Nixon's Shadow: A Look At The Current U.S. Dollar's Performance

Table of Contents

The Bretton Woods Legacy and its Impact on the U.S. Dollar

The Bretton Woods system, established after World War II, pegged major currencies to the U.S. dollar, which in turn was backed by gold. This system provided relative stability, but it ultimately proved unsustainable due to growing imbalances in international trade and the increasing demand for dollars. Nixon's decision to close the "gold window," effectively ending the gold standard, unleashed significant volatility into the global monetary system. This shift to a fiat currency system meant the U.S. dollar's value was no longer directly tied to a physical commodity, instead fluctuating based on market forces, supply, and demand.

This had several significant implications for the U.S. dollar's value:

- Increased volatility: The U.S. dollar's value became subject to significant swings based on economic conditions, investor sentiment, and geopolitical events. This increased volatility presented both opportunities and risks for businesses and investors.

- The role of inflation and interest rates: Inflation and interest rate policies became crucial factors influencing the U.S. dollar's exchange rate. High inflation typically weakens a currency, while higher interest rates can attract foreign investment, strengthening the dollar.

- The rise of the dollar as a global reserve currency: Despite the increased volatility, the U.S. dollar retained and even solidified its position as the world's primary reserve currency. This is largely due to the size and strength of the U.S. economy, as well as the depth and liquidity of its financial markets.

Current Factors Affecting U.S. Dollar Performance

Several factors currently influence the U.S. dollar performance. Understanding these dynamics is crucial for navigating the complexities of the global financial landscape. The Federal Reserve's monetary policy plays a pivotal role, influencing interest rates and the money supply. Other key considerations include:

- Inflation rates: High inflation in the U.S. erodes the purchasing power of the dollar, leading to a weaker exchange rate against other currencies. Conversely, lower inflation rates tend to support the dollar's value.

- Interest rate differentials: The difference between U.S. interest rates and those in other countries influences capital flows. Higher U.S. rates attract foreign investment, increasing demand for the dollar and strengthening its value.

- Geopolitical events: Global political instability and uncertainty often lead to a "flight to safety," where investors seek the perceived security of the U.S. dollar, boosting its value. However, major geopolitical risks can also weaken the dollar.

- Global economic growth: Strong global economic growth can increase demand for the dollar, as it's used extensively in international trade and investment. Conversely, global economic slowdowns can weaken the dollar.

The Dollar's Role in the Global Economy

The U.S. dollar's dominance as a reserve currency is a defining feature of the global economy. This status grants the United States significant influence over international finance and trade.

- Dominance in foreign exchange markets: The dollar is involved in the vast majority of international currency transactions. This high volume of trading contributes to the dollar's liquidity and stability, though this can also contribute to its volatility.

- Use in international transactions and settlements: A significant portion of global trade is invoiced and settled in U.S. dollars, making it a crucial medium of exchange for international commerce. This enhances the dollar’s demand globally.

- Potential challenges to the dollar's global hegemony: The dollar's dominance is not without its challenges. The rise of other major economies, such as China, and the development of alternative payment systems could potentially diminish the dollar's global influence in the future.

Predicting Future U.S. Dollar Performance

Predicting future U.S. dollar performance is inherently challenging due to the multitude of interacting factors at play. However, by considering various potential scenarios, we can outline a few plausible outcomes:

- Future interest rate changes: The Federal Reserve's decisions on interest rates will be a major driver of the dollar's value. Further rate hikes could strengthen the dollar, while rate cuts could weaken it.

- Analyzing potential geopolitical risks: Escalating geopolitical tensions or unexpected global events can significantly impact the dollar's value, often creating short-term volatility. Long-term impact is harder to predict.

- Considering the impact of emerging economies: The continued growth of emerging economies like China and India could gradually shift the global economic balance, potentially challenging the dollar's dominance over the long term.

Conclusion

Nixon's decision to end the Bretton Woods system profoundly impacted the trajectory of the U.S. dollar, creating a more volatile but also more flexible system. The current U.S. dollar performance is influenced by a complex interplay of factors, including inflation, interest rates, geopolitical events, and the ongoing shift in global economic power. Understanding these factors is crucial for navigating the global financial landscape. To stay abreast of the latest developments in U.S. dollar performance, follow reputable economic news sources and utilize search terms like "U.S. dollar performance," "dollar strength," or "USD exchange rate" to conduct further research. Staying informed is key to making sound financial decisions in this dynamic environment.

Featured Posts

-

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

Apr 28, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

Apr 28, 2025 -

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025 -

Chaos And Confusion Before Weezer Bassists Wife Shooting Lapd Video Shows

Apr 28, 2025

Chaos And Confusion Before Weezer Bassists Wife Shooting Lapd Video Shows

Apr 28, 2025 -

Market Volatility And Investor Behavior Understanding The Recent Trend

Apr 28, 2025

Market Volatility And Investor Behavior Understanding The Recent Trend

Apr 28, 2025 -

Is Over The Counter Birth Control The Future Of Reproductive Healthcare

Apr 28, 2025

Is Over The Counter Birth Control The Future Of Reproductive Healthcare

Apr 28, 2025

Latest Posts

-

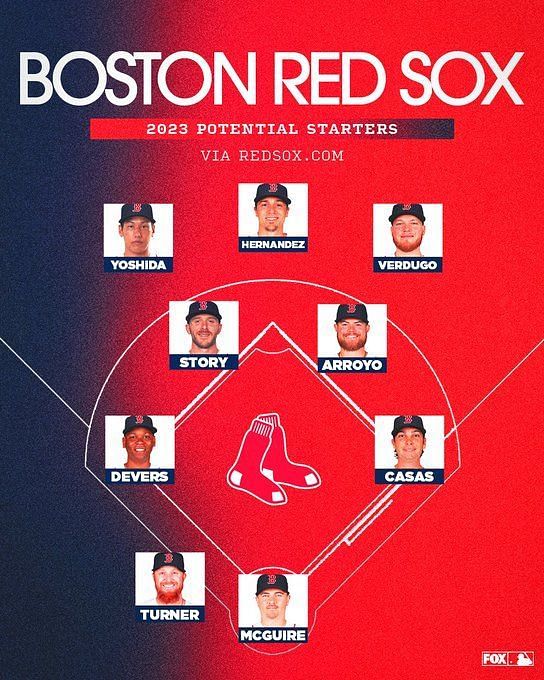

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025