Nippon Steel Merger: Trump's Backing And The Uncertain Future

Table of Contents

Trump's Support and its Impact on the Nippon Steel Merger

The Trump administration's trade policies, characterized by protectionist measures and tariffs, significantly impacted the global steel industry and, consequently, the Nippon Steel merger. While specific details of direct support might remain opaque, the broader context of Trump's "America First" approach and his imposition of steel tariffs created a climate where consolidation within the industry, potentially including mergers like Nippon Steel's, might have been seen as strategically advantageous.

- Specific examples of Trump's actions or statements supporting the merger: While no direct public endorsements are easily documented, the overall pro-domestic steel industry stance of the Trump administration likely created a more favorable environment for the merger to proceed. The administration's focus on strengthening American manufacturing could be interpreted as tacit support for consolidation within the industry to counter international competition.

- Analysis of the political climate during the merger negotiations: The period surrounding the merger saw heightened tensions in US-Japan trade relations. However, the merger may have been viewed as a way to foster collaboration and strengthen the overall competitiveness of steel production in the face of global pressures.

- Assessment of the potential impact of Trump's policies on the global steel market: Trump's tariffs undeniably disrupted the global steel market, leading to price fluctuations and shifts in supply chains. This volatility likely played a role in the strategic decisions driving the Nippon Steel merger, as companies sought to consolidate their positions and secure their market share amidst uncertainty.

Global Market Dynamics and the Future of Nippon Steel

The global steel market is characterized by overcapacity, fluctuating demand influenced by economic cycles, and intense competition from various players. Nippon Steel's merger aimed to address these challenges by creating a larger, more resilient entity with enhanced economies of scale.

- Analysis of major competitors in the global steel market: The merged entity now faces strong competition from companies like ArcelorMittal, Baosteel, and Posco, all vying for market share in a globalized market.

- Discussion of the merger's impact on market share and pricing power: The merger significantly increased Nippon Steel's market share, theoretically providing greater pricing power and potentially influencing market dynamics.

- Assessment of the merger's potential to drive innovation and efficiency: The merger offers the potential for synergies in research and development, leading to innovations in steel production, potentially improving efficiency and reducing costs. However, realizing these synergies will require effective integration of diverse operations and technologies.

Economic and Geopolitical Implications of the Merger

The Nippon Steel merger has significant economic and geopolitical implications. The combined entity's scale impacts global steel production, trade patterns, and potentially even national security considerations within involved countries.

- Analysis of the merger's impact on employment in different regions: The merger could lead to job losses in certain regions due to plant closures or streamlining of operations. However, there is potential for job creation in areas related to research, development, and advanced steel manufacturing.

- Discussion of the potential for supply chain disruptions or vulnerabilities: The merger might lead to consolidation of the supply chain, potentially creating vulnerabilities if unexpected disruptions occur.

- Assessment of the geopolitical implications of the merger for US-Japan relations and global trade dynamics: The merger's impact on global steel trade dynamics is complex, with potential ramifications for US-Japan relations and global trade balances. While it could boost competitiveness, it also raises questions about market concentration and potential trade disputes.

Uncertainties and Challenges Facing the Merged Entity

Despite its potential advantages, the merged entity faces considerable challenges. Successfully integrating two large organizations with different cultures, streamlining operations, and navigating a volatile market are crucial for long-term success.

- Identification of key integration challenges for the merged company: Cultural differences, differing management styles, and the need to consolidate overlapping functions are among the key integration challenges.

- Discussion of potential financial risks associated with the merger: High debt levels incurred during the merger, coupled with potential downturns in the steel market, pose significant financial risks.

- Analysis of the ongoing competitive pressures within the steel industry: The ongoing intense competition from other global steel producers requires the merged entity to maintain a competitive edge through innovation, efficiency gains, and strategic market positioning.

Conclusion

The Nippon Steel merger, influenced by the broader context of the Trump administration's trade policies, represents a significant restructuring in the global steel industry. While the merger offers potential benefits like increased market share and economies of scale, it also faces substantial uncertainties and challenges related to integration, competition, and global market dynamics. Understanding these dynamics is crucial for assessing the long-term success of this major corporate event and its impact on the future of the steel industry. Stay informed about future developments in the Nippon Steel merger and the broader steel industry by following industry news and engaging in further research on the Nippon Steel merger and its implications.

