Nine Sub-Saharan African Countries Affected By PwC's Departure

Table of Contents

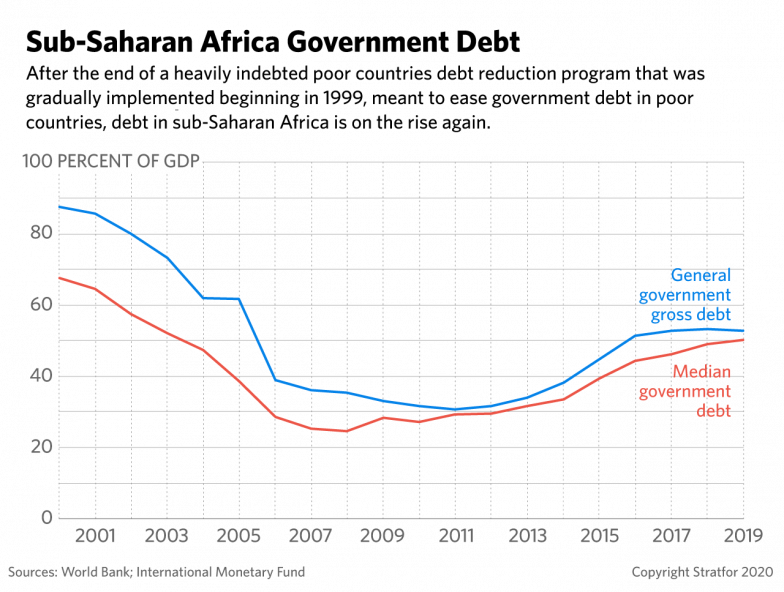

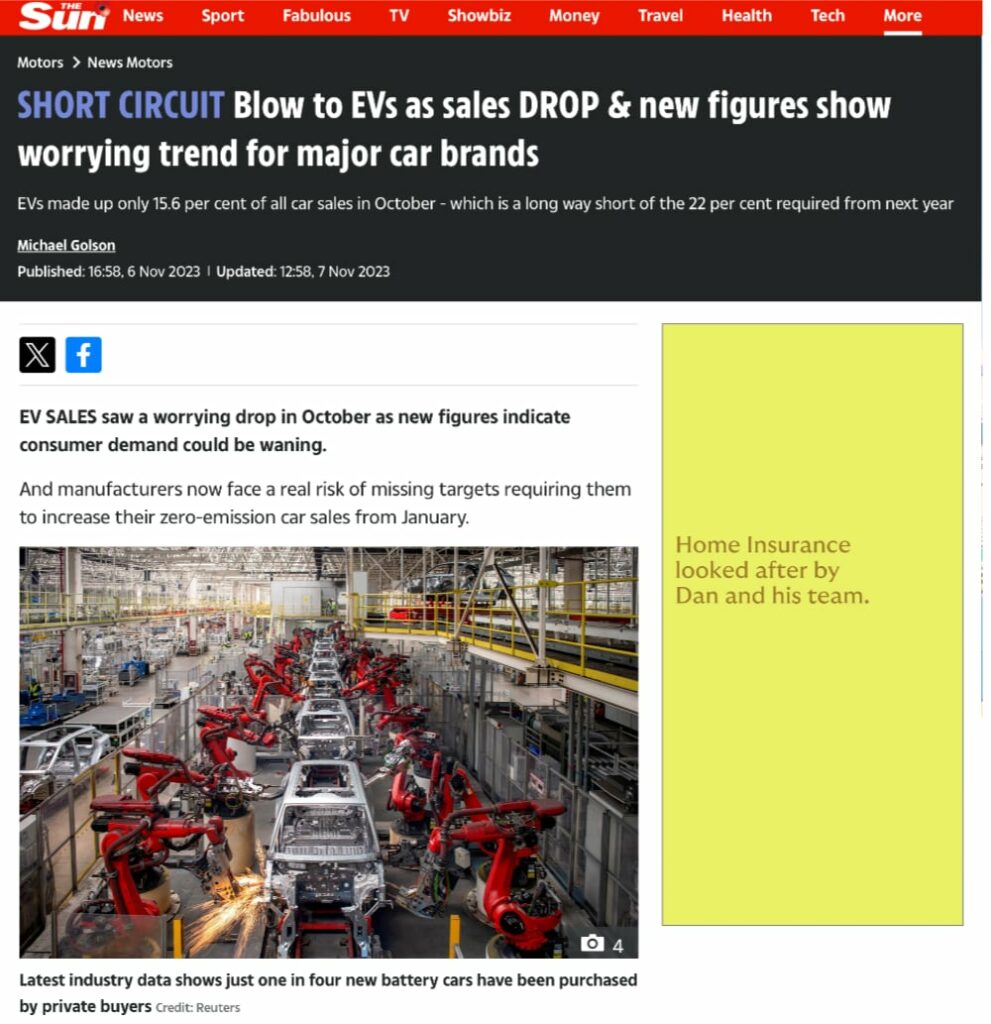

The Nine Affected Countries: A Geographical Overview

PwC's decision impacts nine Sub-Saharan African nations, each with unique economic profiles and contributions to the region. Understanding their geographical context is crucial to grasping the full implications of this development. These countries are: [Insert list of nine countries with official names].

- [Country 1]: [Brief geographical overview, highlighting economic significance, e.g., major exporter of coffee, key player in regional trade]. [Link to relevant country page]

- [Country 2]: [Brief geographical overview, highlighting economic significance, e.g., significant mining industry, growing tourism sector]. [Link to relevant country page]

- [Country 3 - 9]: Repeat the above format for each remaining country, ensuring diverse keyword usage such as "Sub-Saharan Africa," "PwC," "audit services," "tax services," and "country-specific analysis" throughout the descriptions.

This geographical overview demonstrates the broad reach of PwC's presence and the widespread consequences of its departure across diverse Sub-Saharan African economies.

Reasons Behind PwC's Withdrawal: Unpacking the Decision

While PwC has not explicitly detailed the specific reasons behind its withdrawal from these nine nations, several factors likely contributed to the decision. These include:

- Regulatory Changes: Evolving regulatory landscapes and increasing compliance burdens in certain Sub-Saharan African countries may have made operating costs unsustainable for PwC. Stringent new auditing standards and anti-money laundering regulations could have played a significant role.

