Print Dress

May 20, 2025

Paulina Gretzky Channels The Soprano In Stunning Leopard Print Dress

May 20, 2025