Featured Posts

-

Marjorie Taylor Greenes Future A Senate Or Gubernatorial Bid In 2026

May 27, 2025

Marjorie Taylor Greenes Future A Senate Or Gubernatorial Bid In 2026

May 27, 2025 -

Janet Jackson Receiving The Icon Award At The 2025 Amas

May 27, 2025

Janet Jackson Receiving The Icon Award At The 2025 Amas

May 27, 2025 -

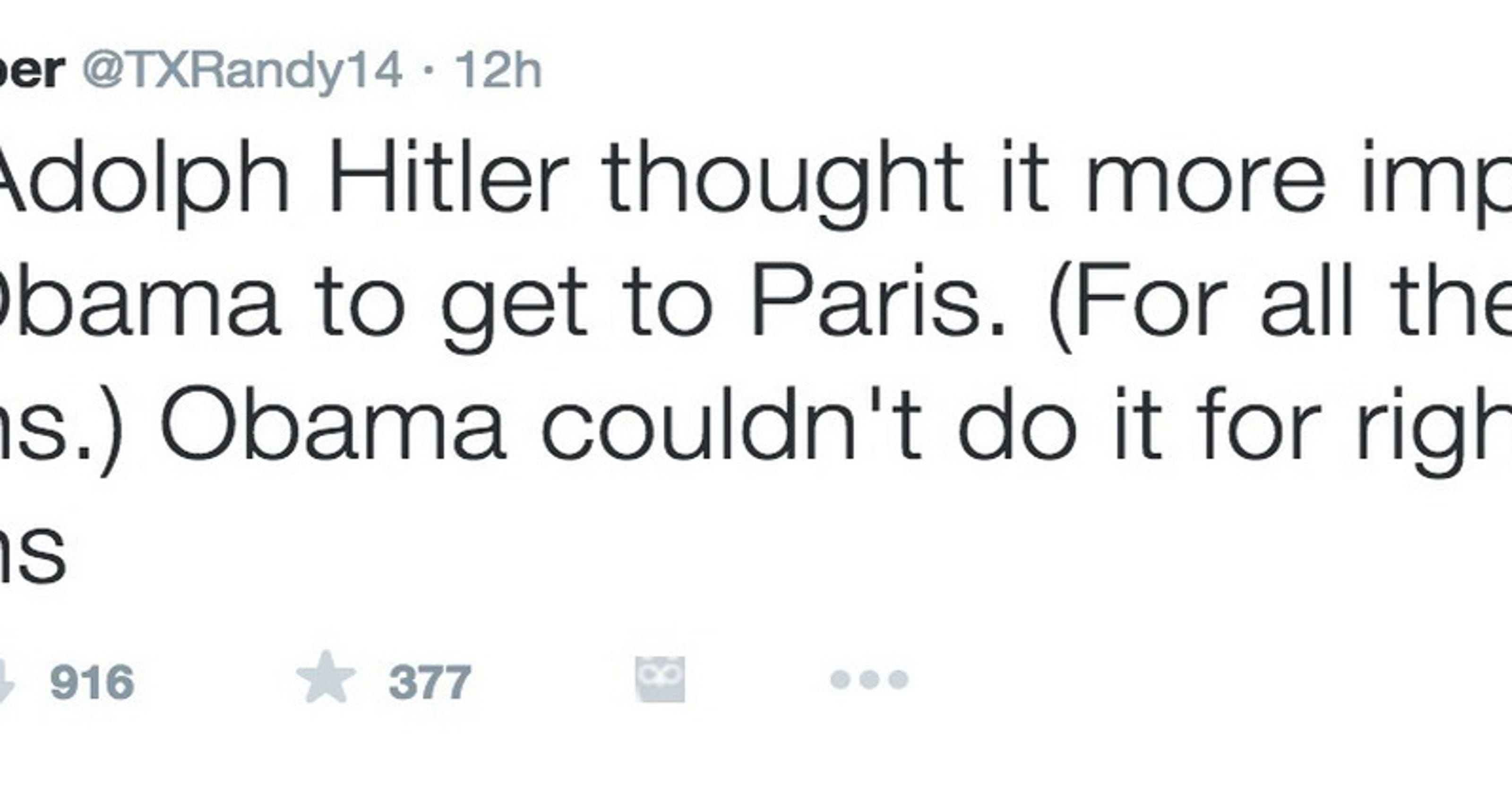

Cenats Response To Influencers Racist Jokes Awaiting Comment

May 27, 2025

Cenats Response To Influencers Racist Jokes Awaiting Comment

May 27, 2025 -

1923 Season 2 Episode 5 How To Watch It Tonight Without Paying

May 27, 2025

1923 Season 2 Episode 5 How To Watch It Tonight Without Paying

May 27, 2025 -

23 Marzo 2024 Almanacco Della Giornata Santo Proverbio E Compleanni

May 27, 2025

23 Marzo 2024 Almanacco Della Giornata Santo Proverbio E Compleanni

May 27, 2025