- Challenges in the Business Environment: Issues such as political instability, corruption, or a lack of transparency in some countries may have increased operational risks for the firm.

- International Accounting Standards: The need to adhere to stringent international accounting standards and ensure consistent global practices might have led PwC to reassess its operational strategy in certain markets perceived as higher-risk. The cost of maintaining these standards in less-developed regulatory environments could have been prohibitive. This complex interplay of factors underlines the intricate challenges facing multinational accounting firms operating within the dynamic landscape of Sub-Saharan Africa. Keywords used here include: "PwC withdrawal," "regulatory challenges," "accounting standards," "business environment," and "Sub-Saharan Africa."

Economic Impact on Affected Nations: Short-Term and Long-Term Consequences

PwC's departure will undoubtedly have significant economic consequences, both in the short and long term.

- Short-Term Impact: The immediate effect will likely include job losses among PwC employees and associated businesses. Reduced investment in these countries is also a possibility, as businesses might hesitate to invest in regions with perceived auditing uncertainty.

- Long-Term Impact: The long-term consequences could be more profound, potentially hindering economic growth and development. The loss of expertise and international credibility could discourage foreign direct investment. The absence of a major player like PwC could affect the quality of financial reporting and corporate governance in the affected countries. Other auditing firms will need to step up, and their capacity to absorb the increased workload needs evaluation. Using keywords like "Economic impact," "job losses," "investment," "economic growth," and "auditing firms" ensures comprehensive SEO optimization.

