No Credit Check, Guaranteed Approval: Find Your Direct Lender Loan

Table of Contents

Understanding "No Credit Check, Guaranteed Approval" Loans

Let's clarify the terminology. While "guaranteed approval" sounds incredibly promising for those with less-than-perfect credit scores, it doesn't mean automatic approval. It simply implies a higher chance of approval compared to traditional lenders who rely heavily on credit reports. Even with no credit check loans, direct lenders still assess risk. They'll likely review your income verification, employment history, and other financial indicators to determine your ability to repay the loan.

A direct lender is a financial institution that provides loans directly to borrowers, eliminating the middleman. This differs significantly from a loan broker, who acts as an intermediary, connecting borrowers with multiple lenders. Dealing directly with the lender offers several advantages:

- Faster processing times: Direct lenders often have streamlined processes, leading to quicker approvals and funding.

- Potentially lower fees: By cutting out the broker, you might avoid additional fees.

- Clearer terms and conditions: You interact directly with the lender, ensuring transparency in the loan agreement.

- Better customer service: Direct communication with the lender simplifies any issues or questions that may arise.

Finding Reputable Direct Lenders for No Credit Check Loans

Finding a trustworthy lender is crucial when searching for no credit check, guaranteed approval loans. The market includes both reputable and predatory lenders. It’s essential to perform thorough research before committing to any loan agreement. Avoid lenders who pressure you into quick decisions or offer loans with unusually high interest rates and fees.

Here's how to identify legitimate lenders:

- Check the lender's website for transparency in fees and interest rates: Look for clearly stated information about all charges associated with the loan.

- Look for positive customer reviews on independent review sites: Websites like Trustpilot or Yelp can provide valuable insights into a lender's reputation.

- Verify the lender's license and registration with relevant authorities: Ensure they operate legally and are authorized to provide loans in your area.

- Avoid lenders who pressure you into applying quickly: Legitimate lenders will provide time to review the terms and conditions.

Types of Loans Available with No Credit Check, Guaranteed Approval

Direct lenders offer several loan types designed for individuals who need quick access to funds, including:

- Payday loans: These are short-term, high-interest loans typically due on your next payday. While convenient for immediate needs, the high interest rates can make them costly if not repaid promptly.

- Installment loans: These loans offer longer repayment periods with smaller monthly payments, making them more manageable than payday loans. However, the total interest paid over time might be higher.

- Personal loans: These loans offer more flexibility in repayment options and potentially lower interest rates compared to payday loans, depending on the lender and borrower's circumstances. Personal loans are often used for various purposes, from debt consolidation to home improvements.

How to Apply for a No Credit Check Loan from a Direct Lender

Applying for a no credit check loan is typically a straightforward process. However, being honest and accurate is essential. Here's a step-by-step guide:

- Gather necessary documents: This usually includes proof of income (pay stubs, bank statements), a valid ID, and possibly proof of address.

- Complete the online application form carefully: Ensure all information is accurate and up-to-date. Inaccuracies can lead to delays or rejection.

- Wait for approval: Processing times vary depending on the lender, but many direct lenders offer quick approvals.

- Review loan terms and conditions before signing: Carefully read the agreement to understand the interest rate, fees, and repayment schedule before accepting the loan.

Secure Your Finances with No Credit Check, Guaranteed Approval Loans

Securing a loan with no credit check and guaranteed approval can provide much-needed financial relief, especially during emergencies or unexpected expenses. Remember to prioritize finding a reputable direct lender, comparing loan terms and interest rates, and borrowing responsibly. Understanding the various loan types and the application process enables you to make informed decisions.

Start your search for a "no credit check, guaranteed approval loan" today by researching reputable direct lenders! Remember to always read the fine print and borrow responsibly. Don't let bad credit hold you back from achieving your financial goals.

Featured Posts

-

Cristiano Ronaldo Nun Marka Degerinin Ardi Rakamlar Ve Gercekler

May 28, 2025

Cristiano Ronaldo Nun Marka Degerinin Ardi Rakamlar Ve Gercekler

May 28, 2025 -

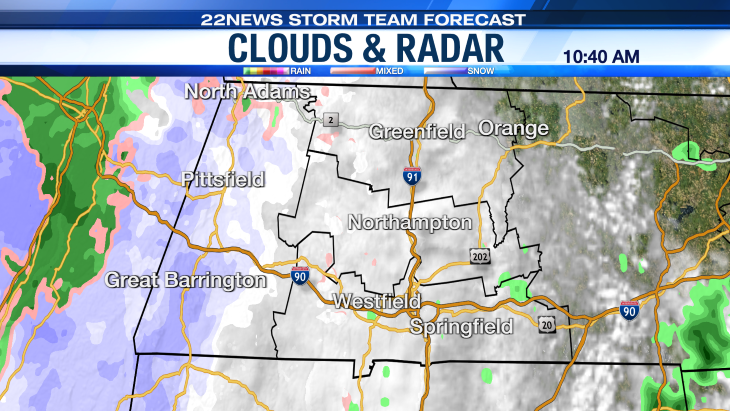

Climate Change And Increased Rainfall In Western Massachusetts

May 28, 2025

Climate Change And Increased Rainfall In Western Massachusetts

May 28, 2025 -

Atletismo Espana En El Mundial Indoor De Nanjing Con Ana Peleteiro A La Cabeza

May 28, 2025

Atletismo Espana En El Mundial Indoor De Nanjing Con Ana Peleteiro A La Cabeza

May 28, 2025 -

Historic Euromillions Jackpot Reaches 202m Your Ticket To Fortune

May 28, 2025

Historic Euromillions Jackpot Reaches 202m Your Ticket To Fortune

May 28, 2025 -

Rayan Cherki News A German Insiders Perspective

May 28, 2025

Rayan Cherki News A German Insiders Perspective

May 28, 2025