Norwegian Cruise Line Holdings Ltd. (NCLH): Earnings Beat Fuels Stock Surge

Table of Contents

NCLH Earnings Report: Key Highlights and Surprises

NCLH's recent earnings report significantly exceeded analysts' expectations, resulting in a substantial boost to the NCLH stock price. The company reported [insert actual figures here – e.g., $X billion in revenue, exceeding projections by $Y million, and a profit of $Z per share, surpassing the anticipated EPS by $W]. This impressive performance was driven by several key factors:

-

Stronger-than-expected booking numbers: NCLH saw a significant increase in booking volume, indicating robust consumer demand for cruises. This surge in bookings exceeded pre-pandemic levels in several key markets. The occupancy rate also improved significantly, suggesting high demand and effective pricing strategies.

-

Improved pricing and yields: The company successfully implemented effective pricing strategies, resulting in higher average fares and improved revenue yield. This demonstrates NCLH's ability to command premium pricing in a competitive market.

-

Cost-cutting measures exceeding projections: NCLH implemented and exceeded its own cost-cutting targets, improving profitability and demonstrating efficient management of resources. This enhanced the overall financial performance, contributing to the positive earnings surprise.

-

Positive outlook for future bookings: The company's forward-looking statements indicated strong booking trends continuing into the next quarter and beyond, boosting investor confidence in the long-term prospects of NCLH. This positive outlook solidified the NCLH revenue forecast for future quarters.

Factors Contributing to the NCLH Stock Surge

The substantial increase in NCLH stock price wasn't solely due to the earnings beat; several other factors contributed to the market's positive reaction. The cruise industry's recovery from the pandemic is gaining momentum, and investor sentiment is improving. NCLH's strong performance solidified this positive sentiment.

-

Increased consumer demand for cruises: The pent-up demand for leisure travel and the allure of cruise vacations fueled the surge in bookings, directly impacting NCLH's revenue and profits.

-

Successful post-pandemic recovery strategy: NCLH's effective strategy to navigate the challenges of the pandemic, including adapting to new health protocols and successfully restarting operations, played a vital role in its strong comeback.

-

Strong financial position and reduced debt: The company's improved financial health, including a reduction in debt, further enhanced investor confidence and contributed to the positive market reaction.

-

Positive investor outlook: Analysts' upgrades and increased price targets following the earnings report signaled a positive outlook for NCLH stock, attracting more investment and driving up the price. This positive sentiment is reflected in the improved analyst ratings for NCLH.

Analysis of NCLH's Future Prospects and Investment Implications

The positive results and strong outlook suggest a promising future for NCLH. However, potential risks and challenges should be considered.

-

Continued growth in demand for cruises: The continued growth in consumer demand for cruises remains a key driver for NCLH's future success. This demand should be monitored alongside potential changes in travel patterns and economic situations.

-

Potential impact of inflation and economic uncertainty: Global economic uncertainty and rising inflation could impact consumer spending and potentially affect demand for cruises.

-

Competition within the cruise industry: The competitive landscape within the cruise industry remains intense, requiring NCLH to maintain its competitive edge through innovation and effective marketing.

-

Opportunities for expansion and innovation: NCLH has opportunities to expand its fleet, explore new destinations, and enhance the onboard experience through innovation.

The NCLH stock forecast remains positive, but investors should conduct thorough due diligence and consider these factors when assessing their investment strategies.

Conclusion

In summary, Norwegian Cruise Line Holdings Ltd. (NCLH) delivered an unexpected earnings beat, leading to a significant stock surge. This positive performance was driven by strong booking numbers, improved pricing, cost-cutting measures, and a positive outlook for future growth. The market's positive reaction reflects renewed confidence in the cruise industry's recovery and NCLH's successful navigation of recent challenges. While the future holds opportunities, investors must consider potential risks. The strong performance of Norwegian Cruise Line Holdings Ltd. (NCLH) makes it a compelling stock to watch. However, conduct thorough research and consult with a financial advisor before making any investment decisions related to NCLH stock or other cruise line investments.