Alternative Auditing Firms and Future Implications

While PwC's exit leaves a void, other major auditing firms operate in Sub-Saharan Africa, including Deloitte, Ernst & Young (EY), and KPMG. This departure may lead to:

- Increased Competition: Existing firms may see opportunities to expand their market share, leading to potentially increased competition within the audit industry.

- Industry Consolidation: Alternatively, there's a possibility of mergers or acquisitions as firms seek to strengthen their positions in the region.

- Regulatory Scrutiny: Governments might respond by strengthening regulatory frameworks to maintain the integrity of financial reporting and attract investment. This section uses keywords like "Alternative auditors," "audit industry," "competition," "regulatory changes," and "Sub-Saharan African markets" to enhance visibility.

Government Response and Policy Adjustments

Governments in the affected countries are likely to respond to PwC's withdrawal in various ways:

- Policy Reforms: There might be a push for regulatory reforms to create a more favorable business environment and attract other international auditing firms.

- Incentive Programs: Governments may introduce incentive programs to encourage investment in the audit sector and prevent a further decline in investor confidence.

- Strengthening Local Firms: Supporting and strengthening local auditing firms could become a priority to fill the gap left by PwC.

Analyzing these government responses and their effectiveness is crucial to understanding the long-term trajectory of the audit sector in these countries. Relevant keywords include "Government response," "policy changes," "regulatory reform," "Sub-Saharan Africa," and "PwC's impact."

Conclusion: Understanding the Ripple Effects of PwC's Departure

PwC's departure from nine Sub-Saharan African countries represents a significant event with wide-ranging implications for the region's economy, regulatory frameworks, and business environment. The potential for job losses, reduced investment, and challenges to economic growth are substantial. While other auditing firms may fill the gap, the long-term consequences will depend heavily on the response from governments and the adaptability of the affected countries. Understanding the ripple effects of PwC's withdrawal requires continued observation and analysis of the evolving situation. We encourage you to further research the affected countries and share your thoughts on the implications of PwC's departure from Sub-Saharan Africa. Stay informed on the developments surrounding PwC's withdrawal and its lasting impact on the region.

Featured Posts

-

Historic Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025

Historic Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025 -

La Fire Victims Face Price Gouging Reality Tv Star Highlights Landlord Exploitation

Apr 29, 2025

La Fire Victims Face Price Gouging Reality Tv Star Highlights Landlord Exploitation

Apr 29, 2025 -

Behind The Scenes Jeff Goldblum And The Flys Ending

Apr 29, 2025

Behind The Scenes Jeff Goldblum And The Flys Ending

Apr 29, 2025 -

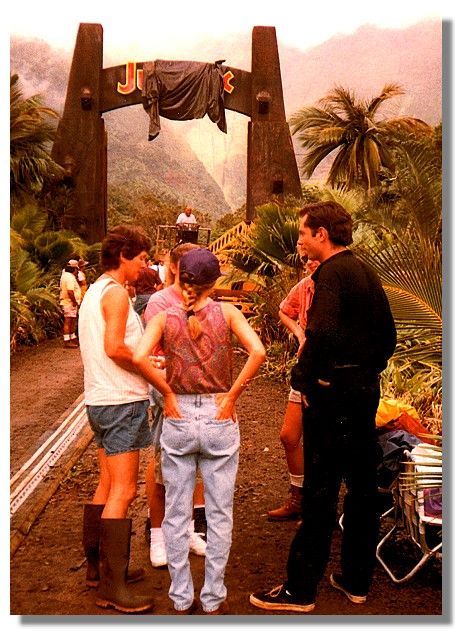

Auto Dealers Double Down On Opposition To Ev Sales Targets

Apr 29, 2025

Auto Dealers Double Down On Opposition To Ev Sales Targets

Apr 29, 2025 -

The Rebecca Lobach Case A Critical Look At Pilot Communication

Apr 29, 2025

The Rebecca Lobach Case A Critical Look At Pilot Communication

Apr 29, 2025

Latest Posts

-

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025 -

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025 -

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025