Featured Posts

-

4 Kwietnia Dzialaj Na Rzecz Zwierzat Bezdomnych

Apr 30, 2025

4 Kwietnia Dzialaj Na Rzecz Zwierzat Bezdomnych

Apr 30, 2025 -

An End To Louisville Mail Delivery Problems Union Offers Hope

Apr 30, 2025

An End To Louisville Mail Delivery Problems Union Offers Hope

Apr 30, 2025 -

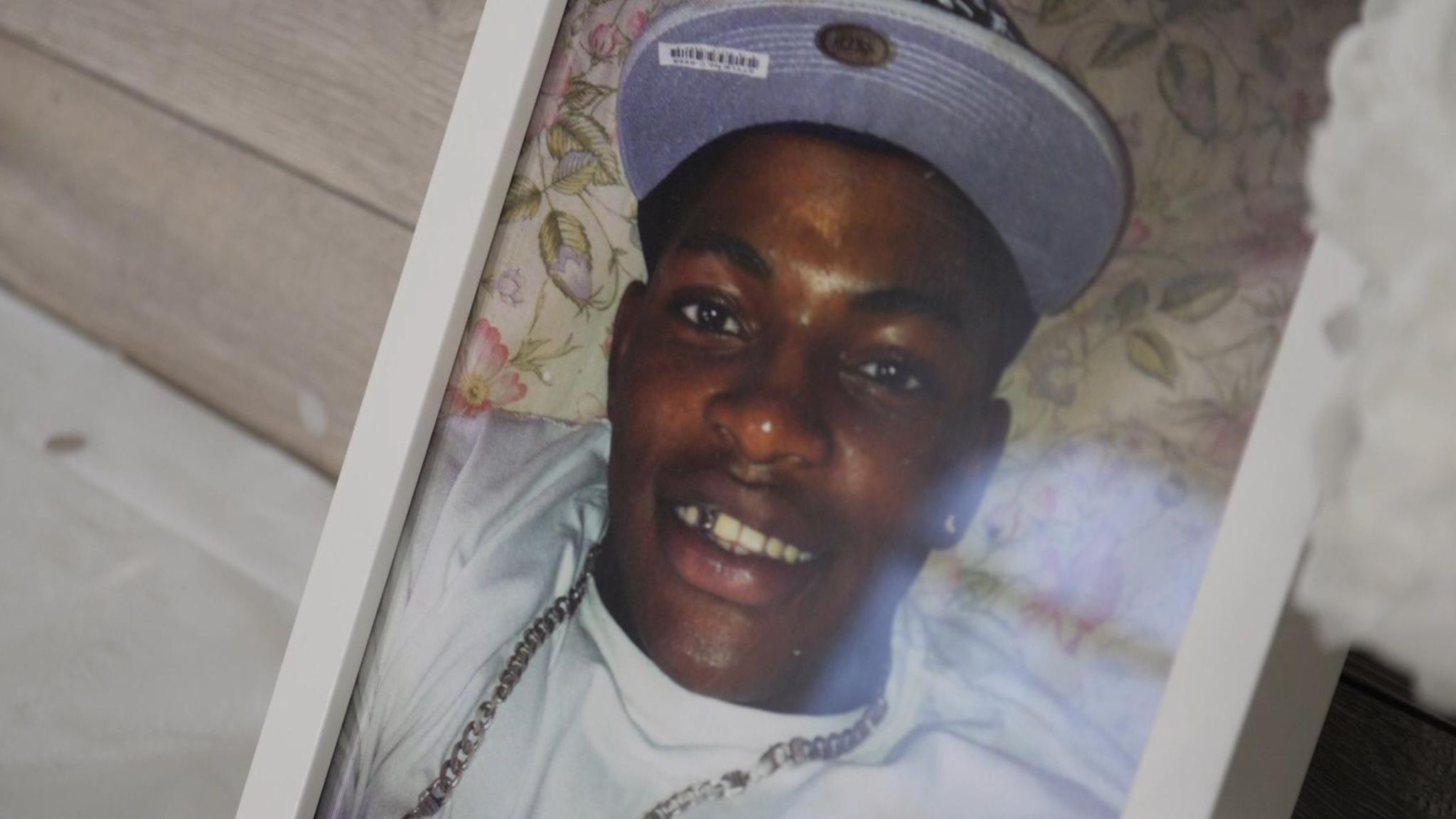

Chris Kaba Panorama Police Complaints Bodys Ofcom Referral

Apr 30, 2025

Chris Kaba Panorama Police Complaints Bodys Ofcom Referral

Apr 30, 2025 -

8xmille Rinvio Del Processo Per Il Fratello Di Becciu

Apr 30, 2025

8xmille Rinvio Del Processo Per Il Fratello Di Becciu

Apr 30, 2025 -

Quick Facts About Wayne Gretzky A Concise Biography

Apr 30, 2025

Quick Facts About Wayne Gretzky A Concise Biography

Apr 30, 2025